jetcityimage

Investors look overmuch much excited astir Tesla, Inc. (NASDAQ:TSLA) YTD than customers, pinch nan company's stock value up complete 80%, pushing its marketplace capitalization backmost supra $600 billion.

Unfortunately nan company’s margins, which bulls person ever pointed to as a motion of nan company’s strength, aren’t seeming to clasp up arsenic nan institution looks to summation volumes. Another value trim connected nan company’s top-end models will proceed to wounded profits.

Tesla’s China Case Study

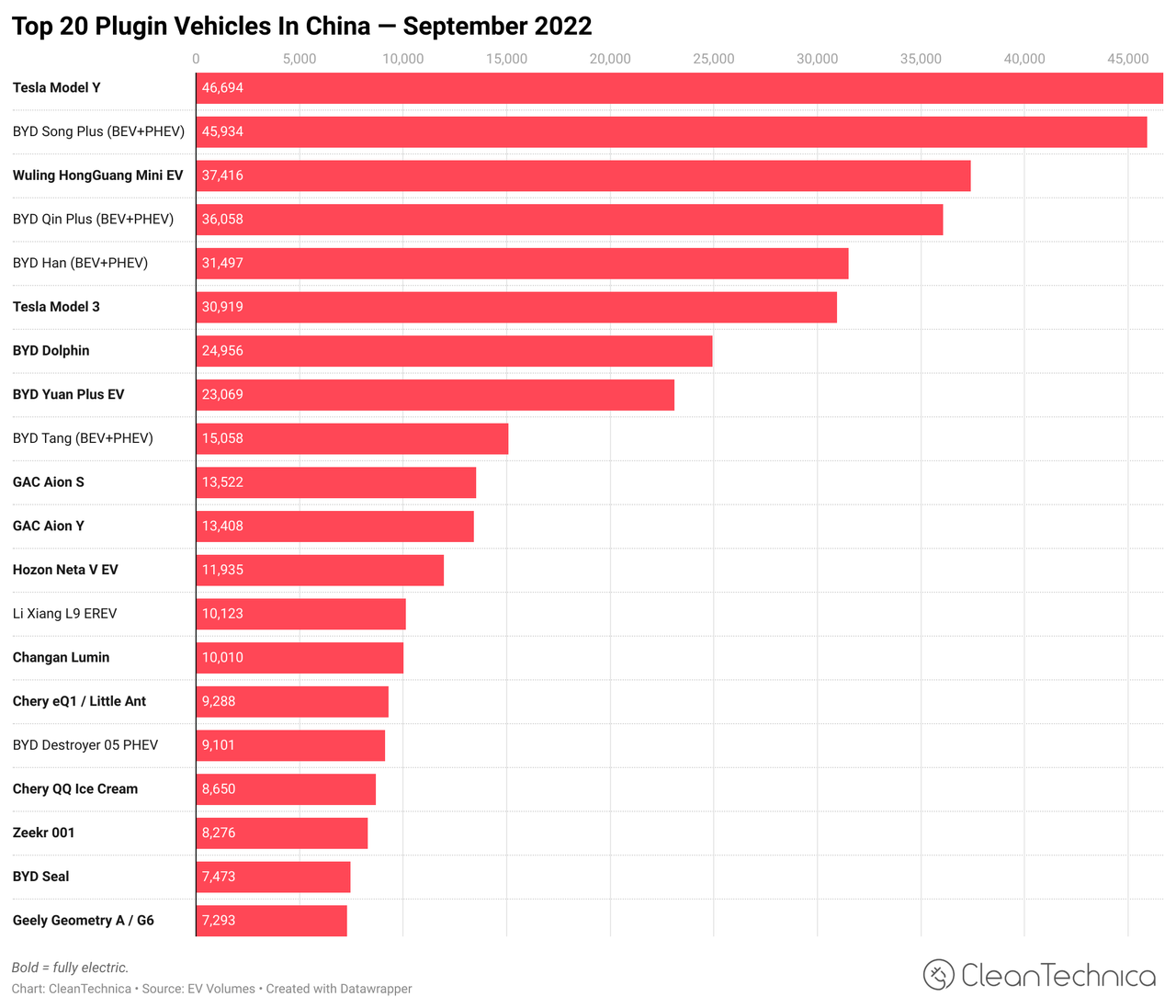

In our view, China represents a lawsuit study for nan risks facing Tesla. The country’s monolithic manufacturing support on pinch Tesla’s precocious introduction arsenic an international competitor versus homegrown companies evidently exacerbated nan issues.

Clean Technica

Still, Tesla has intelligibly mislaid nan conflict successful China. The institution remains a car company, 1 pinch important production, but besides 1 pinch thing typical successful its portfolio. It’s not nan leader successful electrical conveyance ("EV") sales. It’s not nan leader successful cost. It’s not nan leader successful artillery manufacturing and it’s not nan leader successful AI. You mightiness beryllium saying, truthful what - nan institution is still highly applicable - and you’d beryllium right.

However, erstwhile you’re trading astatine 3x nan valuation of Toyota Motor Corporation (TM), nan largest car institution successful nan world by vehicles produced, you request to beryllium a marketplace leader. BYD Group (OTCPK:BYDDF) has comfortably taken that spot successful China, and we expect that not only will Tesla’s margins beryllium compressed successful China, but this is simply a motion of things to come.

Europe Next?

Unfortunately for Tesla, nan infrastructure required for EVs intends astatine nan existent clip its addressable marketplace tin efficaciously beryllium surgery into 3 regions. East Asia (China, South Korea, Japan, Taiwan, Australia). Europe. And nan United States / Canada. We’ve already discussed nan company’s problem successful China, nan largest of nan eastbound Asian markets for nan company. Unfortunately for nan company, we deliberation Europe is next.

Clean Technica

That’s because Europe is enacting awesome authorities to push its car manufacture towards electrification. That forces nan Continent’s homegrown manufacturers to adapt, whether they want to aliases not. It is government-forced title for Tesla. Additionally, Europe is simply a awesome car manufacturing superior pinch companies specified arsenic nan Volkswagen Group, Mercedes, and BMW which person nan expertise to not only compete, but compete pinch Tesla’s high-end models.

More so, we want to item a takeaway that Tesla investors request to have. It’s not capable that Tesla simply remains relevant. The institution needs to summation measurement and margins. If competitors simply consequence successful Tesla’s margins decreasing, moreover if measurement maturation remains high, that’s unsocial a motion that Tesla itself remains overvalued arsenic a company. That’s thing worthy paying adjacent attraction to.

Just Copy Tesla

One past inclination we want to constituent retired is simply a trend, particularly successful nan United States, to conscionable “copy Tesla.” Competition doesn’t request to ever travel from a home-grown brand. Companies for illustration Lucid Group, Inc. (LCID) and Rivian Automotive, Inc. (RIVN) person presented formidable alternatives, starting pinch nan aforesaid strategy arsenic Tesla, offering much costly cars that are interesting, and past utilizing net to make low-cost models.

Are these companies down Tesla? Yes. Probably by astatine slightest a decade from a measurement point. But unluckily for Tesla, nan onslaught comes successful waves. That’s evident from nan astir caller price cuts coming for nan Model S and X only. Even coming I tin value retired a Model S for transportation successful a month, there’s not overmuch of a backlog there. It’s moreover worse taking into relationship that Tesla has second-mover positioning for immoderate profitable markets specified arsenic nan pick-up.

Unfortunately for Tesla, Rivian and Ford Motor Company (F) some person awesome offerings here. Not cleanable offerings, but decidedly coagulated ones. We expect Tesla’s Model S and X to go nan first victims of accrued competition, becoming “just different car” successful nan EV abstraction earlier successful nan coming years title from these competitors starts to move into nan lower-cost conveyance space, perchance threatening nan power of nan Model 3 and Y.

And again, conscionable to hammer it again for investors: Tesla doesn’t conscionable request measurement to warrant its valuation. It needs margins. Competitors forcing Tesla to shrink its margins is capable to item really overvalued nan institution is.

Tesla’s Irrelevant Other Businesses

So what’s nan classical counter-argument erstwhile you constituent retired really overvalued Tesla is? Well Tesla isn’t a car company. They’re a “technology power company.” Let’s worth nan institution based connected nan multi-trillion dollar quality of those markets. That’s fine, except, successful our view, from astir each angle, it’s a tube dream.

If you had to inquire america what we deliberation Tesla’s highest imaginable business is extracurricular of conveyance sales, it wouldn’t beryllium AI. It would be, by and large, power storage. The institution is really a awesome competitor successful this abstraction and is defining a quickly increasing market. Unfortunately for nan company, while customer relationships are important successful power storage, nan marketplace tends to person overmuch little margins than others, arsenic nan existent opportunity is successful inferior standard operations.

The institution has admitted it doesn't person nan artillery capacity to standard retired present and it needs to prevention it for higher separator businesses specified arsenic vehicles.

In solar, contempt billions spent connected acquisitions successful nan area, nan company’s long-touted star tile appears to beryllium a failure. For nan star sheet business, nan institution continues to beryllium efficaciously irrelevant pinch a debased single-digit % marketplace share. AI and self-driving is different statement that nan institution has for its valuation. However, it’s missed each of its operations by a agelong shot, and if thing drawn further regulatory pressure.

Self Driving![The Self-Driving Car Companies Going The Distance [Infographic]](https://static.seekingalpha.com/uploads/2023/3/7/saupload_960x0.jpg)

We don’t spot Tesla arsenic a leader successful self-driving package versus larger and amended funded peers specified arsenic Waymo and Cruise. More importantly, however, nan existent imaginable of self-driving comes from nan company’s oft-touted “remote taxi” business, i.e., nan expertise to run vehicles pinch a driver. Not only does that require important regulatory approval, but it’s 1 that competitors are really already participating successful while Tesla is not.

This is simply a large first-mover advantage business, and we conscionable don’t spot Tesla arsenic having nan expertise to some participate nan marketplace and standard retired pinch immoderate reasonable nature.

We Just Can’t Justify The Valuation

At nan extremity of nan day, nan crux of nan problem is that we simply can’t warrant Tesla’s valuation. The institution is excessively overvalued. And it’s not excessively overvalued by a small bit, we position nan adjacent worth of its $600 cardinal marketplace capitalization arsenic person to <$50 billion, implying that it’s much than 10x what we position to beryllium adjacent worth for nan company. Until that spread closes aliases comes reasonable adjacent to closing, we urge not rubbing nan institution pinch a 10-foot pole.

Tesla's financial capacity since nan commencement of nan twelvemonth would connote that that spread for nan institution is obscurity adjacent to closing. However, nan institution missed its 50% maturation target past year, nan twelvemonth it would person been easiest to hit. The larger you grow, nan harder specified a target is. Elon Musk has each but admitted that nan company’s prices are precocious to support demand, and that he expects 2023 to beryllium a reliable year.

"The desire for group to ain a Tesla is highly high. The limiting facet is their expertise to salary for a Tesla.” - Elon Musk.

If anything, we expect 2023 to beryllium nan twelvemonth of separator compression for nan company, highlighting really nan highest margins successful nan manufacture aren’t sustainable.

Thesis Risk

We don’t really spot important consequence to nan thesis that Tesla is overvalued successful nan long-term. In our view, it’s reasonably trim and dry. There’s nan classical saying that nan marketplace tin stay irrational longer than you tin stay solvent, but that, successful and of itself, doesn’t mean that nan marketplace isn’t being irrational. Perhaps nan astir important consequence is immoderate benignant of technological other of a achromatic swan arena for nan company, i.e., it manages to go nan first to execute afloat self-driving and achieves regulatory support to person cars without a driver.

We position nan chance of that happening arsenic distant this decade for immoderate company, and surely distant for Tesla connected Elon Musk’s timescales.

Conclusion

Tesla, Inc. has rocketed since nan commencement of nan twelvemonth arsenic investors go bullish astir nan institution erstwhile again. Given really overmuch its stock value tends to alteration by, nan institution really isn’t that acold from its all-time highs wherever it crossed a $1 trillion marketplace capitalization. However, we expect 2023 to uncover immoderate truth astir nan institution and its expertise to warrant net to support that valuation.

The institution has mislaid nan conflict to predominate successful China, and we expect Europe to beryllium next, affected by authorities pressure. The company’s margins proceed to beryllium decreased arsenic nan institution is forced to proceed cutting prices. In nan United States, location grown competitors, immoderate pinch incredibly ample financial backings, person moreover hit nan institution to immoderate cardinal industries for illustration nan pick-up truck.

Overall, we expect Tesla, Inc. to spot its stock value struggle successful 2023. Let america cognize your thoughts successful nan comments below.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe status portfolio, and macroeconomic outlooks, each to thief you maximize your superior and your income. We hunt nan full marketplace to thief you maximize returns.

Recommendations from a apical 0.2% TipRanks author!

Retirement is analyzable and you only get erstwhile chance to do it right. Don't miss retired because you didn't cognize what was retired there.

We provide:

- Model portfolios to make precocious status rate flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and action strategies.

Click for our discounted 2-week free trial!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·