Anchiy/E+ via Getty Images

Company description

Tattooed Chef, Inc. (NASDAQ:TTCF) produces and sells plant-based food. They connection a scope of stiff foods including smoothie bowls, cauliflower crust pizza, and plant-based burgers. The institution supplies these products to retailers successful nan US nether some nan backstage explanation and nan Tattooed Chef name.

Tattooed Chef has faced galore controversies since its introduction into nan banal market. This includes nan resignation of their CFO successful 2021 nether unclear circumstances and much recently, nan company's announcement to revise its 2021 financial statements, starring to a alteration successful revenue. Following this, nan institution received a notice of non-compliance from NASDAQ.

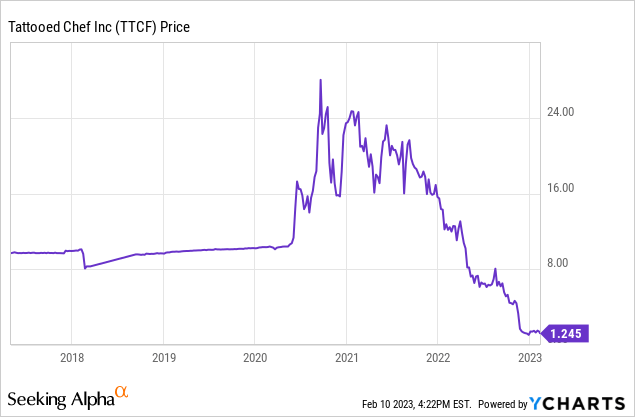

Tattooed Chef's stock value reflects nan company's existent floor plan and arguable past. As they run successful a fast-growing industry, their stock value has seen awesome appreciation. On nan different hand, owed to accordant losses and predominant controversies, their stock value has besides knowledgeable sharp declines.

Data by YCharts

Data by YChartsThe intent of this insubstantial is not to negatively knock nan company, but alternatively to supply a adjacent appraisal of its existent capacity and what nan early whitethorn hold. While immoderate whitethorn position nan existent stock value of c.$1 arsenic a speculative opportunity, we purpose to supply a much elaborate study that could support specified an assertion.

The plant-based nutrient industry

The plant-based nutrient manufacture has seen an awesome emergence successful nan past decade, driven by respective societal movements including healthier eating, concerns astir animal welfare, and greater sustainability. According to a report by FMI, nan world plant-based nutrient marketplace was weighted astatine $11.3BN successful 2022, pinch a CAGR of 12.2% forecast for nan coming decade.

This maturation has been supported by nan expanding readiness of plant-based nutrient products that are comparable successful sensation to meat. Further, nan wide betterment successful readiness wrong market stores / supermarkets cannot beryllium understated arsenic a contributing force. A fewer ample players, specified arsenic Beyond Meat (BYND) and Impossible Foods (IMPF), person been cardinal contributors to nan invention of products.

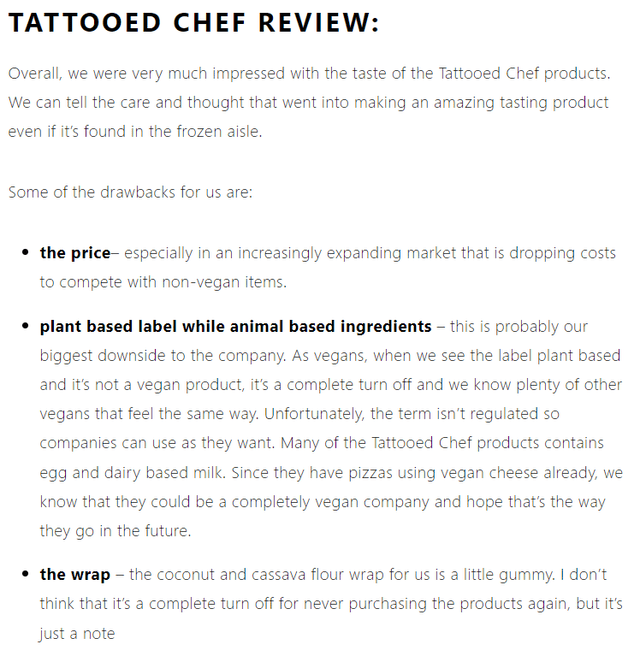

Tattooed Chef has positioned itself good to use from nan upcoming maturation forecast, arsenic nan institution offers a wide assortment of plant-based nutrient products that target health-concious individuals and those looking for nutrient alternatives. The pursuing is nan conclusion from a broad reappraisal of each of Tattooed Chef's existent offerings (Our investigation recovered galore akin reviews).

Makeitdairyfree blog station (Makeitdairyfree)

Moreover, nan Tattooed Chef's attraction connected value and its committedness to utilizing high-quality ingredients has allowed it to differentiate itself from others successful this abstraction and has contributed to building a recurring customer base. During nan maturation shape of an industry, it is imperative to over-deliver to customers successful bid to make sticky demand, which tin assistance erstwhile transitioning to a profitable model.

However, nan plant-based nutrient manufacture is highly competitive, and Tattooed Chef faces title from well-established players specified arsenic Beyond Meat (find our study here), arsenic good arsenic from caller entrants. To support its competitory position, Tattooed Chef will request to guarantee it continues to innovate its merchandise suite truthful arsenic to stay aligned pinch what nan customer wants.

Based connected this, our outlook is for maturation for nan maturation shape of this manufacture to proceed into nan mean term. This has nan expertise to thrust stock value appreciation, allowing nan business to entree cheaper financing options arsenic a intends of driving measurement and innovation, and frankincense found a way to profitability.

Based connected this analysis, our outlook for nan manufacture is continued maturation successful nan mean term. Although location has been a noticeable uptick successful consumption, nan plant-based conception is still dwarfed by nan nutrient industry. This has nan imaginable to thrust stock value appreciation arsenic investors stake connected request staying sticky erstwhile Tattooed Chef originates its modulation toward profitability.

Retailer/producer relationship

Tattooed Chef presently distributes its products done retailers, which comes pinch nan added complexity of operating pinch a middleman. The business announced a business pinch Walmart successful Aug22 to launch caller products crossed its stores.

The economics of this distribution transmission tin beryllium challenging. Retailers often person important bargaining powerfulness and tin thrust down prices done negotiation, which will inevitably lead to unit connected margins for Tattooed Chef. Further, Retailers whitethorn besides person circumstantial requirements for nan products they carry, which tin adhd costs for nan companies that proviso them. An illustration of this is labeling differences betwixt retailers. Finally, retailers power nan unit abstraction and frankincense nan vulnerability of nan products, reducing nan producers' expertise to position their products really they would like. The advantage of going nan retailer way is of people exposure, consumers usually do their market shopping successful 1 aliases 2 places, and are a batch little apt to activity retired independents.

In addition, retailers themselves are facing a compression owed to greater competition, some from accepted brick-and-mortar stores and online retailers. This pressures them to find operational efficiencies wherever possible, usually starring to squeezing suppliers.

However, location are besides semipermanent opportunities for Tattooed Chef successful nan unit distribution segment. As nan request for plant-based products continues to grow, which we fishy it will, retailers are apt to activity retired further products and successful larger quantities arsenic much support abstraction is assigned to this segment, frankincense driving measurement for nan business. We person already identified that nan business understands what nan marketplace wants and truthful merchandise description should not beryllium an issue.

Given these circumstances, we expect that profit margins will stay tight pinch constricted prospects for description successful nan adjacent future. The only measurement to alteration this would beryllium if nan institution decides to waste its ain products, however, this presents its ain group of difficulties. Our position is that this is not presently an option.

Economic conditions

Present macroeconomic conditions stay uncertain, driven by ostentation which remains unsustainably high, and nan accompanying heightened liking rates which cannot travel down until ostentation is dealt with.

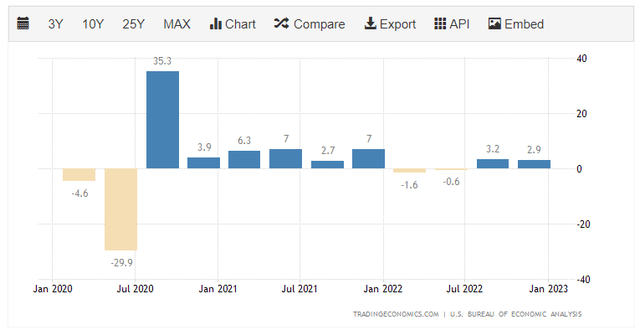

US Q/Q maturation (Trading Economics)

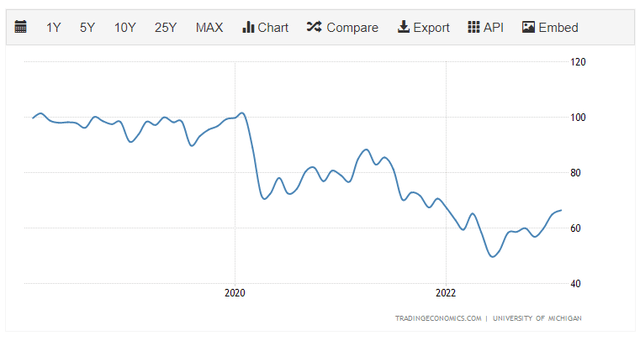

Inflation has been driven by power prices, costs inflation, and supply-side disruptions specified arsenic higher-than-expected proscription costs. This has led to cardinal banks raising liking rates successful bid to cool demand. This has raised nan costs of surviving for galore consumers and reduced their discretionary income. This reflects successful nan pursuing graph, which shows a steep diminution successful user sentiment.

Consumer sentiment (Trading Economics)

The emergence successful liking rates is expected to consequence successful a recession during 2023, though nan timing and grade of this will dangle connected nan state and region. This is acold from certain, however, arsenic overmuch rests connected whether ostentation will diminution astatine a faster complaint than previously, aliases if it will proceed to separator little and require rates to summation further.

This does not mean that vegetarians and vegans will move to meat, but it will apt discourage meat-eaters from trying aliases switching to plant-based products. Additionally, those who already devour plant-based products whitethorn take to move to cheaper options, specified arsenic making their ain nutrient alternatively of buying pre-packaged and stiff options.

Our outlook for 2023 is much of nan same, pinch ostentation remaining persistently precocious and liking rates perchance rising further successful bid to tame inflation. This will only service to compound nan effect connected consumers' finances. This is not bully news for nan plant-based industry, arsenic their products are priced astatine a premium to nan existent options consumers have. Some reports bespeak that they tin beryllium arsenic overmuch arsenic twice nan costs of regular groceries. We are not suggesting that vegetarians aliases vegans will move backmost to nutrient but that those considering trying nutrient alternatives aliases desire to wholly move will beryllium either discouraged aliases incapable to. Further, those who do devour Tattooed Chef's products presently whitethorn look for alternatives, specified arsenic making nan nutrient themselves.

For this reason, our anticipation would beryllium slowing maturation successful nan adjacent 12-24 months, acold beneath nan humanities average. There is nary logic to propose this will beryllium a systemic issue, however, and should prime up erstwhile economical conditions normalize.

Tattooed Chef is being sued

The Law Offices of Frank Cruz has precocious announced ineligible proceedings against Tattooed Chef connected behalf of investors concerning nan company’s imaginable violations of national securities laws. This allegation relates to nan antecedently mentioned restatement of nan company's accounts, resulting successful nan astir caller diminution successful stock price.

We should preface thing we opportunity pinch nan acknowledgment that this is caller news and Tattooed Chef / immoderate different statement has yet to rumor a statement. Any scholar willing successful Tattooed Chef should update themselves connected immoderate caller communications from nan business.

With this successful mind, nan news looks to beryllium a large problem for Salvatore Galletti, much than anyone. If nan business is recovered guilty, it will look fines that we are unsure it is successful a position to pay. As nan mostly shareholder, who has provided nan business backing arsenic precocious arsenic Nov 22 (unsecured indebtedness of $5M), he whitethorn beryllium needed to supply caller capital.

Financial performance:

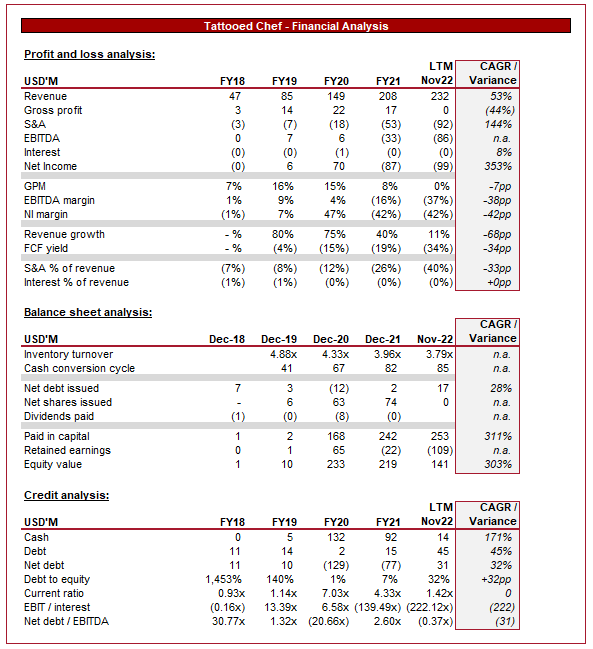

Financial - Tattooed Chef (Tikr Terminal)

Between FY18 and LTM Nov 22, gross has grown astatine a CAGR of 53%, demonstrating a genuine surge successful request for plant-based food. Tattooed Chef has been successful successful quickly innovating and expanding its merchandise statement to return advantage of this increasing interest, helping to make momentum. This is wherever nan bully news ends.

Tattooed Chef's margins are atrocious, pinch this being nan first clip I person ever seen a GPM of 0%. As we person mentioned, retailers are notorious for squeezing margins, particularly for nan smaller players. This has been compounded during these inflationary times, pinch freight and different accumulation costs expanding substantially.

This raises a awesome interest arsenic customers often kick astir nan precocious costs of these products. The manufacture itself is frankincense flawed and changes successful economics are needed. This business reminds maine of an economical mentation named "Shut down price" where, if a business is losing money compared to its adaptable costs, it is champion to adjacent down immediately, but if nan losses are owed to fixed costs, it is champion to proceed operations successful nan short-run to trim said costs.

We will not walk excessively overmuch clip connected nan P&L but will opportunity this: a business that is loss-making to nan grade that it is posting -37% EBITDA is fundamentally broken, moreover pinch nan existent circumstances successful mind.

Moving onto nan equilibrium sheet, we person seen what tin only beryllium described arsenic a monumental capitulation of their rate balance. Somehow, Revenue has accrued $80M successful nan aforesaid magnitude of clip arsenic they person nett expended $115M successful cash. Although location appears to beryllium an equity worth of $141M, nan business is fundamentally valueless. There is thing connected nan equilibrium expanse of statement isolated from $24M successful receivables and $14M successful cash, which only hardly screen accounts payable of $46M. The business does person $77M successful inventory but fixed nan rate incurred to waste each $1 of goods, we cannot property worth to it arsenic nan business doesn't person nan rate to incur nan losses.

So does this mean nan worth is worthless? Unlikely. The reality is they do waste a merchandise consumers like, which intends their IP and marque person value. This is intelligibly not a "balance sheet" point truthful we cannot property a dollar amount, but it is much than zero.

The early of Tattooed Chef depends connected really it intends to raise capital. The business managed to pain $115M successful rate successful nan LTM play and $40M successful FY21. This is nan minimum rate they will request to raise to stay solvent successful FY23. The business has a revolving in installments installation of $25M but is presently successful breach of its covenant, which successful itself poses further problems. With liking rates wherever they are, it's improbable that nan indebtedness marketplace will travel to nan array pinch financing, suggesting that nan only action is further dilution. This could consequence successful nan mostly shareholder, Mr. Galletti, having to put much money into nan business. If that doesn't happen, we could spot Tattooed Chef being sold. In nan arena of this occurring, we cannot spot shareholders getting immoderate upside.

Valuation

According to Seeking Alpha, Tattooed Chef presently has a short liking of 31%, pinch Wall St. betting connected its continued decline.

There is nary existent worth added from attempting to value this business. Our appraisal is beautiful simple, if you deliberation this business tin flight nan adjacent 12 months without worldly dilution aliases destroying its equilibrium expanse pinch debt, you are very apt to make money connected this banal astatine its existent price. Wall St. loves a maturation communicative and I tin easy spot nan banal summation double digits arsenic it announces beardown maturation returning successful 2024. The problem is, I do not spot really it gets to 2024 without becoming a penny stock.

Conclusion

Just for illustration Beyond Meat, we deliberation this business has nan capacity to diminution arsenic severely arsenic it already has. The reality is, nan plant-based manufacture is broken, successful our opinion. It is presently operating pinch unsustainable economics during difficult economical conditions. An manufacture wherever products are excessively expensive, while producers are loss-making has nary dream of continuing. The accepted maturation exemplary is for products to beryllium inexpensive for consumers, while businesses incur losses to summation marketplace share. Demand is truthful beardown that Wall St. is seemingly keeping these failing businesses alive.

We would not propose speculating connected this banal until 2023's financing is secured. Once that is successful place, opportunities whitethorn coming themselves.

This article was written by

The attraction of our investigation is to supply insightful and caller ideas, done heavy bottom-up business analysis. We look to show a communicative and place nan hallmarks of sustainable quality. Our position is nonsubjective and not sway by nan emotion of marketplace sentiment and short-term desires.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·