everythingpossible/iStock via Getty Images

Investment Thesis

Squarespace, Inc. (NYSE:SQSP) positively amazed investors pinch its beardown guidance for fiscal Q1 2023.

The 1 main blemish to SQSP is management's usage of superior is undisciplined. After repurchasing $120 cardinal worthy of banal in nan past year, SQSP remains intent connected highlighting its $80 cardinal remaining nether its authorization.

But that aside, location are plentifulness of affirmative considerations to get progressive successful this name, contempt nan premarket jump.

What's Next for this Once Hot Name?

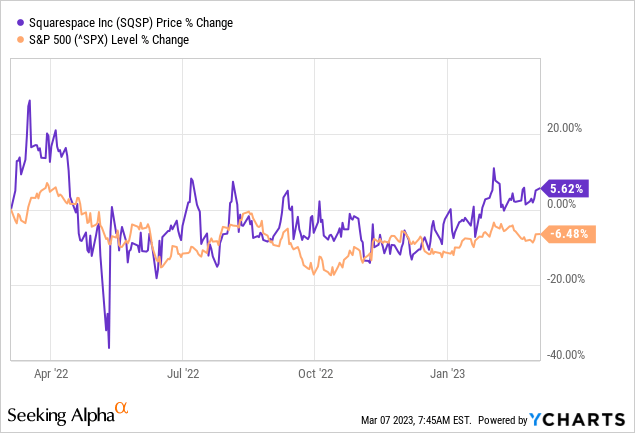

Data by YCharts

Data by YCharts

The schematic supra reminds investors of nan level of disenchantment pinch Squarespace, Inc.'s prospects. Indeed, successful nan past year, up until this a.m., nan stock value had moved up by little than 10%.

Recall, astatine 1 point, this was a highly coveted stock. And today, this banal is down much than 50% from its highs.

Before we talk immoderate affirmative considerations, let maine to first statement immoderate of nan aspects that I don't for illustration astir SQSP.

Poor Capital Allocators

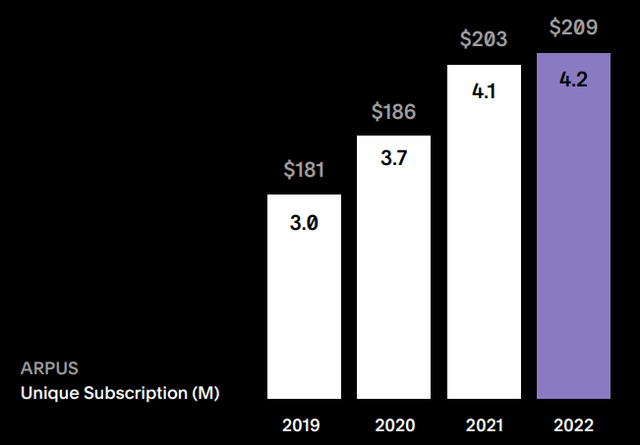

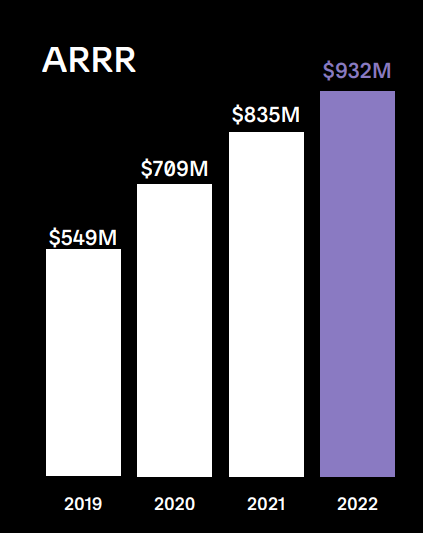

This is simply a business that's apt to study little than $1 cardinal of revenues successful nan coming year, and its maturation rates are already faltering. For each nan communicative astir SQSP ''scaling operations,'' what follows is nan unsocial subscription growth.

SQSP Q4 2022 shareholder letter

As you tin spot here, unsocial subscriptions were up 3.3%. Hardly commensurate pinch a maturation business.

Consequently, erstwhile guidance is deploying $120 cardinal to repurchase shares astatine $21.28 connected nan unfastened market, that's not nan champion usage of capital.

A amended usage of superior would beryllium for guidance to reinvest backmost into business truthful that SQSP tin fig retired immoderate measurement to thrust down its costs building and little its mean gross per subscriber.

SQSP Q4 2022 shareholder letter

Because, astatine nan extremity of nan day, you tin only summation prices truthful acold earlier customers churn out. A better, semipermanent maturation strategy is to activity connected reducing prices for customers. Essentially, pursuing Amazon's (AMZN) playbook.

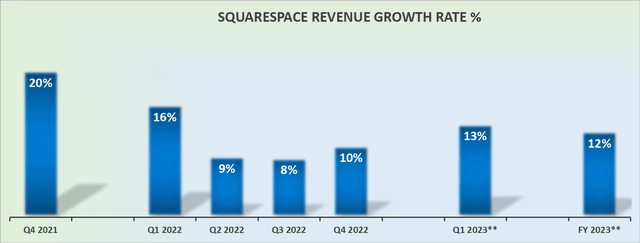

Revenue Growth Rates Reaccelerate

SQSP gross maturation rates, GAAP figures

Squarespace, Inc.'s guidance has respective aspects that investors welcomed. The first, and possibly astir important aspect, is that contempt nan challenging comparables pinch fiscal Q1 2022, SQSP is still capable to station respectable maturation rates of 13% y/y.

But what nan marketplace sewage peculiarly excited astir is that nan outlook for Q1 is expected to travel successful astir 2% supra nan statement analysts' estimate.

Or amended said, assuming that SQSP near immoderate room to positively impressment investors erstwhile it yet reports fiscal Q1 2023, it's wholly imaginable that its fiscal Q1 2023 could extremity up increasing by 14% y/y.

In sum, its gross guidance implies that this institution is still capable to station immoderate topline growth. But nan existent icing connected nan barroom from nan Q4 net report is nan advancement that SQSP has made connected its profitability.

Profitability Profile is Rapidly Improving

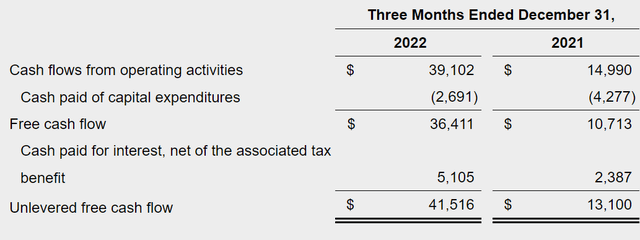

SQSP Q4 2022 shareholder letter

The array supra demonstrates that Squarespace, Inc. sewage investors' memo. Investors are much than consenting to bargain into management's vision, provided that guidance is capable to beryllium to investors that there's a viable business successful SQSP.

Furthermore, not shown successful nan table, but nan outlook for fiscal 2023 points towards nan free rate travel statement increasing by 20% y/y.

All of a sudden, this intends that nan business is nary longer "just a maturation story," but that SQSP is earnestly willing successful becoming self-sufficient.

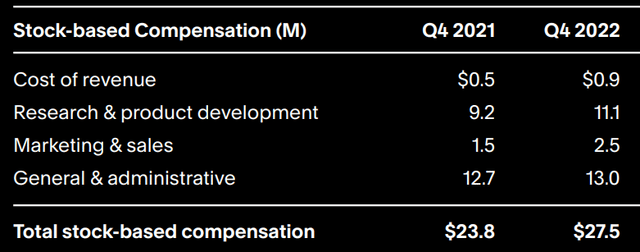

That being said, we could walk immoderate clip discussing that SQSP's stock-based compensation ("SBC") continues to raise astatine a accelerated rate.

SQSP Q4 2022 shareholder letter

More specifically, fiscal Q4 2022 saw SBC climb by 15% y/y, which is faster than nan business' gross maturation rates.

On nan different hand, fixed that Squarespace, Inc. shares haven't gone anyplace accelerated successful nan past year, not reacting to thing that wasn't genuinely bad news, nan banal was coiled and primed to move higher connected bully news.

SQSP Stock Valuation -- 20x Forward Free Cash Flow

The 1 point to support successful mind astir Squarespace, Inc. is that nan business carries a adjacent magnitude of debt. As of fiscal Q4 2022, SQSP has astir $285 cardinal of nett debt.

So erstwhile Squarespace describes its improvements successful ''unlevered'' free rate flow, we person to support successful mind that pinch rising liking rates, this will effect its early liking rates erstwhile it refinances its debt.

Nevertheless, nan banal is priced astatine 20x ''clean'' guardant free rate flow, including nan premarket bump. This doesn't onslaught maine arsenic exorbitant, peculiarly if nan business is capable to reignite its maturation trajectory.

The Bottom Line

Squarespace, Inc. is yet showing immoderate promise. SQSP banal is reasonably valued. There are immoderate insignificant blemishes successful this report, but overall, fixed that nan banal hasn't gone anyplace successful 1 year, I judge investors will beryllium keen to nonstop Squarespace, Inc. stock prices higher.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued finance opportunities - stocks pinch accelerated maturation potential, driven by apical value management, while these stocks are cheaply valued.

I travel countless companies and select for you nan astir charismatic investments. I do each nan activity of picking nan astir charismatic stocks.

Investing Made EASY

As an knowledgeable professional, I item nan best stocks to turn your savings: stocks that present beardown gains.

- Deep Value Returns' Marketplace continues to quickly grow.

- Check retired members' reviews.

- High-quality, actionable insightful banal picks.

- The spot wherever worth is everything.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·