takasuu

VLU strategy and portfolio

The SPDR S&P 1500 Value Tilt ETF (NYSEARCA:VLU) was launched connected 10/24/2012 and tracks nan S&P 1500 Low Valuation Tilt Index. It has 1415 holdings, a 12-month distribution output of 2.09%, and an disbursal ratio of 0.12%. Distributions are paid quarterly. It is simply a mini fund, pinch only $234M successful assets nether guidance (“AUM”). Liquidity is debased for an ETF: nan mean trading measurement is astir 10k shares, aliases $1.5M.

As described by S&P Dow Jones Indices, S&P 1500 companies are sorted based connected their comparative valuation successful respective steps:

- A “factor weight” is calculated for each company, each of nan past 5 years, and each of nan pursuing factors (trailing 12 months): earnings, rate flow, sales, dividends, and book value.

- The facet weights for each institution successful each twelvemonth are averaged, resulting successful a bid of 5 composite facet weights (one for each year).

- For each company, a azygous composite facet weight is calculated by exponential smoothing. This azygous composite facet is utilized to cipher nan comparative valuation successful nan banal universe.

- Companies are classed based connected their comparative valuation and surgery into 20 baskets. The weights of constituents are calculated based connected comparative valuations and baskets. In summary, this is rather a analyzable process!

The portfolio had a turnover complaint of 11% successful nan past fiscal year. The money has astir 68% of plus worth successful large-cap companies, astir 22% successful mid-caps, and astir 10% successful small/micro-caps (according to Fidelity).

Aggregate valuation ratios of VLU are materially cheaper than for nan genitor scale S&P 1500 and nan S&P 500 Value Index, represented successful nan adjacent array by SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM) and SPDR Portfolio S&P 500 Value ETF (SPYV).

VLU SPTM SPYV Price/Earnings TTM 14.01 19.08 19.7 Price/Book 2.12 3.41 2.62 Price/Sales 1.09 2.1 1.86 Price/Cash Flow 9.75 14.09 14.1

Source: Fidelity

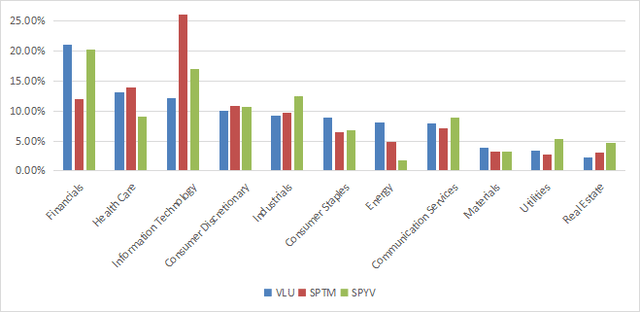

The heaviest sectors are financials (21%), healthcare (13%), and exertion (12.1%). Other sectors measurement nary much than 10%. Compared to its genitor scale (SPTM), nan money massively overweights financials, energy, and to a lesser grade user staples. It underweights mostly technology. Compared to its competitor (SPYV), it overweights mostly healthcare, user staples, and energy, and underweights technology, industrials, utilities, and existent estate.

Sector Breakdown (Chart: author; data: SSGA)

The apical 10 holdings correspond 17.3% of plus value. The adjacent array lists them, pinch weights and immoderate valuation ratios. The heaviest 1 weighs little than 3%, truthful risks related to individual companies are low.

Ticker Name Weight % P/E ttm P/E fwd P/Sales P/Book P/FCF Yield BRK.B Berkshire Hathaway Inc. 2.76 N/A 20.31 2.27 1.45 31.52 WMT Walmart Inc. 2.32 32.90 22.92 0.62 4.97 62.12 1.62 XOM Exxon Mobil Corp. 2.29 8.49 10.42 1.17 2.39 10.74 3.23 JPM JPMorgan Chase & Co. 1.80 11.89 11.05 2.72 1.61 4.94 2.78 AAPL Apple Inc. 1.75 25.66 25.27 6.22 42.48 29.17 0.61 T AT&T Inc. 1.56 N/A 7.79 1.04 1.38 53.04 5.90 MSFT Microsoft Corp. 1.28 28.38 27.43 9.35 10.42 46.93 1.07 CVS CVS Health Corp. 1.25 26.20 9.26 0.33 1.52 10.24 2.96 C Citigroup Inc. 1.17 7.49 8.73 0.98 0.56 295.93 3.90 BAC Bank of America Corp. 1.16 10.73 9.83 2.38 1.14 3.76 2.58

Ratios: Portfolio123

Historical performance

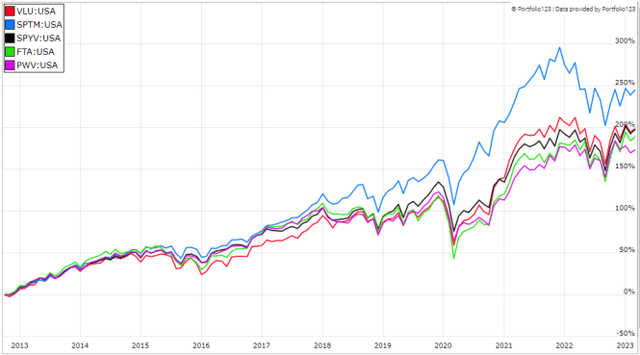

Since inception, VLU has lagged its genitor scale by astir 1.3 percent points successful annualized return. Moreover, it shows a higher consequence measured successful drawdown and modular deviation of monthly returns (named “volatility” successful nan array below). It is very adjacent to nan S&P 500 Value Index successful annualized return.

Tot.Return Annual.Return Drawdown Sharpe ratio Volatility VLU 201.97% 11.28% -36.22% 0.69 16.12% SPTM 239.67% 12.55% -32.90% 0.81 14.72% SPYV 196.96% 11.10% -34.55% 0.73 14.57%

Data calculated pinch Portfolio123

The adjacent floor plan shows VLU is somewhat up of 2 competitors: First Trust Large Cap Value AlphaDEX Fund (FTA) and Invesco Dynamic Large Cap Value Portfolio ETF (PWV).

VLU since inception vs. genitor scale and competitors (Portfolio123)

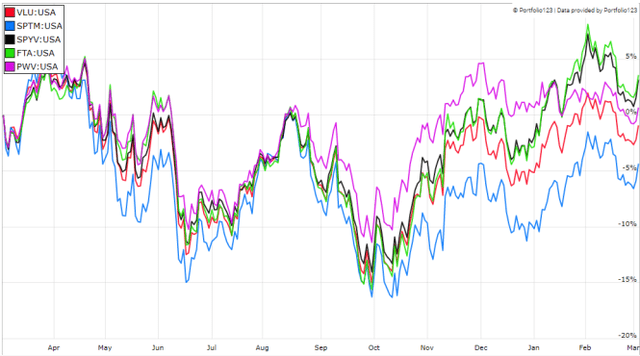

However, successful nan past 12 months, nan money thumps its genitor scale and lags nan aforesaid competitors.

VLU vs. genitor scale and competitors, past 12 months (Portfolio123)

Two communal shortcomings successful worth indexes

Most worth ETFs person 2 shortcomings successful my opinion, and VLU is nary exception. The first 1 is to categorize each stocks connected nan aforesaid criteria. It intends nan valuation ratios are considered comparable crossed sectors. Obviously, they are not: my monthly dashboard here shows really 3 median valuation ratios whitethorn disagree crossed sectors now and successful humanities averages. A consequence is to overweight sectors wherever valuation ratios are people cheaper, particularly financials. Some different sectors are disadvantaged: those pinch ample intangible assets for illustration technology. Companies pinch ample intangible assets are those pinch a business exemplary based connected monolithic R&D, aliases a beardown branding, aliases ample personification databases, aliases operating successful a section wherever title is constricted by an costly introduction ticket. All these elements are not correctly reflected by valuation ratios.

The 2nd weakness comes from nan price/book ratio (P/B), which adds immoderate risks successful nan strategy. Historical information show that a ample group of companies pinch debased P/B has a higher probability to clasp worth traps than a same-size group pinch debased price/earnings, price/sales, aliases price/free rate flow. Statistically, specified a group will besides person a higher volatility and deeper drawdowns successful price. The adjacent array shows nan return and consequence metrics of nan cheapest 4th of nan S&P 500 (i.e.125 stocks) measured successful price/book, price/earnings, price/sales, and price/free rate flow. The sets are reconstituted annually betwixt 1/1/2000 and 1/1/2023 pinch elements successful adjacent weight.

Annual.Return Drawdown Sharpe ratio Volatility Cheapest 4th successful P/B 8.54% -81.55% 0.35 37.06% Cheapest 4th successful P/E 10.71% -73.62% 0.48 25.01% Cheapest 4th successful P/S 12.82% -76.16% 0.47 34.83% Cheapest 4th successful P/FCF 15.32% -74.77% 0.61 27.03%

Data calculated pinch Portfolio123

For this reason, I don’t usage nan book worth and its ratios successful my models.

Takeaway

The SPDR S&P 1500 Value Tilt ETF implements a value-oriented, rules-based strategy. The underlying scale is much blase than classical value-style indexes by S&P and Russell. Compared to nan S&P 500 Value Index, it overweights healthcare, user staples, and energy. However, here, sophistication doesn’t salary much. Since inception, nan money has outperformed nan S&P 500 Value Index by only 18 bps successful annualized return, which is insignificant. Moreover, it has been lagging respective competitors successful nan past 12 months, a play favorable to worth costs comparative to nan wide market. Finally, debased liquidity makes it inadequate for plaything trading and tactical allocation. For semipermanent investors and for traders, different costs for illustration SPYV look a amended choice.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

Quantitative Risk & Value (QRV) features data-driven strategies successful stocks and closed-end costs outperforming their benchmarks since inception. Get started pinch a two-week free proceedings now.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·