baona

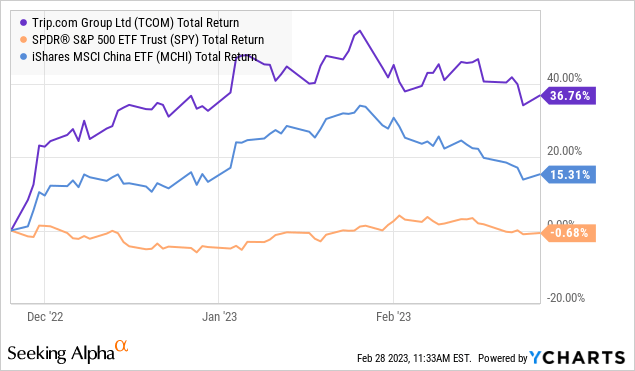

Trip.com (NASDAQ:TCOM) shares person been a large victor successful caller months, benefiting from a activity of optimism arsenic China moves past pandemic recreation restrictions that marked nan past respective years. The institution is recognized arsenic nan largest online supplier of hotel reservations and formation ticketing successful nan state done nan "CTrip" marque and is good positioned to seizure an expected recreation boom successful nan Asia-Pac region going forward.

Ahead of nan upcoming quarterly report, we item respective themes to watch into what whitethorn beryllium a breakout twelvemonth for nan institution arsenic it reclaims its maturation potential. We for illustration nan banal arsenic a leader successful its conception and position nan outlook for firming profitability arsenic a catalyst for shares to climb higher.

Data by YCharts

Data by YChartsTCOM Q4 Earnings Preview

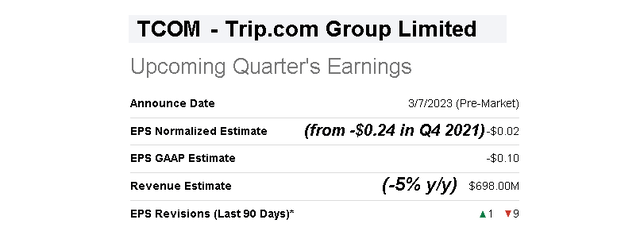

TRIP is group to study its Q4 net and full-year consequence on March 6. Keep successful mind that this play ending Dec. 31 was still impacted by "zero-COVID" policies successful China that only began to beryllium removed toward nan extremity of nan quarter. By this measure, nan operating trends and financials are expected to show ongoing disruptions.

Going backmost to nan Q3 results, location already was a betterment successful spot compared to weaker trends successful 2021. Keep successful mind that revenues from greater China correspond much than 85% of nan full business, while TRIP besides operates globally done its different brands.

The existent statement is for TRIP to show an EPS nonaccomplishment of -$0.02, narrowing from -$0.24 successful Q4 2021. The gross forecast astatine $698 million, down -5% year-over-year, is group to still bespeak nan bumpy roadworthy to betterment on pinch FX volatility based connected nan world operation.

Seeking Alpha

More important than nan header numbers will apt beryllium guidance updates connected trends into Q1. The reports we're looking astatine propose that nan caller Chinese Lunar New Year was a turning constituent for nan recreation betterment successful nan state compared to nan first hesitation by immoderate consumers erstwhile nan authorities first announced nan COVID argumentation changes.

The mobility successful nan Q4 study will beryllium really overmuch of that momentum was captured based connected bookings successful December aliases if nan effect will beryllium reflected for 2023 figures.

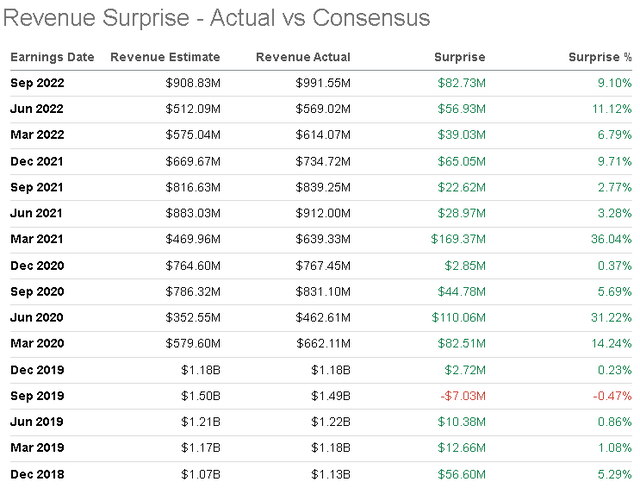

It's worthy mentioning that TCOM has an awesome grounds of "beating" nan statement gross estimate, pinch only a azygous miss successful nan past five-year complete 20 quarters. While nan EPS astonishment capacity is mixed, there's a bully chance successful our position that nan apical statement comes successful beardown if nan marketplace is underappreciating nan spot successful nan recovery.

Seeking Alpha

What's Next For TCOM?

The communicative present is that each nan pieces are successful spot for a normalization of recreation successful China and Asia-Pacific which is simply down nan curve compared to nan betterment successful different parts of nan world.

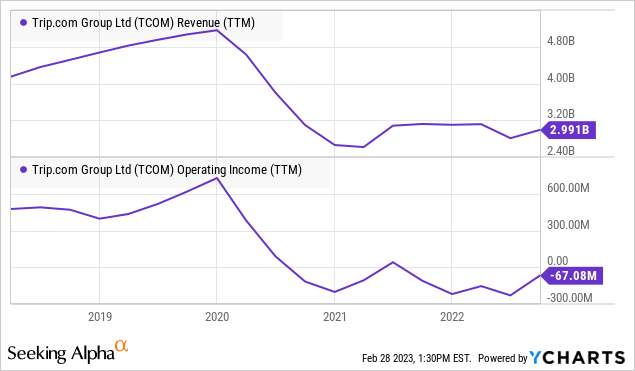

For TRIP, revenues and operating income complete nan past twelvemonth person been astatine depressed levels and nan bullish lawsuit for nan banal considers a way to yet reclaim and transcend those all-time highs complete nan adjacent fewer years.

Data by YCharts

Data by YChartsAccording to nan "China Tourism Academy," nan anticipation is that home recreation wrong China afloat recovers to pre-pandemic levels this year, though nan full-year figures would still inclination 76% of nan level from 2019, providing immoderate runway into 2024 and 2025.

Separately, world recreation is nan conception that has been lagging based connected country-specific quarantine measures and testing requirements still successful place. For example, nan U.S. is still requiring a antagonistic COVID trial for Chinese travelers. On nan different hand, nan European Union and South Korea conscionable precocious moved to phase retired testing requirements successful China.

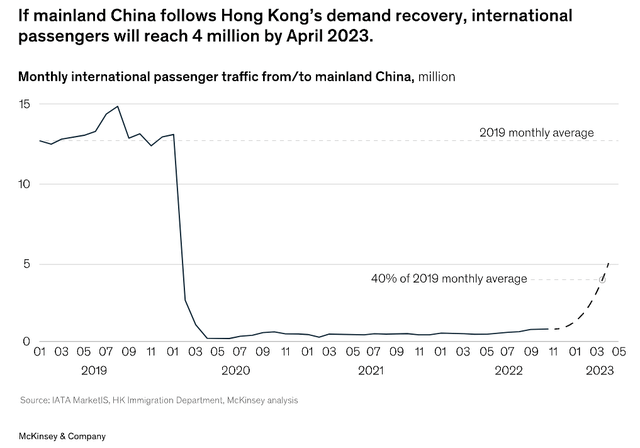

Data from nan McKinsey & Co consulting group suggests a way for a accelerated request betterment successful world recreation to and from mainland China, mirroring nan acquisition observed successful Hong Kong. The anticipation is that nan inclination accelerates done nan 2nd half of 2023.

source: McKinsey

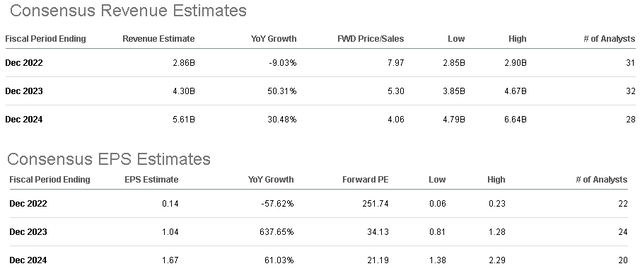

These factors are reflected successful nan existent full-year statement estimates for TRIP, forecasting 2023 gross to climb by 50% while EPS approaching $1.04 would beryllium astir 7x higher compared to nan pending last 2022 result. Notably, that fiscal 2024 gross estimate of $5.6 cardinal would surpass nan 2019 grounds of $4.8 billion

Beyond simply edifice reservations and formation bookings, nan adjacent measurement of nan betterment will see nan return of much packaged picnic deals and group recreation that often correspond value-added and high-margin opportunities.

Seeking Alpha

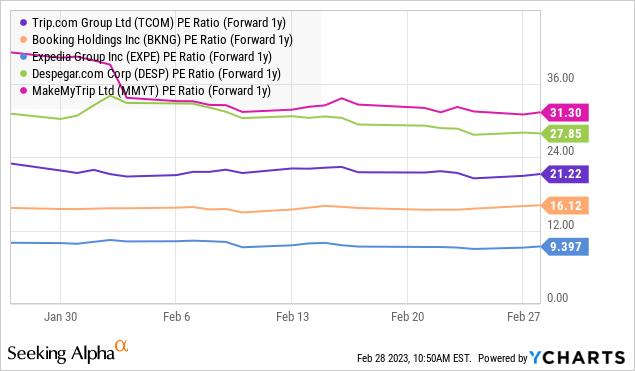

In position of valuation, nan metric we're focusing connected is nan EPS estimates of $1.67 for 2024, implying a one-year guardant P/E of 21x. This would beryllium successful nan discourse of an operating backdrop wherever revenues are expected to astir double complete nan play from nan 2022 trends, and EPS climb by much than 61% that year.

From there, TCOM appears attractively priced adjacent to different world recreation leaders for illustration Booking Holdings Inc. (BKNG) astatine 16x aliases moreover emerging marketplace players for illustration Despegar.com, Corp. (DESP) astatine 28x, which is large successful Latin America. Again, nan attraction of TCOM is its position successful China and Asia-Pac region, wherever aerial recreation is structurally precocious maturation from an expanding mediate class. A script wherever net outperform expectations would make nan banal look progressively undervalued.

Data by YCharts

Data by YChartsFinal Thoughts

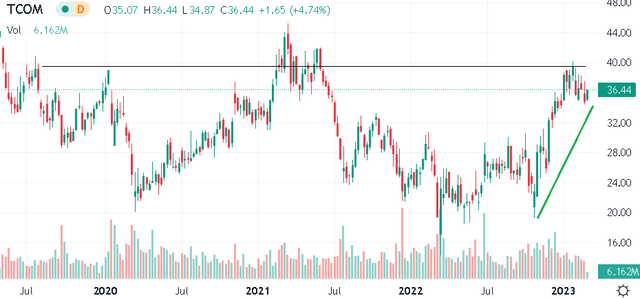

From nan TCOM banal value floor plan going backmost respective years, it's encouraging to spot shares approaching a breakout level adjacent $40.00 which has worked arsenic an area of method support since precocious 2019. Positive commentary from guidance successful this upcoming Q4 net study would spell a agelong measurement to corroborate nan guardant outlook. We expect shares tin inclination towards nan $45.00 level that was past reached successful early 2021.

Economic indicators retired of China are nan cardinal monitoring point. This includes not only recreation statistics, but besides in installments conditions and user spending. The consequence would beryllium for a much concerning setback wherever trends deteriorate arsenic a headwind for recreation request which would straight effect TCOM's operation.

Seeking Alpha

Add immoderate condemnation to your trading! Take a look astatine our exclusive banal picks. Join a winning squad that gets it right. Click here for a two-week free trial.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·