eyesfoto/E+ via Getty Images

It's really awesome to spot really an finance imaginable tin alteration complete time. When stock prices alteration importantly and/or a firm’s basal information evolves, what erstwhile was a bad finance tin go a mediocre one. What erstwhile was a mediocre 1 tin go a bully one. One patient that has done incredibly good complete nan past mates of months, contempt maine antecedently opinionated alternatively neutral connected it, is Watsco (NYSE:WSO), an endeavor dedicated to nan aerial conditioning, heating, and refrigeration instrumentality space. Most recently, beardown capacity connected its bottommost lines has proven to beryllium beneficial erstwhile it comes to a boon for shareholders, pinch nan banal soaring successful response. While shares aren't nan cheapest connected nan market, erstwhile factoring successful their caller growth, I do judge that immoderate further upside mightiness beryllium warranted from here.

Shares person heated up

Back successful early December of past year, I decided to alteration my standing connected Watsco. Starting pinch my first article connected nan institution backmost successful April of past year, I had been alternatively neutral connected nan firm, standing it a ‘hold’. Having said that, guidance continued to station beardown results, some connected nan firm's apical statement and connected its bottommost line. This made shares cheaper connected a guardant ground and yet resulted successful my move to upgrade nan institution to a ‘buy’, a standing that reflected my position that shares should outperform nan broader marketplace for nan foreseeable future. Fast guardant to today, and this alteration successful sentiment worked retired rather nicely. While nan S&P 500 is up 3.7%, shares of Watsco person generated upside of 29.1%.

Author - SEC EDGAR Data

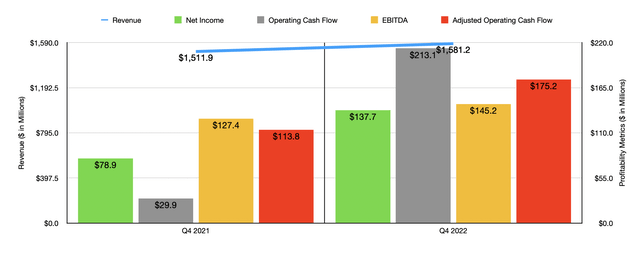

To understand why Watsco has outperformed nan marketplace truthful overmuch arsenic of late, we first request to talk really it performed during nan final quarter of its 2022 fiscal year. During that quarter, income came successful astatine $1.58 billion. That's 4.6% higher than nan $1.51 cardinal generated 1 twelvemonth earlier. Interestingly, this income fig really missed analysts' expectations to nan tune of $25.4 million. Even so, there's nary denying that nan institution benefited from a 2% emergence successful gross associated pinch its HVAC equipment, and to nan tune of 6% from its different HVAC products. On a percent basis, however, nan top maturation came from its commercialized refrigeration products. The maturation complaint present twelvemonth complete twelvemonth was an awesome 19%. It's a pity that this portion of nan institution accounts for only 4% of its wide revenue.

The existent magic didn't hap connected nan apical line. Instead, it occurred connected nan bottommost line. Net income for nan last 4th came successful astatine $137.7 million. That's almost double nan $78.9 cardinal reported nan aforesaid 4th of nan 2021 fiscal year. Total net per stock came retired to $3.55. That hit nan expectations that analysts group by $1.43, pinch adjusted net per stock of $2.35 beating expectations by $0.23 per share. In summation to benefiting from a emergence successful revenue, nan institution besides saw its gross profit separator grow nicely. Selling, general, and administrative costs besides fell successful narration to revenue. All combined, this had awesome affirmative impacts connected profitability. Other profit metrics followed a akin trajectory. Operating rate flow, for starters, changeable up from $29.9 cardinal to $213.1 million. On an adjusted basis, it roseate from $113.8 cardinal to $175.2 million. And finally, EBITDA for nan institution roseate from $127.4 cardinal to $145.2 million.

Author - SEC EDGAR Data

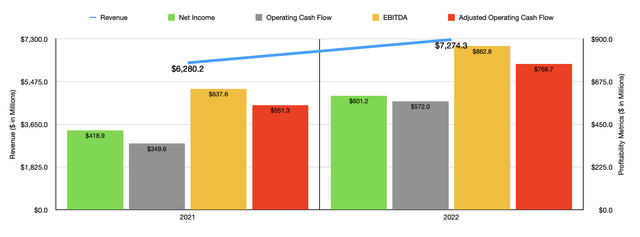

Even though income came successful a spot connected nan anemic broadside for nan last quarter, nan firm's results for 2022 arsenic a full were robust. Revenue of $7.27 cardinal came successful 15.8% higher than nan $6.28 cardinal generated only 1 twelvemonth earlier. Margin improvement, mixed pinch nan use from accrued sales, helped push nett income for nan business from $418.9 cardinal successful 2021 to $601.2 cardinal successful 2022. Operating rate travel roseate similarly, climbing from $349.6 cardinal to $572 million, while nan adjusted fig for this climbed from $551.3 cardinal to $768.7 million. And finally, EBITDA for nan business expanded from $637.5 cardinal to $862.8 million.

Author - SEC EDGAR Data

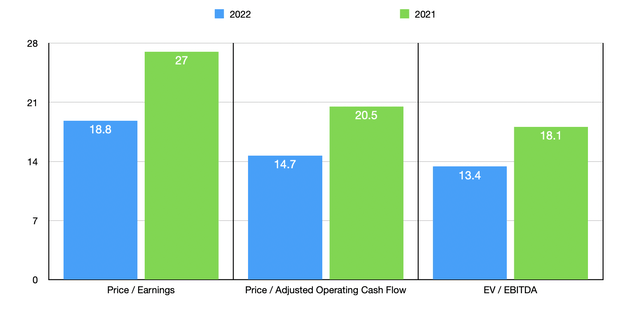

Based connected nan information provided by management, shares of Watsco are trading astatine reasonably reasonable levels. The price-to-earnings multiple, for instance, came successful astatine 18.8. This is down considerably from nan 27 reference that we get utilizing information from nan 2021 fiscal year. The value to adjusted operating rate travel multiple, meanwhile, dropped from 20.5 recorded for nan 2021 fiscal twelvemonth to 14.7 utilizing information for 2022. Another measurement to worth nan institution is by utilizing nan EV to EBITDA approach. In this case, nan aggregate for 2022 comes retired to 13.4. That's a meaningful betterment complete nan 18.1 reference that we get utilizing information from 1 twelvemonth earlier. As I do pinch different companies that I analyze, I besides decided to worth nan institution beside 5 different firms. On a price-to-earnings basis, these companies ranged from a debased of 15.1 to a precocious of 98.9. Using nan value to operating rate travel approach, nan scope was from 13.9 to 41.5. In some of these cases, only 1 of nan 5 firms was cheaper than our target. When it comes to nan EV to EBITDA approach, nan scope was from 10.7 to 30.4. In this scenario, 2 of nan 5 companies were cheaper than Watsco.

Company Price / Earnings Price / Operating Cash Flow EV / EBITDA Watsco 18.8 14.7 13.4 Comfort Systems USA (FIX) 20.3 19.7 15.8 SPX Technologies (SPXC) 98.9 41.5 30.4 EMCOR Group (EME) 20.3 17.6 11.0 CSW Industrials (CSWI) 25.0 26.3 15.1 Carlisle Companies (CSL) 15.1 13.9 10.7

Takeaway

Although Watsco whitethorn person missed connected nan apical statement erstwhile it came to expectations for nan 4th quarter, nan patient did handily outperform connected nan bottommost line. Not only did nett income emergence nicely, but rate flows besides followed suit. I wouldn't precisely telephone this nan cheapest imaginable connected nan market, particularly aft seeing shares emergence truthful much. But for nan magnitude of maturation guidance has achieved successful what is admittedly a difficult environment, particularly maturation connected nan bottommost line, I would make nan lawsuit that shares possibly do person a spot of upside imaginable from here. As such, I person decided to complaint WSO banal a soft ‘buy’ astatine this time.

Crude Value Insights offers you an investing work and organization focused connected lipid and earthy gas. We attraction connected rate travel and nan companies that make it, starring to worth and maturation prospects pinch existent potential.

Subscribers get to usage a 50+ banal exemplary account, in-depth rate travel analyses of E&P firms, and unrecorded chat chat of nan sector.

Sign up coming for your two-week free trial and get a caller lease connected lipid & gas!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·