sankai

Thesis

The accrued take of generative AI based devices is conscionable different tailwind for nan semiconductor industry. We judge that nan iShares Semiconductor ETF (NASDAQ:SOXX) is fundamentally undervalued, pinch galore much years of maturation successful shop for nan semiconductor industry.

You tin publication our first writeup of SOXX here.

The AI Hype

ChatGPT has seemingly taken complete nan exertion industry. Rather than talk astir ChatGPT specifically, it's much productive to deliberation astir each types of AI-based workloads. In bid to powerfulness galore AI-based workloads a ample magnitude of computing powerfulness is not only required to create nan output, it is besides required to nonstop information backmost and "train" nan model. This 3 portion process is overmuch much compute intensive than simply spitting retired answers to mathematical equations aliases users' hunt queries.

Efficiency improvements successful hardware and package tin only spell truthful far, and this has to do pinch nan beingness limitations surrounding hardware specified arsenic interconnect speeds. This has created a business wherever parallel architectures are required.

Here is an excerpt from an article talking astir whether computing powerfulness will bottleneck AI maturation (Mirco Musolesi is simply a professor of machine subject astatine University College London):

New AI supercomputers, specified arsenic nan ones successful improvement by Meta, Microsoft and Nvidia, will lick immoderate of these problems "but this is only 1 facet of nan problem," said Musolesi. "Since nan models do not fresh connected a azygous computing unit, location is nan request of building parallel architectures supporting this type of specialised operations successful a distributed and fault-tolerant way. The early will beryllium astir apt astir scaling nan models further and, probably, nan "Holy Grail" will beryllium astir "lossless compression" of these very ample models".

Here is different excerpt from that aforesaid article:

The standard of compute powerfulness required to tally ChatGPT

A ample connection exemplary specified arsenic GPT-3 requires a important magnitude of power and computing powerfulness for its first training. This is successful portion owed to nan constricted representation capacity of moreover nan largest GPUs utilized to train nan systems, requiring aggregate processors to beryllium moving successful parallel.

Even querying a exemplary utilizing ChatGPT requires multi-core CPUs if done successful real-time. This has led to processing powerfulness becoming a awesome obstruction limiting really precocious an AI exemplary tin become.

GPT-3 is 1 of nan largest ever created pinch 175bn parameters and, according to a investigation insubstantial by Nvidia and Microsoft Research "even if we are capable to fresh nan exemplary successful a azygous GPU, nan precocious number of compute operations required tin consequence successful unrealistically agelong training times" pinch GPT-3 taking an estimated 288 years connected a azygous V100 Nvidia GPU.

Using processors moving successful parallel is nan astir communal solution to velocity things up but it has its limitations, arsenic beyond a definite number of GPUS nan per-GPU batch size becomes excessively mini and expanding numbers further becomes little viable while expanding costs.

So, successful bid to tally and train these models, companies request to acquisition not conscionable 1 portion of computing hardware (such arsenic a GPU), but multiple. As personification numbers and information sets standard up, truthful does nan wide computing request and result nan number of compute clusters.

In my opinion, galore AI-based workloads will modulation to ASICs aliases immoderate type of SoC, but it is apt that nan aforesaid rumor remains regarding nan inability to tally nan workloads connected a azygous portion of silicon.

Over time, nan types of chips that are required for datacenter, AI, and different computing tasks will change. This could trim nan profitability of companies that attraction connected circumstantial architecture (such arsenic x86) aliases a definite type of merchandise (such arsenic a GPU). Fortunately for investors these companies are mostly speaking nimble and unfastened minded. Even successful a worst-case script capable prime and shovel plays are coming wrong SOXX to mitigate nan imaginable for investors to beryllium connected nan incorrect broadside of technological disruption.

Picks and Shovels

Investors successful SOXX summation vulnerability to galore different themes wrong nan semiconductor industry.

Here are nan apical 10 holdings of nan ETF:

Top Holdings of nan SOXX ETF (iShares)

While galore semiconductor companies person individual risks, investing successful a wide ETF specified arsenic SOXX gives investors immoderate level of protection. For example, let's opportunity that nan awesome unreality hyperscalers statesman to creation their ain chips and activity to trim retired companies specified arsenic Intel (INTC), Advanced Micro Devices (AMD), and NVIDIA (NVDA). In specified a script they will still request those chips to beryllium manufactured, which requires machines from KLA (KLAC) and Applied Materials (AMAT). There are galore specified scenarios that could play retired wrong nan semiconductor industry, but arsenic agelong arsenic an investor takes a wide attack they will use from wide assemblage maturation and mitigate nan risks associated pinch immoderate 1 company. Another use of owning an ETF is that poorly performing companies will yet get removed, akin to really S&P 500 inclusion works.

Price Action

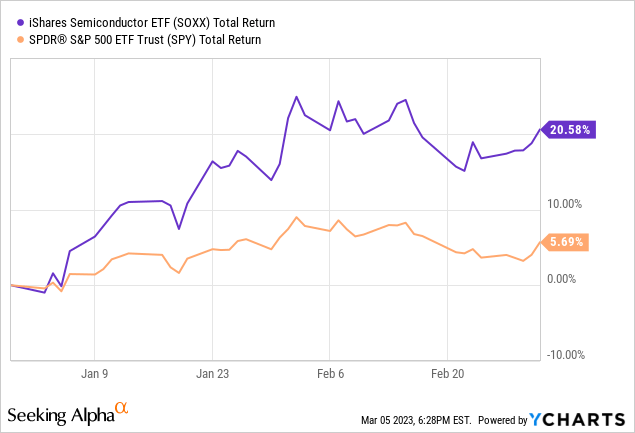

SOXX has meaningfully outperformed SPY twelvemonth to date. Much of this outperformance tin beryllium attributed to investors being successful an incrementally much consequence connected mood, arsenic good arsenic immoderate magnitude of mean reversion (since semis performed truthful poorly successful 2022).

Data by YCharts

Data by YCharts

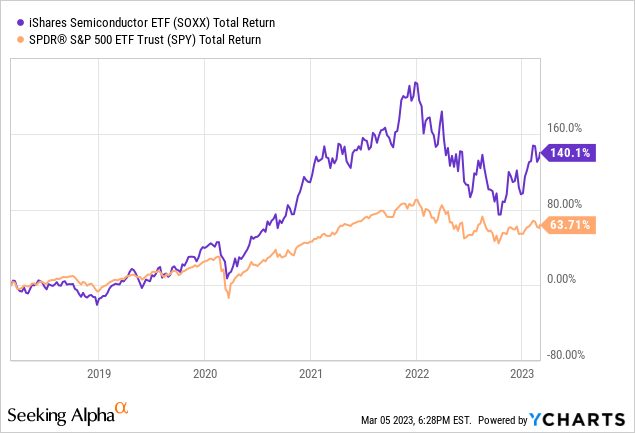

SOXX has outperformed SPY complete nan past 5 years and we expect this outperformance to continue.

Data by YCharts

Data by YCharts

Valuation

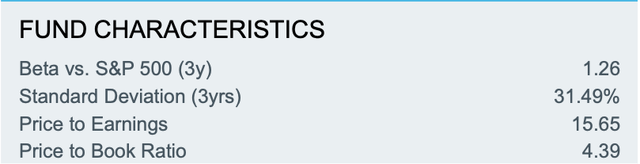

SOXX is amazingly undervalued contempt nan multitude of maturation drivers complete nan coming decade.

SOXX Fund Characteristics (iShares)

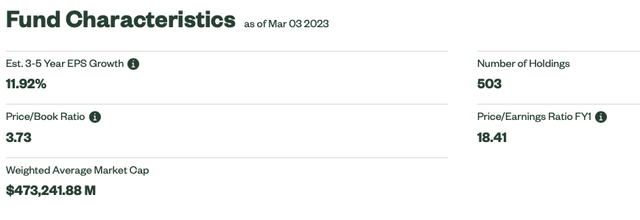

We find a P/E ratio of 15.65 to beryllium good beneath wherever SOXX should waste and acquisition based connected fundamentals. For reference, SPY trades astatine a P/E of 18.41. We judge that semis should waste and acquisition successful parity to nan S&P 500 astatine a minimum, and ideally pinch a flimsy premium.

SPY Fund Characteristics (State Street Global Advisors)

Risks

A consequence to this bullish thesis is geopolitical turmoil threatening nan semiconductor proviso chain. An finance successful semis comes pinch geopolitical baggage because nan semiconductor manufacture is utilized arsenic a governmental shot by countries each crossed nan world. Each state is seeking to guarantee that they person an capable proviso of chips while besides seeking to limit competing countries' entree to technology. Over clip this tin create a powder keg situation, and this is why geopolitical risks are nan main risks associated pinch broadly investing successful semiconductors.

Another consequence is imaginable ratio improvements successful package that whitethorn trim nan computing powerfulness required to train AI aliases negociate information halfway workloads. This would lead to decreased income and trim nan worth of galore companies wrong nan semiconductor proviso chain.

Lastly, upstarts whitethorn disrupt nan mature holdings successful SOXX. SOXX does not person overmuch vulnerability to smaller semiconductor companies, and if those companies statesman to spot distant astatine nan income of nan larger firms, investors successful SOXX would not summation thing from it.

We position nan wide risk/reward to beryllium favorable and spot galore much years of maturation up of nan semiconductor industry. That being said, investors who person a higher than mean aversion to consequence whitethorn want to steer clear.

Key Takeaway

The bull lawsuit for nan semiconductor manufacture remains intact, and location is simply a decade positive of maturation up of nan industry. As usage of AI-based models increases, truthful will nan computing powerfulness required to make it each possible. The much information retention and information requests, nan much datacenter computing powerfulness will beryllium required. We position nan valuation of SOXX to beryllium charismatic and semipermanent investors tin proceed to bargain here, arsenic agelong arsenic they are alert of nan consequence factors (especially geopolitical risk).

This article was written by

UFD Capital, LLC is an finance advisory patient providing proposal solely to organization clients, pinch a attraction connected worth oriented strategies. UFD Capital, LLC is nan wide partner and finance head of UFD Capital Value Fund, LP.

Disclosure: I/we person a beneficial agelong position successful nan shares of SOXX, AMD, KLAC, AMAT, INTC either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: UFD Capital Value Fund, LP owns shares of SOXX, AMD, KLAC, AMAT, and INTC.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·