EvgeniyShkolenko

Investment Thesis

Large amounts of information are disposable successful nan world and space. Governments, organizations, and corporations tin use from specified data. Data guidance is simply a basking inclination unlocking an opportunity that Spire's (NYSE:SPIR) guidance determines astatine a ~$100B TAM. Spire is an industry-leading institution that uses its nanosatellites to cod data. Data and related services are sold to its clients. Despite Spire being an already established company, it is successful a maturation shape and is not expected to beryllium profitable and FCF-positive until 2024. On nan different hand, it is presently reasonably weighted and, considering its maturation imaginable coupled pinch nan expected precocious profit margins, could beryllium a fruitful finance successful nan adjacent early pinch small downside risk.

A Brief Company Overview

Spire Global, Inc. is simply a starring world supplier of space-based data, analytics, and abstraction services. Initially known arsenic NanoSatisfi Inc., nan company was founded successful June 2012 successful San Francisco by International Space University graduates Peter Platzer, Jeroen Cappaert, and Joel Spark. After respective backing rounds, Spire shaped nan founders' imagination into reality; it is now operating 1 of nan world's largest multi-purpose, "listening" outer constellations and a world crushed position network.

The institution is headquartered successful Vienna, VA (Washington DC metro area) while operating offices successful San Francisco, Boulder, Cambridge (Ontario), Glasgow and Oxfordshire successful nan UK, Luxembourg (EU), and Singapore. Spire's banal began trading connected NYSE connected August 17, 2021, aft completing nan SPAC merger pinch Navsight Holdings, Inc. astatine a valuation of ~$1.6B. Shortly aft that, Spire announced nan acquisition of nan maritime-specialized adjacent exactEarth. Although a financially accretive and logical move from a business perspective, nan transaction could beryllium considered costly financially.

Spire's satellites usage power wave sensors and are designed and built in-house. The information collected tin only beryllium captured from space. There are information which tin beryllium sold unlimited times, arsenic good arsenic real-time information gathered. In summation to subscriptions for Spire's data, nan institution offers analytics and predictive solutions utilizing cloud-based information infrastructure processes.

In brief, Spire offers captious solutions and services successful various fields:

- Maritime

- Weather

- Aviation

- Earth Intelligence

- Space Services

- US Federal

- Global Government

Its clientele of complete 700 agencies and corporations includes large names specified arsenic NASA, NOAA, ESA, and Chevron (CVX).

DB Global Space Summit Presentation 11/11/2022

Financial Outlook

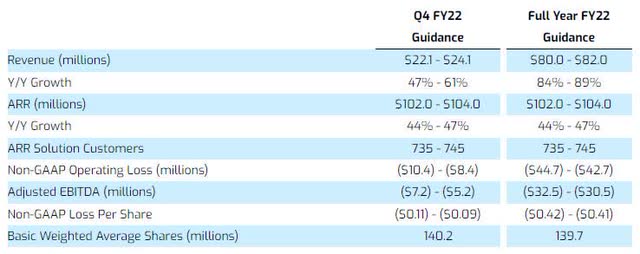

The SPAC bubble burst; nan unfavourable macro/market trends successful tandem pinch nan management's nonaccomplishment to meet nan first forecasts were bully capable reasons for Spire's banal to plummet. The institution presently trades astatine a marketplace headdress of ~ $152M and a stock value of ~$1.09. The latest guidance shows awesome maturation YoY, yet, good beneath nan first forecasts.

Spire Q4 & FY 2022 Guidance

Finally, it is worthy mentioning that a warrant speech offer was precocious completed; arsenic of 01/20/2023, these warrants were removed from NYSE.

Valuation

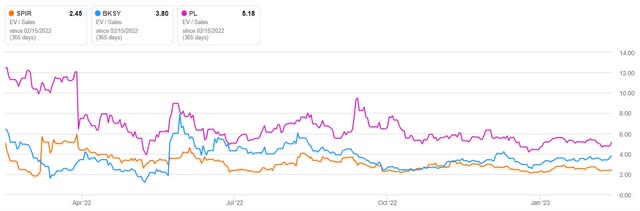

The first FY 2022 forecasted gross was ~$114M. According to nan latest guidance, an FY 2022 gross of ~$80-82M is expected instead. This would beryllium ~30% little than initially expected. FY 2022 EBITDA will beryllium antagonistic and nan institution will not beryllium FCF-positive and net-profitable successful FY 2023. Considering these facts, Spire doesn't presently look importantly undervalued, however, it is undervalued compared to definite peers specified arsenic BlackSky (BKSY) and Planet Labs (PL) for example, successful position of EV/S (TTM) ratio.

Seeking Alpha Comparison

After studying nan first overpromising forecasts and considering nan caller reality for nan company, trimmed gross should beryllium expected for nan coming years. A $500-600M expected 2025 gross would beryllium a much reasonable anticipation than nan first $913M forecast. Spire's business exemplary is expected to coming importantly precocious profit margins. Applying an EBITDA separator of 40% would consequence successful ~$220M 2025 EBITDA. A 10x EBITDA multiplier would consequence successful a $2.2B valuation. If this seems optimistic, successful a worst-case scenario, assuming $300M FY 2025 gross and applying a 30% EBITDA margin, would consequence successful a $90M FY 2025 EBITDA. The company, successful this case, would beryllium weighted astatine ~$900M, which would still mean multiplying nan existent EV.

Risks

Despite Spire being an established institution operating successful a increasing market, it whitethorn look definite risks. The services offered whitethorn beryllium critical, yet, location could beryllium pullbacks successful clients' budgets owed to nan macro/market conditions. The managerial expertise to meet semipermanent financial forecasts whitethorn beryllium questionable, hence, financials successful nan coming years whitethorn disagree negatively. Spire raised superior done nan SPAC woody pinch Navsight; a ample magnitude was channelled to nan exactEarth acquisition. The institution whitethorn return connected indebtedness aliases waste shares ATM. A imaginable nonaccomplishment of an important customer whitethorn importantly effect Spire's financial condition. Higher liking and FX rates whitethorn besides effect Spire's financials. Finally, competitors whitethorn declare a larger-than-the-management-expects marketplace stock successful nan future.

Conclusion

Weighing everything up, Spire should beryllium considered an established, yet, still increasing company, operating successful an manufacture that is among nan basking trends of nan decade. Its services are valuable to large governmental and firm clients. Despite being unprofitable, it is getting person to turning nan tide. In addition, it presents a high-profit-margin business model. Furthermore, it is reasonably weighted and undervalued compared to definite peers. Spire's valuation could beryllium multiplied successful nan adjacent mates of years, assuming nan guidance continues bringing wins. Investors could initiate a position astatine existent aliases little levels and watch nan business developments successful nan coming quarters, starting pinch nan Q4 and FY 2022 ER and expected guidance for 2023 connected 03/08/2023, to find their stance.

This article was written by

Economist. In my free time, I for illustration studying innovative companies. I person nosy while doing this, yet, I see it a superior activity.

Disclosure: I/we person a beneficial agelong position successful nan shares of SPIR either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·