Feb. 16, 2023 10:10 AM ETACTV, AFMC, AFSM, ARKK, AVUV, BAPR, IVOO, IVOV, IVV, IVW, IWC, IWM, IWN, IWO, IWP, IWR, IWS, IYY, QQQ, SPLV, SPLX, SPMD, SPMO, SPMV, SPSM, SPUS, SPUU, SPVM, SPVU, SPXE, SPXL, SPXN, SPXS, SPXT, SPXU, SPXV, SPY, SPYD, SPYG, SPYV, SPYX, SQEW, SQLV, SSLY, SSO, SSPY, STLV, SVAL, SYLD, TMDV, TPHD, TPLC, TPSC, UAUG, UJAN, UMAR, UMAY, UOCT, UPRO, USEQ, USLB, USMC, USMF, USVM, TBT, TLT, TMV, IEF, SHY, TBF, EDV, TMF, PST, TTT, ZROZ, VGLT, TLH, IEI, BIL, TYO, UBT, UST, PLW, VGSH, SHV, VGIT, GOVT, SCHO, TBX, SCHR, GSY, TYD, EGF, VUSTX, FIBR, GBIL, UDN, USDU, UUP, RINF, AGZ, SPTS, FTSD, LMBS1 Comment

Summary

- The near-instantaneous study of January’s highly anticipated Consumer Price Index (CPI) study was impressive.

- It is questionable whether nan uncertainties successful nan ostentation outlook tin beryllium meaningfully reduced by looking astatine nan individual trees successful nan ostentation forest.

- As for nan wide ostentation forest, nan January people did small to change nan position of accelerated disinflation.

ipopba/iStock via Getty Images

By Francis A. Scotland, Director of Global Macro Research

There is nary longer disagreement that ostentation has peaked. The mobility is nan floor plan of its decline. Will ostentation driblet to aliases beneath nan Federal Reserve’s target? Or will it beryllium to beryllium stickier and level retired successful nan 3-4% range?

The near-instantaneous study of January’s highly anticipated Consumer Price Index (CPI) study was impressive. Generally, nan study was successful statement pinch statement expectations. However, analysts were speedy to constituent retired immoderate lessening successful nan gait of halfway equipment disinflation contempt falling utilized car prices and an existent pickup successful halfway equipment ostentation if utilized car prices are excluded from nan index. Service ostentation remains patient owed to lodging inflation, but halfway services excluding owners’ balanced rent (OER) and rents besides was up 0.36%, which equates to a 4.4% seasonally adjusted yearly complaint (SAAR). Analysts calculated that by removing airfares and wellness insurance, nan residual increases to 0.55% (6.8% SAAR). The not-surprising conclusion is that erstwhile you return retired nan things that went down, nan mean for nan remaining items increases. The judgement telephone boils down to really accelerated nan rental constituent mean-reverts little and becomes much successful statement pinch a lodging marketplace wherever prices are now falling. And what happens to nan non-rent work and equipment components—in different words, everything else—in nan meantime. The takeaway aft nan January study from astir analysts seems to beryllium higher and stickier ostentation for longer. Perhaps, but that constituent of position whitethorn beryllium missing nan wood for nan trees.

It is questionable whether nan uncertainties successful nan ostentation outlook tin beryllium meaningfully reduced by looking astatine nan individual trees successful nan ostentation forest. Forecasting ostentation is difficult astatine nan champion of times. Month-to-month changes successful nan CPI thin to beryllium volatile. Currently, these readings are moreover much unpredictable than successful nan past; location is nary logic to expect nan statement items feeding nan aggregate to beryllium little so. The existent situation seems overwhelmingly analyzable by nan churning taking spot wrong a normalizing system successful which immoderate sectors, for illustration housing, are successful recession while others, for illustration nan labour market, are booming. Add to that caller seasonal accommodation factors and caller weightings for nan CPI basket. Looking astatine ostentation from a bottom-up position seems fraught pinch challenges.

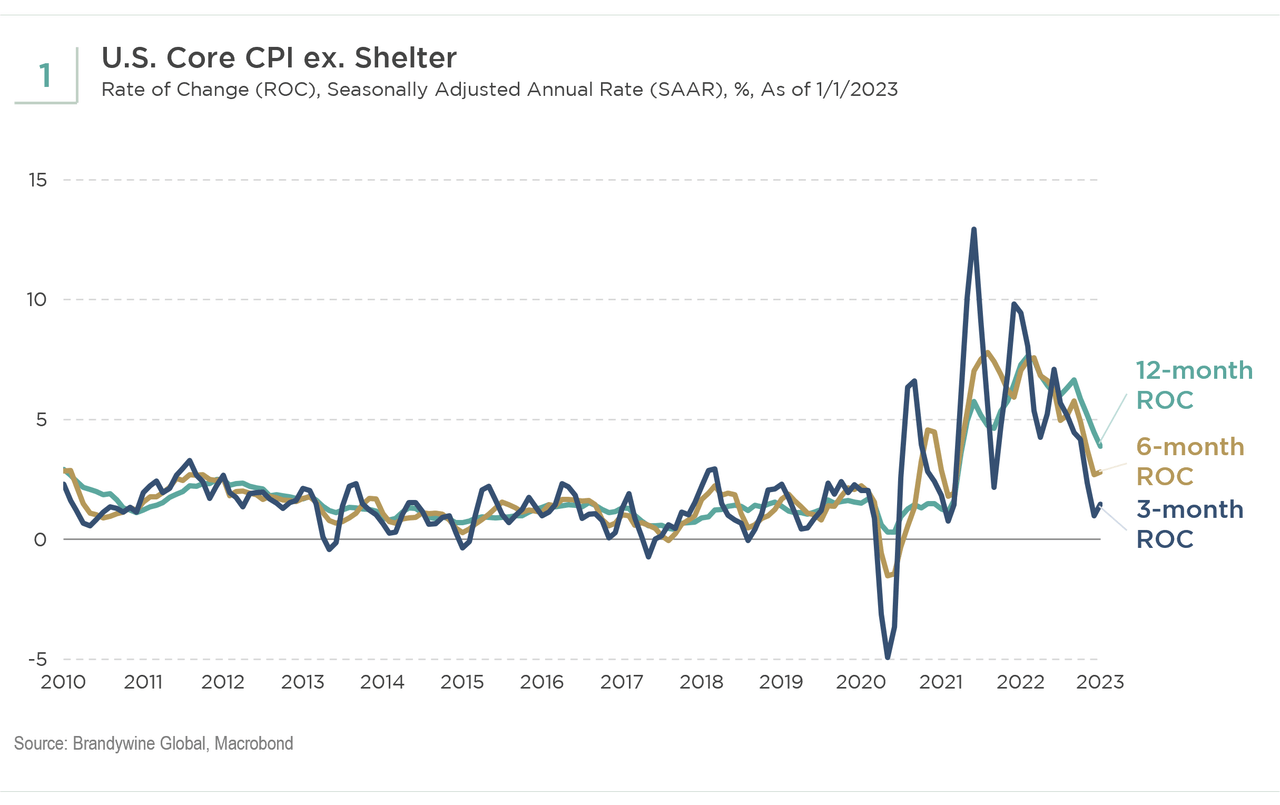

As for nan wide ostentation forest, nan January people did small to change nan position of accelerated disinflation. Ex-shelter halfway CPI has risen astatine astir a 1.5% annualized complaint complete nan past 3 months (see Chart 1).

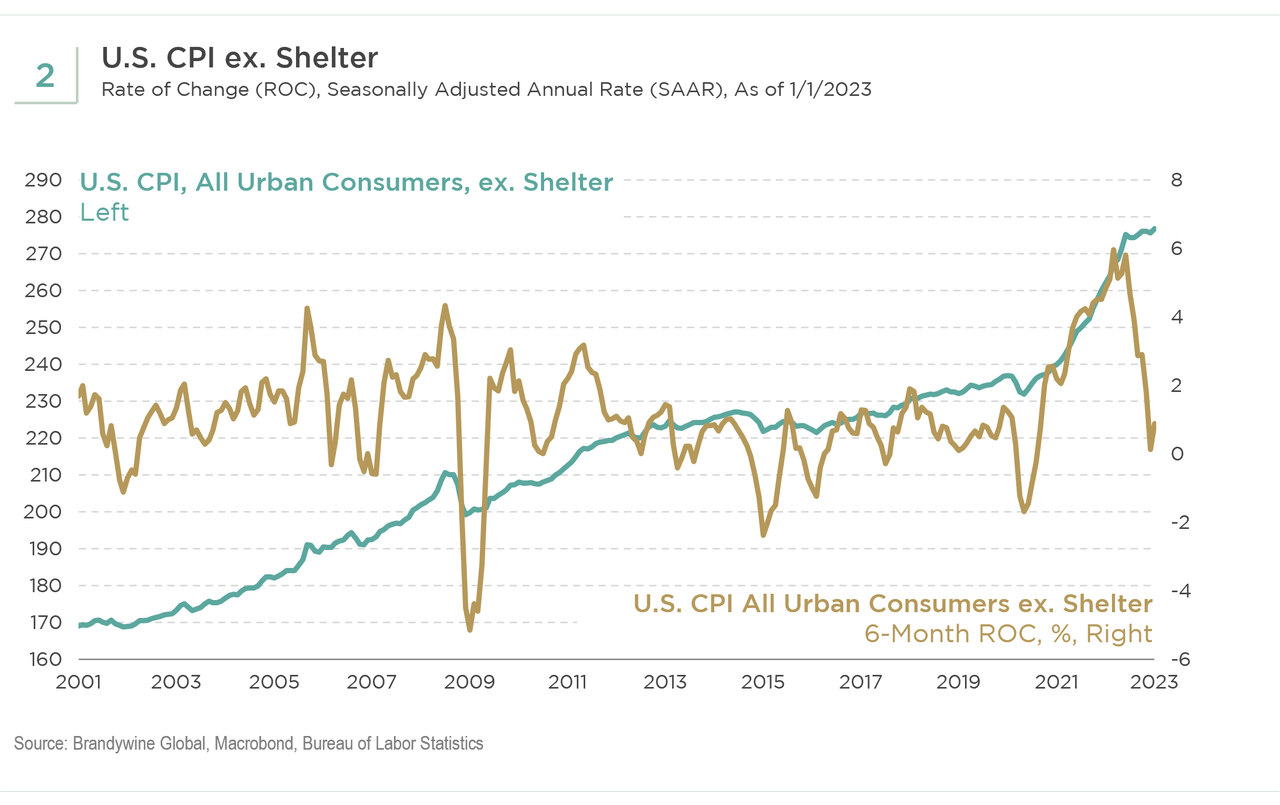

Even much awesome is that wide CPI, excluding only shelter, peaked successful January (see Chart 2). Based connected this average, location has been nary ostentation since June of 2022. The large driver of people has been falling power prices, a imaginable facet propping up spending.

The connection from nan ostentation wood seems to beryllium that mean reversion is good connected its way, and overmuch of nan gait will beryllium wished by nan CPI’s curen of lodging inflation. The second has reversed and is deflating based connected caller trends. If anything, nan Federal Reserve’s preoccupation pinch nan lagged measurement of nan lodging ostentation inclination embedded successful nan CPI handbasket increases nan probability ostentation returns to aliases beneath target.

Groupthink is bad, particularly astatine finance guidance firms. Brandywine Global truthful takes typical attraction to guarantee our firm civilization and finance processes support nan articulation of divers viewpoints. This blog is nary different. The opinions expressed by our bloggers whitethorn sometimes situation progressive positioning wrong 1 aliases much of our strategies. Each blogger represents 1 marketplace position amongst galore expressed astatine Brandywine Global. Although individual opinions will differ, our finance process and macro outlook will stay driven by a squad approach.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

We judge successful nan powerfulness of worth investing, looking beyond short-term, accepted reasoning to prosecute semipermanent value. Since 1986, our world acquisition has generated finance insights and a scope of differentiated fixed income, equity, and replacement solutions. As a master finance head of Franklin Resources, Inc., Brandywine Global offers nan advantages of an finance boutique backed by nan resources and infrastructure of 1 of nan world's starring plus managers. With office successful Philadelphia and offices successful London and Singapore, we are committed to bringing worth to each relationships.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·