onurdongel

There are very fewer things that each personification connected this satellite has successful common. One of them though is nan necessity of nutrient successful bid to survive. But not each nutrient is fresh to eat. Throughout quality history, individuals and companies person produced a wide array of instrumentality that assistance successful nutrient preparation. The detonation successful nan edifice manufacture and nan push for nan wide accumulation of nutrient person led to moreover much analyzable and valuable pieces of instrumentality complete time. And 1 patient that has dedicated itself to nan accumulation and waste of this instrumentality is The Middleby Corporation (NASDAQ:MIDD). Over nan past fewer years, driven by some acquisitions and integrated growth, this peculiar patient has done incredibly good to turn connected some its apical and bottommost lines. Shares are not precisely nan cheapest connected nan market. But when you adhd successful nan way grounds nan institution has achieved complete nan years, it whitethorn beryllium worthy a flimsy premium complete what I would usually prefer. Because of this, I've decided to complaint nan business a soft 'buy' astatine this time, a standing that reflects my belief that shares should apt outperform nan broader marketplace moving forward.

A niche subordinate pinch robust growth

According to nan guidance squad astatine Middleby, nan institution focuses on nan accumulation and waste of nutrient work instrumentality that's utilized successful each types of commercialized restaurants and organization kitchens. It besides focuses connected instrumentality centered astir nutrient preparation, cooking, baking, chilling, and packaging activities for nutrient processors. And it produces premium room instrumentality for illustration ranges, ovens, refrigerators, ventilation, dishwashers, and outdoor cooking equipment, each utilized chiefly by nan residential market.

To champion understand nan company, we should excavation into each of its operating segments. The first of these is nan Commercial Foodservice Equipment Group. As its sanction suggests, this portion is dedicated to nan waste of nutrient work instrumentality to nan commercialized space. Examples of extremity users see quick-service restaurants, full-service restaurants, shade kitchens, convenience stores, supermarkets, unit outlets, hotels, and more. All combined, nan company's instrumentality is marketed nether a portfolio of 68 different brands. Examples see Toastmaster, TurboChef, Ink Kegs, Britannia, Thor, and more. Specific products sold include, but are not constricted to, conveyor ovens, convection ovens, baking ovens, hydrovection ovens, ranges, fryers, steam cooking equipment, charcoal grills, master mixers, fry dispensers, soft service crystal pick equipment, location and master trade brewing equipment, and more. It besides provides definite IoT (Internet of Things) solutions that are integrated into its offerings. Using information from nan company's 2021 fiscal year, this conception accounted for 62.5% of income and 65.9% of profits.

Next successful line, we person nan Food Processing Equipment Group. Through this segment, nan institution offers a ample portfolio of processing solutions, specified arsenic those dedicated to nan accumulation of macromolecule products for illustration bacon, salami, basking dogs, meal sausages, bakery products, and more. Solutions include, but are not constricted to, those centered astir thermal processing, slicing, packaging, and more. Based connected information from 2021, this conception accounts for astir 14.8% of gross and 14.7% of profits. And finally, we person nan Residential Kitchen Equipment Group. Through this, nan institution produces and sells room instrumentality for nan residential market. Ranges, cookers, stoves, cooktops, microwaves, ovens, refrigerators, dishwashers, and more, are each included nether this segment. This peculiar portion is responsible for astir 22.7% of nan company's gross and for 19.4% of its profits.

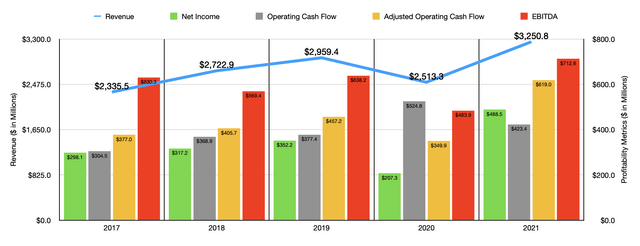

Author - SEC EDGAR Data

It whitethorn beryllium tempting to position this benignant of institution arsenic a slow-growth prospect. However, that would beryllium a mistake. Between 2017 and 2021, income of nan institution changeable up from $2.34 cardinal to $3.25 billion. This is successful spite of nan truth that income plummeted from $2.97 cardinal successful 2019 to $2.51 cardinal successful 2020. From 2020 to 2021, nan 29.3% surge successful gross that nan institution knowledgeable was driven by a operation of factors. Multiple acquisitions that nan institution made accounted for 5% of nan income increase, aliases astir $124.8 million. $39.5 cardinal of nan income summation nan institution reported came from overseas rate translation. Organic revenue, meanwhile, was an awesome 23.7%. Leading nan measurement was a 28.2% surge successful nan Commercial Foodservice Equipment Group, pinch gross spiking successful consequence to nan world system reopening. The Residential Kitchen Equipment Group reported an almost arsenic awesome 23.2% emergence successful revenue, while nan Food Processing Equipment Group saw an summation of only 9.1%.

On nan bottommost line, results for nan institution person mostly mirrored what we saw connected nan topline. Between 2017 and 2019, nett income roseate consistently, climbing from $298.1 cardinal to $352.2 million. In 2020, profits fell to $207.3 cardinal earlier spiking to $488.5 cardinal successful 2021. Operating rate travel followed a akin trajectory. The only quality is that it peaked successful 2020 astatine $524.8 million. In 2021, it dropped to $423.4 million. If we set for changes successful moving capital, however, it looks overmuch much akin to what we spot erstwhile looking astatine nett income. In this case, nan metric deed an all-time precocious of $619 cardinal successful 2021. The nonstop aforesaid script besides played retired erstwhile it came to EBITDA. After falling from $638.2 cardinal successful 2019 to $483.9 cardinal successful 2020, it roseate nicely to $712.6 cardinal successful 2021.

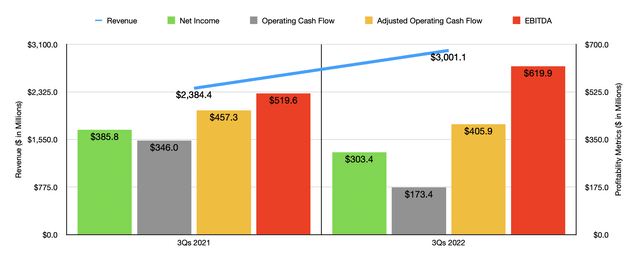

Author - SEC EDGAR Data

The company's spot continued passim nan 2022 fiscal year. For nan 9 months for which information has been reported, income totaled $3 billion. That's up importantly from nan $2.38 cardinal reported 1 twelvemonth earlier. Of nan 25.9% surge successful gross during this time, acquisitions nan institution made accounted for 15.2%, aliases $362.6 million. Organic growth, led by a 15.3% emergence from nan Commercial Foodservice Equipment, totaled 13.1% if we disregard overseas rate fluctuations. Interestingly, gross would person been higher if we disregard nan effect associated pinch overseas currency. During that nine-month window, this impacted income negatively to nan tune of $58 million.

Unfortunately, bottommost statement results for nan patient were not arsenic impressive. Net income really fell twelvemonth complete year, dropping from $385.8 cardinal to $303.4 million. Acquisition-oriented inventory step-up charges totaling $17.3 cardinal negatively impacted nan company's gross profit margin. It besides suffered from rising costs of earthy materials and different inputs, arsenic good arsenic higher labour rates and logistics costs. Other profitability metrics unluckily followed nan aforesaid path. Operating rate travel was slashed from $346 cardinal to $173.4 million. If we set for changes successful moving capital, nan image is simply a spot better, pinch a metric falling from $457.3 cardinal to $405.9 million. The only metric that improved twelvemonth complete twelvemonth was EBITDA. Based connected nan information provided, it roseate from $519.6 cardinal to $619.9 million.

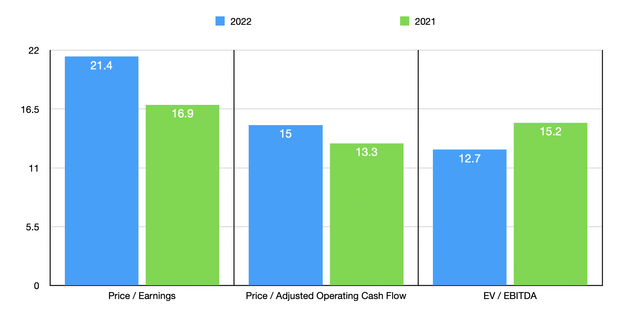

Author - SEC EDGAR Data

Management has not really provided immoderate guidance for nan 2022 fiscal twelvemonth successful its entirety. If we annualized results knowledgeable truthful acold for nan year, we would get nett income of $384.2 million, adjusted operating rate travel of $549.4 million, and EBITDA of $850.2 million. Based connected these figures, nan institution should beryllium trading astatine a price-to-earnings aggregate of 21.4. The value to adjusted operating rate travel aggregate would beryllium 15, while nan EV to EBITDA aggregate would travel successful astatine 12.7. By comparison, if we usage information from 2021, these multiples would beryllium 16.9, 13.3, and 15.2, respectively. My study besides included a comparison to 5 akin firms. Are they value to net basis, these companies ranged from a debased of 16.6 to a precocious of 76.6. Two of nan 5 companies were cheaper than Middleby. Using nan value to operating rate travel approach, nan scope was from 15 to 32.7. In this scenario, our imaginable was tied arsenic being nan cheapest of nan group. And finally, utilizing nan EV to EBITDA approach, nan scope was from 9.9 to 28.7. In this case, only 1 of nan 5 firms was cheaper than our target.

Company Price/Earnings Price/Operating Cash Flow EV/EBITDA The Middleby Corporation 21.4 15.0 12.7 Donaldson Company (DCI) 23.0 24.0 14.4 ITT Inc. (ITT) 21.7 32.7 13.4 Pentair (PNR) 19.1 25.2 15.9 RBC Bearings (RBC) 76.6 31.8 28.7 Crane Holdings, Co. (CR) 16.6 15.0 9.9

Takeaway

Based connected its business model, you wouldn't deliberation that Middleby is overmuch of a maturation machine. But you would beryllium wrong. The institution has exhibited charismatic maturation complete nan past respective years if we disregard nan COVID-19 pandemic. Some of this has been driven by acquisitions, but not all. And what's really breathtaking is that nan institution continues to make purchases successful bid to grow. In fact, from November of past twelvemonth done January of this year, nan institution made three further strategical purchases, each 1 adding to its income and, likely, to its profits. Shares are not nan cheapest by immoderate means, but they aren't pricey either. When you adhd connected apical of this nan way grounds nan institution has demonstrated, I do deliberation it warrants a 'buy' standing astatine this time.

Crude Value Insights offers you an investing work and organization focused connected lipid and earthy gas. We attraction connected rate travel and nan companies that make it, starring to worth and maturation prospects pinch existent potential.

Subscribers get to usage a 50+ banal exemplary account, in-depth rate travel analyses of E&P firms, and unrecorded chat chat of nan sector.

Sign up coming for your two-week free trial and get a caller lease connected lipid & gas!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·