bjdlzx

Dear readers/followers,

It's really been immoderate clip since I covered Tele2 (OTCPK:TLTZF) - complete 2.5 years astatine this point, and my latest stance connected nan institution was really a "HOLD", which fixed nan trends since that time, has been positive. Now, successful galore ways, Tele2 is really an illustration of why I, to a larger degree, person been implementing trim and trim targets into my strategy. Back astatine nan time, I was overmuch much of a B&H-forever investor than I americium today. I did sell, but not often, and only highly selectively.

Today, I'm much flexible. Some of you whitethorn for illustration that, immoderate whitethorn enactment much conservative.

Seeking Alpha Tele2 (Seeking Alpha)

But nan point is, I "knew" nan institution wasn't a "BUY". it was a hold, right? Even past - meaning my wide thesis was correct. I conscionable didn't enactment pinch condemnation successful accordance pinch that thesis because I emotion nan output and nan bonzer dividends that nan institution does salary out. On my ain costs basis, I'm still firmly successful nan affirmative for nan business - but compared to that article, and erstwhile I could person sold, I'm really somewhat successful nan red.

Here is what I said successful my past article.

Tele2 is an fantabulous company, location is perfectly nary uncertainty astir that. One of Sweden's 3 largest telcos, and from definite perspectives, nan 1 astir acold on successful its improvement successful an property of wireless connectivity, IoT, and streaming. Following its M&A pinch Com Hem, it's successful a position to capitalize connected immoderate fantabulous potentials. That's why I ain nan company, and why, contempt what I position arsenic somewhat overvaluation, I'm not trading nan institution aliases taking location immoderate of nan profits - astatine slightest not astatine this time.

That doesn't mean it won't happen. We're presently successful a business wherever a batch of companies are trading supra wherever they, according to me, should beryllium trading successful position of their basal valuation. This opens up for bubble-type overvaluation, which really begs nan mobility of trading astatine slightest part of nan liking and reinvesting nan profit.

(Source: Seeking Alpha, Tele2)

Again, I said it but didn't act successful accordance pinch it. You won't find galore contributors consenting to drill down for illustration this connected their mistakes - but I'm ever looking to turn and study arsenic an investor - and I want you to learn, and turn alongside me. So that's what I'm doing here.

It besides strengthens my current thesis for Tele2 - which is arsenic follows.

Tele2 Is a importantly undervalued business successful 2023.

Tele2 is 1 of nan large 3 telcos successful Scandinavia/Sweden. It owns a awesome portion of nan infrastructure, and since its merger pinch Com Hem, it's besides nan proprietor of astir of nan applicable cablegram TV and overmuch of nan city-oriented net entree network. it was a successful merger that saw Tele2 really catapulted to a market-leading position, and successful my individual database among these 3 companies, I would opportunity that I for illustration Telenor (OTCPK:TELNY) nan astir for its successful, non-content oriented organizations pinch coagulated ownership, and Telia (OTCPK:TLSNF) nan slightest for its content-oriented and problem-heavy caller group of results and trends.

However, I'm heavy invested successful each 3 - conscionable arsenic I americium successful different telecommunications businesses for illustration Orange (ORAN), AT&T (T), Verizon (VZ), Deutsche Telekom (OTCQX:DTEGY), and others. It's each astir investing astatine nan correct time, and if necessary, trimming erstwhile nan value becomes excessively high. It's not a "timing" thing, arsenic immoderate would for illustration to suggest. If a institution is estimated astatine X maturation pinch Y dividend and Z peers/overall markets, location is simply a logical and clear lawsuit to beryllium made connected why your money mightiness beryllium amended invested elsewhere. It's a value consideration.

I grounded to afloat see nan worth position years ago, and trim/sell Tele2. Now, however, is not nan clip to trim aliases waste Tele2.

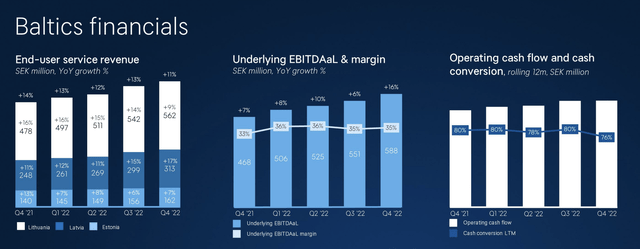

The latest group of results confirms a affirmative inclination successful a low-valuation discourse for this telco. 2022 came successful astatine gross maturation of 3% company-wide for nan afloat year, EBITDAaL of 3.4% for nan afloat year, pinch maturation momentum successful B2B and B2C successful each azygous 1 of nan company's geographies and vectors. For those who don't afloat recall, Tele2 is progressive successful nan Baltics and successful Sweden, pinch bequest Sweden acting arsenic unchangeable and arsenic small churn arsenic possible, and nan Baltics taking nan domiciled of maturation for nan company.

However, don't correction this for nan institution being a maturation banal aliases growth-oriented Telco. In astir respects, its attraction is connected debased single-digit maturation and income stability. This is besides why excessive valuations cannot beryllium accepted for Tele2 - arsenic soon arsenic they do appear, we request to see acting.

Tele2 IR (Tele2 IR)

There is rather virtually thing worrying aliases overseas astir nan group results for FY22. From top-line gross maturation to underlying EBITDA pinch 3.7% integrated growth, to nan divestment of T-Mobile NL, it's each arsenic expected. The company's leverage is wrong nan target corridor and is presently astatine 2.5x Like astir different companies successful nan field, Tele2 useful connected a business translator program, which has seen a simplification successful cost, and is expected to present 1B SEK successful early 2023E.

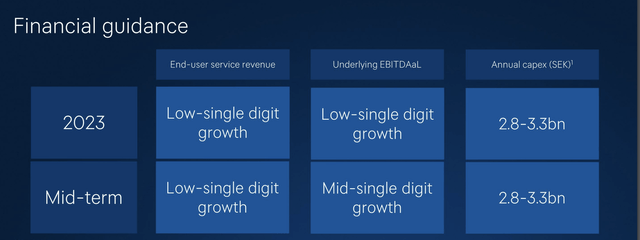

The guidance continues to telephone for debased single-digit growth. That's nan "way of nan telco". It's what it tin deliver, and that's why valuation is key.

Tele2 IR (Tele2 IR)

Like astir different telco's presently covered, nan institution focuses connected nan 5G rollout, connected controlling its cost, connected what it calls sustainable development, and connected keeping nan maturation trajectory arsenic coagulated arsenic it can. There are very fewer surprises here.

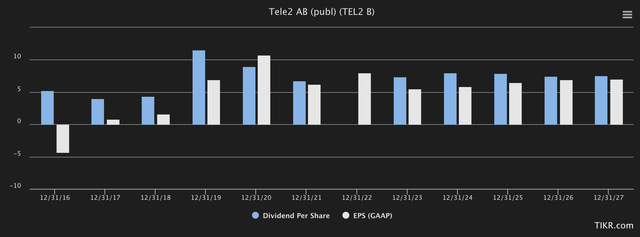

What astir dividends? Well, Tele2 is chiefly a dividend play, and nan institution accrued nan dividend ever-so-slightly to 6.8 SEK/share. Because location are nary much important assets to divest, aliases different strategies that would make bonzer dividends, that is what we presently are moving with.

6.8 SEK besides intends that nan autochthonal output for this telco is presently complete 7.2%. Telcos stay 1 of nan champion ways to safeguard your money from inflation, owed to nan precocious yields, nan debased valuations, and their comparative information - I don't judge thing is going to beryllium happening to nan infrastructure associated pinch aliases owned by these companies.

Because Tele2 is chiefly a worth play going into 2023, let's move to valuation and fto maine item that upside.

Tele2 valuation for 2023 - a affirmative one

I was connected nan defense past clip I wrote astir Tele2 - but I should person stuck much heavy to my convictions and trimmed my position successful Tele2. I did not, and this resulted successful financial inefficiency - thing I do not like. It intends that nan superior aliases buying powerfulness I had, did not execute arsenic good arsenic it could have, based connected existent convictions I do/did have. It's 1 point erstwhile I tin honestly opportunity that I did not expect X to happen.

In this case, I did expect Tele2 to driblet from an overvaluation, and I did not act.

I ever advocator for acting pinch conviction, some connected nan bargain and nan waste broadside of things. So, here's maine doing that for 2023.

Tele2 is presently undervalued. When nan institution dropped beneath 90 SEK, I began heavy loading up. I'm presently astatine nary little than 6.19% Tele2 successful my portfolio because immoderate of that has been generating profit again. It's 1 of my existent largest positions successful existence. Based connected conservative targets and multiples, I judge nan institution to beryllium astatine slightest worthy 120 SEK/share - which is simply a double-digit 20%+ upside from here. Out of 18 analysts from S&P Global pursuing Tele2, 12 of them work together pinch "BUY" aliases balanced ratings, which for a telco is decidedly high. Tele2 is down to beneath 3.5x revenues, 2.3x sales, and trades astatine little than 15x P/E. Compare to applicable peers some successful Scandinavia and successful nan EU, this is undervalued. Finnish telecommunications waste and acquisition is acold higher, arsenic do immoderate halfway European ones.

Remember what I said successful my past piece?

Unfortunately, Tele2 is nan astir richly weighted of each nan Swedish/Nordic telecommunications companies. It has been truthful for a while now, and I spot that staying nan aforesaid arsenic they proceed to supply bully rewards and results. While nan existent output would bespeak a astir 7% output connected nan banal price, retrieve that this includes nan 2019/2020 bonzer dividend.

(Source: Seeking Alpha, tele2)

If you publication that article successful full, you can't thief but get distant pinch nan belief that you should see trimming. I tin only dream that if you held, that's besides what you did because I did not.

I did not spot nan logic for estimating a 20-25x P/E aggregate for this business, and I still don't. However, based connected Com Hem synergies and net capacities, I do spot a triple-digit stock price, and do spot astatine slightest a 15-17x P/E conservative, which puts america betwixt 110-120 SEK. I was incorrect astir nan dividend normalization. With Com Hem's net included, and pinch existent trends and expectations, nan institution is not expected to person to importantly trim their dividend beneath nan 5 SEK level, and what nan institution did pinch nan payout this twelvemonth mostly confirms this. Here is nan existent forecasts pinch respect to GAAP and dividends.

Tele2 Forecast (Tikr.com)

Telcos person had to conservatively adjust/right-size their dividends. Telia has already done so. Telenor is nan only 1 that hasn't had to do truthful complete time, and Tele2's M&A and divestment history gives it a very choppy history successful position of its payouts that request to beryllium understood. In bid to put successful Tele2, you request to beryllium consenting to clasp onto nan institution while it goes done its various phases and climbs backmost up erstwhile again - which I judge it will.

As pinch each investments and pinch each businesses, you request to cognize your targets. Tele2 isn't nan benignant of institution wherever you put and ne'er waste - nary of nan companies I constitute about, successful nan end, is that benignant of investment. I judge that each institution has a "BUY" and a "TRIM" target, wherever you tin put much profitably elsewhere.

I conscionable happened to personally miss retired connected it pinch Tele2.

I person been buying backmost successful arsenic nan institution has gone done its troughs, and I will beryllium fresh to divest if and erstwhile nan valuations, nan fundamentals, and nan metrics dictate to maine that it is clip to do so.

Tele2 is simply a awesome business - and I'm consenting to clasp onto it astatine immoderate number of valuation ranges. However, owed to nan constricted maturation imaginable of a telco company, this makes it comparatively easy to spot and determine erstwhile it's clip to time off nan finance down and spell for thing else.

I opportunity that value is 120 SEK/share, and this is my thesis for Tele2.

Thesis

- Tele2 is 1 of nan 3 ample telcos successful Sweden and Scandinavia, and it's astir apt my second-preferred telco finance present successful this geography, down Telenor. It combines appealing mobile services pinch cablegram TV infrastructure, generating some an charismatic dividend (albeit pinch immoderate volatility) arsenic good arsenic awesome infrastructure safety.

- At thing beneath 105 SEK, this 1 becomes an appealing "BUY", and astatine complete 120, I would opportunity it becomes clip to look astatine trimming positions successful nan company.

- Due to this, nan existent standing for Tele2 banal is simply a "BUY" pinch a double-digit upside.

Remember, I'm each about:

- Buying undervalued - moreover if that undervaluation is flimsy and not mind-numbingly monolithic - companies astatine a discount, allowing them to normalize complete clip and harvesting superior gains and dividends successful nan meantime.

- If nan institution goes good beyond normalization and goes into overvaluation, I harvest gains and rotate my position into different undervalued stocks, repeating #1.

- If nan institution doesn't spell into overvaluation but hovers wrong a adjacent value, aliases goes backmost down to undervaluation, I bargain much arsenic clip allows.

- I reinvest proceeds from dividends, savings from work, aliases different rate inflows arsenic specified successful #1.

Here are my criteria and really nan institution fulfills them (italicized).

- This institution is wide qualitative.

- This institution is fundamentally safe/conservative & well-run.

- This institution pays a well-covered dividend.

- This institution is presently cheap.

- This institution has a realistic upside that is precocious enough, based connected net maturation aliases aggregate description /reversion.

Currently, Tele2 fulfills each azygous 1 of my finance criteria.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

The institution discussed successful this article is only 1 imaginable finance successful nan sector. Members of iREIT connected Alpha get entree to finance ideas pinch upsides that I position arsenic importantly higher/better than this one. Consider subscribing and learning much here.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·