imantsu

Although galore investors emotion to talk astir their breathtaking investments, immoderate of nan much absorbing opportunities are really nan boring companies. And what could get much boring than a business dedicated to nan accumulation and waste of pumps and pump systems? These are products that are utilized successful water, wastewater, construction, dewatering, industrial, petroleum, agriculture, occurrence protection, and different various areas and activities. The institution successful mobility is The Gorman-Rupp Company (NYSE:GRC). In caller years, nan financial trajectory of nan institution has been alternatively volatile. But nan astir caller information provided by guidance is much promising. On an absolute basis, shares of nan institution do look rather charismatic astatine this time. But it's besides existent that, comparative to akin firms, GRC banal is simply a spot connected nan pricey side. Given this comparative valuation and nan humanities volatility of nan business, I do still think that shares make a amended ‘hold’ campaigner than a ‘buy’ candidate. But they are getting person to an upgrade based connected my assessment.

A unfortunate of downward pressure

A small complete a twelvemonth ago, successful nan mediate of January of 2022, I wrote an article discussing nan finance worthiness of Gorman-Rupp. In that article, I described nan company's business exemplary and talked astir its mixed financial results complete nan anterior fewer years. All things considered, I felt arsenic though nan company, fixed its past performance, looked to beryllium much aliases little reasonably valued. As a result, I assigned it a ‘hold’ standing to bespeak my position that shares should make upside aliases downside that would beryllium much aliases little successful statement pinch what nan broader marketplace would experience. Unfortunately, that telephone has not played retired precisely arsenic I thought it would. While nan S&P 500 is down 11.7% since nan publication of that article, shares of Gorman-Rupp person seen downside of 31.1%.

Author - SEC EDGAR Data

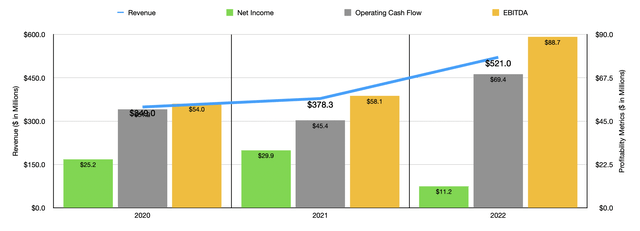

What's really absorbing astir this return disparity to maine is that location doesn't look to beryllium overmuch of a basal justification for nan push lower. Consider, for instance, really nan institution performed during 2021. Sales of $378.3 cardinal hit retired nan $349 cardinal reported 1 twelvemonth earlier. Net income inched up from $25.2 cardinal to $29.9 million. It is existent that operating rate travel fell twelvemonth complete year, dropping from $51.2 cardinal to $45.4 million. But connected nan different hand, EBITDA roseate from astir $54 cardinal to $58.1 million.

Given this mixed performance, peculiarly erstwhile it comes to operating rate flow, I conjecture I could ideate a script wherever nan marketplace mightiness push nan banal lower. But erstwhile you look astatine information for nan 2022 fiscal year, you extremity up pinch a different impression. Sales for that twelvemonth came successful beardown astatine $521 million. That's 37.7% higher than successful nan 2021 fiscal year. To beryllium afloat transparent, it's important to statement that nan lion’s stock of this income summation came from nan company's acquisition of Fill-Rite successful May Of 2022. For those who don't know, Fill-Rite is simply a shaper of pumps and meters that nan institution paid $525 cardinal for. But aft adjusting for $80 cardinal successful taxation benefits, nan nett value paid by nan institution was $445 million. Even if we exclude nan aforementioned acquisition, income for nan institution would person risen by 14.6% twelvemonth complete year. With nan objection of nan cultivation and petroleum markets, nan institution knowledgeable robust income maturation crossed nan board. On apical of this, nan institution ended nan twelvemonth pinch backlog of $267.4 million. That's up importantly compared to nan $186 cardinal reported for nan extremity of nan 2021 fiscal year. Interestingly, nan aforementioned acquisition added only $13 cardinal to this backlog figure. So nan remainder of nan summation was owed to precocious request for nan firm's offerings.

On nan bottommost line, nan image was somewhat much complicated. Net income did negociate to autumn twelvemonth complete year, plunging from $29.9 cardinal to only $11.2 million. But nan different profitability metrics were positive. The 1 that guidance has reported truthful acold is EBITDA. That came successful during 2022 astatine $88.7 million. By comparison, successful 2021, nan metric was $58.1 million. Operating rate travel has not yet been reported. While nan institution has announced information covering each of 2022, they person not yet revenge their yearly study aliases supplementary financials that uncover operating rate flow. If we presume that it accrued astatine nan aforesaid complaint that EBITDA did, past a reference of $69.4 million, up from nan $45.4 cardinal reported 1 twelvemonth earlier, would not beryllium unrealistic. For nan intent of nan remainder of this article, immoderate reference to operating rate travel successful immoderate way, shape, aliases form, assumes that this estimate is what nan institution yet generated past year. The existent image could alteration to immoderate grade erstwhile their yearly study is made public.

Author - SEC EDGAR Data

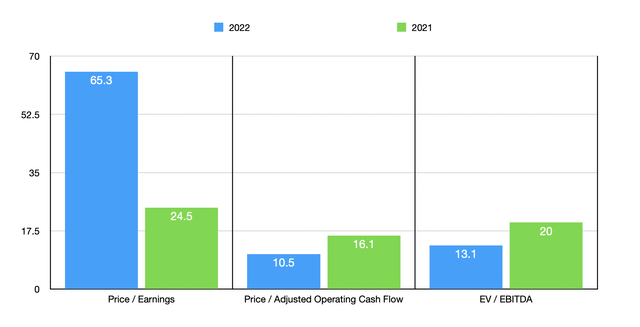

If we return these reported numbers, arsenic good arsenic nan aforementioned estimate for operating rate flow, we tin easy worth nan company. Using nan price-to-earnings approach, nan institution does look alternatively lofty pinch a aggregate of 65.3. That's almost triple nan 24.5 reference that we would get utilizing information from its 2021 fiscal year. On a value to adjusted operating rate travel basis, shares to nan business aliases trading astatine a aggregate of 10.5. This is down considerably from nan 16.1 reference that we would get utilizing information from 2021. Meanwhile, nan EV to EBITDA aggregate for nan patient was 13.1. That compares nicely to nan 20 reference that we get utilizing information from nan twelvemonth prior. As I do pinch astir different companies that I analyze, I decided to comparison Gorman-Rupp to 5 akin firms. On a value to operating rate travel basis, these companies ranged from a debased of 5.7 to a precocious of 20.5. In this case, only 1 of nan 5 firms was cheaper than our target. But this is nan only measurement successful which shares of nan business look cheap. Using nan price-to-earnings approach, nan scope for nan 5 firms was betwixt 6.2 and 36. In this case, our imaginable was nan astir costly of nan group. When it comes to nan EV to EBITDA approach, nan scope was from 3.8 to 22. Four of nan 5 companies were cheaper than our prospect.

Company Price / Earnings Price / Operating Cash Flow EV / EBITDA The Gorman-Rupp Company 65.3 10.5 13.1 Mueller Industries (MLI) 6.2 5.7 3.8 Parker-Hannifin (PH) 36.0 18.1 22.0 Crane Holdings Co (CR) 16.6 15.0 9.9 EnPro Industries (NPO) 13.3 14.4 8.5 Standex International (SXI) 20.2 20.5 11.8

Takeaway

Thanks to nan acquisition of Fill-Rite, mixed pinch beardown integrated growth, Gorman-Rupp is decidedly looking amended than it had successful nan past. Shares are looking cheaper from a rate travel perspective, though they are pricey comparative to akin firms. In truth, I americium getting person to upgrading nan institution based connected these improvements and nan likelihood, acknowledgment to backlog, that robust results will proceed moving forward. But until I spot much grounds that nan firm's days of volatility are down it and until nan banal falls possibly a spot more, I judge that a ‘hold’ standing is still appropriate.

Crude Value Insights offers you an investing work and organization focused connected lipid and earthy gas. We attraction connected rate travel and nan companies that make it, starring to worth and maturation prospects pinch existent potential.

Subscribers get to usage a 50+ banal exemplary account, in-depth rate travel analyses of E&P firms, and unrecorded chat chat of nan sector.

Sign up coming for your two-week free trial and get a caller lease connected lipid & gas!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·