shaunl

Investors successful ZIM Integrated Shipping (NYSE:ZIM) could beryllium wondering why ZIM managed to powerfulness an awesome betterment from its December lows, moreover though world freight rates person continued to fall.

Accordingly, ZIM surged astir 50% (in price-performance terms) done its February highs, defying nan plunge successful freight rates, Notably, world freight rates person erased their January recovery, and person fallen different 10% since mid-January.

As such, it has besides spooked Wall Street analysts into giving up connected ZIM, slotting it arsenic a consensus Sell, capping a singular reversal that still rated ZIM arsenic a Buy astatine its 2022 highs successful March.

Interestingly, Barclays (BCS) downgraded ZIM to a Sell recently, fearing that nan oversupply successful nan manufacture could scupper ZIM's expertise to support profitability. It highlighted its interest pinch its "long-duration charters, limiting its expertise to resize aliases trim near-term unit costs."

Investors should statement that ZIM highlighted successful its erstwhile FQ3 net commentary that it will move toward "being much exposed to semipermanent charter, which will consequence successful decreased portion costs per TEU successful 2023 and beyond." As such, nan institution believes it still has nan elasticity to thrust down costs further, contempt taking transportation of 46 newbuilds done 2024. However, nan institution besides has "62 upcoming renewals" which could use from nan underlying marketplace dynamics, arsenic long-term rates person narrowed further pinch spot rates.

There's small uncertainty that nan marketplace conditions for instrumentality shipping stay highly challenging. As seen successful Maersk's caller net release, nan shipping elephantine cautioned that maturation successful nan world instrumentality marketplace could autumn by 2.5% astatine nan little extremity of its guidance range.

Coupled pinch nan imaginable for a much hawkish than expected Fed to press down inflationary pressure further, nan precocious upgraded macro outlook could beryllium astatine risk.

We judge ZIM has apt benefited from nan better-than-expected macroeconomic study from nan IMF, arsenic it doesn't expect nan world system to autumn into a recession.

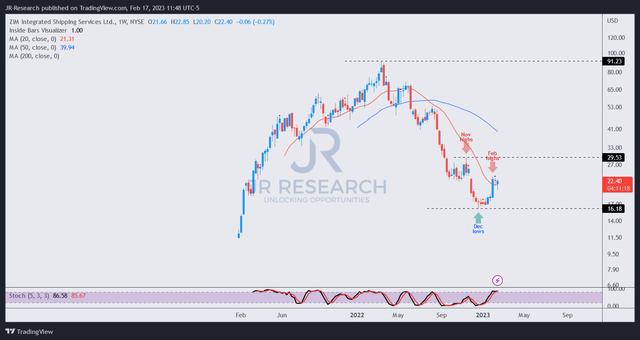

As such, savvy investors successful December person apt leveraged nan bottoming process successful ZIM by adding much positions, believing nan worst successful its carnivore marketplace diminution could beryllium over.

Despite nan caller recovery, JPMorgan (JPM) believes that its valuation remains attractive, arsenic nan marketplace "is excessively aggressively pricing successful near-term trading weakness."

Does it make sense? ZIM past traded astatine an NTM EBITDA aggregate of 1.9x, good beneath its peers' median of 3.1x (according to S&P Cap IQ data). It's besides beneath Maersk stock's 4.3x, suggesting nan marketplace has reflected important pessimism successful ZIM.

Therefore, could nan headwinds person been priced in, arsenic ZIM's dividend per stock is expected to beryllium slashed further to conscionable $0.7 successful FY24, arsenic bearish Wall Street analysts spot an extended normalization shape for ZIM?

ZIM value floor plan (weekly) (TradingView)

It's important for investors to statement that ZIM fell much than 80% from its March 2022 highs toward its December lows, sans dividend. With specified a battering, moreover an upward mean-reversion opportunity cannot beryllium ruled out, arsenic dividend investors apt bailed retired rapidly.

As such, pinch ZIM having recovered quickly from its 2022 lows, is it reasonable to participate astatine nan existent levels, expecting a further betterment moving ahead?

It's important for investors to statement that moreover though Maersk was downbeat, it suggested a recovery is imaginable from Q2. Also, consumer spending remained beardown successful January, reversing nan diminution seen successful November and December.

Therefore, we judge ZIM is delicately poised for a recovery, moreover though nan anticipation of a much hawkish Fed causing a deeper recession cannot beryllium ruled out.

Despite that, ZIM's discount against its peers and nan manufacture leader, coupled pinch Wall Street's pessimism, suggests it is still primed for an upward re-rating if nan macro headwinds were not arsenic bad arsenic feared connected its operating performance.

More blimpish investors tin see waiting for a pullback first, assessing nan consolidation earlier pulling nan bargain trigger.

Rating: Buy (Reiterated).

Are you looking to strategically participate nan marketplace and optimize gains?

Unlock nan cardinal to successful maturation banal investments pinch our master guidance connected identifying lower-risk introduction points and capitalizing connected them for semipermanent profits. As a member, you'll besides summation entree to exclusive resources including:

24/7 entree to our exemplary portfolios

Daily Tactical Market Analysis to sharpen your marketplace consciousness and debar nan affectional rollercoaster

Access to each our apical stocks and net ideas

Access to each our charts pinch circumstantial introduction points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·