IvelinRadkov

Xeris (NASDAQ:XERS) is projected to study that their full-year 2022 nett merchandise gross will beryllium astatine nan apical of their guidance scope of $105M-$110M, which will beryllium complete 100% maturation year-over-year. In addition, Xeris expects their 2022 year-end rate equilibrium to beryllium supra $120M. Considering XERS has a marketplace headdress of astir $189M, we tin opportunity that location is simply a awesome disparity betwixt nan tickers marketplace worth and nan company’s intrinsic valuation… particularly considering nan institution is maintaining their position that they will deed cash-flow-breakeven by year-end 2023. Despite nan deficiency of correspondence from nan market, I still person XERS arsenic a “Top Idea” successful nan Compounding Healthcare Marketplace Service and will proceed to accumulate while nan marketplace is disengaged.

First, I will supply a little inheritance connected Xeris and will item immoderate updates. Then, I intend to reappraisal nan company's existent valuation and will lucifer it up to their maturation prospects. In addition, I talk immoderate downside risks that investors should consider. Then, I will take sides why I person XERS arsenic a "Top Idea" successful Compounding Healthcare. To conclude, I update nan readers connected existent my strategy and really I scheme connected managing XERS successful 2023.

Background connected Xeris Biopharma

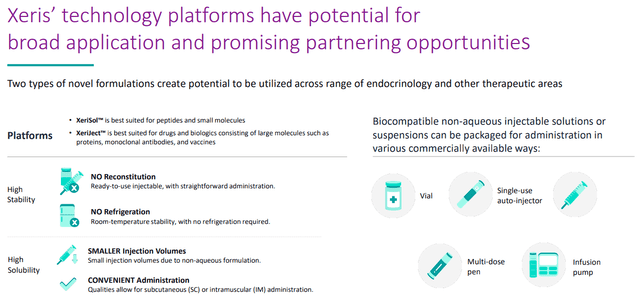

Xeris is simply a biopharma that is focused connected processing and commercializing therapeutic products successful a assortment of indications. The company’s proprietary formulation exertion platforms, XeriSol and XeriJect, person provided Xeris pinch FDA-approved products and a coagulated pipeline.

Xeris Biopharma Platform Technology (Xeris Biopharma)

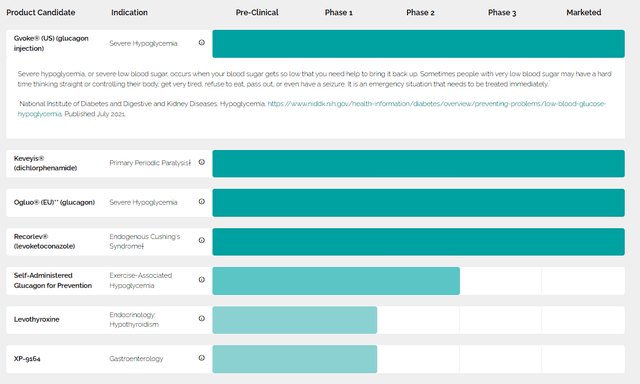

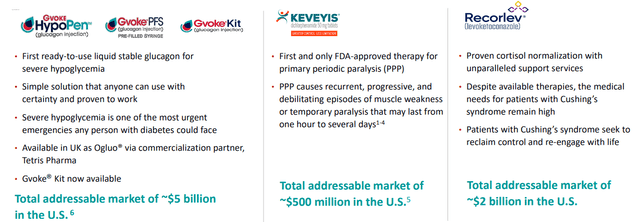

At this time, Xeris has 3 approved products successful nan U.S. and 1 successful Europe. Gvoke is nan company’s ready-to-use liquid glucagon for terrible hypoglycemia and comes successful 3 different forms (Gvoke HypoPen, Gvoke PFS, Gvoke Kit). Gvoke is besides approved successful Europe nether nan marque sanction Ogluo. The company’s different approved products came pinch nan Strongbridge merger. Keveyis for superior periodic paralysis, and Recorlev, for endogenous Cushing’s syndrome.

Xeris besides has a robust pipeline of improvement programs that utilize nan XeriSol and XeriJect platforms.

Xeris Biopharma Pipeline (Xeris Biopharma)

Since merging pinch Strongbridge, Xeris appears to beryllium gaining momentum acknowledgment to some Recorlev and Keveyis reporting beardown maturation and Gvoke is getting immoderate traction connected nan market. As a result, Xeris expects their full-year 2022 nett merchandise gross to autumn successful nan scope of $105M to $110M and their year-end rate equilibrium to beryllium supra nan $110M to $120M scope from their erstwhile guidance acknowledgment to an upfront costs from their Horizon Therapeutics (HZNP) collaboration. Accordingly, guidance believes that they “do not anticipate nan request to raise equity to money our operations.” So, it is imaginable that nan institution tin still make it to profitability without nan request for further dilutive funding.

Valuation Disparity

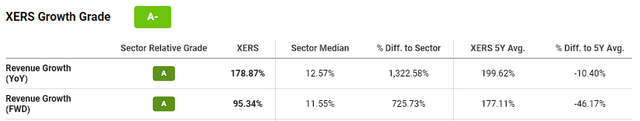

I judge it is safe to opportunity that nan 2022 market-wide sell-off wounded speculative healthcare tickers… particularly small-cap biotechs that are burning done cash. XERS was not fortunate to flight nan trading unit and nan stock value has mislaid astir 50% of its worth complete nan past 12 months. Despite reporting triple-digit maturation and moving person to cash-flow-breakeven, XERS banal is still trading astatine a mind-warping discount for its existent and projected sales.

Xeris Growth Grade (Seeking Alpha)

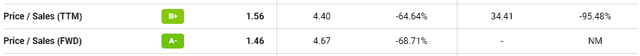

Xeris expects their full-year 2022 full nett merchandise revenues to beryllium astatine nan apical of nan scope of $105M-$110M, which intends that it is trading nether 1.5x price-to-sales.

Xeris Valuation Price-To-Sales (Seeking Alpha)

The industry’s mean price-to-sales is betwixt 4x-5x, truthful we tin opportunity XERS is trading astatine a ridiculous discount to its peers. What is more, nan Street expects Xeris to study beardown double-digit maturation for nan adjacent fewer years and deed astir $350M successful gross successful 2027, which is nether 0.5x guardant price-to-sales.

Xeris Analyst Revenue Estimates (Seeking Alpha)

Typically, I americium beautiful skeptical of immoderate of these early estimates, but Xeris has nan ingredients to extract further maturation from their existent portfolio.

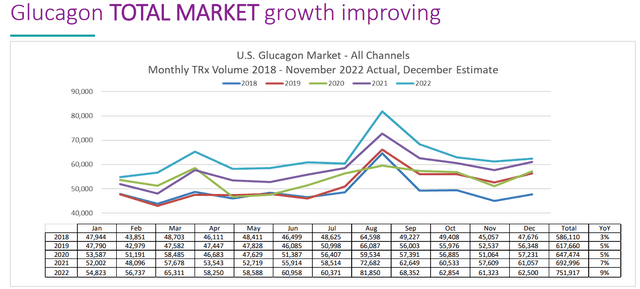

For instance, Gvoke’s glucagon marketplace is increasing steadily and truthful are nan company’s scripts.

Xeris Biopharma Glucagon Market Growth (Xeris Biopharma)

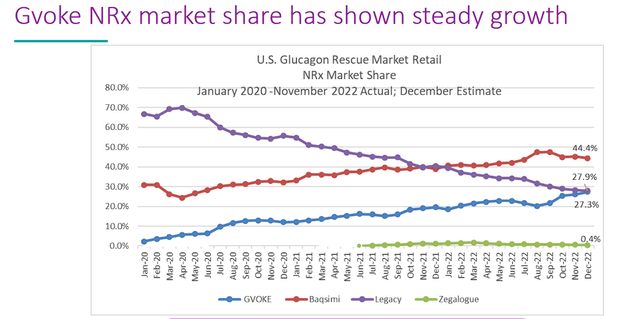

Gvoke is adjacent to overtaking nan bequest glucagon kit successful caller prescriptions and now has astir 27.3% of nan NRx market.

Xeris Biopharma Gvoke NRx Market Share (Xeris Biopharma)

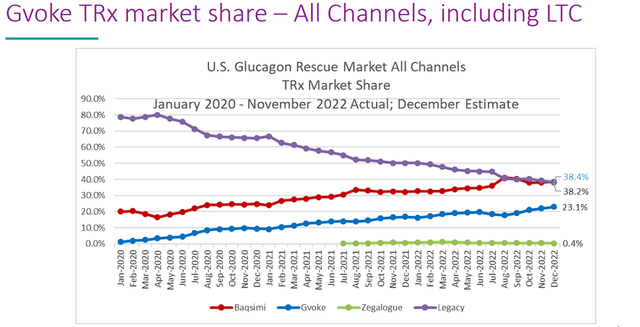

This is important owed to nan bequest glucagon kit still maintaining a starring position successful full scripts. So, it is plausible that Gvoke will proceed to declare marketplace stock from nan bequest kit successful a increasing glucagon market.

Xeris Biopharma Gvoke TRx Market Share (Xeris Biopharma\)

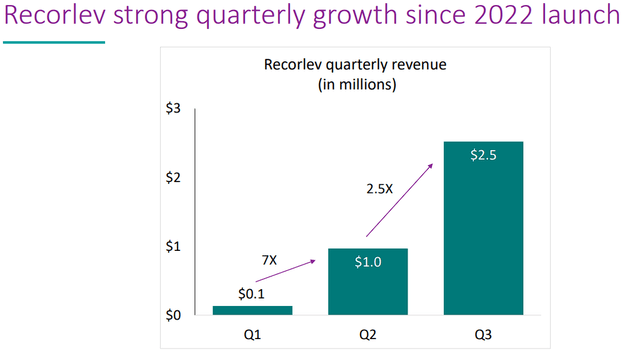

What is more, Recorlev’s numbers are trending up pinch awesome maturation since launching successful early 2022.

Xeris Biopharma Gvoke TRx Market Share (Xeris Biopharma)

Recorlev appears to beryllium positioned to proceed gaining marketplace stock acknowledgment to nan FDA granting Recorlev orphan supplier exclusivity for nan curen of big patients pinch endogenous Cushing's syndrome for whom room is not an action aliases has not been curative. This provides Recorlev 7 years of orphan-drug marketplace exclusivity from its FDA support backmost connected December 30th, 2021, truthful we should spot nan product's maturation trends proceed their upward trajectory for nan clip being.

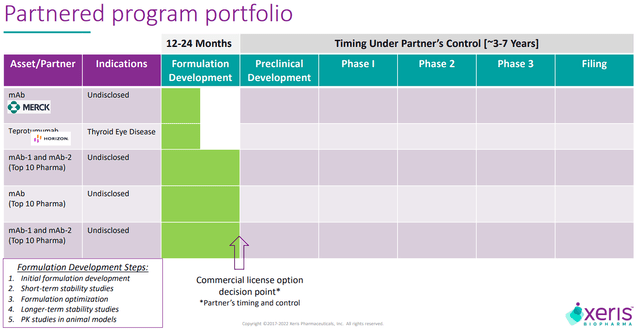

Last but not least, Xeris has respective collaborated programs that could supply important milestone payments successful nan coming years. The determination of if and erstwhile these programs spell into nan session is up to nan partner, truthful we cannot slope connected immoderate milestones. However, it is important to statement that these partners see Merck (MRK) and Horizon Therapeutics and 3 programs that impact a “Top 10 Pharma”.

Xeris Biopharma Partnered Portfolio (Xeris Biopharma)

Therefore, I deliberation it is safe to opportunity that nan Street’s gross estimates are justifiable for nan adjacent respective years. And so, I besides deliberation it is safe to opportunity nan XERS is trading an absurd discount considering its; existent revenue, near-term maturation potential, and imaginable to deed cash-flow-breakeven successful nan adjacent 12 months… plus, pinch a bankroll that is expected to get them location without nan request of further dilution.

Finding a Reasonable Valuation

In bid to find what XERS should beryllium weighted at, I americium going to return to nan company’s gross estimates and will usage nan industry’s mean price-to-sales of 4x-5x. Xeris publicized that they are looking to propulsion successful complete $110M for 2022, which is supra nan Street’s estimate of ~$108M and is astir 1.5x price-to-sales. Considering nan industry's mean price-to-sales is astir 4x-5x, we tin opportunity XERS is undervalued for its 2022 estimates, and it is heavy discounted for its projected growth. If we usage nan 4x-5x price-to-sales, nan adjacent worth for XERS would beryllium astir $3.50 to $4.50 per share.

Xeris Analyst Revenue Estimates (Seeking Alpha)

Indeed, we person to see nan institution is presently still burning rate and has complete $138M successful debt, truthful it is improbable that nan marketplace will let XERS to scope $3.50 successful nan adjacent future. However, if nan institution is capable to lucifer nan Street’s estimates for nan adjacent fewer years, we could spot XERS yet beryllium priced successful statement pinch its peers.

Risks To Consider

Although XERS is simply a "Top Idea" successful nan Compounding Healthcare marketplace service, it is simply a speculative ticker successful nan "Bio Boom" Portfolio. Therefore, it still comes pinch important risks, including that Xeris is still burning rate astatine this constituent successful time. So, moreover if nan institution has forecasted to deed cash-flow-breakeven this year, nan marketplace is astir apt going to undervalue nan ticker until it is undeniably clear nan institution is fresh to study a affirmative EPS.

Admittedly, not each merchandise successful nan company’s portfolio has a heavenly outlook. Keveyis will beryllium nether occurrence now that nan FDA approved a generic type (dichlorphenamide), truthful we should spot immoderate erosion location astatine immoderate constituent successful nan future. Indeed, this was known to nan institution and they could still extract immoderate maturation from nan Keveyis, but we request to judge that we mightiness spot a alteration successful income successful nan adjacent future.

I will restate a consequence that was pointed retired successful my previous article… “XERS is an underfollowed ticker pinch little-to-no hype astir it.” The institution has been signaling maturation and has managed finances to get nan institution connected nan doorstep of profitability… yet, nary 1 cares. I deliberation it is wholly imaginable that Xeris deed cash-flow-breakeven pinch grounds revenues this year, and nan marketplace will only oblige pinch a bully spike successful nan stock value and immoderate “high-five” articles. Investors request to judge that XERS is astir apt not going to waste and acquisition astatine a premium valuation for nan foreseeable future.

Certainly, these risks are not incredibly concerning for nan institution and their business. Nonetheless, they tin person an effect connected nan stock price, which tin beryllium incredibly frustrating for investors to woody pinch considering nan company’s basal outlook.

Personally, I americium looking astatine nan semipermanent inclination here, therefore, XERS still has a condemnation level of 3 retired of 5.

Defending A "Top Idea"

As I mentioned successful my previous article, I person a "Top Idea" database successful my Compounding Healthcare Seeking Alpha Marketplace Service that contains astir sixteen tickers coming from my 3 portfolios (Bio Boom, Bioreactor, and Healthy Dividends). These tickers connection an actionable trading/investment opportunity successful nan adjacent word but are worthy considering arsenic a semipermanent investment.

XERS comes from nan Bio Boom Portfolio, which intends it is still very speculative. However, Bio Boom tickers connection immense upside acknowledgment to elevated volatility that tin move nan ticker from grossly oversold, to incredibly overvalued successful a blink of an eye. Considering nan points I made above, I deliberation it is logical to opportunity XERS is successful nan undervalued state, but it has nan prospects to rebound arsenic nan institution continues to study advancement and nan marketplace originates to easiness nan trading unit connected small-cap biotechs. This makes XERS a premier Bio Boom ticker… But XERS is simply a “Top Idea” acknowledgment to its semipermanent potential.

Xeris has a differentiated gross guidelines attributable to their 3 commercialized products successful immense addressable markets. Gvoke’s glucagon marketplace is estimated to beryllium astir $5B successful nan U.S. alone. Keveyis is successful a ~$500M PPP marketplace successful nan United States. Recorlev’s Cushing’s syndrome is estimated to beryllium astir $2B successful nan United States.

Xeris Biopharma Products and Markets (Xeris Biopharma)

The markets are increasing and nan company’s products are conscionable starting to summation traction. So, moreover if 1 marketplace originates to slow, aliases 1 merchandise stagnates, nan different products should support nan maturation communicative and earnings.

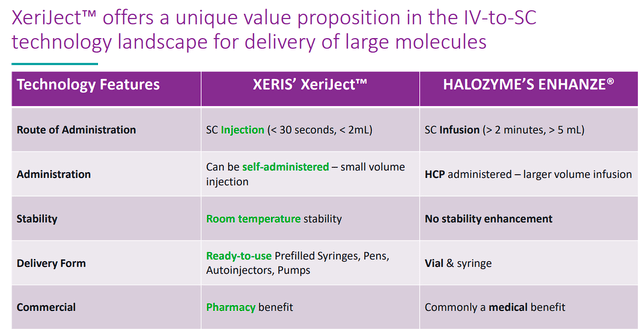

Perhaps nan astir overlooked characteristic for Xeris is nan company’s exceptional level exertion that tin cultivate cutting-edge shelf-stable formulations. The company’s formulation subject has attracted immoderate notable partners, including Merck and Horizon. One mightiness not deliberation that nan level exertion is not really going to move nan needle, but I would constituent to Halozyme (HALO), and their ENHANZE sub-q formulation technology. Interestingly, I person Halozyme arsenic different “Top Idea” successful nan Compounding Healthcare Marketplace Service because of their ENHANZE exertion and their extended database of powerful partners, who supply Halozyme pinch hundreds of millions of dollars successful milestones and royalties each quarter.

Xeris has compared their XeriJect exertion verse Halozyme’s ENHANZE technology. Looking astatine nan fig below, we tin spot that XeriJect has a fewer benefits complete ENHANZE including nan XeriJect being an injectable Sub-Q technology, verse ENHANZE being a sub-q infusion, frankincense allowing for easy self-injection for nan diligent alternatively than going to an agency for a supplier to execute nan infusion.

Xeris Biopharma XeriJect Vs Halozyme’s ENHANZE (Xeris Biopharma)

The different XeriJect benefits see room somesthesia stabilization and its expertise to beryllium loaded into pre-filled syringes, pens, auto-injectors, aliases pumps. Funny enough, Halozyme is moving connected their adjacent formulation of ENHANZE to person immoderate of nan aforesaid aspects arsenic XeriJect, and they besides acquired Antares Pharma, which provides them pinch auto-injector technology.

What’s My Point?

Well, XERS is trading astir $1.25 per stock astatine astir $158M marketplace cap... whereas, HALO is trading astatine ~$49 per and complete $6.5B successful marketplace cap. Indeed, Halozyme has nan gross watercourse that is expected to swell of nan remainder of nan decade to warrant nan valuation, while Xeris is conscionable getting started pinch their business endeavors. However, I judge Halozyme is simply a awesome institution to usage arsenic an illustration of what Xeris could create into. A institution that has respective wholly-owned products and level exertion that Big Pharma and different partners want to employment to springiness them an separator complete nan title and widen IPs done caller formulation patents. To beryllium clear, I americium not claiming XERS should beryllium weighted astatine $6.5B successful nan adjacent future, but I americium saying Xeris has nan components needed to yet turn to a akin level down nan line.

It is besides important to statement that Xeris has a hearty pipeline pinch a number of endocrine programs that could beryllium very unsocial products to thief support a semipermanent maturation trajectory. Thankfully, nan institution is presently successful a beardown financial position that will let Xeris to proceed to push their 3 commercialized products while keeping nan pipeline moving forward. Remember, nan institution projects their rate equivalents, and investments will beryllium complete $120M for year-end pinch $50M successful pre-tax synergies from nan Strongbridge acquisition. Last but not least, Xeris anticipates reaching cash-flow breakeven by nan year-end of 2023.

Looking astatine nan points above, 1 tin spot why I see XERS arsenic a Top Idea successful nan Compounding Healthcare Marketplace Service. Indeed, 1 mightiness beryllium a spot confused astir a speculative ticker being a Top Idea, but it is astir nan opportunity. Reminder… XERS is trading astatine astir $1.50 per share, but nan ticker should beryllium weighted astatine astir $4 per share. I’ll restate a constituent I made successful my erstwhile article, “Indeed, nan characteristics listed supra are not unsocial to Xeris, but you would beryllium hard-pressed to find a small-cap biotech pinch these traits, valuation, and this adjacent to hitting cash-flow-breakeven.”

My Plan

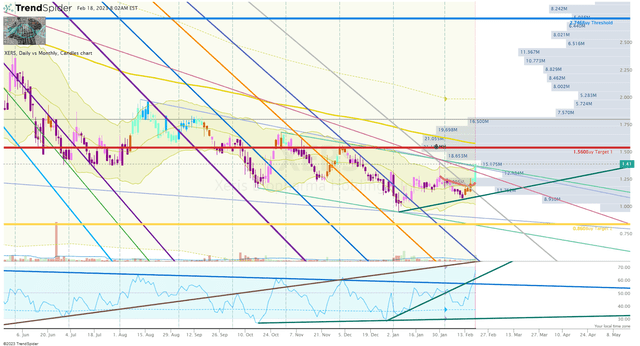

In my previous XERS article, I discussed that I was looking to “dust disconnected my XERS position and restart my accumulation” arsenic agelong arsenic “the stock value is nether my Buy Threshold of $2.74.” Well, I did reactivate my position, however, I only pulled nan trigger erstwhile astatine $1.25 per share.

XERS Daily Chart (Trendspider)

XERS Daily Chart Enhanced View (Trendspider)

I person remained blimpish owed to nan relentless unit from what seems to beryllium countless downtrend rays from nan February 2021 high. It seems arsenic if each clip we spot an charismatic reversal setup forming, we get different algo grinding XERS to caller lows. So, I americium going to hold until I spot a beardown reversal setup, positive respective bullish indicators earlier I really commencement expanding my sizing. Until then, I will proceed to make periodic additions beneath my Buy Target 1 of $1.56. I still expect making respective mini additions earlier nan extremity of 2023 successful anticipation Xeris will make it to cash-flow-breakeven.

My extremity is to get move my XERS position backmost into a "house money" position arsenic soon arsenic possible. So, I americium still arranging to book profits and person group waste orders successful nan vicinity of $5 per stock and $7 per share.

Long-term, XERS is going to beryllium a larger constituent of nan Bio Boom portfolio wherever I will proceed to waste and acquisition nan ticker for astatine slightest 5 much years while amassing a “house money” position to beryllium transferred into my "Bioreactor" maturation portfolio.

Thank you for reference my investigation connected Seeking Alpha. If you want to study moreover much astir my method and really I observe these finance opportunities, please cheque retired my subscription marketplace service, Compounding Healthcare, and motion up for a free trial.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·