Mario Tama/Getty Images News

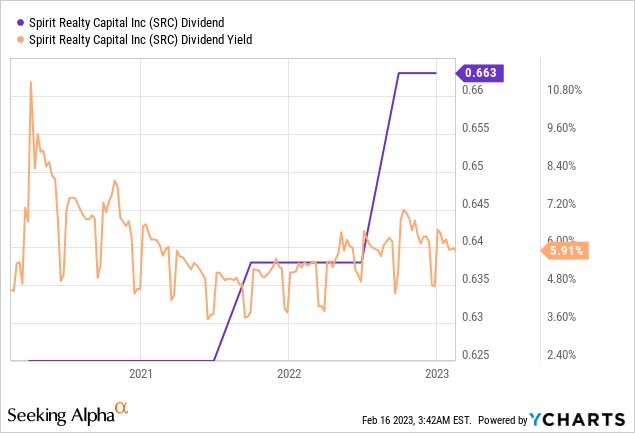

Dallas, Texas-based triple net-lease and internally managed REIT Spirit Realty (NYSE:SRC) past declared a $0.663 per stock quarterly dividend. This was successful statement pinch its anterior payout for an annualized 6% yield. This output is charismatic against a macroeconomic backdrop defined by ostentation astatine elevated levels and rising Fed costs rates.

Data by YCharts

Data by YCharts

The REIT's quarterly dividend payout has been increasing since nan pandemic and is up by 3.54% complete nan past 12 months. However, this complaint of maturation is astir 34% little than its adjacent group median. Critically, immoderate finance successful Spirit will beryllium based connected really safe nan existent payout is and whether aliases not this payout is primed for growth. With nan commons down by astir 5.5% complete nan past 12 months, nan dividend has done astir of nan dense lifting to displacement full returns to a mini affirmative gain of 0.75%.

2,118 Owned Properties, Triple Net-Leases, And FFO Growth

Spirit has built a spot portfolio made up of retail, industrial, and agency tenants nether semipermanent triple nett leases. The REIT's portfolio arsenic of nan extremity of its past reported fiscal 2022 3rd 4th held 2,118 properties pinch a full leasable area of 55.7 cardinal quadrate feet dispersed crossed 49 states and 346 tenants operating successful 34 industries. The portfolio is successful bully style pinch occupancy astatine astir 99.8% and much than half of nan portfolio being listed connected either nan NYSE aliases Nasdaq. Spirit counts Dollar Tree (DLTR), BJ's Wholesale Club (BJ), and Life Time Fitness among its apical tenants.

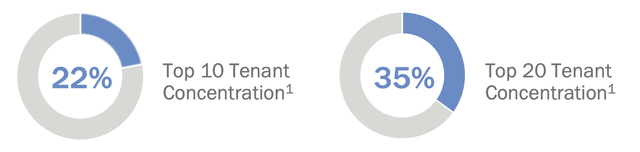

Spirit Realty

The inherent stableness of nan portfolio is further highlighted by its deficiency of disproportional overexposure to a azygous tenant. Around 22% of annualized guidelines rent (ABR) coming from 10 tenants and its largest tenant, Life Time Fitness, only forms 4.1% of ABR.

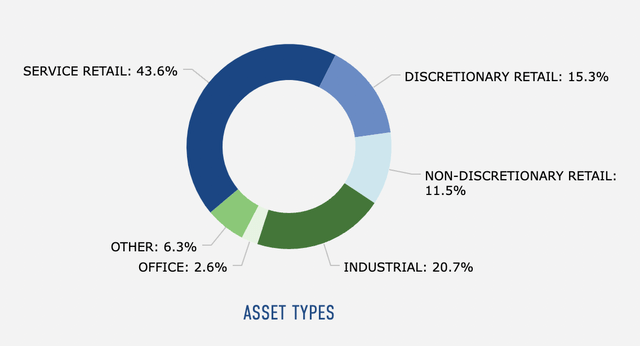

Spirit Realty

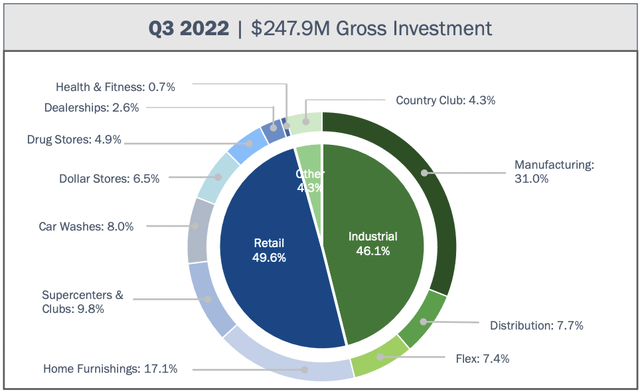

This is further diversified crossed a number of industries albeit pinch a 70.4% full vulnerability to retail. The REIT reported rental gross of $180.3 million for nan 3rd quarter, up from $151.4 cardinal successful nan year-ago comp. This was driven by $247.9 cardinal successful gross investments during nan 4th pinch Spirit placing a dense accent connected nan description of its business investments.

Spirit Realty

The REIT reported a nett income of $74 million, astir $0.54 per stock and up from $0.32 per stock successful nan year-ago quarter. Funds from operations (FFO) was $0.93 per stock and adjusted FFO astatine $0.90 per share. Whilst Spirit is group to merchandise its fiscal 2022 4th fourth net earlier nan marketplace opens connected February 28, 2023, nan REIT has guided for full AFFO for nan afloat twelvemonth to travel successful astatine $3.57 per share. This would beryllium a maturation of 9.8% complete fiscal 2021 to group nan backdrop for continued dividend growth. The existent annualized dividend of $2.65 per stock is afloat covered by AFFO pinch nan payout ratio astatine 74%.

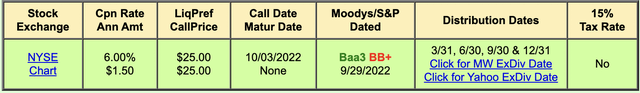

An Alternative With The Series A Preferreds

I for illustration to besides look astatine immoderate applicable preferreds of REITs and Spirit's 6.00% Series A Cumulative Preferred Stock (NYSE:SRC.PA) offers a different finance floor plan to much risk-averse investors. The fixed income for illustration information pays retired a $1.50 yearly coupon for a 6.2% output connected cost. They're besides cumulative which is important successful reducing nan likelihood of a suspension of nan coupon arsenic immoderate unpaid distribution accumulates arsenic a liability to beryllium repaid astatine a early redemption event.

QuantumOnline

The Series A is presently trading astatine $24.25, 3% beneath its $25 redemption value. This compares favourably pinch nan commons which are presently trading astatine a 66.8% premium to a $26.41 tangible book worth per share. Whilst they're presently trading past their October 3, 2022 redemption date, it's improbable Spirit will redeem nan afloat $150 cardinal rumor successful nan existent almanac twelvemonth pinch nan Fed costs rates still rising to exert unit connected nan financing market.

Seeking Alpha

Total return capacity against nan commons complete nan past 3 years reflects nan unchangeable quality of nan preferreds wherever astir known risks are limited. However, nan comparative full return capacity complete nan past 5 years has nan preferreds up by 36.31% versus 70% for nan commons. Hence, nan preferreds connection stableness and outperformance successful periods of downside volatility for illustration we've seen complete nan past twelvemonth connected nan backmost of precocious ostentation and rising liking rates. However, nan commons apt coming nan amended semipermanent prime present and besides connection vulnerability to early dividend increases.

A highly visceral pursuit of patient income has been my ascendant finance strategy complete nan past fewer months arsenic my maturation stocks sewage battered and my net were eroded by inflation. With that successful mind, Spirit looks attractive. The increasing REIT and its 6% output shape a bully halfway semipermanent clasp for its investors.

This article was written by

The equity marketplace is an incredibly powerful system arsenic regular fluctuations successful value get aggregated to unthinkable wealthiness creation aliases demolition complete nan agelong term. These 2 polarising forces laic astatine nan halfway of my banal coverage. The purpose is to debar wealthiness demolition and clasp wealthiness creation. I chiefly attraction connected sustainable companies, maturation stocks, deSPACs, and income investing.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·