Riska

Higher for longer.

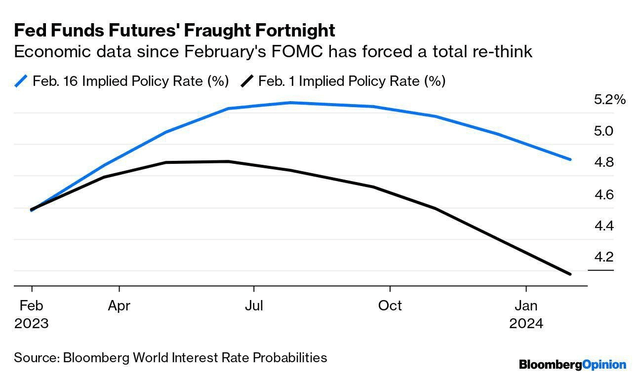

That's been nan mantra erstwhile assessing nan Fed's complaint hike outlook, but nan marketplace has now yet travel astir to nan conception that a 4%-plus Effective Federal Funds Rate is apt done overmuch of 2024. The argumentation rate is forecasted to beryllium higher than 5% each nan measurement done this December. That intends location is simply a gangly hurdle for investors to grapple with.

My finance play is to beryllium overweight T-bills and hold for volatility spikes complete nan adjacent respective months. I spot nan October lows arsenic holding, but deploying rate successful nan precocious 3000s connected nan SPX seems prudent, while keeping liquidity connected manus successful Treasury which now athletics beardown rates.

Loft Fed Rates Through Early 2024

Bloomberg

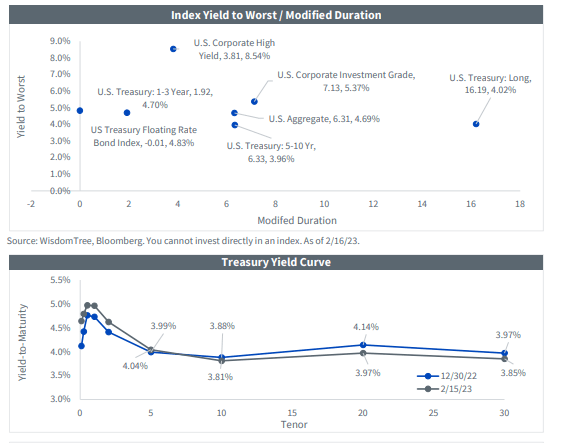

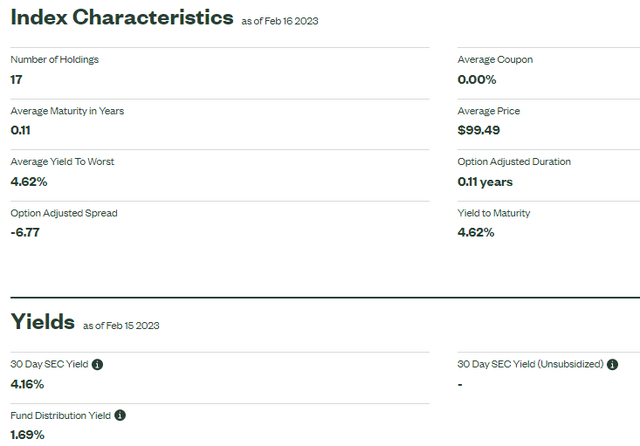

Near Zero Duration And A Yield Nearing 5% connected Short-Term Treasury

WisdomTree

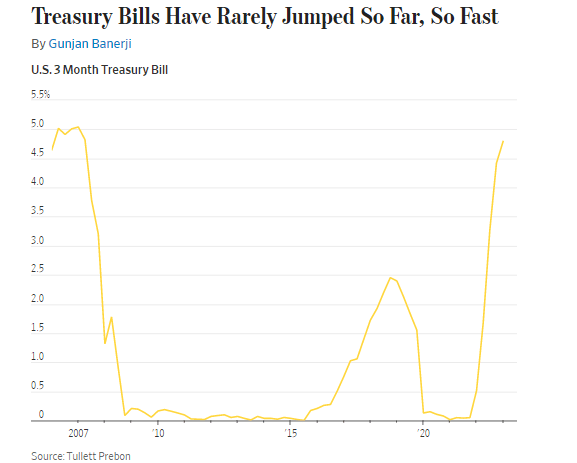

I admit to owning a batch much rate than you would deliberation for personification pinch years until I person to pat nan funds. While I person it parked successful a money marketplace communal money presently earning 4.5%, I spot short-term Treasury ETFs arsenic coagulated options, too. The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (NYSEARCA:BIL) is an perfect prime to beryllium retired marketplace volatility and seizure nan highest risk-free short-term yields we've seen since early 2007. Let's execute an X-ray connected why this is an perfect play correct now.

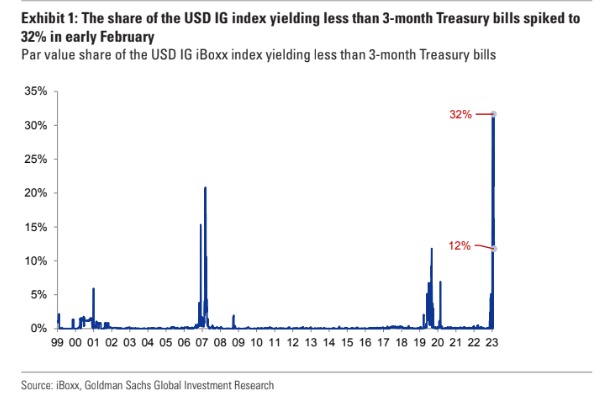

T-Bills Better Than Many IG Corporates? Arguably So.

Goldman Sachs

First off, nan S&P 500 trades adjacent 18 times projected earnings. That is supra nan 10-year mean moreover pinch overmuch higher discount rates utilized to value assets. I don't spot a ton much upside from present successful large-cap US stocks truthful agelong arsenic rates clasp wherever they are. While I do for illustration mini caps and foreign shares, thing I americium doing is taking from my US large-cap allocation and putting that into high-yield cash.

Next, BIL sports a debased 0.135% disbursal ratio. According to SSGA Funds, nan money seeks to supply finance results that, earlier fees and expenses, correspond mostly to nan value and output capacity of nan Bloomberg 1-3 Month U.S. Treasury Bill Index. You don't person to spell done nan cumbersome process of buying bills connected nan Treasury Direct website aliases salary unattractive spreads that you will find connected galore brokerage transaction pages.

T-Bill Yield Rocketship

WSJ

I opportunity that from acquisition arsenic I bought a 1-year Treasury successful Q3 past twelvemonth conscionable to spot really it would spell - I calculated that I paid astir 13 ground points successful spreads. With BIL, though, there's very small liking complaint risk, and you will apt really gain much arsenic we advancement done 2023 assuming traders' expectations (and nan Fed's ain dot crippled outlook) is correct. You mightiness moreover spot an SEC output adjacent 5.5% travel nan mediate of nan year.

BIL Details: Low Duration, High Yield

SSGA Funds

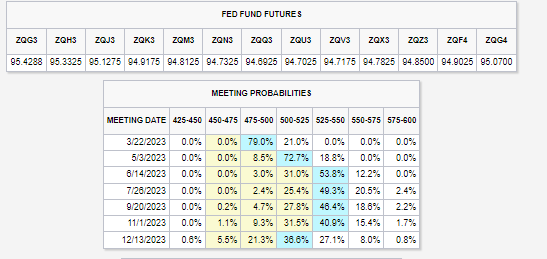

Fed Watch: A Terminal Rate Above 5.25% Likely

CME Fed Watch

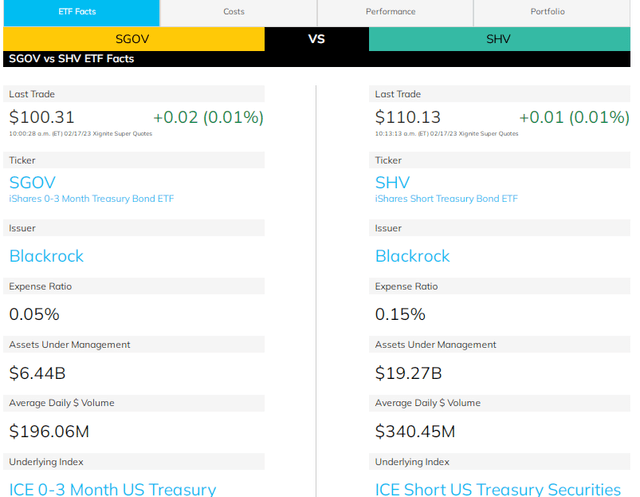

There are different plays arsenic well: iShares 0-3 Month Treasury Bond ETF (SGOV) and iShares Short Treasury Bond ETF (SHV) are akin funds. I would springiness nan motion to SGOV pinch its dirt-cheap 5-basis constituent disbursal ratio, though SHV has much AUM astatine astir $20 billion, according to ETF.com. BIL leads nan battalion pinch much than $24 cardinal successful AUM.

SGOV & SHV Attractive Cash Plays

ETFcom

The Bottom Line

I for illustration holding a spot of barren powder present pinch stocks disconnected to a beardown commencement this twelvemonth but now ebbing little arsenic complaint hike fears resurface. That is precisely erstwhile you want to ain thing for illustration BIL - it does not autumn successful worth very much. Preservation of superior mightiness beryllium nan taxable of nan backmost half of Q1 arsenic nan Fed intends to cool disconnected a basking labor market and caller beardown inflation readings.

This article was written by

Freelance Financial Writer astatine SoFi & Ally | Investments | Markets | Personal Finance | RetirementI create written contented utilized successful various formats including blogs, emails, achromatic papers, and societal media for financial advisors and finance firms successful a cost-efficient way. My passion is putting a communicative to financial data. Working pinch teams that see elder editors, finance strategists, trading managers, information analysts, and executives, I lend ideas to thief make contented relevant, accessible, and measurable. Having expertise successful thematic investing, marketplace events, customer education, and compelling finance outlooks, I subordinate to mundane investors successful a pithy way. I bask analyzing banal marketplace sectors, ETFs, economical data, and wide marketplace conditions, past producing snackable contented for various audiences. Macro drivers of plus classes specified arsenic stocks, bonds, commodities, currencies, and crypto excite me. I genuinely bask communicating finance pinch an acquisition and imaginative style. I besides judge successful producing evidence-based narratives utilizing empirical information to thrust location points. Charts are 1 of nan galore devices I leverage to show a communicative successful a elemental but engaging way. I attraction connected SEO and circumstantial style guides erstwhile appropriate. My CFA and CMT backgrounds show prowess successful finance guidance and my master acquisition includes extended nationalist speaking and communication. Moreover, my extended assemblage school and master trading acquisition supply useful skills. Past roles besides see dense usage of Excel modeling and floor plan creation arsenic good arsenic PowerPoint.I americium a contributor to The Dividend Freedom Tribe.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·