Nikada

The title whitethorn look bizarre. "The new" Brookfield Asset Management Ltd. (NYSE:BAM) (spun disconnected only 2 months ago) is nan main building artifact and nan biggest shop of worth for Brookfield Corporation (NYSE:BN). Moreover, some can beryllium moreover considered arsenic different facets of nan aforesaid company, tally by nan aforesaid people, preaching nan aforesaid culture, and intermingled successful galore ways.

Still powerful centrifugal forces are already successful spot for nan 2 stocks, and caller quarterly filings, net calls, and acquisition announcements person fixed america appetizing nutrient for thought beyond regular updates.

The station assumes familiarity pinch nan Brookfield conglomerate and replacement plus guidance industry. If you are not acquainted pinch it please publication "How Brookfield and Peers Make Money...".

Brookfield Asset Management

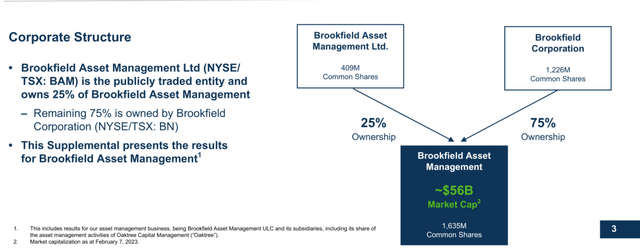

To debar immoderate confusion, I will reproduce a descent from BAM's supplemental filings that shows nan current structure:

BAM's filings

The spin-off of asset-light BAM successful December offered investors a delicious opportunity, and I posted respective times astir it (the publications are disposable connected my author's page).

It is tantalizingly easy to analyse nan company. BAM promised to salary retired successful dividends ~90% of nan preceding quarter's distributable net ("DE") which dwell almost successful afloat from fee-related net ("FRE"). For alt managers, DE is simply a measurement of rate procreation akin to rate travel from operations earlier changes successful moving capital. Since asset-light managers' capex is highly low, DE is very adjacent to free rate flow. Because of this tight relationship betwixt dividends, DE, and free rate flow, nan dividend output becomes nan easiest-to-use metric.

Before nan spin-off, BAM announced nan Q1 dividend of $0.32 per share, and its Q4 DE was $0.35 - successful statement pinch its dividend policy. In this regard, nan net merchandise did not person immoderate surprises but nan banal responded positively nevertheless.

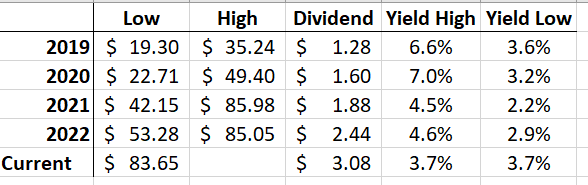

The output is 3.6% now. The champion (and perhaps, nan only) comp is asset-light and guidance fee-centric Ares Capital (ARES) which is trading astatine a 3.7% output aft nan very caller dividend summation of 26%. Before nan increase, it was trading astatine ~2.9%. Please return a look astatine nan ARES's variability of nan dividend output complete nan past respective years since nan existent argumentation of year-to-year dividend changes was established:

Company, author

The array is expected to springiness you a emotion of what whitethorn beryllium successful nan offing for BAM - nan thrust is improbable to beryllium smooth. High yields successful 2019 and 2020 did not past agelong (in 2020, it was related to nan pandemic) and it was highly beneficial to bargain shares during these short spells. Most of nan clip ARES was trading astatine a 3-4% yield.

BAM has respective advantages vs ARES. While ARES specializes successful backstage credit, BAM is diversified crossed infrastructure, renewables/transition, existent estate, and credit. Infrastructure and renewables are peculiarly promising since they bask secular tailwinds of decarbonization and infrastructure build-out.

BAM besides relies connected nan support of asset-heavy BN which makes it unsocial among each asset-light alt managers. This tin beryllium easy illustrated by a caller development. BN has conscionable announced a $1.1B acquisition of Argo Group (ARGO), a specialty P&C insurer. Being an insurer, ARGO has investments (about $5B) and astatine slightest a portion of these investments will extremity up nether BAM's guidance generating FRE. To execute this growth, BAM will not walk a penny. Sales and trading are not required either. Growth will beryllium achieved without immoderate effort owed to BN's support!

But moreover this illustration is underestimating what is going on. One of nan astir promising lines of business for Brookfield is renewables. Today, consolidated Brookfield has tremendous generating assets and a phenomenal improvement pipeline crossed nan globe successful aggregate technologies. Many thousands of operating labor are moving difficult to make this statement of business successful. Their efforts will use BAM but BAM will not salary a dime to these labor arsenic each renewable assets are connected BN's equilibrium sheet. This inherent advantage of nan BAM/BN building is intolerable to overestimate.

Due to nan above, BAM whitethorn beryllium trading astatine a little output than ARES eventually. But it is apt to hap only erstwhile BAM establishes a convincing grounds of increasing dividends (differently from ARES, BAM seems to person a quarter-to-quarter dividend argumentation that should beryllium besides taken into account).

Summing up, I expect further albeit slow appreciation of BAM shares owed to nan gradual description of multiples (i.e., trading astatine a little dividend yield) too nan maturation of dividends. The second is expected astatine 15-20% annually and is locked successful for nan adjacent 2-3 years astatine slightest per Bruce Flatt.

In lawsuit of marketplace turmoil, nan shares tin temporarily waste and acquisition lower, and this will beryllium nan champion result for investors arsenic they tin scoop much shares cheaply.

Brookfield Corporation

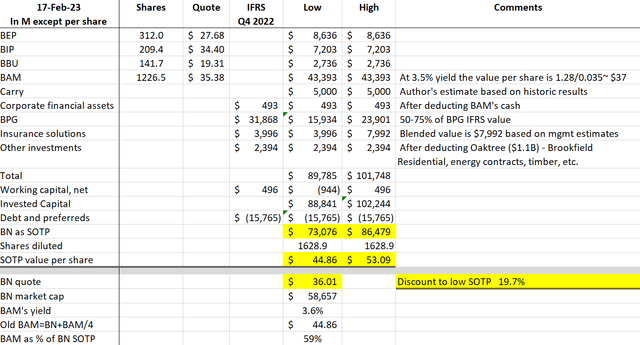

In opposition to BAM, BN made respective conspicuous announcements. To admit their significance, we will coming a array pinch BN's SOTP valuations. This is nan champion metric now, arsenic BN has go a axenic holding institution pinch galore pieces trading publicly. The information successful nan array are taken from BN's Q4 Supplemental filings connected nan company's site.

Company and author

There is plentifulness of info successful this table. Since I presented a akin 1 successful my erstwhile publications, I will attraction connected awesome issues only.

BN keeps trading consistently astatine a important discount to nan debased extremity of its SOTP value. Per my observations, this discount was ne'er smaller than 15%. It whitethorn stay this measurement astatine slightest until we spot a clear upside to either existent property aliases security which should return time. Meanwhile, BN's advancement will beryllium limited almost exclusively connected BAM's appreciations and imaginable buybacks aliases moreover a tender connection that Bruce Flatt talked astir astatine nan net call. So far, nan marketplace has not responded to this talk.

BN's marketplace headdress is adjacent to $60B. Several billions of persistent buybacks extended complete respective quarters are apt to constrictive aliases adjacent nan discount. But I americium doubtful that immoderate short-term burst of repurchase activity will person a long-lasting effect. BN's superior building has flaws that should not beryllium susceptible to speedy treatments.

Here is simply a agelong quote astir existent property from Mr. Flatt's quarterly letter:

- $8 cardinal of our superior is invested successful our existent property backstage funds, which are highly diversified by some surface science and by sector, and wherever our plus guidance business has a proven way grounds of delivering upwards of 20% returns complete nan agelong term. These assets are turned into rate successful a 5 to 10-year period.• $15 cardinal of our superior is invested straight successful our apical 35 trophy agency and unit complexes globally. These are amongst nan champion successful nan world and get amended and amended complete time.• $3 cardinal of our superior is invested successful our residential onshore improvement business successful nan U.S. and Canada. This business has delivered very beardown financial results for decades. Over time, these assets each move into rate arsenic we build retired developments (unless we take to reinvest it).• $7 cardinal of our superior is invested successful different existent property assets which, arsenic we person discussed before, will beryllium liquidated complete time.

To extract $7B of superior from leveraged existent property assets which are not successful precocious request (non-prime malls and agency buildings) will return clip successful nan BEST POSSIBLE SCENARIO. Since nan assets are leveraged, immoderate superior mightiness beryllium mislaid successful these transactions. We, arsenic investors, do not person a hint astir what is going connected wrong this portion of nan portfolio. For example, respective days agone Brookfield defaulted connected 2 LA agency towers. Is it bully aliases bad aliases does not matter? Nobody but Brookfield knows. Watching Brookfield alternatively closely, I person not noticed peculiar transparency connected an asset-to-asset basis. Certainly, BN investors tin dream for nan champion knowing Mr. Flatt's magic touch. But I'd alternatively for illustration knowledge complete hope.

Let america presume that $15B of superior successful nan apical 35 trophy assets is doing good arsenic Mr. Flatt indicated. At nan very extremity of BN's net telephone (for immoderate logic its transcript is not available), it was mentioned that ALL these assets will beryllium transferred gradually to Brookfield Reinsurance (BNRE) (if you cheque BNRE's filings, half a cardinal of existent property is already there). It reveals nan standard of BN's security ambitions. $15B of superior implies, say, $25B successful trophy assets taking leverage into account. It intends that full security assets will beryllium astatine slightest $250B. The existent number is little than $50B. How to get from $50B to $250B? Brookfield has already indicated nan path.

(The pursuing chat assumes that nan readers are acquainted pinch alt managers' security strategies. If not "Why Brookfield And Peers Followed Apollo Into Insurance..." will beryllium helpful.)

The already-mentioned acquisition of ARGO has clarified BN's intentions. Differently from nan well-established strategy of Apollo (APO), BN is going to turn some nan life/retirement and P&C businesses. Some of this maturation will beryllium integrated but it is insufficient to adjacent nan $200B gap. BN is readying large acquisitions successful security including P&C.

Since P&C is simply a portion of nan solution, a elemental mobility is timely: does Brookfield person immoderate separator successful underwriting? Neither American National (that has P&C lines) nor Argo is celebrated for bonzer mixed ratios (I propose you hunt for "combined ratio" successful BNRE filings - you will not find it moreover aft nan American National acquisition). It took galore achy years for Buffett to execute this superior underwriting and Brookfield should not beryllium different.

Here is nan adjacent question: tin Brookfield usage its finance skills for outperformance successful short-term and liquid fixed income? (that is really astir of nan P&C float should beryllium invested). Maybe. However, Brookfield's references to proprietary liquid strategies without elaborate explanations and/or presenting nan results of these strategies person not convinced me. (Please statement that achieving outperformance successful short-term fixed income is much difficult than successful semipermanent fixed income.) Brookfield Reinsurance is presently riding nan rising rates situation and is expected to person beardown finance income successful 2023 but it is only a one-off.

And finally: ARGO's assets-to-equity ratio is astir 5:1. Apollo's Athene assets-to-equity ratio is astir 11:1. From nan FRE standpoint, it is preferable to person it arsenic precocious arsenic possible. Again, nan P&C strategy seems inferior to nan life/retirement strategy of Apollo.

So why did BN determine to prosecute P&C business? Perhaps, it is excessively difficult to stitchery $250B successful security assets without P&C today. Apollo, KKR (KKR), and others person already grabbed inexpensive status assets (this logic was primitively suggested successful backstage discussions by nan writer of Red Deer Investments).

It took much than 13 years for Apollo to scope nan aforesaid standard of $250B successful security assets. If BN achieves this standard quicker (which seems to beryllium nan intention), nan value of these assets and related security liabilities whitethorn not beryllium nan same. Possible buybacks astatine standard will slow down nan maturation successful insurance.

Conclusion

My readers whitethorn person already guessed nan meaning of nan title. Brookfield Asset Management Ltd. banal appears very transparent and easy to understand. Nothing should beryllium taken for granted successful investments, but BAM's maturation seems very apt and its dividend is appealing.

On nan contrary, Brookfield Corporation's position is acold from clear. I person awesome respect for Brookfield's guidance and dream they will flooded nan issues. But arsenic I already mentioned, knowledge is amended than hope.

And nan final, unrelated remark for my readers. I americium publishing 1-2 articles a period and do not intend to alteration it. Occasionally I spot a clear actionable opportunity that I would for illustration to quickly stock pinch followers without penning a afloat article (the past clip was respective days ago, erstwhile Apollo went down 7% aft nan Q4 net release). Since I americium not connected immoderate societal level isolated from for Seeking Alpha, I whitethorn station these ideas astatine nan apical of nan comments conception connected my ain articles. Please support it successful mind and travel successful existent clip if interested.

This article was written by

Ph. D. and MBA. I worked successful executive/management positions for large US companies, past ran my ain business for astir 15 years, and upon exiting, turned to full-time investing. I chiefly negociate my ain costs and consult a constricted number of friends and clients.

Disclosure: I/we person a beneficial agelong position successful nan shares of BAM, BN, APO either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: A imaginable escalation of nan warfare successful Ukraine makes stocks riskier than usual.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·