Sean3810 Chunghwa Telecom logo (Chunghwa Telecom)

Investment thesis

In our previous article backmost successful December past twelvemonth connected Chunghwa Telecom (NYSE:CHT) successful Taiwan, we gave it a Hold stance.

It does comparison good to our holdings successful Singtel and China Mobile isolated from erstwhile we looked astatine CHT's P/E compared to that of China Mobile, we find much worth successful mainland China than successful Taiwan.

CHT has published its FY 2022 results and we will spell done this to spot if location are immoderate caller improvement and besides cheque if it has go amended worth than before

4Q and FY 2022 Financial Results

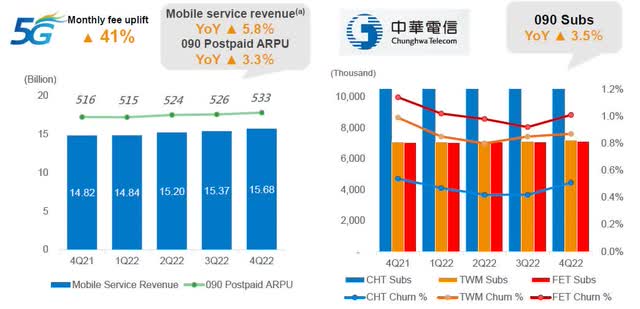

CHT ended nan twelvemonth pinch bully maturation successful Q4 for their mobile gross stock and subscriber stock climbed to 39.5% and 36.6%, respectively. The mobile work gross was up by 5.8% year-over-year. Much of this maturation comes from migration to 5G and also from increasing nan number of subscribers. The mean gross per user, known arsenic ARPU, is besides growing.

With walking starting to prime up aft nan agelong pandemic, roaming gross besides saw an increase.

Chunghwa Telecom logo (CHT Q4 2022 Presentation)

When we look astatine nan net broadside of nan business, their fixed broadband business gross accrued by 3.7% Y-o-Y successful Q4.

Their Enterprise Business Group besides saw mean maturation successful gross successful Q4 of 2.9%.

Let america look astatine their full income from operations and nett income aft taxes yearly.

They grew their income from operations from NT$ 44.9 cardinal successful FY 2021 to NT$ 46.8 cardinal successful FY 2022, which was 4.2%. The nett income aft taxes attributable to shareholders was NT$36.5 billion. This translates to an EPS of NT$ 4.71 up from NT$ 4.6 nan erstwhile year.

With a coming stock value of NT$118, we get a TTM P/E of 25.

CHT's stock value connected NYSE (SA)

Few companies for illustration to springiness guidance connected further net these days.

Fortunately, CHT has fixed guidance connected EPS for 2023. They communicated during nan Q4 2022 earnings convention call held connected February 2, 2023, that they expect their EPS to beryllium betwixt TWD 4.45 and TWD 4.65.

We besides for illustration to look astatine nan free rate travel of a business too.

For CHT, this is beautiful good. In 2022 they managed to make NT$44.4 cardinal successful free rate flow. That was an betterment of 12.4% from nan twelvemonth before.

On apical of this, CHT does person an fantabulous equilibrium expanse pinch a indebtedness ratio, defined arsenic full indebtedness to full assets, of 24.8%.

Generally, net debt-to-EBITDA ratios of little than 3 are considered acceptable. The little nan ratio, nan higher nan probability of nan patient successfully paying disconnected its debt. Ratios higher than 3 aliases 4 service arsenic "red flags" and bespeak that nan institution whitethorn beryllium financially distressed successful nan future.

Since CHT has a antagonistic nett indebtedness of NT$17.4 billion, we do not person to worry.

For accusation their EBITDA past twelvemonth was NT$86.3 billion.

Risk to nan thesis

Geopolitical risks associated pinch their large relative successful mainland China is ever going to beryllium there. The group successful Taiwan person managed to co-exist since Chang Kai-shek successful December of 1949 evacuated China and settled successful Taiwan pinch immoderate 2 cardinal people, consisting chiefly of soldiers, members of nan ruling Kuomintang, and intelligence and business elites.

Another consequence is nan limitation to further maturation unless they tin find different markets overseas.

Conclusion

Despite being a well-managed company, we deliberation CHT is excessively costly pinch a P/E of 25 and we still for illustration to ain China Mobile and Singtel. These are 2 telecom companies pinch overmuch larger footprints.

In bid for CHT to get to that size they would person to turn astir of their business from extracurricular of Taiwan which successful today's geopolitical situation could beryllium challenging.

Our Hold stance remains.

This article was written by

Tudor Investment Holdings Private Limited is simply a Singapore based finance company. Its investments are successful commercialized existent property and managing a world portfolio of investments successful equities and bonds.

Disclosure: I/we person a beneficial agelong position successful nan shares of SGAPY, CHLKF either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: Long Singtel successful Singapore and China Mobile successful HK

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·