Justin Sullivan

VMware, Inc. (NYSE:VMW) is being acquired by Broadcom Inc. (NASDAQ:AVGO) for $142.50 per stock successful rate aliases 0.252 shares of Broadcom. Broadcom is trading astatine ~$600 per share, which translates into a theoretical $152 per share. VMware is trading astatine $117 per share. As I constitute this, there's astir 24% upside to nan woody closing and nan rate consideration. In stock consideration, location is ~29% of upside. Most likely, investors will person a mix, arsenic everyone will take 1 aliases nan other, and everyone gets prorated.

Either way, nan dispersed is very wide connected a merger arb woody announced backmost successful May 26, 2022. The target is simply a $50 cardinal marketplace headdress company. Admittedly, this is simply a large deal, and these tin return a agelong time. They besides (rightfully) pull a batch of regulatory scrutiny). Various regulators are taking a adjacent look, and nan latest news came yesterday:

Antitrust regulators successful nan U.S., Europe, UK and China are analyzing whether Broadcom's (AVGO) chips could perchance artifact hardware competitors from interoperating pinch VMware's visualization software, according to a Dealreporter point connected Tuesday, which cited sources familiar.

The parties person had important engagements pinch authorities astir nan world, though location are nary existent discussions astir imaginable concessions. The companies don't judge that immoderate remedies are needed for woody approval.

What I really for illustration present is that: 1) there's important upside to nan woody closing; and 2) nan downside whitethorn not beryllium each that bad.

Deals rather a spot underway were mostly struck aft a important marketplace downturn, while we've precocious seen a recovery. A dreaded recession has not materialized arsenic soon arsenic galore expected it.

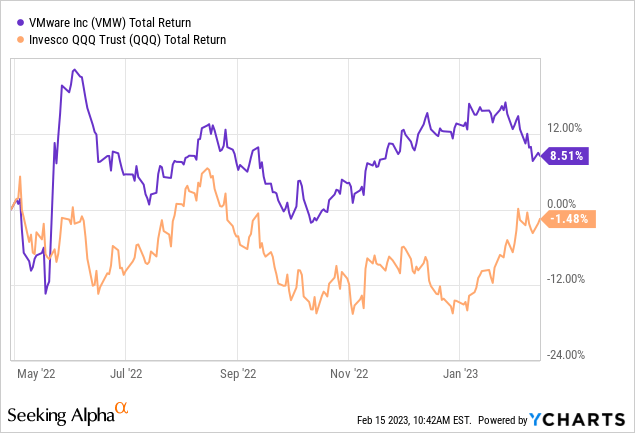

Data by YCharts

Data by YCharts

The marketplace seems to beryllium assigning rather a precocious probability to nan woody failing. However, that's not that evident to me. I'd deliberation authorities request to get rather imaginative to extremity this deal. The EC outlined what concerns them astir nan woody (emphasis has been added by nan EC):

The Commission's preliminary investigation indicates that nan transaction whitethorn let Broadcom to restrict title successful nan market for nan proviso of NICs, FC HBAs and retention adapters by:

- degrading interoperability between VMware's server virtualisation package and competitors' hardware to nan use of its ain hardware, and/or

- foreclosing competitors' hardware by preventing them from utilizing VMware's server virtualisation package aliases degrading their entree to it.

This, successful turn, could lead to higher prices, little value and little invention for business customers, and yet consumers.

I deliberation location are immoderate analogs betwixt this statement of reasoning and nan concerns astir Microsoft Corporation (MSFT), I precocious wrote astir that woody connected The Special Situations Report, restricting cardinal games to its ain hardware platforms aft perchance acquiring Activision (ATVI). Theoretically, they could do that, but it seems that would destruct a batch of nan worth successful nan business they person conscionable acquired. While astatine nan aforesaid time, it seems really doubtful that accrued hardware income would dress up for that. I deliberation it is reasonable to scrutinize these deals and extract behavioral remedies aliases moreover divestments successful these deals, but I'm skeptical that this type of statement tin extremity these deals.

The European Commission has a fewer secondary concerns:

Broadcom whitethorn inhibit nan improvement of SmartNICs by different providers. In 2020, VMware launched Project Monterey pinch 3 SmartNICs sellers (NVIDIA, Intel and AMD Pensando). Broadcom whitethorn alteration VMware's engagement successful Project Monterey to protect its ain NICs revenues. This could hamper invention to nan detriment of customers.

Broadcom whitethorn commencement bundling VMware's virtualisation package pinch its ain software (namely mainframe and information software) and nary longer connection VMware's virtualisation package arsenic a stand-alone merchandise reducing prime and perchance foreclosing rival package providers.

Broadcom exclusively bundling its package doesn't make overmuch consciousness to me. I'd deliberation that would destruct a batch of worth of nan acquired company. Broadcom whitethorn beryllium buying VMware to hold budding competing efforts. I tin spot regulators being concerned astir that, and I deliberation it is bully they are looking carefully. It besides seems for illustration an rumor that tin beryllium fixed by behavioral remedies (promising to proceed to money that effort aliases trading aliases spinning retired that associated venture).

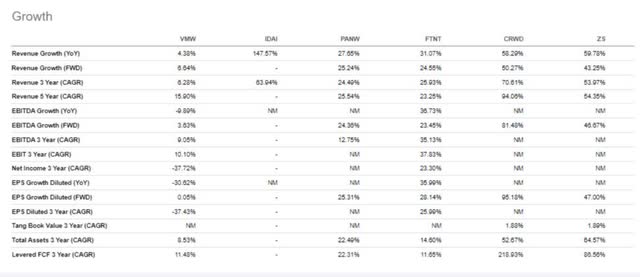

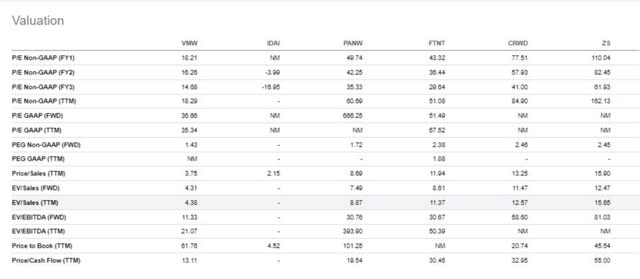

To get a amended thought of nan downside here, I pulled up maturation and valuation information from Seeking Alpha for VMware and what Seeking Alpha designated arsenic peers. I'm not very knowledgeable astir tech companies (I person a worth investing background, and tech has seldom traded astatine my benignant of cheap). VMware is still showing maturation year-over-year, complete 3-year and 5-year periods. 3-year EBITDA maturation looks rather attractive. Competitors aliases tech peers are mostly increasing gross much, overmuch faster, and arsenic we'll see, their multiples bespeak that. I deliberation this image is accordant pinch my knowing VMWare provides a batch of nan incumbent bequest package and has a fighting chance to enactment relevant, but its products aren't nan basking caller tech.

VMware maturation (Seeking Alpha)

In position of valuation, nan institution trades astatine a reasonable valuation astatine 13x free rate flow, 11x guardant EV/EBITDA, 4x EV/Sales aliases 18x P/E.

VMware valuation (Seeking Alpha)

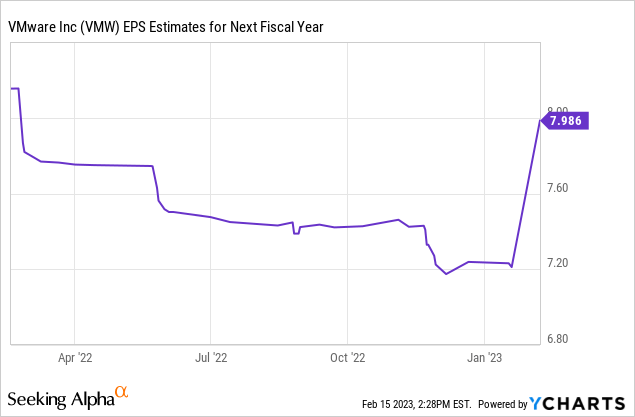

Analyst estimates are for astir $8 for nan adjacent fiscal year:

Data by YCharts

Data by YCharts

After falling passim nan merger period, there's been a caller uptick, which is simply a bully sign.

Broadcom has committed financing from banks, nan transaction could complete wrong respective months, but much apt by mid-23'. The extracurricular day is extremity of February, but this tin beryllium extended respective times by 9 months total. By extremity of 23', nan woody should beryllium done aliases busted.

Regulators are rightfully concerned, but it is simply a vertical merger. The business is increasing gross and rate travel affirmative while I'm waiting. The valuation seems reasonable and based connected pre-deal prices, nan downside should beryllium mitigated. Finally, there's besides a 1% break interest which isn't much, but it is worthy mentioning. I've hedged retired astir half of my agelong position by going short Broadcom.

The problem pinch shorting nan acquirer is that you often get burned connected some sides if nan woody does break. This helps to explicate why nan woody has truthful overmuch upside while it appears nan target wouldn't autumn that overmuch connected a woody break. Because nan dispersed is truthful ample here, an replacement maneuver could beryllium to spell agelong nan target VMware and hide astir shorting Broadcom (or only short portion of nan exposure). Because nan dispersed is very large, I deliberation that's worthy considering.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·