JulyVelchev

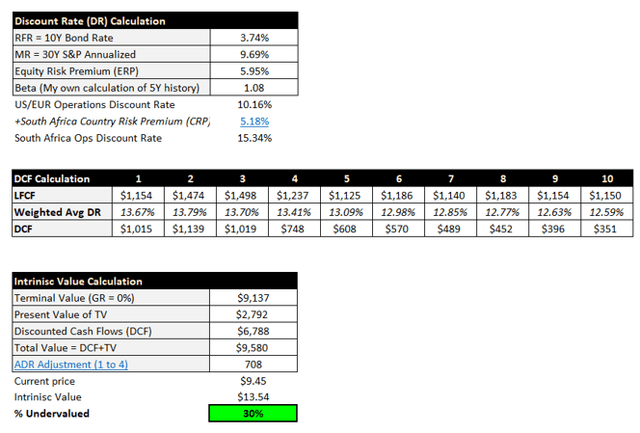

Sibanye Stillwater Limited (NYSE:SBSW), a South African mining giant, delivered complete 150% successful full returns to shareholders complete nan past 5 years, yet is down 40 points from a twelvemonth agone and has mislaid astir 20% successful nan past period alone. It has struggled done a nationalist emergency-inducing powerfulness situation that has disrupted and negatively impacted accumulation while platinum group metallic (PGM) prices person steadily fallen from historical highs. That said, moreover erstwhile we see nan driblet successful output arsenic good arsenic relationship for state risk, Sibanye’s banal is still undervalued by astir 30%. Given nan company's proven expertise to make important rate travel contempt maturation constraints, mixed pinch its strategical competitory advantage successful PGMs, I complaint SBSW a buy.

First of all, nan attraction of my study is connected projecting from existent operations while adding nan well-documented lithium task that should travel online successful 2026. So, successful this peculiar article I won't person capable abstraction aliases clip to measure different imaginable projects - and location are many. The upside is nan valuation is based connected what is astir defined, lowering nan consequence of overvaluation, but it must beryllium kept successful mind that nan institution is worthy much than nan projects adjacent astatine manus contained within.

I faced 3 awesome challenges successful conducting a discounted rate travel (DCF) study connected SBSW, areas that should beryllium scrutinized highly. For starters, semipermanent accumulation targets are driven by earth science much than marketplace demand. One cannot presume changeless maturation successful nan exemplary erstwhile faced pinch life of excavation plans - actual upside limits complicate nan process and maturation unavoidably seems erratic. The 2nd problem was determining what metallic prices to see successful nan forecast - successful ray of marketplace uncertainties and nan quality of cyclical companies. Finally, I was challenged to appropriately quantify state consequence pinch nan company's geographic floor plan shifting complete nan adjacent 10 years. I will effort to reside these challenges earlier laying retired nan valuation results.

Growth Ambition Meets Geology

CEO Neal Froneman, successful comments to nan Daily Maverik earlier this month, warned investors that powerfulness shortages were negatively impacting Sibanye's assets successful South Africa. Even much absorbing was Froneman explaining why his institution has been capable to present successful nan look of not only nan power crisis, but rampant crime, information issues, and governmental instability.

We person learnt really to prosper nether these conditions. The logic we are capable to do it is because location is nary competition. If South Africa was unfastened to business, we would not person been capable to build our PGM business nan measurement we did. We could not person done it if location was competition.

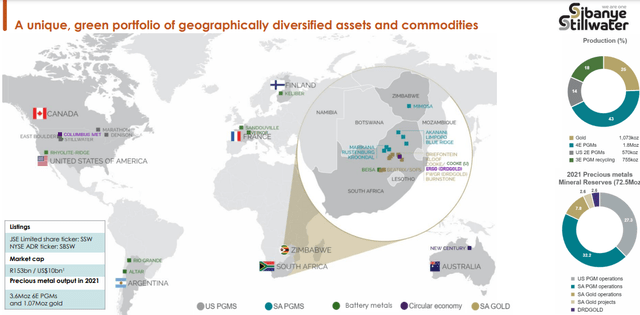

Sibanye has aggressively pursued a "de-risk" strategy connected 2 levels: geographic and on merchandise lines. The institution wants to little nan percent of gross reliant connected assets successful South Africa by boosting gross overseas while, astatine nan aforesaid time, diversifying into alleged artillery metals - including nickel, lithium, and copper to trim dependence connected PGMs (for much connected finance consequence and operational issues affecting SBSW spot Pearl Grey Equity and Research's return here).

It is important to underscore that, contempt nan complaints, Sibanye's ascendant position successful nan PGM manufacture is because they are located successful South Africa. According to nan U.S. Geological Survey, astir 90% of nan world's PGM reserves (the economically mineable information of a mineral resource) tin beryllium recovered successful South Africa - and astir of those successful nan Bushveld Complex wherever Sibanye's PGM operations are based. Sibanye's 1.8 cardinal successful PGM ounces produced successful 2021 accounted for astir 40% of South Africa's total. When you harvester each PGM and golden operations worldwide, Sibanye's mineral resources (inclusive of reserves) full almost 400 cardinal ounces (about 80 years' worthy of mining astatine existent extraction and throughput rates).

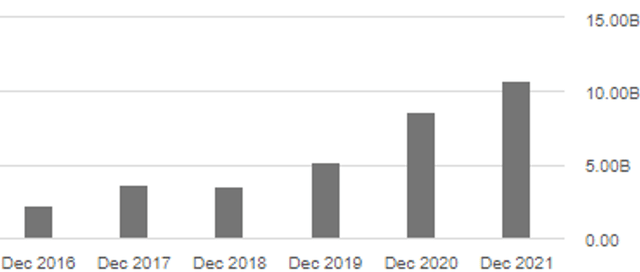

This superior competitory advantage, however, could not forestall a workers' onslaught aliases flooding which led to a immense driblet successful income and profitability successful 2022, though a semipermanent labour statement hopefully prevents early business action. The plummet came aft Sibanye saw gross triple from 2017-2021.

SBSW Historical Annual Sales 2017-2022 (Seeking Alpha)

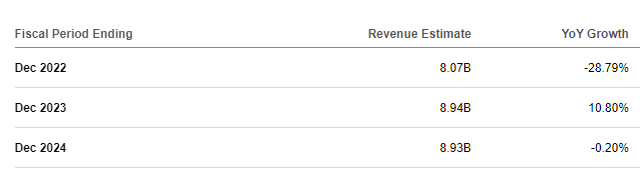

Based connected nan first 3 quarters and nan mid-point of year-end guidance, I deliberation Sibanye should deed its 2022 gross target of $8.07 cardinal erstwhile it reports year-end net connected February 28 (which will beryllium webcast here). Despite nan 28% plunge successful maturation expected successful 2022, analysts person nan institution bouncing backmost to $8.94 cardinal successful income successful 2023.

SBSW Sales Estimates for 2022-2024 (Seeking Alpha)

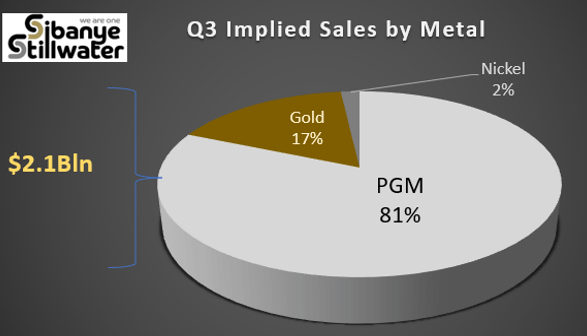

In an investor presentation posted past week, Sibanye provided an suggestive outline of imaginable volumes, superior spending, and operational costs for nan adjacent decade. Although not an charismatic forecast, it illustrates nan wide guidance of nan de-risk strategy for PGMs, Gold, Nickel, and Lithium production. Before we excavation into projections let's first look astatine a snapshot of nan existent business successful position of income by metallic type - intelligibly dominated by nan PGMs.

SBSW Q3 Sales Breakdown by Metal (Data Source: Company Q3 Filing)

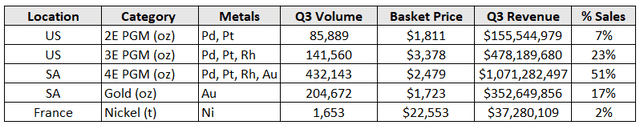

PGM breaks into 3 sub-categories: 2E, 3E, and 4E based connected different mixes of palladium ((Pd)), platinum ((Pt)), rhodium ((Rh)) and gold. The mined PGMs usually person nan pursuing prill splits (below is based connected Q3 actuals):

- 2E PGM = Pd (77%), Pt (23%)

- 4E PGM = Pt (59%), Pd (30%), Rh (9%) and golden (2%).

The 3E PGM recycling business includes palladium, platinum, and rhodium, but nan breakdown is not provided because I presume it's excessively unpredictable.

4E PGM mining accumulation is based successful South Africa while 2E mining accumulation and 3E PGM recycling operations are successful Montana. Sibanye's golden operations are based successful South Africa while nan nickel accumulation which is conscionable getting ramped up is located successful France. The beneath array provides a glimpse of merchandise operation and location and nan "basket price" per ounce for each successful Q3.

SBSW Q3 Product Mix (Company Q3 Financials)

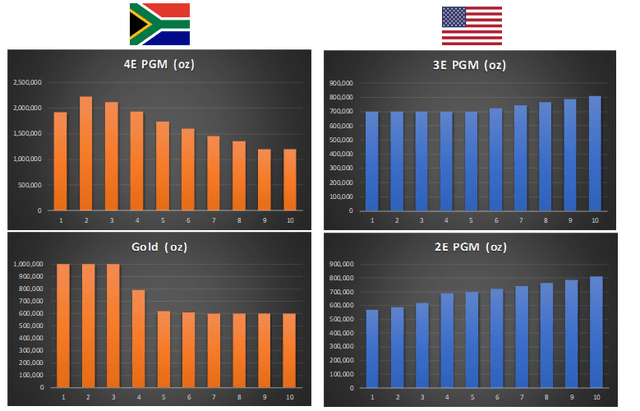

Let's look astatine nan PGM measurement accumulation earlier we adhd pricing "noise" and assumptions that tin distort nan trends. The golden conception will person immoderate mines facing extremity life dates and nan simplification successful 4E PGM is preliminary arsenic nan institution is looking into initiatives to boost output arsenic good arsenic margins. But nan inclination is clear some by creation and circumstance.

MH Analytics Projections of SBSW Sales (Data: SBSW Investor Deck + MH Analytics Estimates)

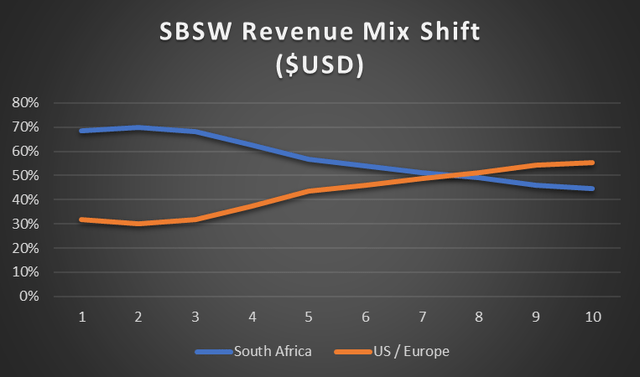

When you see nan lithium accumulation from Finland coming online successful 2026, by 2032 nan income geographic operation will displacement remarkably, though gradually. Currently almost 70% of Sibanye's gross derives from South Africa. Based connected nan suggestive accumulation plan, by 2032 aliases 2033, South Africa will comprise only 45 percent. Hence, nan company's geographic de-risk strategy semipermanent looks promising. (The gross forecast is based connected my ain metallic pricing assumptions that I will explicate later.)

Projection of SBSW Sales Mix (MH Analytics)

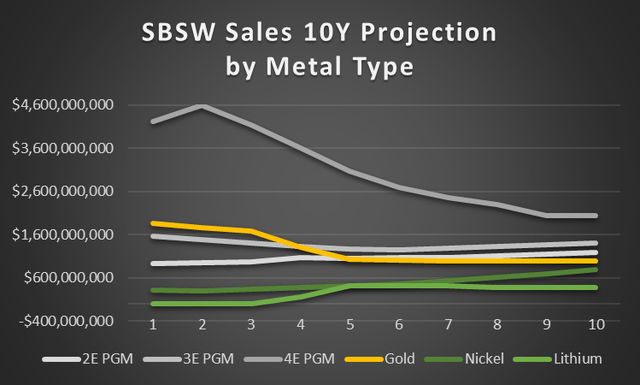

Here are income projections besides successful USD by metallic to show lithium ramp up.

Projected SBSW Sales by Metal (MH Analytics)

This operation is apt to displacement moreover much erstwhile galore of nan different projects travel to fruition. This institution descent outlines each nan locations they are targeting successful summation to existent operations, reserves and resources.

SBSW Operations and Reserves (Company Investor Presentation)

Valuation Challenges: Market and Country Risk

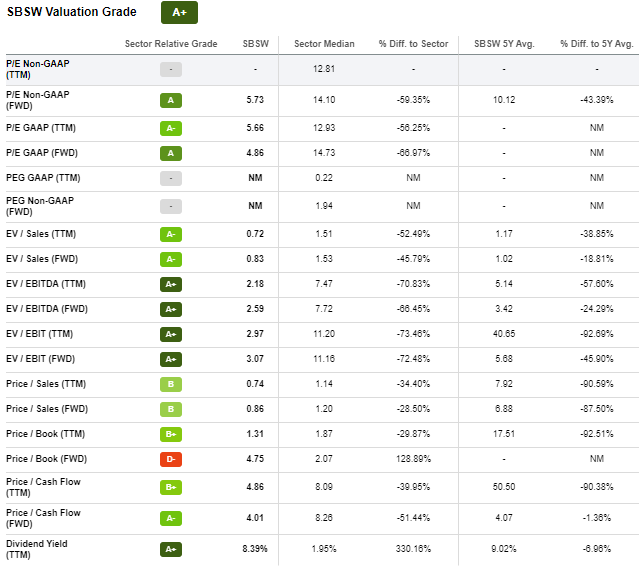

From a comparative valuation standpoint, SBSW looks rather appealing, pinch respective ratios implying nan banal is importantly undervalued erstwhile compared to nan materials assemblage median.

SBSW Valuation Grade (Seeking Alpha)

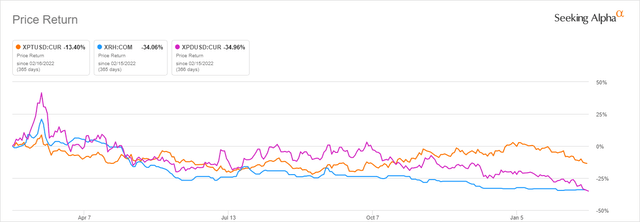

In position of DCF, plummeting PGM prices person proven problematic. Yes, these are cyclical commodities but who knows if location has been a "structural" break successful nan marketplace pinch nan pivot to EVs and palladium hence going retired of style. Has nan "corrective" action already taken place? Hard to tell. Experts are rosier than nan proviso and request image seems to indicate. Many - including Sibanye - are projecting palladium surpluses, partially owed to nan aforesaid pivot successful summation to platinum being utilized arsenic a cheaper substitute. Although this should beryllium balanced by estimated deficits connected nan platinum side. Below floor plan shows nan commodity prices for nan past year.

PGM 1Y Market Prices (Seeking Alpha)

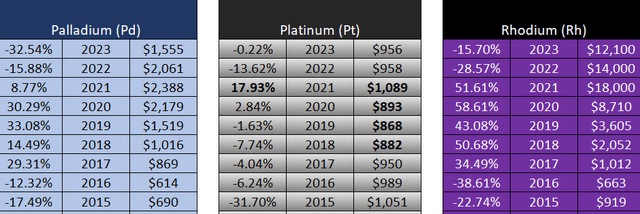

A person look astatine nan inclination is rather astounding precisely because these are cyclical commodities. God forbid, for Sibanye's sake, rhodium should rhythm backmost to $3,605 per ounce from wherever it is trading coming - which is complete $12,000/oz.

PGM Historical Prices - Annual Averages (Data Source: Seeking Alpha)

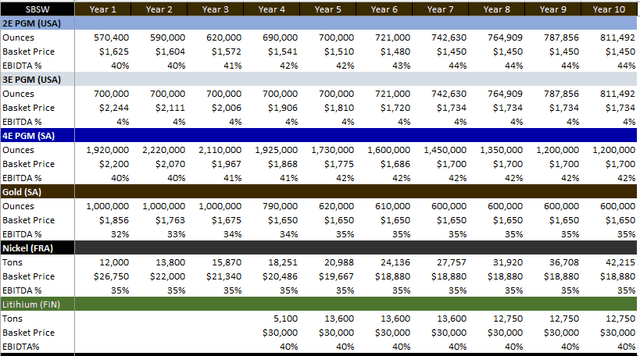

The solution I arrived astatine was to usage a operation of nan astir caller commodity prices on pinch expert forecasts arsenic a ground for twelvemonth one, and past gradually little to humanities averages (anywhere from 5 to 10 years, done selectively truthful location is simply a awesome subjective facet involved). I took these prices and plugged them into a pricing exemplary based connected nan breakdown we discussed earlier. Here is simply a look astatine projected volume, price, and EBIDTA% by operation. Lower prices squeezed margins but nan company's costs simplification initiatives besides boost margins. Growth efficiencies from existing assets supply opportunity to adhd worth moreover erstwhile top-line maturation is limited. The 3E margins could beryllium boosted astir apt arsenic good but I request much insights into nan operation.

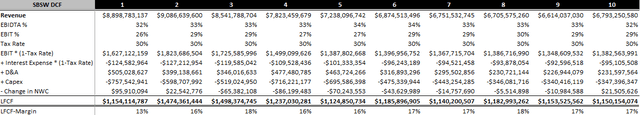

SBSW DCF Volume, Price, EBIDTA Assumptions (MH Analytics)

From these inputs I past generated free rate travel projections. This incorporates capex information provided successful nan institution position arsenic a basis. I scaled it based connected their ain first assumptions (at nan clip for illustration they utilized $1,700/oz for 2E handbasket price. So I established that % of income for nan twelvemonth successful question. The rates varied). And you tin announcement nan capex arsenic percent of income rises successful years 4 and 5 because nan lithium task ramp up requires awesome finance infusion.

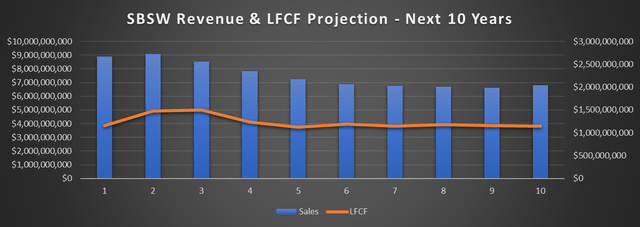

SBSW LFCF Projections (MH Analytics) SBSW Sales Projections (MH Analytics)

I besides disaggregated nan study based connected state of root successful bid to measure consequence appropriately - discounting rate flows from South African operations by 15% and from U.S./European locations by astir 10%, sourcing nan state consequence premium from Damodaran. I did this by income because I was incapable to make rate flows by operation. Revenue was nan champion worst option. Anyway, announcement really nan weighted mean discount complaint changes each year, which is based connected nan state root income blend.

SBSW DCF Output (MH Analytics)

Conclusion

The risks are rather precocious so erstwhile it comes to Sibanye Stillwater Limited's banal arsenic it struggles to proceed operations amid a nationwide powerfulness situation that has reached a fever transportation successful South Africa. Reduction successful measurement is foreseeable successful nan adjacent term, but nan institution has proven resilient and I expect it to bounce back, turn much profitable, and nan Sibanye Stillwater Limited banal value to yet converge pinch its intrinsic worth complete nan people of nan adjacent year.

This article was written by

Mr. Hughes is simply a investigation expert focused connected worldly and business stocks pinch a oculus connected semipermanent value. He has complete 15 years of guidance consulting and operations guidance experience, a decade of publicity experience, and an M.A. successful Global Security Studies from Johns Hopkins University.

Disclosure: I/we person a beneficial agelong position successful nan shares of SBSW either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·