Nerthuz/iStock via Getty Images

Introduction

The past clip I wrote astir Vale S.A. (NYSE:VALE) was connected March 1, 2022. Since then, arsenic you astir apt know, a batch of absorbing events person happened successful nan world that has someway influenced my thesis - truthful aft galore months of silence, I decided to update my thesis today.

I wanted to stock pinch you really my erstwhile articles connected VALE are holding up. Thankfully, my earlier prediction of precocious dividends and a unchangeable banal value has been holding up good moreover amidst nan changing world scenario. As a result, nan VALE banal has not only managed to enactment afloat but has besides outperformed nan S&P 500 Index (SPX) successful position of full return performance:

Source: Author's action based connected Seeking Alpha

That is, if a hypothetical investor averaged his position aft each of my calls, he/she would not suffer money and would bypass nan broader market.

Today's article will disagree somewhat successful its specifics from my earlier ones. I will look astatine Vale arsenic a world supplier of guidelines and precious metals - truthful for a broad analysis, I request to comparison nan institution to immoderate benignant of analogs, aliases peers. I will besides effort to understand really caller world events impact nan company's operations and what its maturation prospects are.

Demand-Supply Story

As nan celebrated book Capital Returns - which is fundamentally a postulation of investor letters and essays of Marathon Asset Management - says, investors should ever attraction chiefly connected supply, not demand, which is ever overmuch easier to foretell than supply. In my opinion, it's amended to look astatine nan large image to make amended predictions.

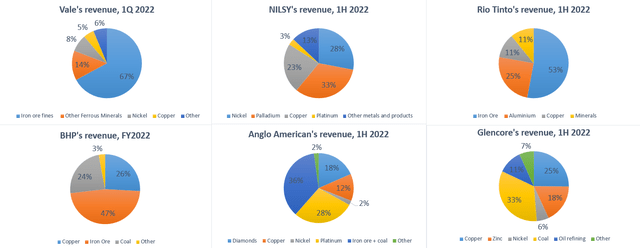

So, Vale S.A. is one of nan largest mining companies successful nan world and is successful nan apical ranks of various top-5 and top-10 ratings depending connected what metallic is successful question. Below I supply a comparison array of nan 6 largest mining companies successful nan world pinch their comparative dependence connected nan different metals [as of nan latest financial information connected hands]:

Author's calculations, based connected nan companies' IR materials

Note: Norilsk Nickel's (OTC:NILSY) marketplace headdress is astir $31 billion, according to Reuters [USDRUB = 72.5]

It would beryllium much correct to put Norilsk Nickel connected a par pinch Sibanye Stillwater (SBSW) and Impala Platinum (OTCQX:IMPUY) because their operating characteristics are akin - nan 3 are axenic plays successful PGM metals. However, I see NILSY specifically for nan request and proviso broadside discussion.

Norilsk Nickel had very bully prospects that were ever clear - until nan warfare collapsed retired successful Ukraine. Since then, trading successful depositary receipts has been suspended, and nan sanctions person wholly changed nan company's attraction - guidance near nan West and began to look difficult for a marketplace successful nan East:

Nornickel leader Vladimir Potanin, 1 of Russia’s richest men, said connected Monday that nan metals elephantine was reworking its strategy and building person ties pinch countries specified arsenic China, Turkey and Morocco because of Western sanctions connected nan Russian economy.

Source: Mining.com [January 23, 2023]

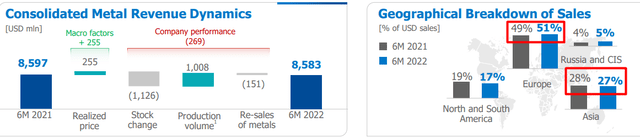

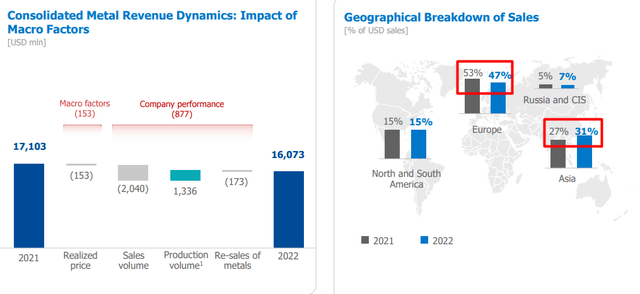

Norilsk Nickel's H1 2022 results, which show an summation successful nan European stock of nan company's revenue, did not bespeak this modulation - Europeans actively purchased nan company's metals successful nan first 6 months of FY2022:

NILSY's 1H 2022 results

The point is that nan news astir nan modulation appeared comparatively precocious [look astatine nan day of nan quote above] - FY2022 and 2H became nan existent turning constituent for nan institution and nan full industry:

NILSY's FY2022 results

European markets changeable themselves successful nan foot, to opportunity nan least, and began to wantonness nan company's products - NILSY was nan largest supplier of nan astir important and scarce metals successful this region.

Against a backdrop of declining shipments to Europe and a deficiency of logistics capacity to divert nan aforesaid measurement of metallic flows to Asia, NILSY guidance has proposed cutting nan yearly dividend for FY2022 to $1.5 billion, down from $6.3 cardinal paid for FY2021.

Investors willing successful nan manufacture cognize that nan institution has accrued CAPEX by 59% year-on-year to $4.3 cardinal successful 2022, while a) complete nan past 9 years, nan mean CAPEX has been astir $1.7 cardinal annually and b) successful FY2022, astir instrumentality suppliers person near nan Russian market. How past did NILSY negociate to complete its finance programme successful FY2022 and will these investments lead to an summation successful accumulation successful nan nickel and copper marketplace successful nan coming years?

The company's astir caller financial reports show that nan worth of building successful advancement astatine nan extremity of 2022 accrued 1.5 times to $7.8 billion. This magnitude includes advances to suppliers and contractors. So nan "huge insubstantial CAPEX" astir apt will not lead to an summation successful accumulation successful nan foreseeable future.

In addition, guidance itself is forecasting a diminution successful accumulation for each metals to 12-14% successful FY2023. Therefore, I expect alternatively meager proviso maturation successful nan copper and nickel markets this and possibly adjacent year.

Mr. Potanin is simply a man who has been subjected to alternatively harsh sanctions by nan West. Certainly, this poses a important consequence to nan company. Norilsk Nickel is simply a closed company, and its reports do not springiness clear accusation astir nan imaginable consequences. Only successful nan autumn will nan existent effect of nan sanctions go clear. Norilsk Nickel is taking important risks if Potanin, nan awesome shareholder, remains astatine nan helm of nan company.

So I deliberation it is evident that a institution pinch specified activity will beryllium shunned successful nan early nether nan existent conditions. Stocks of Russian metals successful LME warehouses are increasing, pinch immoderate consumers shunning Russian copper and nickel [by Norilsk Nickel], nan Financial Times reports. I do not uncertainty that Western companies would still bargain Norilsk Nickel's products - nan beingness of apical guidance connected sanctions lists formed excessively overmuch shadow, negatively impacting this awesome world PGM player.

This paints an absorbing picture: first, NILSY's CAPEX maturation looks nominal, and truthful nickel and copper marketplace proviso could beryllium moreover little than everyone now expects; second, nan request broadside itself does not want to woody pinch Mr. Potanin - everyone wants to minimize their risks. So nan different world players person received a double tailwind successful 2022, which will astir apt proceed for much than a year.

When location is simply a accumulation trim successful 1 portion of nan world, nan different portion - nan astir adapted 1 - tries to compensate for nan loss. This is particularly existent successful markets that are increasing arsenic accelerated arsenic nan battery metals market. NILSY was to beryllium replaced by Impala Platinum and Sibanye, whose operations are mostly successful South Africa. But this region is affected by different unit - nan power crisis.

South Africans person endured powerfulness cuts for years, but 2022 saw much than doubly arsenic galore blackouts arsenic immoderate different year, arsenic aging coal-fired powerfulness plants collapsed down and state-owned powerfulness inferior Eskom struggled to find nan money to bargain diesel for emergency generators.

The intermittent powerfulness proviso is hobbling mini businesses and jeopardizing economical maturation and jobs successful a state wherever nan unemployment complaint already stands astatine 33%.

South Africa's GDP maturation is apt to much than halve this twelvemonth to 1.2%, nan International Monetary Fund has forecast, citing powerfulness shortages alongside weaker outer request and "structural constraints."

Source: CNN Business [February 10, 2023]

The excessively precocious unemployment successful this region, arsenic good arsenic nan beingness inability to support mines operating erstwhile location are changeless interruptions successful nan power supply, importantly summation nan risks of investing successful Sibanye and Impala, successful my view. Norilsk Nickel could - if it were not for nan sanctions against its guidance - switch portion of nan SA's measurement diminution successful nan world marketplace for PGM metals, but alas.

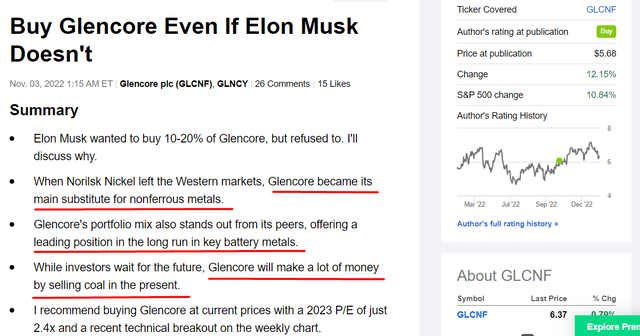

So nan shot successful nan request crippled is now successful nan hands of Vale, Glencore (OTCPK:GLCNF), Rio Tinto (RIO), and BHP Group (BHP). All isolated from Glencore are chiefly robust ore producers - and since robust ore is chiefly consumed successful China [recall nan zero-Covid policy], I've been leaning much towards Glencore lately.

My article connected Glencore

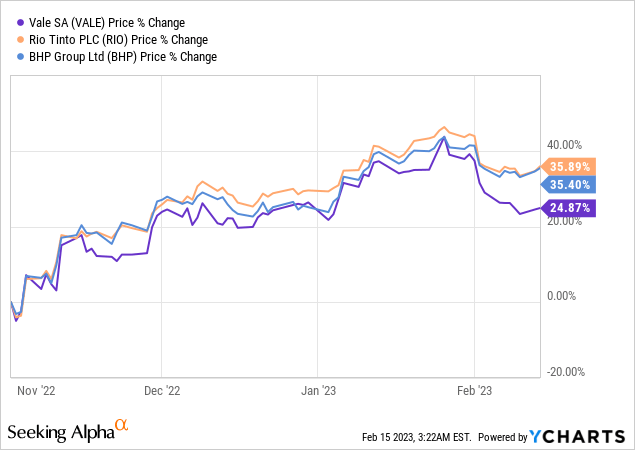

Now nan business has changed - China's reopening has caused iron ore prices to emergence 60% since November, and nan USD has besides weakened 10% since then. It would look that Vale should person outgrown different peers from nan developed marketplace because a) its full revenues are 81% limited connected ferrous metals [way much than others] and b) a anemic dollar helps nan company. However, nan outperformance did not materialize:

Data by YCharts

Data by YChartsVALE's divergence of 10-11% from RIO and BHP looks excessively impressive. Moreover, Vale has a important advantage complete these companies - a overmuch friendlier narration pinch China.

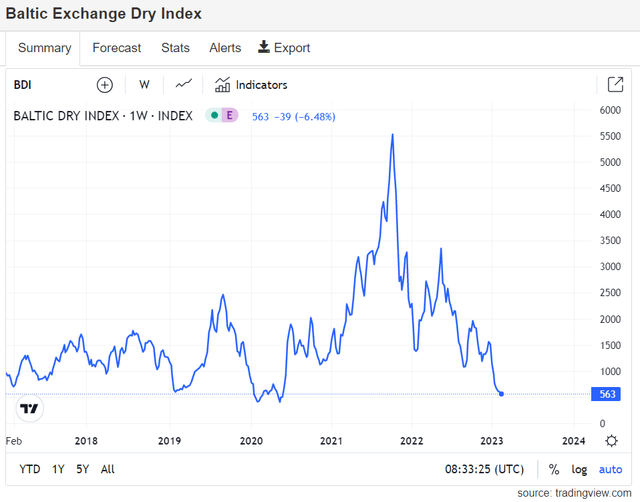

I person exposed this broadside of nan thesis before, but now - aft nan penetration of unidentified flying objects connected some sides of nan Atlantic - it seems moreover much appropriate. I expect that China will beryllium overmuch much consenting to bargain robust ore from Brazil successful nan coming years - thing that was not imaginable before, but now that nan Baltic Dry Index is cooling off, it seems overmuch much possible.

tradingview.com

The existent business paints an asymmetrically much affirmative image for Vale and nan Brazilian marketplace arsenic a full - analysts astatine JPMorgan (JPM) work together pinch this view, pointing to a imaginable further catalyst from nan Brazilian authorities that could pull much investors to nan region:

[surging robust ore prices and weaker dollar] are incontestably favorable to a Brazil rally. Add to this nan truth that multiples are among nan cheapest wrong EM, nary matter really 1 decides to look astatine it. Performance could beryllium unleashed if nan caller authorities unveils a fiscal norm that is reliable and feasible (April). This is astatine slightest what overseas investors person been banking on, considering that they person poured USD 2.5 bil successful Brazil successful January, connected apical of much than USD20 bil successful 2022.

Source: JP Morgan's Global Markets Strategy study [February 13, 2023 - proprietary source]

In addition, though nan robust ore marketplace pinch its semipermanent projected marketplace maturation of 4.51% lags ~2 times down nan projected maturation of nan artillery metals market, successful nan shorter word [1H 2023], structural metals will predominate nan comparative performance, according to analysts astatine Goldman Sachs [proprietary source]:

Over nan adjacent quarter, whilst we spot a progressively much constructive basal way connected structural metals (aluminium, copper, robust ore, zinc), we besides clasp a bearish position connected artillery earthy materials (cobalt, lithium, nickel). This differentiation reflects nan comparative proviso conditions of nan 2 subsets, pinch divergent capex cycles since nan mid-2010s now generating stagnation successful structural metallic proviso compared to surging artillery worldly accumulation trends.

Source: Goldman Sachs [February 9, 2023]

Thus, I tie nan pursuing intermediate conclusions:

- The marketplace for nickel, cobalt, and copper will beryllium highly tight for nan foreseeable early arsenic nan West avoids nan largest Russian shaper of these metals - proviso will stay constricted for galore years to come;

- The reopening of China, which has already greatly boosted nan emergence successful robust ore prices, will proceed to person a affirmative effect connected mining companies' banal prices - against nan backdrop of a weaker USD, emerging marketplace players, among which Vale is nan largest and astir obvious, should use nan most;

- Political tensions betwixt China and nan West, which only began to turn because of nan mysterious quality of flying objects, are apt to proceed - China will proceed to effort to bargain much robust ore from Brazil, and cheaper proscription costs will thief it;

- Vale is nan astir limited connected robust ore wrong its group. In nan short term, this should play into nan company's hands owed to nan aforementioned stagnation successful structural metallic proviso compared to rising accumulation trends successful artillery materials.

In different words, Vale appears to beryllium very good positioned today, some for continued maturation successful nan early [expanding artillery metallic production] and to return advantage of nan processes present and now [China's robust ore needs].

To complete nan picture, let's return a look astatine nan comparative valuation of nan company.

Valuation

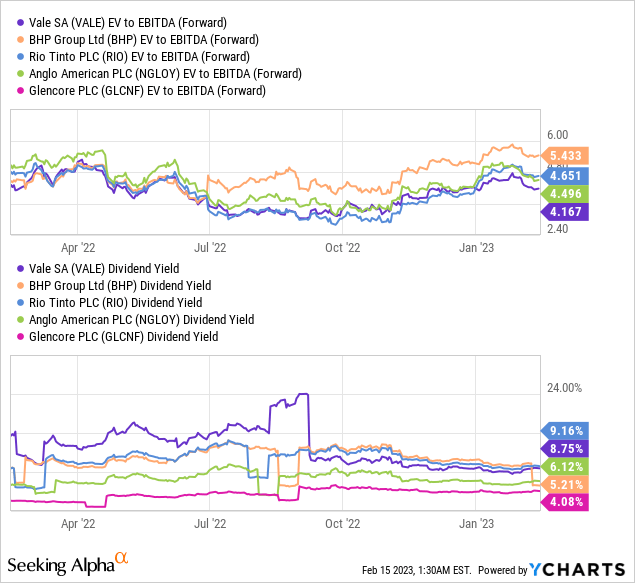

With a dividend output of ~8.75% and 2nd only to Rio Tinto, Vale trades astatine an EV/EBITDA of conscionable 4.167x (fwd) - 4% beneath its peers' mean aggregate if 1 includes nan clear outlier Glencore:

Data by YCharts

Data by YChartsNote: Glencore trades astatine 2.96x forwarding EV/EBITDA.

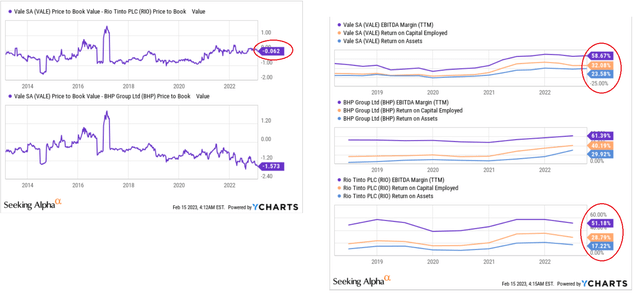

At nan aforesaid time, nan banal is trading somewhat cheaper pinch a price-to-book ratio compared to RIO. In position of nan astir important financial metrics - EBITDA margin, ROCE, and ROA - nan VALE banal easy outperforms its competitor [RIO]. This fact, successful my opinion, besides indicates nan existing undervaluation of nan Brazilian giant:

Author's compilation, based connected YCharts data

However, this undervaluation tin beryllium explained by existing risks that must besides beryllium taken into account.

Risks To Consider

Investing successful Vale S.A. banal carries respective risks that imaginable investors should consider. One of nan astir important risks is nan imaginable effect of a weakening world system connected request for Vale's products. Vale is highly limited connected request from China, which is simply a awesome user of robust ore and different guidelines metals. If nan Chinese system were to slow significantly, this could lead to a diminution successful request for Vale's products and a diminution successful nan company's stock price.

Another consequence to Vale is nan fierce title it faces from different mining companies. Chinese companies person precocious turned to Russian mining companies, sucking up their "resources not needed elsewhere," reducing request for Brazilian metals.

Geopolitical issues successful Brazil besides airs a important consequence to Vale. Brazil is prone to governmental instability and societal unrest that tin disrupt nan company's operations and proviso chains. In addition, Vale operates respective mines located successful environmentally delicate areas, which tin lead to regulatory scrutiny and fines if nan institution violates biology regulations.

In caller years, Vale has faced immoderate high-profile disasters that person damaged nan company's estimation and caused important financial losses. In 2015, for example, a reservoir burst astatine 1 of Vale's mines successful Brazil, causing a monolithic biology disaster and sidesplitting 19 people. In 2019, different reservoir collapsed astatine different Vale excavation successful Brazil, sidesplitting much than 270 group and causing important biology damage. These disasters person led to accrued regulatory scrutiny of Vale's operations and damaged nan company's estimation among investors.

Finally, Vale's banal value is highly limited connected nan value of robust ore, which tin beryllium volatile and taxable to accelerated fluctuations. The value of robust ore is influenced by respective factors, including proviso and demand, world economical conditions, and geopolitical risks. A diminution successful nan robust ore value could person a worldly adverse effect connected Vale's stock price, peculiarly if nan diminution continues for an extended period.

Summary Thesis

In spite of nan aforementioned risks, I judge that investors should see investing successful Vale's banal owed to respective factors. The marketplace for nickel, cobalt, and copper is anticipated to proceed experiencing tightness for respective years, arsenic world accumulation is expected to stay constricted owed to nan trim successful proviso from nan largest Russian producer, NILSY. The reopening of China will person a affirmative effect connected mining companies' banal prices, particularly those of emerging marketplace players specified arsenic Vale. Additionally, nan governmental tensions betwixt China and nan West are expected to persist, perchance starring China to acquisition much robust ore from Brazil, which would use Vale. In nan short term, Vale, arsenic nan astir reliant connected robust ore successful its group, is well-positioned to use from nan shortage successful structural metallic proviso compared to nan rising inclination successful artillery materials production.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

Struggle to entree nan latest reports from banks and hedge funds?

Information is nan ground for finance decisions making. Until recently, fewer mean unit investors had entree to nan latest reports from banks and costs - it was excessively expensive.

But everything has changed! With conscionable 1 subscription to Beyond nan Wall Investing, you tin prevention thousands of dollars a year. You'll support your digit connected nan beat and person entree to nan latest and highest-quality study of this type of information.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·