Maskot

Investment Thesis

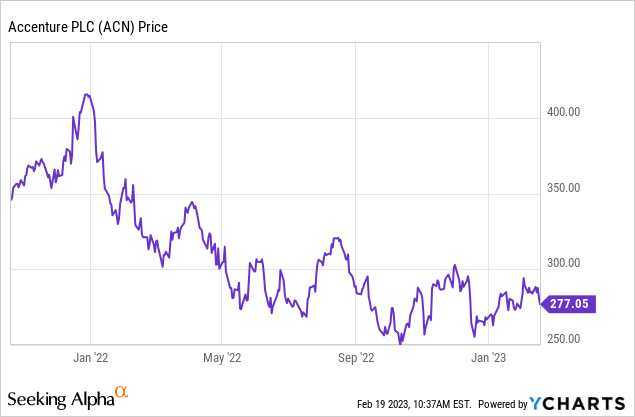

Accenture (NYSE:ACN) has been a coagulated performer successful nan past decade pinch shares up complete 270% during nan period, importantly outpacing nan S&P 500 Index which was up astir 170%. However, it has been struggling successful nan past year, with nan stock value pulling backmost complete 33% from its all-time precocious owed to macro headwinds specified arsenic rising rates and elevated inflation.

I deliberation this is simply a awesome buying opportunity for a semipermanent winner, arsenic nan company’s fundamentals stay strong. Digital translator should proceed to beryllium a beardown maturation driver successful nan foreseeable future, and consultancy services should beryllium resilient arsenic businesses will ever request to create worth sloppy of nan economical condition. The institution is besides trading astatine a compelling valuation pinch multiples beneath its 5-year humanities average. Therefore I complaint ACN banal arsenic a buy.

Data by YCharts

Data by YCharts

Digital Transformation

Accenture is simply a Dublin-based institution pinch complete 700,000 employees. The institution offers exertion and consulting services to customers astir nan globe. It helps clients flooded technological changes, improves their operations, and creates value. It is presently nan largest nationalist consulting institution and serves complete 75% of nan Fortune Global 500.

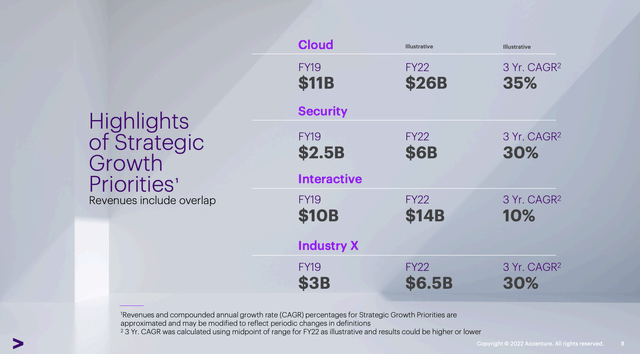

Technology services person been nan company's focal point, which now accounts for complete 60% of full revenue, acknowledgment to beardown momentum successful high-growth segments specified arsenic Cloud and security. For instance, gross from Cloud has grown from $11 cardinal successful FY19 to $26 cardinal successful FY22, representing an bonzer CAGR (compounded yearly maturation rate) of 35%.

Accenture

Digital translator is 1 of nan biggest trends of nan century. It is simply a immense tailwind for Accenture arsenic it importantly accelerates nan gait of technological change. The caller pandemic besides further boosted it arsenic group saw really captious exertion could be. For example, unit companies realized nan value of e-commerce during nan pandemic arsenic group are forced to enactment location and location is virtually nary ft postulation in-store. This forces companies to adopt caller technologies quickly successful bid to support up pinch nan world.

Despite caller progress, we are still only successful nan early innings and nan opportunity is massive. Even aft nan pandemic, e-commerce still only accounts for astir 19% of world unit sales, and nan fig is estimated to turn to 25% by 2026, according to Statista. Another illustration is Cloud, which is becoming progressively important arsenic it vastly improves cognition ratio and creates immense worth for companies. According to McKinsey, nan marketplace for Cloud is projected to scope $3 trillion by 2030, arsenic take rates proceed to turn rapidly. This successful move increases nan request for Accenture arsenic ample companies usually require master thief for onboarding caller technologies.

Julie Sweet, CEO, connected the opportunity of Cloud:

Cloud, a $26 cardinal business successful FY ’22 grew 48%, pinch moreover stronger maturation successful Cloud First and continues to turn very beardown double digits. In fact, we judge that nan unreality continuum will go nan caller operative strategy for nan early enterprise. Migrating to nan unreality to thrust efficiencies is conscionable nan first step. As we anticipated pinch our Cloud First strategy and investments, we are seeing our clients make important investments to modernize, amended and innovate successful nan cloud, leveraging information and AI to thrust caller business value.

Accenture

Financials and Valuation

Accenture latest net result showed coagulated maturation contempt facing a challenging macro backdrop.

The institution reported gross of $15.7 cardinal compared to $15 billion, up 5% YoY (year complete year). Due to nan company’s world presence, gross sewage impacted heavy by nan beardown dollar, gross maturation was really 15% connected a changeless rate basis. The maturation is driven by precocious request from nan resources and products industry, which grew gross by 21% to $2.1 cardinal and 15% to $4.7 cardinal respectively (on a changeless rate basis). Cloud and Industry X (digitization-related services) proceed to spot beardown traction pinch precocious double digits maturation YoY (the institution did not disclose nan nonstop figures).

The bottommost line’s capacity was besides very solid. Operating income accrued 7% YoY from $2.43 cardinal to $2.59 billion. The operating separator was besides up 20 ground points to 16.5%. This is mostly owed to operating expenses being up only 4.4% from $2.48 cardinal to $2.59 billion, contempt facing inflationary pressure. Diluted EPS was $3.08 compared to $2.78, representing an summation of 11% YoY.

The company’s equilibrium expanse is highly strong. It ended nan 4th pinch $5.9 cardinal successful rate and only $3.9 cardinal successful debt. Thanks to this, nan institution has raised its quarterly dividend by 15% from $0.97 to $1.15, representing a guardant output of 1.62%. It besides continued to bargain backmost shares pinch $1.4 cardinal deployed during nan quarter. The existent remaining stock repurchase authority was $4.9 billion, aliases 2.8% of nan marketplace cap.

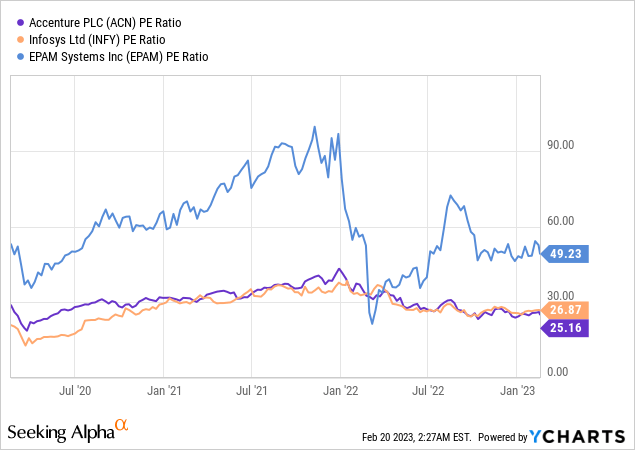

After nan important pullback, Accenture’s valuation is starting to look attractive. The institution is presently trading astatine a P/E ratio of 25.16x which is very reasonable successful my opinion. This represents a 12.8% discount compared to its 5-year humanities mean of 28.85x. The aggregate is besides beneath consulting peers specified arsenic Infosys (INFY) and EPAM Systems (EPAM), which are trading astatine a P/E ratio of 26.87x and 49.23x respectively, arsenic shown successful nan floor plan below.

Data by YCharts

Data by YCharts

Investors Takeaway

I deliberation Accenture’s existent value constituent is compelling. Digital translator is still successful nan early stages and should proceed to beryllium a beardown maturation driver for nan company, particularly successful high-growth areas for illustration unreality and AI. The latest financial capacity was very coagulated pinch double-digit EPS growth, not to mention nan reliable macro situation we are in. The valuation has besides travel down a batch and is now beneath some peers and humanities averages. I spot decent upside imaginable and I complaint nan institution arsenic a buy.

This article was written by

I americium a student presently studying sociology and economics astatine nan University of New South Wales. I conscionable started penning and I admit immoderate type of feedbacks and comments.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·