Jarvell Jardey/iStock via Getty Images

V&M Breakout Update - New Bearish Signals

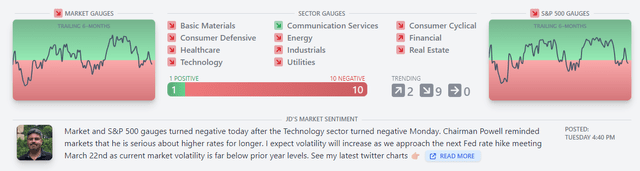

We person caller bearish signals this week for some nan wide marketplace of 7,500+ stocks and nan S&P 500 (SP500). However, sectors stay mixed while each weakening sharply again.

app.VMBreakouts.com

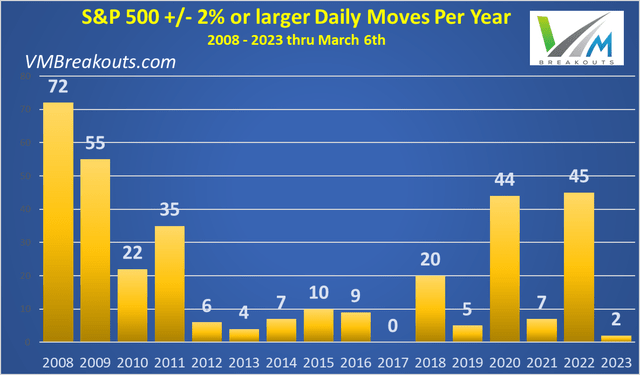

S&P 500 Volatility

So acold into 2023, nan S&P 500 volatility remains highly low. We person only had 2 days this twelvemonth pinch complete +/- 2% regular moves good beneath nan mean past twelvemonth pinch astir 4 days a period pinch large moves. I afloat expect to spot volatility prime up into Q2.

VMBreakouts.com

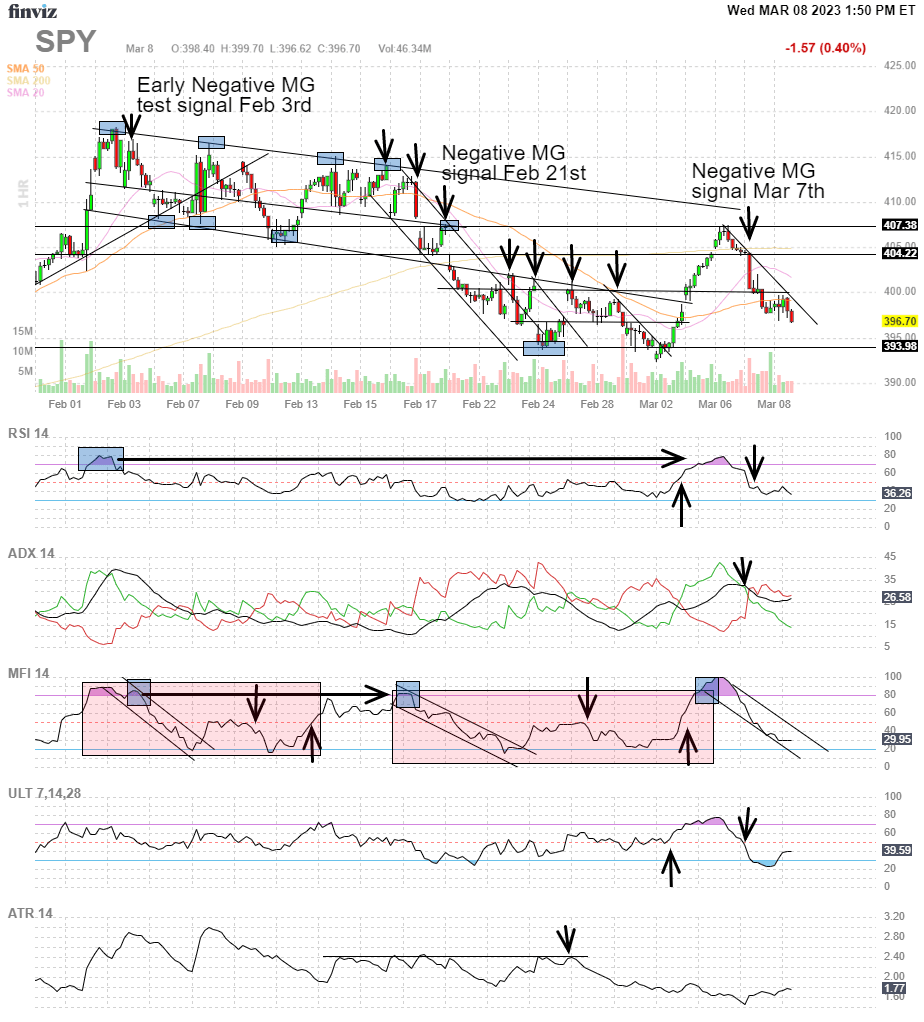

SPDR S&P 500 Trust ETF (NYSEARCA:SPY) February-March roadmap shows nan continuing breakdown from February antagonistic signal. Bearish step steps pinch little highs and little lows are apt to continue, pinch nan marketplace heading toward a test of March support levels.

VMBreakouts.com FinViz.com

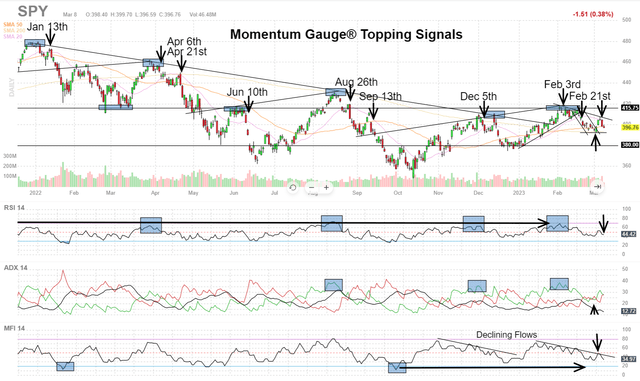

The Daily SPY chart shows nan breakdown from nan early February 3rd awesome and again connected February 21st. The similarities to nan August 2022 topping awesome stay strong, arsenic we saw predominant carnivore bounces connected nan measurement to -16.2% declines into September past year.

VMBreakouts.com FinViz.com

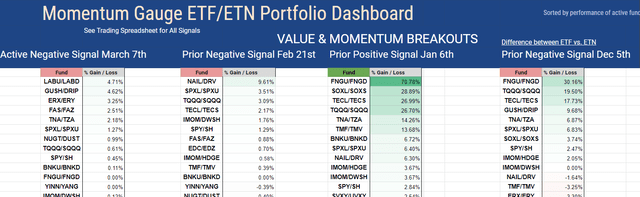

The ETF momentum gauge trading model switches betwixt Bull/Bear combos pursuing nan affirmative aliases antagonistic signals connected nan gauges. Members of my work person seen nan pursuing returns from nan changing signals. These returns are further enhanced pursuing nan early informing signals (not shown). The past affirmative awesome was excessively short to show returns.

VMBreakouts.com

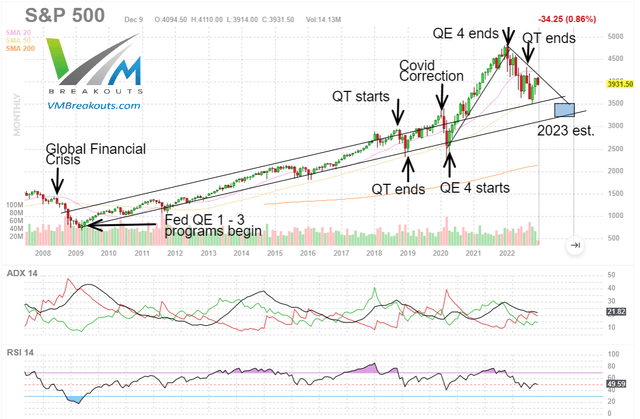

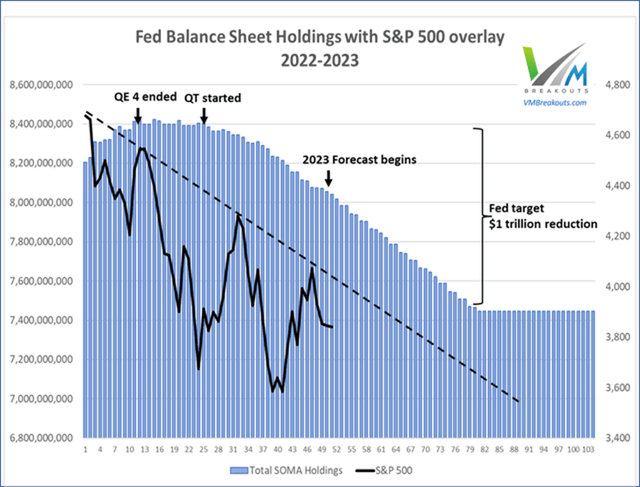

Long-Term Forecasts for 2023

Forecasts stay unchanged for a bearish outlook based connected nan effect of QT and complaint hikes connected markets successful each my QT studies from 2018. I person added a caller outlook article pinch nan imaginable for a Debt-Ceiling standoff:

VMBreakouts.com FinViz.com

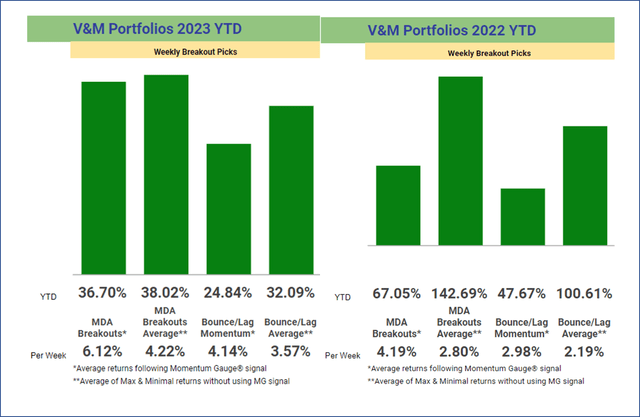

Short-Term Portfolios/Models

The 2 play breakout portfolios are shown below, on pinch existent 2023 returns. The ongoing title betwixt nan Bounce/Lag Momentum exemplary (from Prof Grant Henning, PhD Statistics) and MDA Breakout picks (from JD Henning, PhD Finance) is shown beneath with/without utilizing nan Momentum Gauge trading signal. The per-week returns equalize nan comparison, wherever location were only 16 affirmative trading weeks past year.

VMBreakouts.com

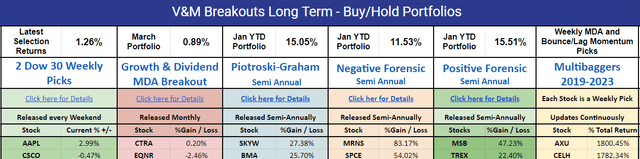

Long-Term Buy/Hold Portfolios

Positive Forensic portfolio is starring YTD returns +15.5% but disconnected nan highs arsenic Momentum Gauges move negative.

VMBreakouts.com

You tin find specifications connected nan semipermanent portfolios here:

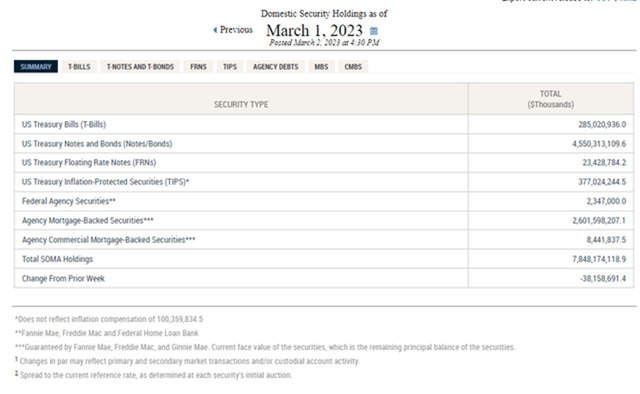

Fed Balance Sheet Tracker

We tin corroborate nan Fed reported different -$38.1 cardinal simplification successful their equilibrium expanse this week, pinch totals down much than -$468 cardinal since nan week 21 highest past twelvemonth pinch a $1 trillion simplification target. The Fed equilibrium expanse has been reduced backmost to levels successful October 2021. We will get nan latest equilibrium expanse update each Thursday aft nan close.

System Open Market Account Holdings - FEDERAL RESERVE BANK of NEW YORK.

Federal Reserve

Federal Reserve equilibrium expanse reduction, actuals and estimates

The Fed trim their equilibrium expanse different -$38.1 cardinal past week, pinch only 3 weeks pinch a larger trim since QT started past June. Next update from nan Fed is Thursday.

VMBreakouts.com

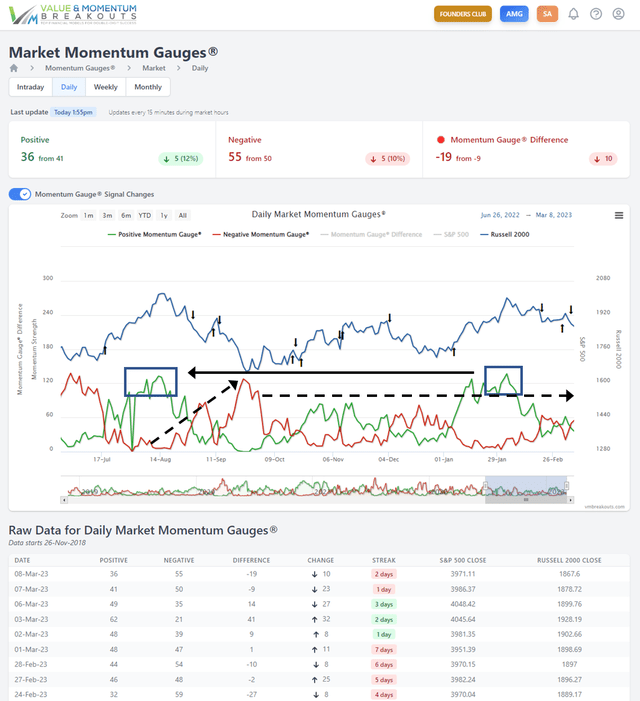

Daily Momentum Gauge Forecast

The Daily Market Momentum Gauges showing akin carnivore bounce activity arsenic past August. The larger antagonistic awesome has returned aft a short affirmative signal, declining from nan highest affirmative momentum levels since August 2022. We are seeing very akin patterns to nan August peak, pinch imaginable for antagonistic momentum (dotted line) to scope anterior September levels. Last August, nan S&P 500 declined -16.2% to nan September lows.

app.VMBreakouts.com

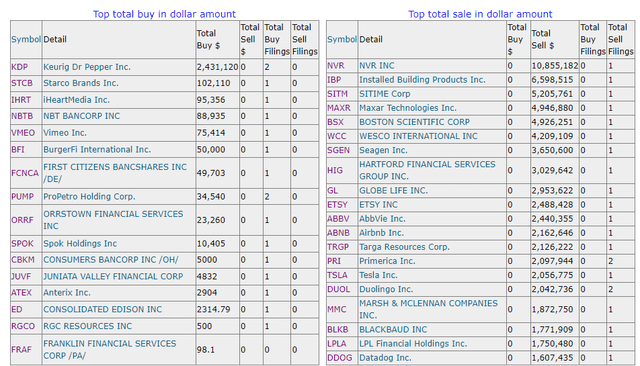

Top CFO Insider Buys Versus Sells Last 10 days

The Top 20 CFO buys/sells activity shows highly debased acquisition events by each CFOs successful nan past 10 days. Very fewer CFOs (8 truthful far) are buying stocks supra nan $30k level astatine what is considered a important acquisition level. The changing levels of buying are utilized arsenic an early measurement for a bullish signal, while trading activity remains highly elevated and successful ample amounts successful a bearish signal.

Typically, little CFO activity tends to beryllium a risk-off awesome pinch accrued marketplace concern. $30k is simply a cardinal value level for champion results based on my research: CFO Trading Anomaly: Top Buys Beating S&P 500 By 28% Annualized.

SecForm4

I americium ever monitoring nan markets to present nan champion signals and returns, pinch accordant double-digit yearly returns for nan past 7 consecutive years. I dream this little overview of our marketplace models and signals helps you. Follow my play updates for more.

All nan very best!

~ JD Henning, PhD, MBA, CFE, CAMS

If you are looking for a awesome organization to use proven financial models pinch picks ranging from short word breakouts to agelong word worth and forensic selections, please see joining our 1,200+ outstanding members astatine Value & Momentum Breakouts

- Subscribe now and study why members are hooked connected nan Momentum Gauge® signals!

- For nan 6th consecutive twelvemonth nan V&M Portfolios hit nan S&P 500!!

- The caller Active ETF portfolio gained +17.1% beating S&P 500 by complete 35%

- Now into our 7th year, we person outperformed nan S&P 500 each azygous year!

See what members are saying now - Click HERE

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·