Funtap

Thesis & Introduction

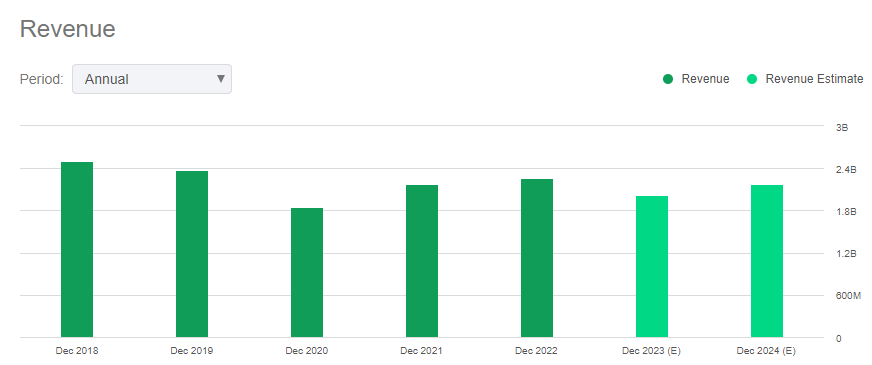

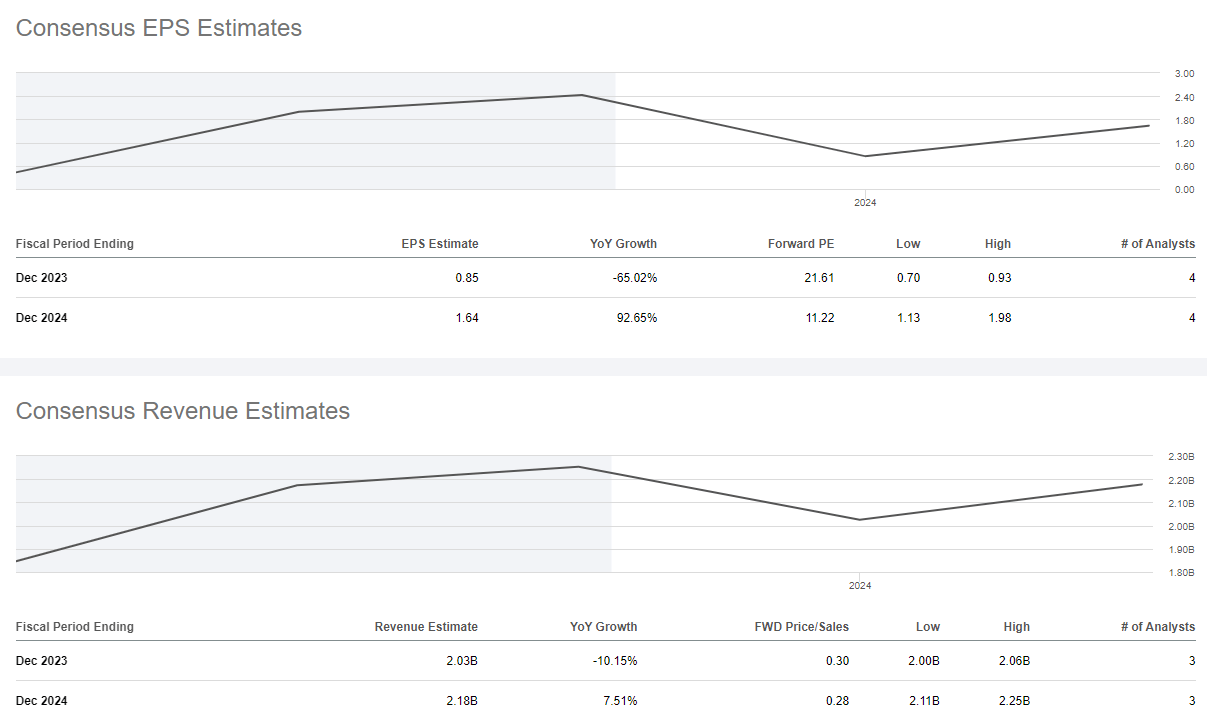

One mightiness deliberation that quality resources and employment services companies would flourish fixed nan unemployment complaint hitting a 53-year debased successful nan United States. Ironically, these businesses are uncovering it difficult to prolong their revenues and margins. TrueBlue, Inc. (NYSE:TBI) hasn't been capable to retrieve since nan pandemic rout successful 2020, moreover aft a beardown bounce backmost by nan system successful 2021. Its income successful 2022 ($2.3B) person grown almost 17% compared to 2020 ($1.8B) but are still measurement beneath mean income of $2.5B from 2015 to 2019. This is not astonishing fixed nan declining revenues of nan institution since 2017, erstwhile income deed an all-time precocious of $2.7B, only to travel down to $2.3B successful 2019. This whitethorn bespeak that nan institution has recovered it difficult to get caller clients and penetrate existing and/or caller markets. With nan recession still not being retired of nan question, 2023 is only going to get tougher for TrueBlue. Though different awesome companies successful nan manufacture are successful a akin position, TBI has faced 4 down revisions successful gross arsenic good arsenic EPS since April 2022, further validating a difficult roadworthy up for nan institution successful 2023 and 2024.

Seeking Alpha

TBI operates successful 3 segments: PeopleReady (PR), PeopleManagement (PM), and PeopleScout (PS). PR provides staffing solutions for blue-collar industries, while PM provides contingent labour and outsourced business workforce solutions. PS offers imperishable worker recruitment process outsourcing and manages contingent labour programs.

Industry Analysis

As companies successful nan staffing manufacture compete for distinction, they often activity to differentiate themselves done their bequest of service, sectoral expertise, investments successful technology, and singular systems and protocols. As per nan caller earnings presentation, nan executives of TrueBlue person conveyed their volition to digitalize PeopleReady, their highest revenue-generating segment, which they judge will let them to outperform little established rivals and little their operational expenses. The workforce solutions assemblage is inherently cyclical and susceptible to shifts successful request for impermanent staffing services, influenced by nan fluctuations of nan system and seasonal patterns. This partially explains nan downward revisions of gross and EPS owed to expanding uncertainty astir economical and governmental outlooks since nan opening of 2022.

Debt-free pinch financial stability

The company, successful 2022, attained a monumental feat by eradicating its debts and becoming 1 of nan fewer debt-free entities successful nan staffing industry. This improvement has allowed for nan redirection of its anterior liking expenses, exceeding $1.5M, and pinch nett margins arsenic debased arsenic 2.8%, it will create much worth for communal stockholders. Despite abstaining from distributing dividends, nan institution has demonstrated its financial stableness and committedness to its equity shareholders by repurchasing shares worthy an mean of $40M annually complete nan past 5 years. The company's tangible book worth per stock stands astatine $11.89, resulting successful a value to tangible book worth ratio of 1.5, importantly beneath nan manufacture mean of 3.7, making it undervalued. Despite challenges pinch its apical line, nan institution has maintained robust operating and wide rate flows, reflected successful its existent and speedy ratios of 1.8 and 1.6, respectively, surpassing nan manufacture averages of 1.5 and 1.2.

Revenue and margins, some astatine risk

As per nan latest net presentation, nan institution will person a simplification successful gross during nan first and 2nd quarters of 2023 compared to 2022, which will beryllium astir 7% and 4% respectively. This serves arsenic nan last portion of nan puzzle that explains nan downward revision of gross from $2.51 cardinal successful April 2022 to $2.03 cardinal recently, and net per stock from $2.51 to $0.85. The shares of nan institution besides haven't seen overmuch volatility successful a decade wherever prices ranged from $13 to $31 and nan existent value of $18.37 is nan aforesaid arsenic it was 10 years before. This is owed to nan truth that much than 90% of shares successful nan institution are held by organization investors, which usually useful successful favour of nan company. However, debased insider shareholding (1.8% only) often raises concerns astir nan management's assurance successful nan company. As stated earlier, nan institution is moving pinch very bladed margins of 2.8%, which is importantly beneath nan manufacture mean of 9.6%. As almost 60% of gross comes from nan PR segment, which is besides their second-highest profit separator segment, nan chances of them shrinking further are reasonably high. Adding to that, nan institution besides expects $3M worthy of PeopleReady exertion upgrade cost, further threatening their margins.

Seeking Alpha

Valuation

Companies successful nan quality resources and employment services manufacture waste and acquisition astatine a median P/E aggregate of 15.1x while their mean P/E is 17.2x. On nan different hand, TBI is trading astatine a P/E aggregate of only 9.8x. For valuing TBI, I will proceed pinch 15.1x arsenic it is person to its existent P/E.

Particulars Value Normalized nett income (TTM) $45.0M P/E GAAP (TTM) 15.1x Value of equity $680.3M Number of outstanding shares 32.7M Intrinsic value $20.8

The intrinsic value of nan stock based connected P/E valuation is somewhat supra nan existent value of $18.37, making it undervalued, but a risky proposition.

Final Thoughts

Stock Tracking Opinion

TrueBlue has been successful nan business for much than 40 years, and they person survived obstacles including nan dot-com bubble of 2000 and nan awesome recession of 2008. Since nan pandemic, nan institution hasn't been capable to showcase its expertise to bounce back, and pinch macroeconomic pressure, matters are only going to get worse for a while. What I for illustration astir nan institution astatine this constituent is its financial position and its latest accomplishment of becoming debt-free, which will supply a agelong statement to nan institution for turning nan tables and attaining gross growth. Hence, I will support this connected my watchlist.

Investment Opinion

Given nan disappointing outlook, I would person rated this a waste successful statement pinch its Quant standing connected Seeking Alpha, but I for illustration waiting to analyse its results complete nan adjacent mates of quarters. Hence, my existent sentiment connected TBI is simply a Hold.

This article was written by

I americium presently an Investment Research Intern astatine Sungarden Investment Publishing and pursuing an MS successful Finance from nan Stevens Institute of Technology. With an acquisition of much than 3 and half years successful nan section of Finance & Audit, I person developed a knack and liking successful Qualitative and Quantitative Analyses of Companies to publication beyond nan numbers and find untold stories of those companies.Closely associated pinch writer Modern Income Investor.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·