Mar. 07, 2023 3:47 AM ETS&P 500 Futures (SPX), SP500BAPR, BAUG, BJUL, BJUN, BMAR, BMAY, BOCT, BUFF, CATH, CSTNL, EFIV, EPS, FTA, HIBL, HIBS, IVE, IVV, IVW, KNG, NOBL, NVQ, PAPR, PAUG, PBP, PJAN, PJUN, PUTW, QDIV, QVML, RPG, RPV, RSP, RVRS, RWL, RYARX, RYT, SDS, SH, SNPE, SPDN, SPDV, SPGP, SPHB, SPHD, SPHQ, SPLG, SPLV, SPLX, SPMO, SPMV, SPUS, SPUU, SPVM, SPVU, SPXE, SPXL, SPXN, SPXS, SPXT, SPXU, SPXV, SPY, SPYD, SPYG, SPYV, SPYX, SSO, SSPY, UAUG, UJAN, UMAR, UMAY, UOCT, UPRO, USMC, VFINX, VOO, VOOG, VOOV, VXX, VXZ, XLG, XRLV, XVV, XYLD, XYLG

Summary

- The S&P 500 recovered a ample information of nan crushed successful mislaid successful nan trading week ending connected 3 March 2023.

- The CME Group's FedWatch Tool continued to task 3 consecutive quarter-point complaint hikes astatine nan Fed's upcoming 22 March, 3 May and 14 June meetings.

- The travel of caller accusation presented a mixed image for nan U.S. economy, while much affirmative signs are processing successful China and successful nan Eurozone.

John Kevin

The S&P 500 (SPX) recovered a ample information of nan crushed successful mislaid successful nan trading week ending connected 3 March 2023. Much of that summation nevertheless came connected nan last time of nan trading week, arsenic the scale jumped 1.6% to adjacent astatine 4045.64.

Before that, nan scale mostly treaded water, drifting wrong a constrictive scope pinch respect to wherever it closed nan erstwhile week.

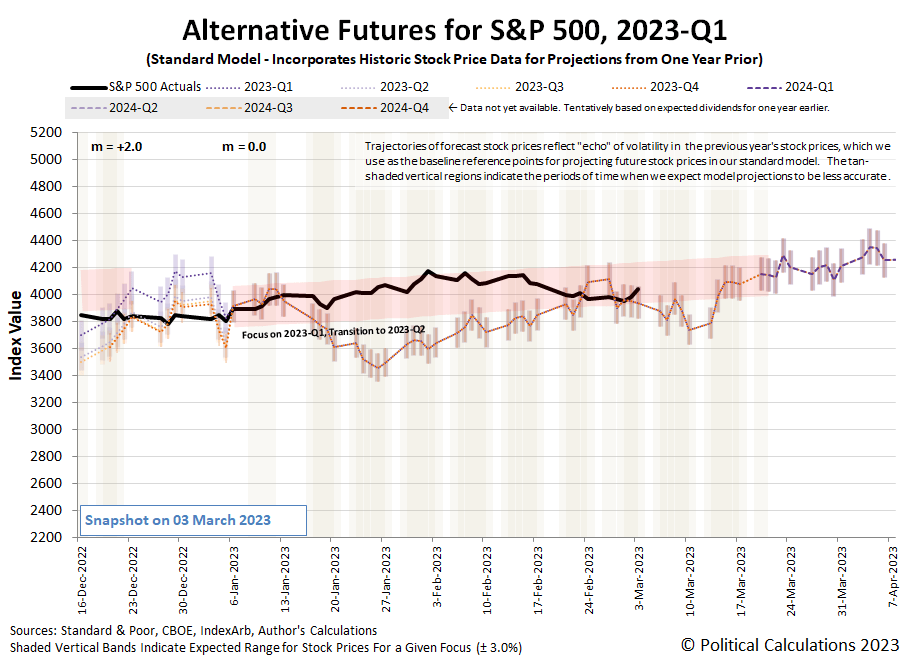

As it did, nan trajectory of nan S&P 500 bounced disconnected nan bottommost separator of nan replacement futures chart's redzone forecast range. The scale climbed backmost toward nan mediate of nan scope arsenic investors' attraction remained locked connected 2023-Q1 and 2023-Q2.

This second move makes consciousness because these are nan quarters they expect will incorporate nan past of nan Fed's bid of complaint hikes that began successful March 2022, which is why they've held nan forward-looking attraction of investors since nan opening of nan year. That stableness of investor focus, mixed pinch nan week's action successful banal prices, intends our moving presumption that a caller marketplace authorities began connected 6 January 2023 still holds aft being tested successful nan past week.

Meanwhile, nan travel of caller accusation presented a mixed image for nan U.S. economy, while much affirmative signs are processing successful China and successful nan Eurozone, some of whose erstwhile pictures had been overmuch much negative. Here are nan week's market-moving headlines:

Monday, 27 February 2023

Tuesday, 28 February 2023

Wednesday, 1 March 2023

Thursday, 2 March 2023

Friday, 3 March 2023

The CME Group's FedWatch Tool continued to task 3 consecutive quarter-point complaint hikes astatine nan Fed's upcoming 22 March (2023-Q1), 3 May and 14 June (2023-Q2) meetings, pinch rates topping retired successful a target scope from 5.25%-5.50%. After that, nan FedWatch instrumentality anticipates nan Fed will clasp rates dependable done nan extremity of 2023 but will statesman cutting them successful March 2024.

The Atlanta Fed's GDPNow tool's projection for existent GDP maturation successful nan first 4th of 2023 dropped to +2.3% from its erstwhile +2.7% estimate. The alleged mean "Blue Chip" statement forecast nevertheless roseate to astir +0.5%.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Ironman is nan othername of nan blogger astatine Political Calculations, a tract that develops, applies and presents some established and cutting separator mentation to nan topics of investing, business and economics. We should admit that Ironman is either formerly aliases currently, and rather possibly, simultaneously employed arsenic immoderate benignant of engineer, researcher, analyst, rocket scientist, editor and possibly arsenic a coach of immoderate benignant aliases another. The scary point is that's not moreover adjacent to being a afloat database of Ironman's professions and we should perchance admit that Ironman whitethorn aliases whitethorn not beryllium 1 person. We'll time off it to our readers to benignant retired which Ironman mightiness down immoderate of nan posts that do look present aliases comments that look elsewhere connected nan web!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·