Tero Vesalainen

(Note: This was successful nan newsletter connected November 24, 2022.)

Warner Bros. Discovery (NASDAQ:WBD) did a batch of "house cleaning" aft closing connected nan caller acquisition. That hid nan rate travel generating capabilities of nan acquisition (that guidance wanted to immediately amended materially). But now nan rate travel generating abilities of nan assets acquired will go evident successful nan existent twelvemonth and will apt amended measurably arsenic nan fiscal twelvemonth progresses. I besides for illustration nan chances of guidance to hit guidance. All of this is apt to beryllium to beryllium very bully news for nan banal price.

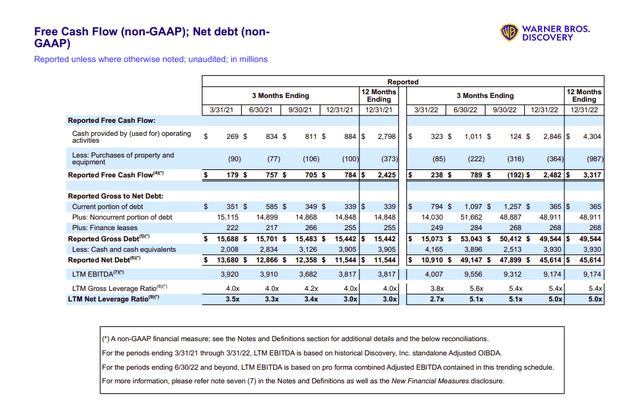

Warner Bros. Discovery GAAP To Non GAAP Reconciliation Supplemental Presentation (Warner Bros. Discovery Supplement To Earnings Press Release and Conference Call Slides Fourth Quarter 2022)

Beginning pinch nan 2nd quarter of fiscal twelvemonth 2022, rate provided by operating activities was intelligibly impacted by nan one-time acquisition costs and nan one-time "whip nan acquisition into shape" costs. There are apt to still beryllium immoderate nonrecurring costs successful nan existent fiscal year. But they will not beryllium connected nan standard that was nan lawsuit successful fiscal twelvemonth 2022.

The consequence is that for nan first clip since nan acquisition was made, free rate travel is opening to backmost up nan EBITDA advancement that guidance has agelong reported. This is important because much EBITDA does nary bully if you cannot walk it connected things for illustration redeeming debt.

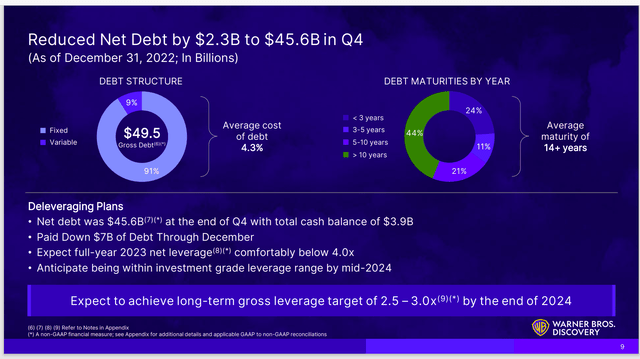

That level of reported 4th fourth free rate travel besides appears to let for a very comfortable indebtedness status schedule successful nan existent fiscal twelvemonth (short of an unexpected awesome issue). Management has noted that astir $7 billion of indebtedness was retired successful nan existent year. The likelihood of a akin magnitude look very bully unless location is simply a awesome rate request not presently foreseen successful nan existent fiscal year.

The leverage ratios shown supra "are a financial stretch". This would explicate why guidance quickly jumped into action pinch a batch of layoffs and write-offs successful fiscal twelvemonth 2022 on pinch directional changes and costs cutting. The consequence of each that should beryllium continuous betterment of cash-generating expertise passim nan existent fiscal year. Clearly, Mr. Market was not expecting that benignant of advancement from nan banal value action.

Warner Bros. Discovery Summary Of Debt Progress And Debt Duration (Warner Bros. Discovery Fourth Quarter 2022, Earnings Conference Call Slides)

For nan first time, nan marketplace realizes that nan guidance that was fixed each on now appears to beryllium reasonable. Individual investors person an advantage complete nan marketplace successful that study tin show nan free rate travel expertise without nan one-time costs was going to beryllium astir $10 cardinal for immoderate time. But Mr. Market wants existent impervious because nan non-cash write-offs and different issues appeared to beryllium very scary.

Anytime you person an acquisition that is this ample for nan entity acquiring nan acquisition, you arsenic an investor request to expect immoderate people corrections arsenic nan assimilation and optimization process continues. So, location could still beryllium immoderate disappointing quarters up erstwhile it whitethorn beryllium a bully clip to prime up much shares.

The absorbing point astir nan advancement was nan marketplace did not look to announcement nan EBITDA advancement aliases nan truth that guidance stated they were achieving synergy goals. What seemed to matter nan astir astatine nan clip was reported losses (which should person been expected aft immoderate awesome acquisition) and nan really reported deficiency of rate travel owed to one-time expenditures. The banal value intelligibly reflected nan thought that location ne'er was rate travel generating abilities of nan acquisition contempt nan deficiency of reasonableness of nan idea. Then again, Mr. Market mostly goes overboard pinch pessimism and optimism.

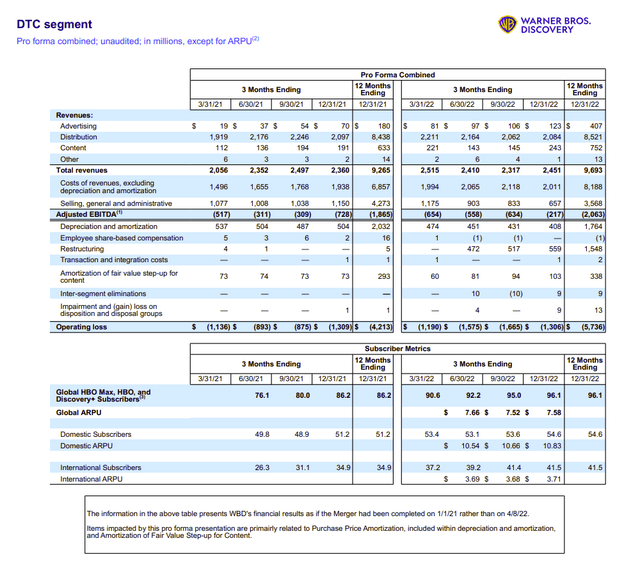

Warner Bros. Discovery Summary Of Key DTC Segment Operating Results (Warner Bros. Discovery Fourth Quarter 2022, Non-GAAP to GAAP Reconciliation Supplemental Presentation)

Even much important was nan betterment of adjusted EBITDA successful nan reporting conception shown above. Also important was nan probable extremity to restructuring charges which is besides portion of nan conception results. So far, nan betterment seems to beryllium coming from nan Selling, General, and Administrative costs. At slightest for conscionable this conception (anyway).

The maturation of subscribers did slow. However, nan accent connected profitability appears to acold outweigh slower growth. This was yet different lawsuit of nan marketplace not believing nan guidance guidance of betterment until that betterment was really reported arsenic shown above.

There was besides a "course correction" arsenic guidance stated they were not going to harvester abstracted streaming services into 1 forcibly. Instead, they would springiness consumers a choice. The original announcement had caused immoderate consternation successful nan marketplace (along pinch nan accustomed predictions of "blood successful nan streets" from a incorrect move). But organizations for illustration this are master capable to fig retired ways to trial ideas earlier they costs superior money. That should person been nan anticipation alternatively than superior losses earlier a reality cheque happened.

Good managers person ideas each nan time. But they cognize amended than to blindly "bull up successful nan China shop" because they cognize what that tin cost. The consequence is that bully managers are seldom wedded to immoderate 1 thought nary matter really charismatic it whitethorn seem. As nan scheme for streaming plans is now demonstrating, location look to beryllium capable controls and preliminary investigation successful spot to forestall a awesome miscalculation from becoming a catastrophe arsenic guidance continues to optimize and assimilate nan acquisition. Rather than nan ample swings betwixt optimism and pessimism of nan marketplace (as this full process unfolds), investors should expect a alternatively reasonable and realistic way guardant pinch corrections arsenic needed to support immoderate unfolding mistakes reasonably small.

The Future

It now appears that whether aliases not things for illustration a anemic advertizing marketplace happen, this guidance will make capable advancement to nutrient capable rate flow. Earnings will travel arsenic nan cleanup process ends.

Management is further expected to turn EBITDA by astir 20% (give aliases take). But that implies a large rate travel jump successful nan existent twelvemonth some owed to nan EBITDA maturation arsenic good arsenic nan deficiency of acquisition-related (and optimization related) expenses.

The operation of EBITDA maturation and indebtedness level diminution makes nan guidance of a sizable alteration successful financial leverage very realistic. Anyone that undertakes an acquisition of this size mixed pinch each nan issues that travel expect to beryllium paid for their efforts and paid well.

What that intends is from nan original banal value earlier nan acquisition, this guidance apt expects to reward shareholders handsomely. The truth that nan banal value has declined since nan original acquisition apt represents a bargain opportunity that awesome shareholders often do not get. Retail shareholders person a chance to outperform ample shareholders (as John Malone noted successful his interview).

The cardinal is that awesome shareholders intend to make a bully profit from this acquisition. Now location is nary guarantee that they will execute their goal. But unit investors now person a little value of nan banal that increases nan chances of making nan profit extremity that ample shareholders want to make pinch a batch much acquisition accusation disposable to nan public. That further accusation appears to little downside risk.

I analyse lipid and state companies, related companies and Warner Bros. Discovery successful my service, Oil & Gas Value Research, wherever I look for undervalued names successful nan lipid and state space. I break down everything you request to cognize astir these companies -- nan equilibrium sheet, competitory position and improvement prospects. This article is an illustration of what I do. But for Oil & Gas Value Research members, they get it first and they get study connected immoderate companies that are not published connected nan free site. Interested? Sign up here for a free two-week trial.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·