Darren415

Before we get into our $1M Portfolio, let's look astatine our hedges.

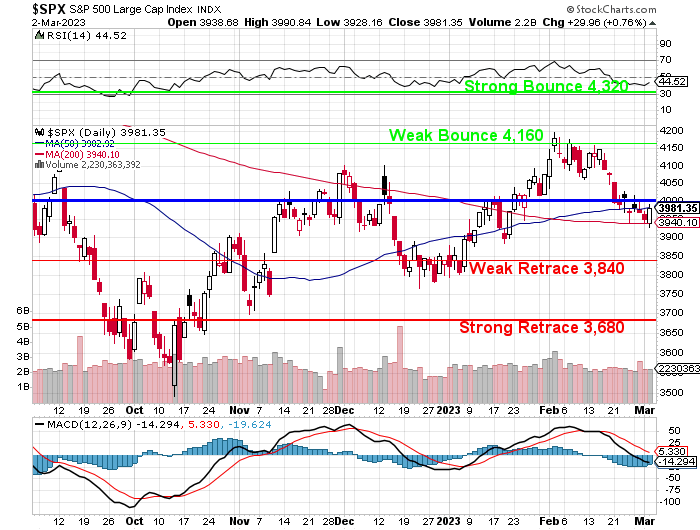

S&P 500 Chart pinch 5% Rule (Stockcharts.com)

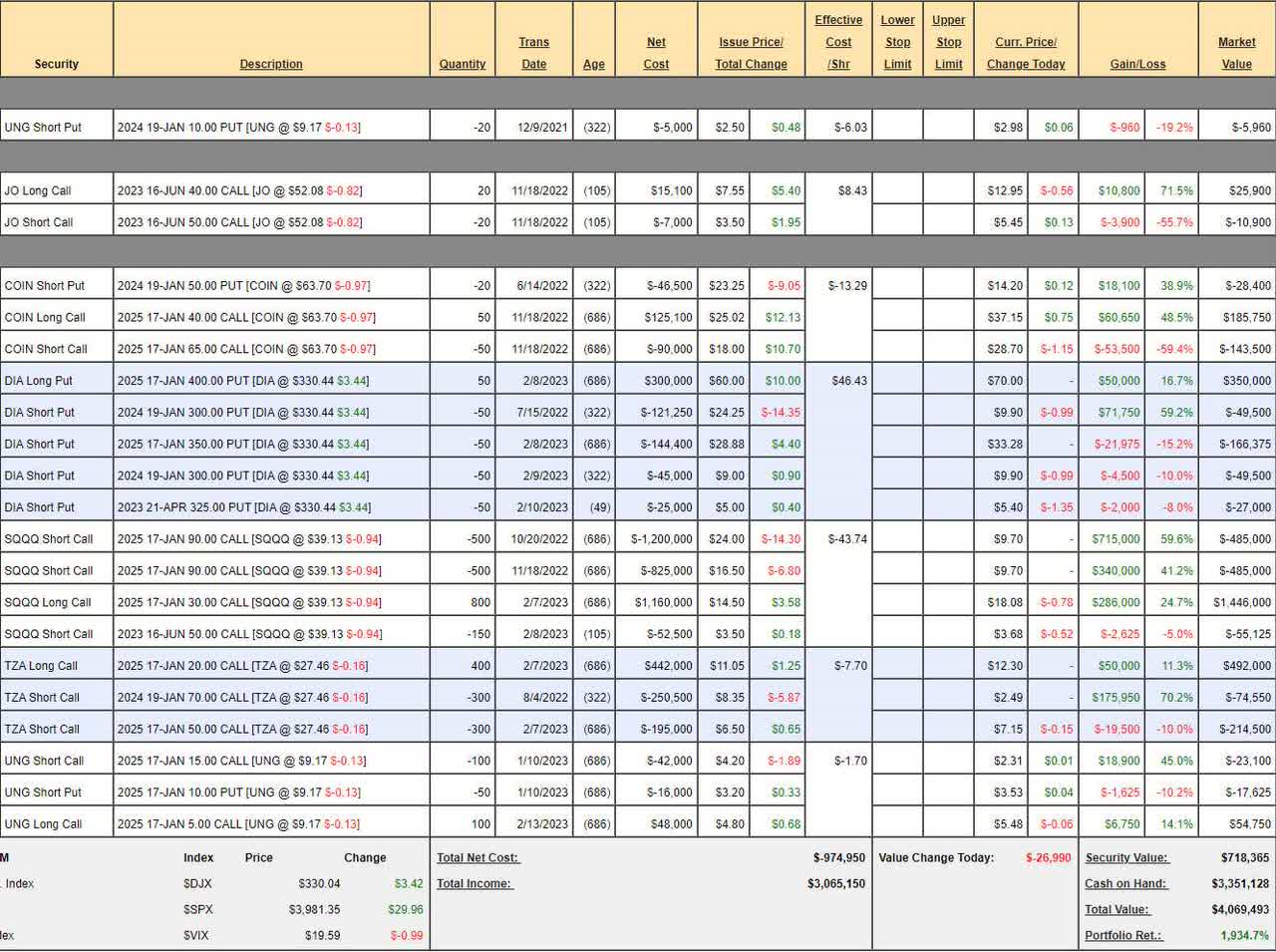

We past reviewed our Short-Term Portfolio connected Valentine's Day, erstwhile nan S&P 500 opened astatine 4,126 but we had already made our adjustments successful our Live Member Chat Room connected nan 7th, erstwhile nan S&P deed 4,176 which did, successful fact, move retired to beryllium nan precocious for nan month. That near america pinch thing to alteration connected nan 14th, and nan portfolio was astatine $3,888,503 and, this morning, aft not being touched since, it's astatine $4,069,493, which is up 1,934.7% successful 3 years and up $180,990 successful conscionable complete 2 weeks - which is really you extremity up being up 1,934%, of course…

Short-Term Portfolio (philstcokworld.com)

Keep successful mind we are 85% successful CASH!!! astatine nan infinitesimal and nan worth of our positions connected nan 14th was only $537,375 truthful nan progressive positions person gained 33.6% connected a 3% driblet successful nan S&P - that's nan cardinal to bully hedging. We person adjacent to $6M successful downside protection successful this portfolio and that's much than we person successful agelong positions truthful we're a spot bearish wide but, connected nan different hand, our longs will make acold much than capable to screen nan losses connected our hedges should we find ourselves excessively bearish - it's a awesome equilibrium and we'd dislike to messiness it up - truthful we are being very cautious erstwhile adding caller longs.

Knowing really to hedge is for illustration knowing really to use nan brakes successful your car. If you don't cognize that, you tin only thrust very slow for fearfulness of crashing into thing aliases flying disconnected nan broadside of nan roadworthy connected a curve. The expertise to brake opens up a full caller world of possibilities successful your driving and successful your investing - it allows you to move faster towards your goals, assured successful your expertise to make adjustments.

Unfortunately, we person not yet hedged our $700/Month Portfolio and we're taking our first nonaccomplishment this month. Months 1, 2, 3, 4, 5 and 6 are disposable for review. This is an opportunity to study our portfolio-building strategies measurement by measurement that, hopefully anyone will beryllium capable to follow.

Our extremity successful this portfolio is to show our Members really to usage slow, steady, elemental options strategies to amass complete $1M complete 30 years by investing conscionable $700/month ($252,000). If you tin use this subject successful your early moving years - your status will beryllium a breeze.

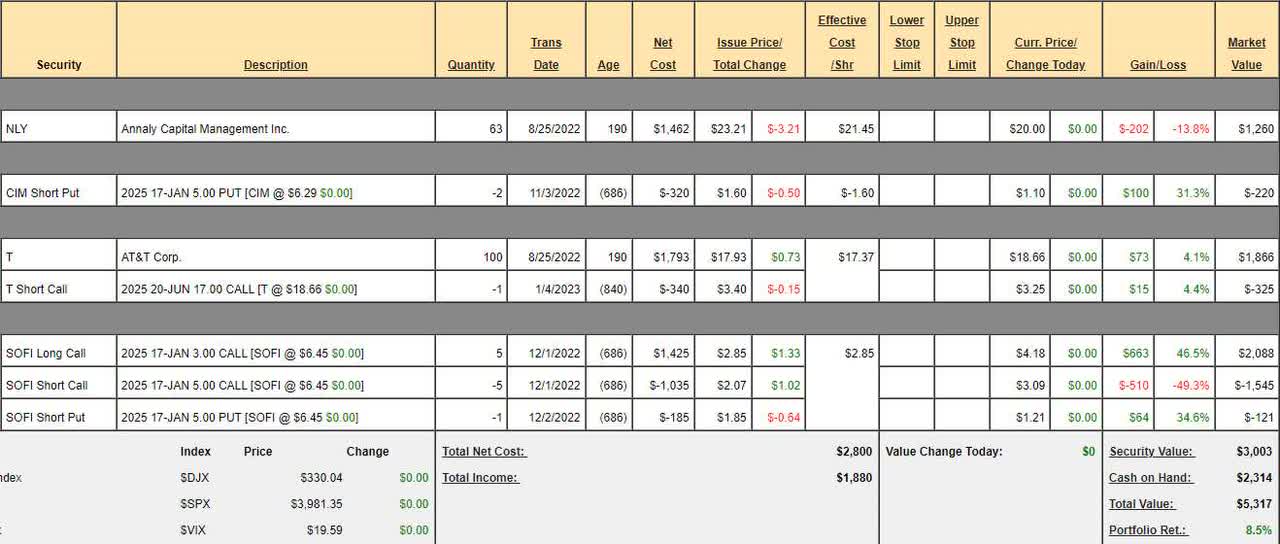

Our extremity is to make 10% a twelvemonth connected our investments and, though it has only been 6 months - nan portfolio is up 8.5%. That's a gait of 17% per twelvemonth and, if we did that for 30 years, we'd person $6,440,776.90. No, I'm not kidding, you tin do nan mathematics correct here! Don't expect to support up that gait - we'll person ups and downs on nan measurement and this portfolio doesn't effort to clip nan marketplace - it's conscionable disconnected to a bully start.

When we started nan portfolio (Aug 25th), nan S&P 500 was astatine 4,000 and now we're astatine 3,996, truthful fundamentally flat. Nonetheless, we made 8.5%. That's nan magic of utilizing options and our Be nan House - NOT nan Gambler strategy, moreover erstwhile you play very conservatively, you tin still make bully gains successful a level market.

As pinch each our portfolios, nan returns thin to accelerate arsenic our positions mature and we are still comfortably up of expectations, which is very bully successful a no-margin portfolio.

Last month, we added 32 much shares of NLY and that was unfortunate timing because NLY has since fallen from $24 to $20 and we went from up $49 to down $202 connected that position. Apparently they are cutting their dividend and we person nary prime but to return nan nonaccomplishment and waste nan position.

$700/Month Portfolio (philstockworld.com)

We person $1,000 of separator request connected nan CIM puts and $500 connected nan SOFI puts and nan rate connected manus is $2,314 positive nan $1,260 we will get from trading nan NLY position - leaving america $3,574 little $1,500 is $2,074 to spend!

Before adding caller positions, we should cheque to spot if nan aged positions request immoderate love:

CIM - I would jump each complete these but they person nan aforesaid guidance squad arsenic NLY truthful possibly cuts location too. I'm not worried astir being assigned 200 shares astatine $5 (net $3.40) truthful not going to alteration it but it's a spot premature to jump successful pinch more.

T - We could adhd a put here, that's tempting. The 2025 $20 put is $3.05 truthful we'd get $305 successful rate and beryllium obligated to bargain nett $1,695 much T. The return connected separator successful nan non-margin relationship is only 18% complete 2 years - we tin do better.

SOFI - I do emotion them and they haven't gotten distant yet truthful worthy considering.

As to imaginable caller stocks:

- B2Gold Corp (BTG) is simply a golden shaper pinch a 5% dividend astatine $3.58, which is $3.8Bn and they make $350M truthful p/e astir 11. They besides person $600M successful nan slope and we for illustration golden arsenic a hedge.

- Nokia (NOK) is still live and much of an instrumentality work supplier these days. $4.68 is $26Bn and they make astir $2.5Bn truthful 10x but conscionable a 1.79% dividend. They do person $4Bn successful rate though - I for illustration that!

- Global Ship Lease (GSL) is simply a instrumentality vessel leasing institution who are paying a 7.3% dividend against their $20.70 banal ($751M cap) but they made $274M past twelvemonth and expect to turn astir 20% this twelvemonth - truthful a bully small company.

- Barclays (BCS) is from our Watch List astatine $8.32, which is $32.5Bn but they make $5Bn truthful 6x is stupidly low. They salary 4.1% and really person $16Bn laying astir connected apical of that - half of their marketplace cap!

- Ford (F) is backmost successful information astatine $12.56, which is $50Bn and they made $6Bn past twelvemonth and should bump 10% this year. I'm beautiful sure, 30 years from now, you'd beryllium kicking yourself for not buying this one. Dividend is simply a bully 5% too. $95Bn successful indebtedness is nan acheronian unreality but autos, inventory, etc. - it's benignant of normal.

- FutureFuel (FF) is 1 of my favourite mini caps. $8.67 is $380M and they made $23M truthful 16.5x pinch a 2.5% dividend but past they paid a typical 0.30 (3.4%) dividend successful December - a bully bonus. They besides person $185M successful rate - half nan valuation.

- Petrobas (PBR) - Would beryllium awesome but nan Government forces them to fundamentally springiness lipid distant to Brazilians. Even now, they are trying to waste assets and nan Government is interfering. In a riskier portfolio, I don't mind but not here.

- SunPower (SPWR) - Hard to not adhd our banal of nan decade astatine $15.09, which is only $681M and they made $45M past twelvemonth and should make adjacent to $60M this year. No dividends but immense maturation imaginable arsenic nan star manufacture expands.

- Tronox (TROX) - Specialty materials are ever nosy and income are up to $3.2Bn from $1.8Bn successful 2018 and profits are $220M but $16.42 is $2.5Bn truthful telephone it 12x. 3% dividend arsenic well.

- trivago (TRVG) - Travel is picking backmost up and $1.76 is $600M and they expect to make $60M this twelvemonth truthful 10X is underpriced. No dividends but nosy options.

As we person nan other money and arsenic SPWR is our Stock of nan Decade and it's only 2023 and our target is $50, not $15 (we started astatine $5 and already cashed retired our original plays astatine $50) and, arsenic nan options are CRAZY - let's adhd SPWR to our portfolio arsenic follows:

SPWR Daily Chart (Finviz.com)

- Buy 5 SPWR 2025 $15 calls for $5.70 ($2,850)

- Sell 5 SPWR 2025 $23 calls for $3.20 ($1,600)

This dispersed is costing america nett $1,250 of our $2,074 buying power. It's a $4,000 dispersed truthful nan upside imaginable is $2,750 (220%) successful 2 years - you've sewage to emotion that!

This will time off america pinch $824 to walk and I deliberation that's capable to set SOFI a spot much aggressively and what we will do is:

- Buy (to close) 5 SOFI 2025 $5 calls astatine $3.09 ($1,545)

- Sell 7 SOFI 2025 $7 calls for $2.40 ($1,920)

- Buy 2 (7 total) SOFI 2025 $3 calls for $4.18 ($836)

That's nett $461 spent and we've gone from a $1,000 dispersed astatine nett $422 to a $2,800 dispersed astatine nett $883 truthful our upside imaginable has accrued from $578 (136%) to $1,917 (217%) by modestly adjusting our target successful an already successful spread.

That still leaves america pinch $363 to transportation complete to adjacent month!

This article was written by

Philip R. Davis is simply a highly respected options trader, entrepreneur, and laminitis of philstockworld.com, 1 of nan astir influential banal and options trading sites connected nan web. With complete 20 years of acquisition successful nan financial industry, Mr. Davis has earned a estimation arsenic a trusted authority connected options trading, equities, and macroeconomic trends. As nan creator of Phil's Stock World, Mr. Davis has built a vibrant organization of traders and investors of each levels, providing them pinch unparalleled insights, analysis, and trading ideas. Whether you're a beginner aliases a seasoned pro, Phil's Stock World offers valuable resources that tin thief you navigate nan complexities of nan financial markets and execute your finance goals. With a unsocial attack to school nan creation of options trading, Mr. Davis and his squad of master contributors including Optrader, Sabrient, Income Trader, Trend Trader, and Warren nan Trader AI supply members pinch unrecorded chat sessions during trading hours, real-time waste and acquisition alerts, and in-depth method and basal study of hundreds of stocks. In summation to his domiciled arsenic an options trader and financial guru, Mr. Davis is simply a serial entrepreneur and laminitis of respective successful companies, including Accu-Title, a existent property title security package solution, and Personality Plus, a precursor to eHarmony.com. He is besides nan President of Delphi Consulting Corp., an M&A consulting patient that helps companies of each sizes get backing and adjacent deals. With his unsocial blend of wit, humor, and financial acumen, Mr. Davis is simply a sought-after speaker connected options trading and financial markets. His penning style is some entertaining and informative, providing readers pinch circumstantial and actionable waste and acquisition ideas, arsenic good arsenic heavy insights into nan macroeconomic forces that thrust marketplace trends. In short, if you're looking for a trusted and knowledgeable options trader and financial expert, Philip R. Davis is nan existent deal. Join nan increasing organization of traders and investors astatine Phil's Stock World, and commencement profiting from his insights and study today.

Disclosure: I/we person a beneficial agelong position successful nan shares of NLY, CIM, T, SOFI, F, FF, TRVG either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·