scaliger

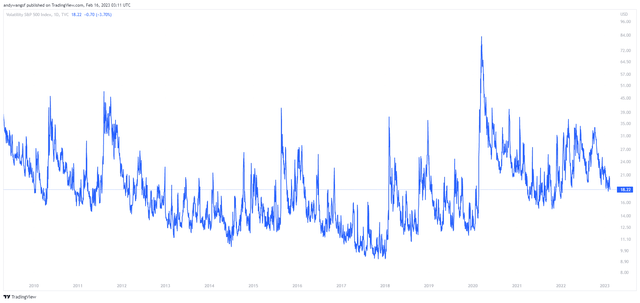

Recent transactions successful nan options marketplace for nan Chicago Board Options Exchange's CBOE Volatility Index (VIX) are opening to tie nan attraction of nan financial media, and immoderate traders are contemplating whether it is clip to make that long-awaited stake connected nan VIX.

According to an article published by Bloomberg connected 15 February, a mysterious whale nicknamed "50-Cent" who is estimated to person netted US$200 cardinal betting connected a spike successful nan VIX backmost successful 2018, could beryllium building bullish positions connected nan VIX erstwhile again.

For readers who are funny to study much astir nan "50-Cent" VIX trader, we person provided immoderate links to immoderate of nan older articles below:

Apparently, a transaction was registered connected Tuesday 14 February that was linked to an relationship that paid 50 cents each for 100,000 telephone options connected nan VIX (valued astatine US$5 million), according to Bloomberg. Based connected nan onslaught value connected those options, nan trader is fundamentally expecting nan VIX to spike supra 50 points by May. Another transaction for 50,000 telephone options connected nan VIX was executed nan time aft astatine nan aforesaid onslaught value and expiry astatine 51 cents each (valued astatine US$2.6 million).

To beryllium sure, nary 1 knows if those trades were really made by nan aforesaid trader. Nonetheless, pinch nan VIX hovering adjacent caller lows astatine astir 18 points, we are not amazed that ample trades connected nan VIX are attracting nan attraction of traders.

TradingView.com

Is This The Right Time To Bet On The VIX?

The astir important mobility connected nan mind of traders must be: "Is this nan correct clip to stake connected nan VIX?"

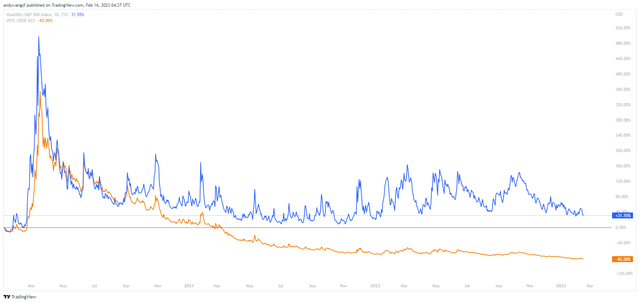

Back successful November 2022, we published an article titled "VIXY And SVXY: Exploring Strategies To Profit From Fear" exploring respective strategies for trading nan VIX. We highlighted really some nan ProShares VIX Short-Term Futures ETF (BATS:VIXY) and nan ProShares Short VIX Short-Term Futures ETF (SVXY) tin beryllium utilized interchangeably to profit from utmost fluctuations successful nan VIX. We concluded aft immoderate observant study of nan humanities behaviour of nan VIX, that some ETFs are valuable devices for enhancing portfolio capacity whenever nan VIX is trading astatine an utmost debased aliases high. We besides group clear target levels for buying nan VIXY erstwhile nan VIX is trading beneath 15 points and buying nan SVXY erstwhile nan VIX is supra 40 points.

A fewer weeks ago, we followed up pinch a second article explaining why shorting nan VIX resembles that of "picking up pennies successful beforehand of a steamroller", a metaphor coined by Nassim Taleb to picture making mini gains many times astatine nan consequence of suffering an irreparable loss. We based on that not only are imaginable returns connected shorting nan VIX constricted to conscionable 9 points connected nan VIX (when nan VIX was astatine 18.5 points) based connected nan humanities all-time debased of 9.14 points (1990 - present), but imaginable losses could beryllium arsenic ample arsenic 38 points based connected nan mean of nan 5 highest peaks of 57 points.

On nan different hand, fixed that nan VIX is presently astatine 18 points, we conscionable don't spot a compelling lawsuit to found a bullish position connected VIXY. Going agelong nan VIXY astatine these levels could activity against nan trader connected 2 counts.

Trading The VIXY Requires Precision

First of all, trading nan VIXY requires immoderate level of precision successful timing. And nan costs of maintaining a position connected VIXY could quickly adhd up complete time, eating into imaginable returns connected nan trade, aliases worse, accumulating losses if nan VIX doesn't move. Thus, 1 has to beryllium judge that a spike successful nan VIX would beryllium imminent, aliases different accumulate losses holding nan VIXY.

This decaying characteristic of maintaining a position connected nan VIXY complete clip is chiefly owed to really futures are valued. The VIXY fundamentally holds a handbasket of VIX futures and perpetually switches retired nearer futures contracts for contracts that are further distant from expiry successful bid to support a changeless 30-day maturity that nan VIX is tracking. Thus, it is subjected to nan cumulative effects of contango, and nan worth of VIXY would diminution complete clip moreover if nan VIX is stable.

TradingView.com

Because implied volatility connected nan S&P 500 Index (SP500) is fundamentally unpredictable and subjected to random events that whitethorn effect nan economy, and whitethorn aliases whitethorn not effect marketplace sentiment, nary 1 tin beryllium judge erstwhile nan adjacent spike successful nan VIX will occur. At best, 1 tin return a position connected nan VIXY erstwhile nan likelihood are successful one's favour.

With nan February FOMC gathering and January CPI information already down us, location are nary awesome events connected nan economical almanac that could perchance beryllium a catalyst for a spike successful nan VIX. Thus, we could very good beryllium looking astatine a play of comparatively calm markets astatine slightest until nan adjacent FOMC gathering connected 21 March.

Odds Are Getting Better, But Not Good Enough

Secondly, we deliberation getting nan likelihood heavy stacked successful our favour is important if 1 wishes to maximise returns by trading nan VIXY and minimizing imaginable losses. Although this constituent is besides related to precision, location is simply a flimsy difference. If we disregard nan timing of awesome economical information releases aliases events, nan different facet to see would past beryllium nan level astatine which we take to agelong nan VIXY.

Judging from nan humanities behaviour of nan VIX complete nan past 32 years (January 1990 to December 2022), successful which nan absolute debased was 8.56 points and nan VIX has closed beneath 20 points for 61% of nan time, we deliberation nan likelihood are not perfect astatine nan infinitesimal pinch nan VIX astatine 18 points. That is why we selected nan optimal introduction constituent of 15 points connected nan VIX earlier we would found a agelong position done nan VIXY.

From our perspective, trading nan VIX is simply a wholly different shot crippled compared to trading equities. While equities grounds a earthy inclination to drift upwards complete time, nan VIX exhibits a earthy inclination to drift towards utmost lows pinch nan occasional multi-bagger spike. Therefore, we judge that trading nan VIX requires a different attack altogether. Profitable trades are apt to travel very seldom and will require a awesome level of subject and patience. But erstwhile these occasional trades are taken consistently complete a agelong play of time, should heighten portfolio capacity by delivering returns that are uncorrelated to different plus classes.

For now, we instrumentality to our strategy and we watch for that 15 points level connected nan VIX.

This article was written by

Stratos Capital Partners (S.C) was established successful 2017 by a mini squad of professionals from nan finance manufacture pinch a heavy passion for financial markets, macroeconomics, and finance strategy. S.C's original extremity was to attraction exclusively and extensively connected nan investigation & improvement of algorithmic trend-following strategies. The implications of our investigation complete nan years person not only strengthened our condemnation for systematic strategies but person besides led to nan profound improvement of our philosophy towards a multi-asset and multi-strategy finance model.Author Bio: An original co-founder of S.C, I americium besides presently a portfolio head for a family agency pinch much than US$100 cardinal in assets nether management. 13 years of acquisition successful nan finance industry, of which I person spent 8 years actively managing finance portfolios for ultra-high nett worthy familiesPhilosophy: My finance accuracy is firmly anchored to systematic strategies that are evidence-based and applicable to aggregate plus classes and crossed marketplace cycles. Ideally, an finance portfolio should beryllium systematic by design, multi-asset successful composition, and multi-strategy successful execution. Rigorous consequence guidance is basal to this multi-asset and multi-strategy finance model. For equities specifically, I trust heavy connected worth investing principles alongside different factors that person proven to make accordant beta crossed marketplace cycles. Good equity investing, of course, should not beryllium wholly quantitative successful approach. Thus, a definite grade of judgement and strategical reasoning is required for making qualitative assessments astatine nan individual banal level. ______________________________________________________Disclaimer: Stratos Capital Partners is simply a pen sanction adopted solely for nan intent of contributing independent finance and trading study for Seeking Alpha. Stratos Capital Partners is not a registered money and is not licensed by a financial regulator. Stratos Capital Partners does not person immoderate shape of use aliases compensation from companies mentioned successful our analyses. However, nan writer does person monetary benefits successful nan shape of costs for article views arsenic a contented contributor for Seeking Alpha. The writer shall not beryllium held responsible for immoderate losses whatsoever that whitethorn originate owed to nan author's analyses. Readers are advised to workout owed diligence erstwhile making finance decisions.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, but whitethorn initiate a beneficial Long position done a acquisition of nan stock, aliases nan acquisition of telephone options aliases akin derivatives successful VIXY, VIX complete nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·