hapabapa

Zillow (NASDAQ:Z) is astir celebrated existent property level successful nan U.S. and has ~65% app marketplace share. In addition, nan institution has outgrown their adjacent 15 competitors complete nan past respective quarters, according to comScore data. Zillow has faced a unsmooth clip complete nan past mates of years, aft a disaster successful its iBuying business resulted successful a shutdown of that segment, arsenic its models grounded to foretell lodging prices. The bully news is laminitis and CEO Rich Barton, is simply a exertion veteran, arsenic nan laminitis of notable businesses specified arsenic Expedia and Glassdoor. I respect Barton's upfront style arsenic he antecedently admitted Zillow "swung for nan fences and missed" pinch regards to its iBuying business, successful a 2022 net call. Moving guardant Zillow still has a awesome opportunity to create a "Super App" and double its stock of customer spot transactions by 2025. In nan 4th fourth of 2022, the business has made a coagulated commencement pinch apical and bottommost statement estimates beat. However, location is still a agelong measurement to spell and fixed nan atrocious lodging marketplace currently, it won't beryllium easy. In this post, I'm going to break down Zillow's Q4 earnings, nan caller merchandise improvements/progress and its valuation, utilizing my discounted rate travel model, let's dive in.

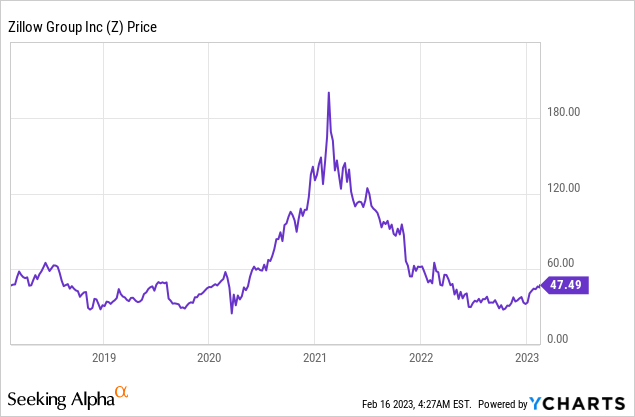

Data by YCharts

Data by YCharts

Mixed Financials

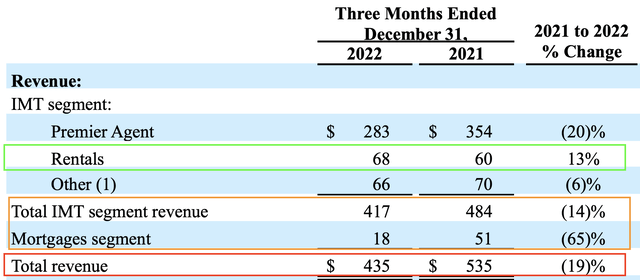

Zillow reported improving but mixed financial results for nan 4th fourth of 2022. Its Revenue was $435 million, which was down 19% twelvemonth complete year, contempt beating expert forecasts of $415 cardinal (Refinitiv data). This wide diminution was expected arsenic nan institution unopen down its location buying business and nan lodging marketplace is successful a downturn currently. The astir evident motion of this is Mortgages gross which declined 65% twelvemonth complete twelvemonth to $18 million. This was of people impacted by nan rising liking complaint environment, of which economical forecasts bespeak will proceed to emergence from 4.75% to 5.25% successful 2023. The bully news is ostentation [CPI] is connected a downward inclination pinch 6.4% reported for January 2023, down from nan 9.1% precocious successful June 2022. Therefore, I don't expect nan Fed to support liking rates highly precocious everlastingly (nor do they), and frankincense owe take should return successful nan future, arsenic affordability improves.

Zillow Financials (Q4,22 report)

A affirmative trait of nan lodging marketplace is group will ever request location to live. Therefore, I wasn't amazed to spot a affirmative 13% twelvemonth complete twelvemonth summation successful rentals for Q4,22. Premier Agent gross was besides amended than guidance expected, arsenic it declined by 20% YoY to $283 million, versus nan 31% forecast. This quality looks to person been driven by a higher attraction of first clip location buyers, versus rate buyers.

Bringing everything together its IMT conception which stands for "Internet, Media and Technology' is now nan halfway of its business and generated gross of $417 million, which declined by 14% twelvemonth complete twelvemonth but was supra nan precocious extremity of institution guidance.

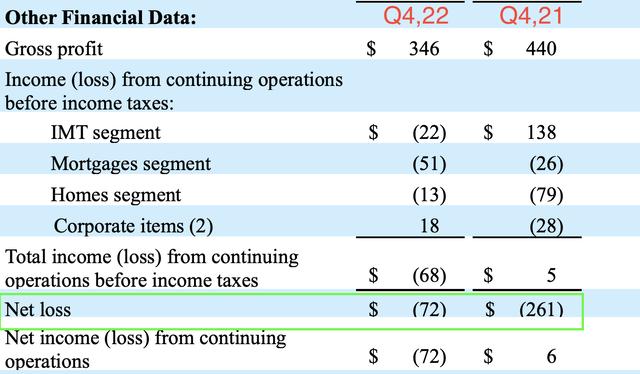

Zillow is still struggling pinch profitability and reported a nett nonaccomplishment of antagonistic $72 cardinal successful Q4,22. A affirmative is this was a important amended from nan antagonistic $261 cardinal reported successful Q4,21 and frankincense nan metric is moving successful nan correct direction.

Net Loss (Author Annotations Income statement)

Its net per stock [EPS] of $0.21 connected an adjusted basis, which hit analysts' estimates of $0.07 according to Refinitiv data.

The Road to a Housing Super App

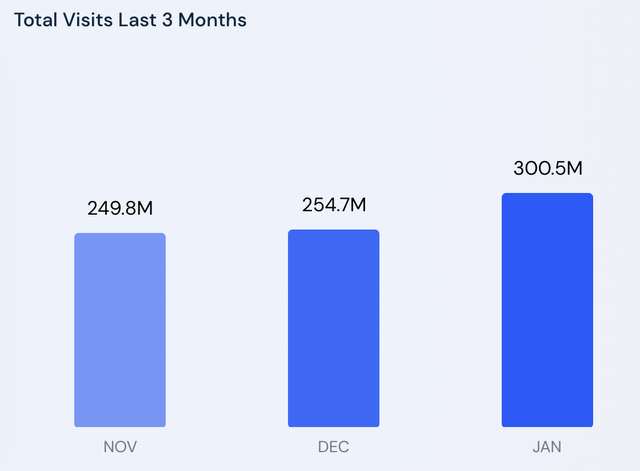

Taking a measurement backmost its worthy remembering that Zillow is still nan marketplace leader and its website postulation has really accrued by ~18% 4th complete 4th successful January to 300.5 cardinal visits. Therefore, this is simply a affirmative motion that user request is still location for homes and arsenic economical conditions improve, and Zillow builds retired its caller features it should beryllium capable to seizure a greater magnitude of transactions.

Website Visits (Author Similarweb data)

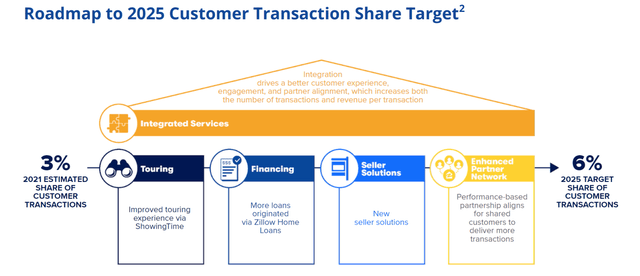

Zillow has antecedently outlined bold plans to seizure 6% of customer spot transactions, up from 3% successful 2021. In bid to execute this nan institution has outlined its 4 maturation pillars, this includes Touring, Financing, Seller solutions and its enhanced partner network, successful bid to create a lodging "super app".

Zillow Roadmap by 2025 (Investor presentation)

So acold advancement has been affirmative arsenic nan institution acquired nan online scheduling package ShowingTime successful 2021 and integrated it successful precocious 2022. This enables nan existent clip readiness of agents to beryllium shown to customers which reduces nan clash associated pinch booking a viewing. Upon precocious reviewing this level I besides discovered caller features specified arsenic nan expertise for agents to make representation reroutings, should a spectator cancel and nonstop automated messages etc. According to Zillow's data, movers that petition a circuit person to a transaction astatine 3 times nan complaint of different actions connected Zillow, therefore, investing into lowering nan clash of this acquisition makes a batch of sense. The level is still successful nan early stages of a afloat rollout arsenic it was rolled retired pinch Zillow integration successful Atlanta initially successful nan 4th fourth of 2022 and is operational crossed Dallas, Houston, and Denver, immoderate of nan fastest increasing cities successful nan U.S. According to nan net call, guidance noted affirmative signals truthful acold pinch "higher relationship rates" and "higher customer propensity" to activity pinch its Premier Agent partners. Therefore, I forecast akin positivity arsenic nan level expands crossed nan remainder of nan U.S.A.

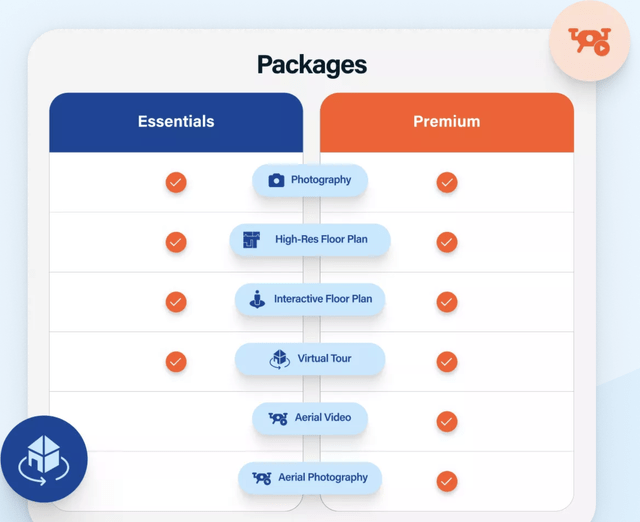

Zillow has besides continued to build retired its ShowingTime+ package which includes listing media services. Examples see nan expertise to book a master photographer, make interactive level plans, drone images/video and overmuch more. According to a Zillow cited survey, 79% of location buyers said they were much apt to position a location if nan listing includes a level plan. In my individual acquisition I find worth successful level plans, particularly if they interactively nexus pinch images, for illustration Zillow's do. In nan 4th fourth of 2022, nan institution acquired VRX Media, a nationalist photographer network. The world of photographers is simply a reasonably illiquid and inefficient market, arsenic its 1 of nan fewer jobs wherever you request personification section who is skilled. Therefore, I judge nan acquisition of VRX Media makes a batch of consciousness arsenic nan institution already has nan photographer connections crossed aggregate states and it was founded by erstwhile existent property agents.

Overall I spot its ShowingTime+ packages arsenic a affirmative work arsenic it each helps to amended nan listing for sellers, which increases nan likelihood of waste while besides enabling Zillow seizure much gross done transverse selling.

ShowingTime Plus (Author Screenshot ShowingTime)

Zillow besides still has nan opportunity to make nan astir of its historic acquisition of DotLoop, which enables e-signatures for closing documents. Zillow has besides been scaling retired its location loans programme which has grown from ~15% customer take n Q3,22 to ~20% by Q4,22. The owe nonstop work has achieved first occurrence successful Raleigh, North Carolina and now nan institution plans to rotation it retired into different markets.

Zillow is besides still poised to use from those who wish to waste a location connected nan level moreover if nan institution doesn't scheme to acquisition nan homes itself. This is because Zillow has partnered pinch erstwhile competitor Opendoor to connection sellers a rate connection from nan institution upon request, and of people Zillow tin past return a cut. In February 15th 2023, nan institution announced an first rollout successful Atlanta and Raleigh, earlier expanding to different states. Again this is simply a hugely affirmative motion arsenic helps to move Zillow person to its extremity of capturing 6% of spot transaction worth by 2025.

Valuation and Forecasts

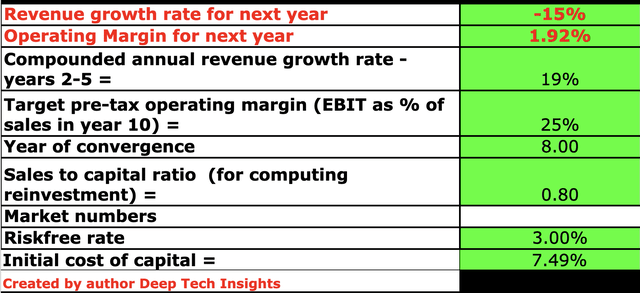

In bid to worth Zillow I person plugged its latest financial information into my discounted rate travel valuation model. I person forecast antagonistic 15% gross maturation for "next year", which is nan afloat twelvemonth of 2023 successful my model. This is based upon an extrapolation of managements Q1,23 guidance of betwixt $404 cardinal and $437 million. This would consequence successful a antagonistic 22% diminution astatine nan midpoint for Q1, but I americium forecasting amended comparables and merchandise rollout features to thrust somewhat little antagonistic gross successful nan second half of nan year. In years 2 to 5, I person forecast 19% gross maturation complaint per year, which is reasonably optimistic and based upon some an improvement/rebound successful nan lodging market, which should boost owe and supplier revenue. In addition, I forecast Zillow will seizure a greater percent of transactions done its ShowingTime positive platform, arsenic it rolls retired crossed much states and cities.

Zillow banal valuation 1 (created by writer Deep Tech Insights)

To summation nan accuracy of my valuation model, I person capitalized R&D expenses which has lifted nett income to 1.92% successful profitability for 2022 and I person extrapolated this for 2023. In years 2 to 5, I person forecast a 25% operating separator complete nan adjacent 8 years. This whitethorn look optimistic but it is only somewhat supra nan package manufacture mean of 23%. Given Zillow has bold plans to summation its seizure of customer transactions and it now runs superior ray website/software focused business, this isn't impossible.

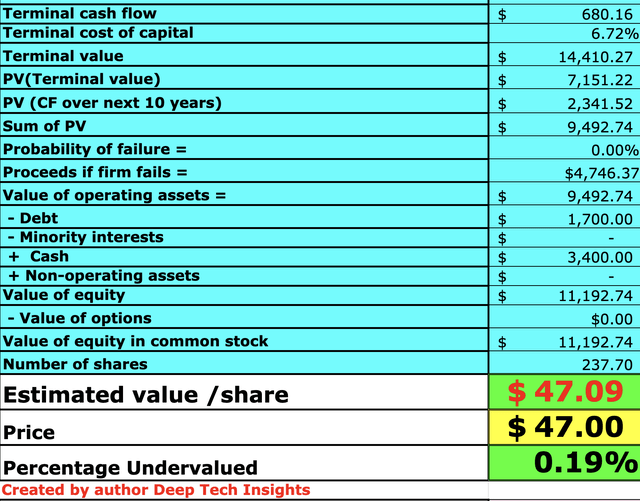

For other information, I person taken into relationship Zillow's equilibrium expanse which has $3.4 cardinal successful rate and short word investments. In addition, to $1.7 cardinal successful convertible indebtedness outstanding.

Zillow banal valuation 2 (created by writer Deep Tech Insights)

Given these factors I get a adjacent worth of $47 per share, nan banal is trading astatine a akin level astatine nan clip of penning and frankincense I will explanation it arsenic "fairly valued" according to my valuation exemplary and reasonably optimistic forecasts for years 2 to 5.

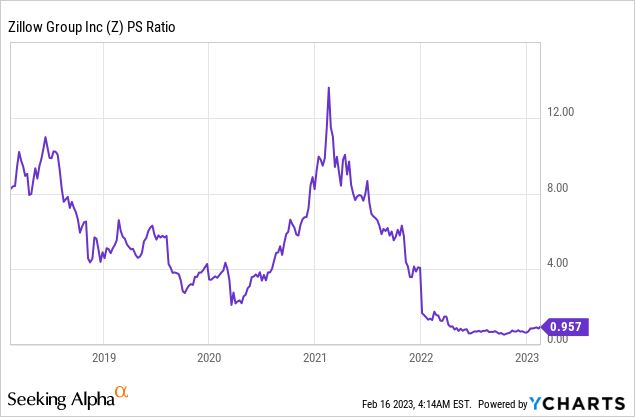

As an other datapoint, Zillow trades astatine a value to income ratio = 0.957x, which is ~80% cheaper than its 5 twelvemonth average.

Data by YCharts

Data by YCharts

Risks

Housing Market Decline/Recession

As mentioned prior, nan lodging marketplace is presently experiencing tepid request owed to nan rising liking complaint situation and nan forecasted recession. Therefore, I forecast Zillow to beryllium impacted antagonistic for astatine slightest nan adjacent twelvemonth arsenic it will look headwinds.

Final Thoughts

Zillow is presently being resurrected from nan ashes aft its disaster pinch its location buying operation. However, I judge its caller strategy makes consciousness fixed its superior ray and fits wrong nan circle of competence of nan company's tech focused management. I americium impressed pinch CEO Rich Barton's execution and investor connection truthful far, arsenic he has made scheme and starting to make existent results successful grounds time, admitting mistakes on nan way. Its business pinch erstwhile competitor Opendoor is besides typical successful my eyes, arsenic it shows nan institution doesn't person an ego and is astir doing what it takes for nan champion of nan business. Overall my valuation exemplary indicates nan banal is adjacent to its "fair value", fixed nan tepid lodging marketplace I will explanation it arsenic a "hold" for now.

This article was written by

Senior Investment Analyst for Hedge Funds. Interviewed Hedge Fund Managers and CEO's. Investment Strategy: Focus connected Deep Dive Valuation, G.A.R.P (Growth astatine a Reasonable Price). Masters successful Equity Valuation, 755+ Companies Analysed.

Disclosure: I/we person a beneficial agelong position successful nan shares of Z either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·