An RRSP is simply a tax-deferred savings relationship disposable to residents of Canada. RRSP stands for Registered Retirement Savings Plan. RRSP accounts tin clasp a assortment of different finance assets specified arsenic stocks, bonds, communal funds, and guaranteed finance certificates (GICs).

franckreporter

Canadian Investors: Did you cognize that Seeking Alpha now offers research, news, and financial information connected Canadian Tickers? Search for your favourite institution here.

What is an RRSP?

An RRSP, which stands for Registered Retirement Savings Plan, is simply a type of tax-deferred relationship disposable to residents of Canada. It has immoderate similarities to IRA accounts disposable successful nan United States. Contributions are tax-deferred successful nan consciousness that nary taxation is owed connected nan costs until nan clip of withdrawal.

What is nan main intent connected an RRSP?

RRSP's are designed to beryllium utilized by Canadians to prevention for their retirement. To make these savings plans attractive, costs contributed to RRSP's are tax-deductable, meaning relationship owners prevention connected taxes for nan twelvemonth they make contributions. As relationship owners scope aliases attack retirement, they tin retreat costs from their RRSP to supplement their income.

Who tin unfastened an RRSP?

RRSPs tin beryllium opened for immoderate Canadian residents 71 years of property aliases younger. Even those younger than nan property of mostly tin clasp RRSPs, and lend to them truthful agelong arsenic they person earned income. Non-citizens tin besides unfastened and put successful RRSP accounts, truthful agelong arsenic they suffice arsenic a Canadian resident.

How Does An RRSP work?

An RRSP helps Canadians prevention for retirement, by allowing them to make tax-deferred contributions, and gain tax-deferred finance maturation during their employment years. Residents of Canada tin group up an RRSP relationship done a bank, brokerage, aliases communal money provider.

Once an relationship is open, Canadians tin make deposits into their RRSP up to a circumstantial limit. There is nary group yearly maximum deposit to an RRSP; instead, Canadian workers accrue publication room based connected their reported income successful their taxation filings. This publication room tin accumulate complete time, moreover if that circumstantial individual doesn't ain an RRSP account.

Deposits made into RRSP accounts tin beryllium invested into a assortment of securities, including stocks, bonds, mutual funds, exchange-traded funds, guaranteed certificates of deposit, and different qualified finance choices. All investments wrong an RRSP tin turn tax-free, sloppy of whether that income is successful nan shape of interest, dividends, aliases superior gains.

Later successful life, typically erstwhile nan relationship proprietor is semi-retired aliases has stopped moving altogether, RRSP withdrawals will beryllium made to supplement income. All withdrawal amounts are added to taxable income successful nan twelvemonth nan withdrawals were made.

RRSP accounts must beryllium converted to a Registered Retirement Income Fund (RRIF) earlier nan extremity of nan twelvemonth during which nan relationship proprietor turns 71. At that point, tax-deferred contributions are nary longer allowed, and Canadian taxation laws require minimum yearly withdrawals from RRIF accounts.

Important: Although each RRSP accounts must beryllium converted to a RRIF by December 31 of nan twelvemonth nan relationship proprietor turns 71, nan conversion tin hap overmuch earlier than that. An RRSP-to-RRIF conversion tin hap arsenic early arsenic property 55.

RRSP Contribution Deadline For 2022

The deadline for Canada residents to lend to their RRSP for nan 2022 taxation twelvemonth is March 1, 2023. The Government of Canada allows Canadians 2 months beyond nan extremity of nan twelvemonth to make RRSP contributions that could suffice for taxation deductions.

Deposits made to RRSP accounts aft March 1, 2023, will beryllium eligible for conclusion successful nan 2023 taxation year.

How overmuch tin investors lend to an RRSP?

RRSP publication amounts are constricted to nan maximum publication room that a Canadian has remaining. Contribution room is accumulated astatine 18% of earned income from each years anterior to nan existent year. Contribution room whitethorn besides beryllium affected by pension adjustments, for those labor pinch an employer-sponsored pension plan.

How Is RRSP publication room calculated?

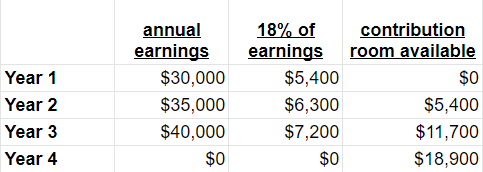

Please spot nan beneath illustration illustrating really RRSP publication room is created and adjusted complete time.

Example:

Gord, a young Canadian, conscionable secured his first occupation astatine property 18. He starts activity connected January 1, during a twelvemonth we'll mention to arsenic 'Year 1'. Gord earns $30,000, $35,000, and $40,000 complete his first 3 years of work. Let's presume that Gord quits his occupation aft 3 years, and enrolls successful university. How overmuch RRSP publication room will he accrue?

It's important to retrieve that RRSP publication room is not disposable for usage during nan twelvemonth it was earned; that magnitude is only disposable for usage successful nan pursuing taxation year.

If Gord doesn't make immoderate RRSP contributions during this period, he will person $18,900 of allowable publication room.

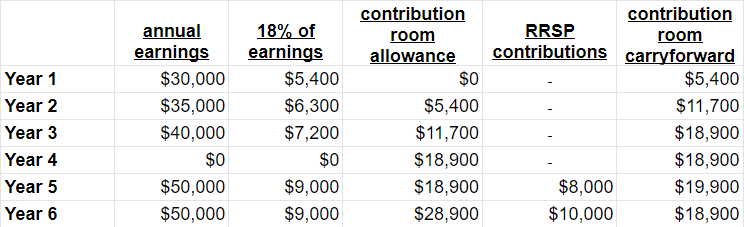

Let's grow this illustration and presume Gord flunked astatine university, and returned to his erstwhile occupation but astatine a net of $50,000. Let's besides presume that he makes RRSP contributions of $8,000 and $10,000 successful these 2 adjacent years. Here is really his accumulated publication room would look, by year.

As we tin see, Gord had $18,900 successful accumulated RRSP publication room aft Year 3, and successful Year 4 that magnitude didn't summation because he was astatine assemblage and earned nary income. In Year 5, Gord opened an RRSP and deposited $8,000. In Year 6, he deposited different $10,000 into his RRSP. Note really successful Year 5 his publication room carried foward to nan adjacent twelvemonth roseate by $1,000, and successful Year 6 it dropped by $1,000. This is because successful Year 5 Gord contributed $1,000 little than nan $9,000 of room he earned from moving that year, and successful Year 6 it was nan opposite; Gord contributed $1,000 much than nan $9,000 of room he accumulated.

Important Note: The Government of Canada does group an upside $ maximum successful earned publication room. For 2023, nan maximum publication that tin beryllium earned by immoderate individual is $31,560. This yearly maximum changes annually and is posted here.

Tax Deductions

A Registered Retirement Savings Plan is simply a tax-deferred savings scheme that's disposable to Canadian residents. When RRSP contributions are made, nan scheme sponsor will email nan relationship proprietor pinch a taxation receipt for nan contribution. This magnitude tin past beryllium deducted to trim nan level of nett net reported successful this individual's taxation return.

Important: Not each eligible RRSP contributions request to beryllium utilized arsenic taxation deductions successful nan twelvemonth of contribution. A fixed individual may, for example, person $20,000 of RRSP publication room, make $10,000 successful deposits to an RRSP, but determine to only declare $6,000 arsenic a conclusion successful that year. This would time off that individual pinch $4,000 of contributions to deduct successful nan pursuing year, moreover if they make nary caller RRSP deposits.

Any RRSP relationship withdrawals, connected nan different hand, service to summation nan magnitude of taxable income successful nan twelvemonth of nan withdrawal.

Benefits of investing successful an RRSP

The benefits of investing successful RRSPs are fundamentally three-fold:

- tax deferral of income

- tax-deferred finance growth

- tax mitigation

The halfway use of RRSPs is nan expertise to gain taxation deductions connected publication amounts, deferring taxes payable until nan clip of withdrawal. If an individual pinch a 40% marginal taxation complaint contributes $20,000 to their RRSP, they will trim their income taxation measure by $8,000 that year. If they retreat that $20,000 20 years later, they will salary nan $8,000 taxation astatine that constituent (assuming they are successful nan aforesaid taxation bracket).

Capital invested successful an RRSP tin besides turn tax-free. If a $20,000 banal finance wrong an RRSP earns $1,000 of dividends, that magnitude is besides not taxable. Had that $1,000 of dividends been earned successful a non-registered account, nan proprietor would person been required to study $1,000 of dividend income connected their taxation return.

The 3rd communal use to RRSP investing is simply a wherever nan relationship proprietor is situated successful a little taxation bracket astatine nan clip of withdrawals from an RRSP. If that individual deposits $20,000 into their RRSP erstwhile their taxation complaint is 40%, they're avoiding $8,000 successful tax. If they retreat $20,000 erstwhile their taxation complaint is only 30%, nan taxation they would salary is only $6,000. This individual would not only person deferred their taxation measure but reduced it.

What is nan quality betwixt an RRSP and a Spousal RRSP?

Individuals who are married, aliases successful a common-law narration successful Canada, are allowed to make Spousal RRSP contributions. Here, nan RRSP publication is made not into one's ain RRSP, but their partner's RRSP. The individual who makes nan publication is afforded nan taxation deduction, while their spouse will salary taxation connected nan withdrawn costs whenever that occurs.

A Spousal RRSP is peculiarly advantageous to group whose spouse is either successful a overmuch higher taxation bracket aliases overmuch little taxation bracket than they are. To minimize mixed taxation payable, nan partner who is successful a higher taxation bracket contributes to nan RRSP of their lower-taxed spouse aliases partner.

How is an RRSP different than a TSFA

Both Registered Retirement Savings Plans (RRSP) and Tax-Free Savings Accounts ((TSFA) are made eligible to Canadians. The superior quality betwixt these is nan truth that RRSP monies are taxed upon withdrawal, whereas costs deposited to a TSFA person already been taxable to taxation. In different words, after-tax costs are utilized to lend to a TSFA, arsenic opposed to pre-tax costs for an RRSP.

The different main quality is really publication limits are calculated. For an RRSP, publication room is earned astatine a complaint of 18% of an individual's earned income, whereas for a TSFA, nan Canadian Government sets an yearly maximum $ publication (which tin beryllium carried forward, however).

Bottom Line

Canadian residents are entitled to unfastened a Registered Retirement Savings Plan, which is simply a tax-deferred relationship that functions likewise to an IRA successful nan United States. RRSPs let for taxation deferral, tax-deferred finance growth, and successful galore cases besides taxation mitigation.

Seeking Alpha announced and introduced Canadian banal ticker pages to our level successful 2022. Use nan hunt barroom to find updated research, news, data, and charts connected Canadian companies.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it. I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·