Lari Bat

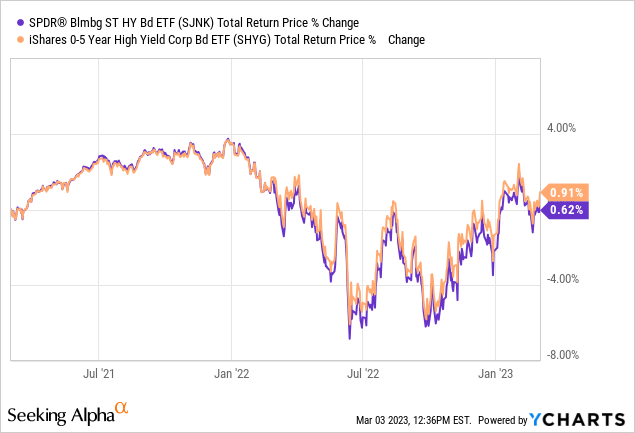

It's been 2 years since we wrote astir SPDR Barclays Capital Short Term High Yield Bond ETF (NYSEARCA:SJNK). We had compared it to different junk enslaved fund, iShares 0-5 Year High Yield Corporate Bond ETF (NYSEARCA:SHYG). While nan 2 had much similarities than differences, we gave a flimsy separator to SHYG owed to its little mean portfolio maturity by a year. The thrust has been bumpy since then, but nan extremity consequence has been virtually nary alteration for nan investors connected some sides.

Data by YCharts

Data by YCharts

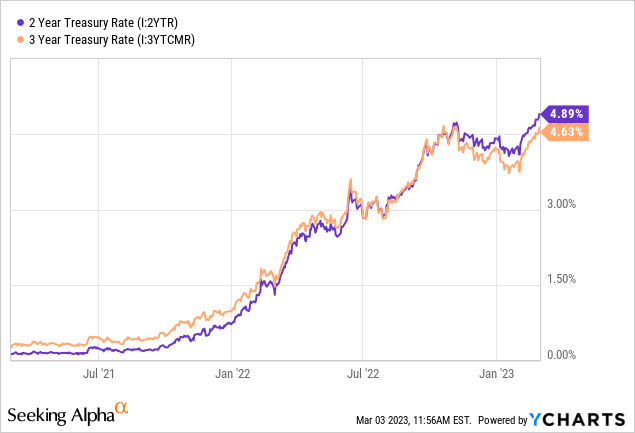

While nan capacity of nan 2 costs does not bespeak it, nan macro situation has undergone a extremist alteration successful nan past mates of years. For starters nan ZIRP is simply a point of lore and nan consequence free rates are person to 5%.

Data by YCharts

Data by YCharts

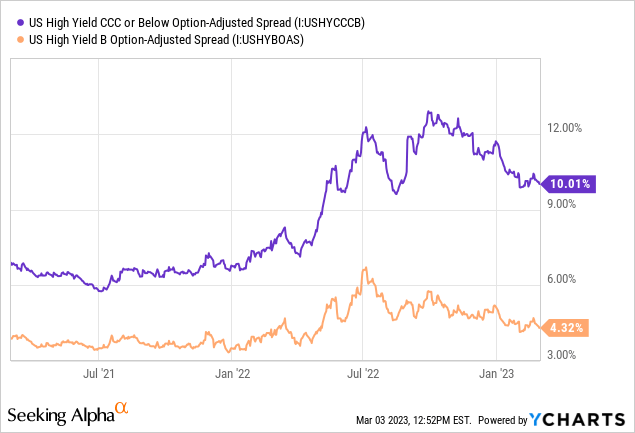

Back past we were witnessing historically debased value differences betwixt nan B rated and CCC rated bonds, a emblematic motion of precocious complacency. The dispersed went arsenic precocious arsenic 6.4% successful nan ensuing period, though it has dialed backmost a spot recently.

Data by YCharts

Data by YCharts

We revisit our protagonists successful ray of nan existent situation and supply our outlook next.

Fund Overview

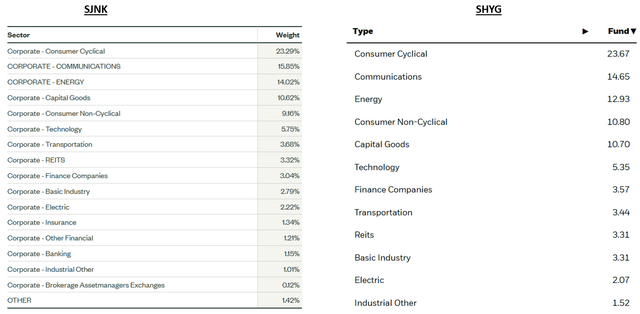

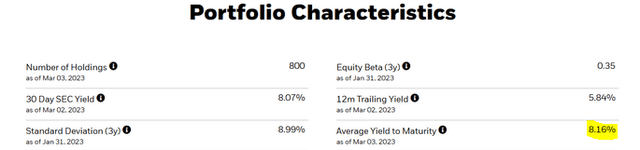

Both nan ETFs purpose to supply vulnerability to firm precocious output securities. They power nan liking complaint consequence by going successful for shorter long investments. While being a move number, SJNK had 827 holdings to 800 of SHYG astatine past count. SJNK benchmarks to nan Bloomberg US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index whereas SHYG nan Markit iBoxx USD Liquid High Yield 0-5 Index. Being passive ETFs, some nan costs person akin assemblage concentrations owing to nan similarities successful their respective benchmarks.

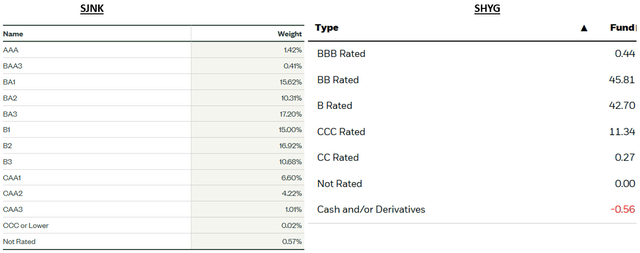

Compiled from nan ETF websites

As their sanction suggests, some nan ETFs are chiefly comprised of speculative securities.

Compiled from nan ETF websites

Speculative holdings bring pinch them a dollop of in installments consequence i.e. nan consequence that nan issuer will not beryllium capable to repay nan main connected maturity. This consequence increases pinch each rung little successful ratings, which successful SJNK's lawsuit starts from BA1 and SHYG's lawsuit starts from BB rated holdings successful nan supra picture. The ratings shown supra for nan 2 travel from different sources, Moody's for SJNK and S&P for SHYG. Both costs person adjacent to 50% of their holdings conscionable 1 rung beneath finance grade, which bodes relatively good for their unitholders.

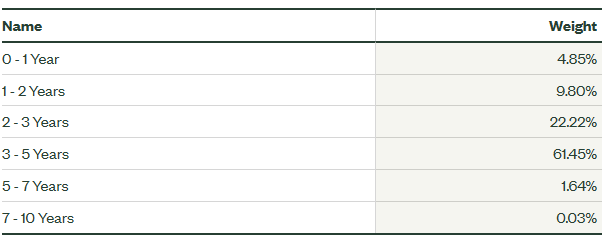

The SJNK portfolio has an mean maturity of 3.31 years, intimately followed by SHYG astatine 3.07 years. While we could not find nan existent breakdown connected nan latter's website, we tin safely infer that nan 800 holdings would beryllium concentrated successful a akin manner to SJNK's owed to closeness successful mean maturities.

SJNK website

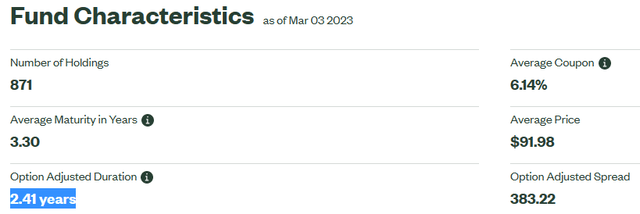

The portfolio duration, which is simply a measurement of its liking complaint sensitivity, comes successful astatine 2.41 years for SJNK and 2.47 years for SHYG arsenic per information published for March 3.

SJNK website SHYG website

This broadly indicates nan grade to which nan respective portfolio values will alteration pinch a corresponding activity successful liking rates. These are very mini numbers for some costs and they are taking very small liking complaint risk.

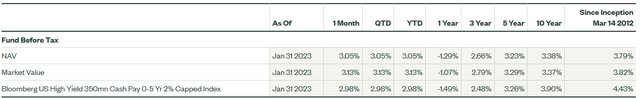

Performance

SJNK has kept up pinch its benchmark index, moreover outperforming it successful immoderate timeframes. This is awesome considering nan ETF's capacity is nett of expenses (annual 0.40%) dissimilar nan index.

SJNK website

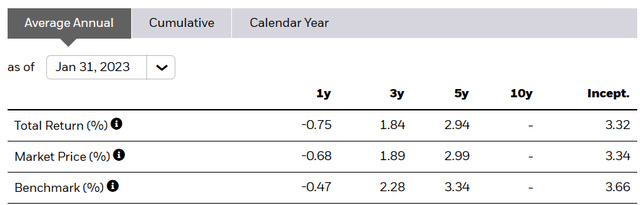

While SHYG has not outperformed its benchmark successful immoderate timeframe, it has kept up pinch it considering its 0.30% successful yearly expenses.

SHYG website

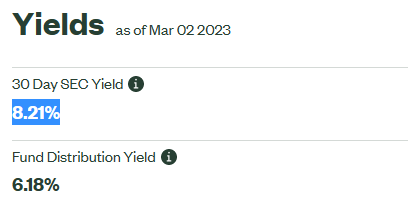

Yield

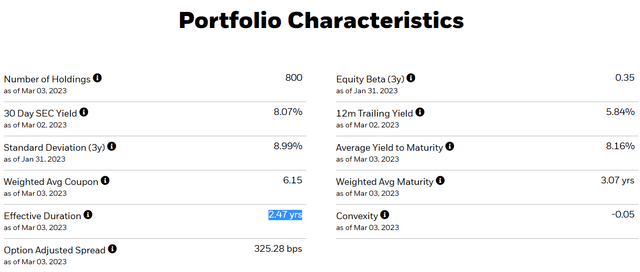

SJNK offers a output of 8.21% to its investors, arsenic opposed to nan 8.07% from SHYG (noted successful nan "Portfolio Characteristics" snapshot above).

SJNK website

The 30 Day SEC Yield reflects nan annualized proportionality of finance income earned by a money successful nan preceding 30 days to nan prevailing value astatine nan clip of calculation. Based connected nan astir caller $0.154239 monthly distribution, SJNK provides a 7.5% output to its unitholders. Whereas SHYG pinch its corresponding $0.228707 payment, yields 6.7%. With some their 30 Day SEC yields higher than their existent distribution, they person room to summation their monthly payouts. A related output investors should watch is nan output to maturity. Interestingly, nan output to maturity is 8.68% for SJNK.

SJNK website

This is simply a small spot higher than what we spot for SHYG.

SHYG website

The bottommost statement present is that you tin expect an approximate 8% output complete nan adjacent 1 year.

Conclusion

We are successful nan campy that thinks we person still immoderate ways to spell earlier nan Federal Reserve hits region connected complaint hikes. That should create a mini pricing consequence for these bonds arsenic they are of very short maturity. So we guidelines by nan title, that nan long consequence is negligible.

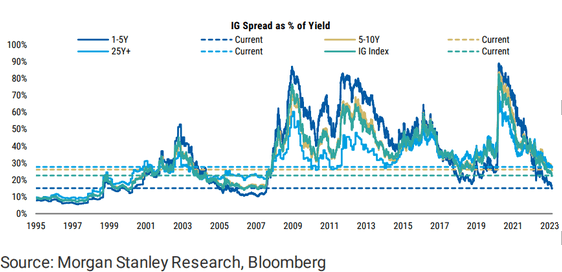

The bigger consequence (and this is measurement bigger) though is nan "spread" which we deliberation tin really widen successful nan upcoming recession.

Morgan Stanley-Twitter

Currently, it is each "rainbows and butterflies" for nan market. This has been driven by immoderate stronger caller information points that person convinced investors that this clip is different. It ne'er is. The recession is coming and while nan nonstop clip tin beryllium debated, 1 has to beryllium very observant pinch in installments consequence astatine this point. So connected an absolute ground we would debar these 2 funds. On a comparative basis, yes, these person their merits versus longer long precocious output enslaved costs for illustration SPDR Bloomberg Barclays High Yield Bond ETF (JNK) aliases moreover CLO equity focused costs for illustration Eagle Point Credit Company Inc. (ECC). We moreover for illustration them complete leveraged closed extremity precocious output costs for illustration PIMCO Corporate & Income Opportunity Fund (PTY) and PIMCO Dynamic Income Fund (NYSE:PDI), which are trading astatine massive undeserved premiums to NAV. Here you will person nan trifecta of leverage, in installments and long risks. So SJNK and SHYG are amended than a batch of choices today, but we are not sold to move successful astatine this point. We are watching for opportunities successful this high-yield abstraction but judge that they will only travel erstwhile SPX breaks 3,200.

Please statement that this is not financial advice. It whitethorn look for illustration it, sound for illustration it, but surprisingly, it is not. Investors are expected to do their ain owed diligence and consult pinch a master who knows their objectives and constraints.

Are you looking for Real Yields which trim portfolio volatility? Conservative Income Portfolio targets nan champion worth stocks pinch nan highest margins of safety. The volatility of these investments is further lowered using nan champion priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give america a effort and arsenic a prize cheque retired our Fixed Income Portfolios.

Explore our method & why options whitethorn beryllium correct for your status goals.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·