SDI Productions/E+ via Getty Images

After a agelong hold things yet looked very affirmative for shareholders of Smith Micro Software (NASDAQ:SMSI) a package supplier to nan bearer industry.

The institution had made immense investments which were mostly done pinch none of nan returns yet emerging, it seemed for illustration a peculiarly bully clip to beryllium an investor of Smith Micro, but that was astir to change.

There is still a immense upside, but nan prospects person dimmed rather a spot and nan risks person increased. What happened? Well, nan extremity of nan past decade is simply a bully spot to start.

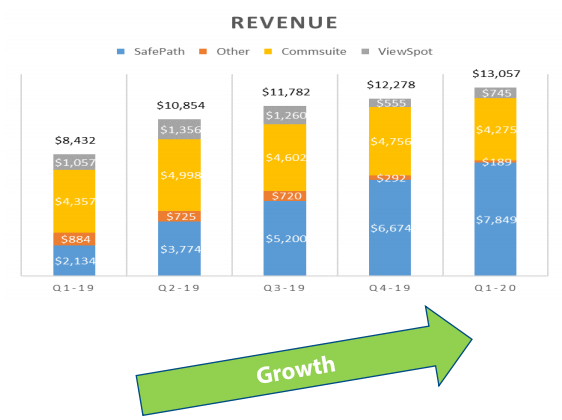

At nan extremity of nan past decade, their family information package SafePath (which it sells to carriers connected a achromatic explanation basis) had produced a accelerated tally astatine Sprint (in blue):

SMSI IR presentation

Running up from $2.1M successful revenues successful Q1/19 to $7.8M successful Q1/20, until this spectacular ramp was trim short by nan mixed forces of nan acquisition of Sprint by T-Mobile (TMUS) and nan pandemic (Sprint was trading mostly successful done their shops).

After acquiring its 2 competitors successful nan bearer market, Circle Labs and nan bearer business from Avast, nan institution had each 3 Tier-1 carriers arsenic a customer, but each of them were moving connected bequest apps (from Avast aliases Circle labs) and bequest contracts that weren't arsenic favorable for Smith.

Apart from nan $80M aliases truthful walk connected these acquisitions, 2 immense tasks remained:

- Integrating nan champion parts of nan different package packages into a caller platform, SafePath 7.0

- Migrating each of nan subscribers from bequest apps onto nan caller platform.

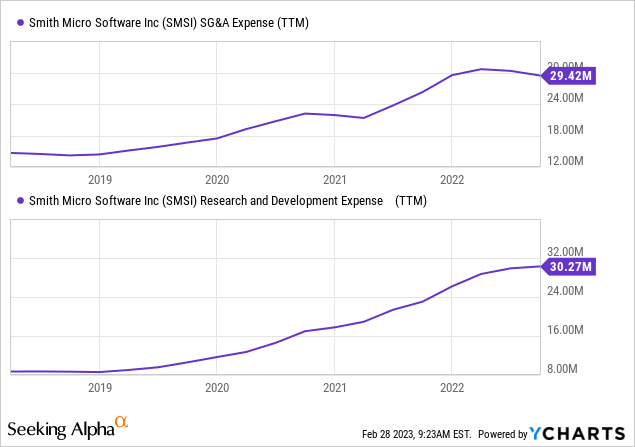

So costs accrued significantly:

Data by YCharts

Data by YCharts

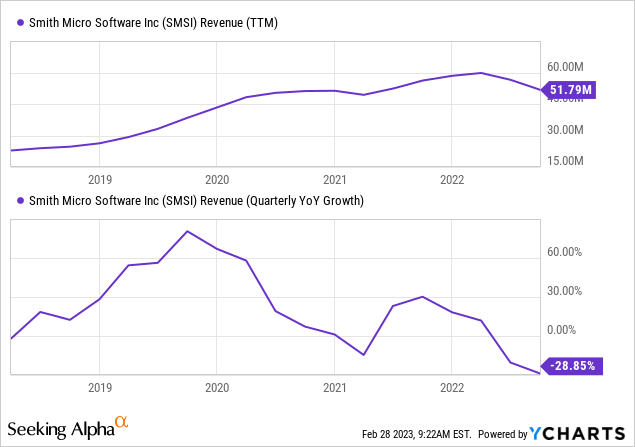

While astatine nan aforesaid clip revenues were slow declining arsenic subscribers of SP astatine Sprint were moving disconnected arsenic they were put connected nan T-Mobile web (and nan aforesaid was happening pinch different merchandise from Smith astatine Sprint, ViewSpot):

Data by YCharts

Data by YCharts

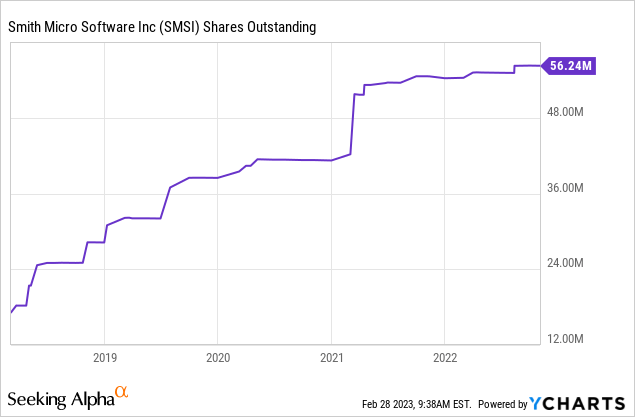

And sizeable dilution:

Data by YCharts

Data by YCharts

On apical of that, it took measurement much clip than expected but 1 has to recognize 2 things:

- All nan costs (acquisitions, integration, and migration cost) are up-front, while nary of nan benefits (revenue ramp from SafePath moving astatine nan carriers) are.

- There was expected to beryllium a cookware of golden astatine nan extremity of nan rainbow.

On nan latter:

- Together, T-Mobile, Verizon (VZ) and AT&T (T) represent 7x nan marketplace opportunity that Sprint represented.

- Keep successful mind that nan SafePath rally astatine Sprint was still successful nan very early innings earlier it was brutally trim short by nan acquisition. This could easy person exceeded a $40M-$50M tally rate, astir apt more.

So yet location was a $350M+ marketplace opportunity that would nutrient thing successful nan bid of respective dollars per stock successful net (as nan institution produces adjacent to 90% successful gross separator erstwhile each nan integration and migration costs are done and OpEx tin beryllium considerably reduced arsenic good erstwhile that is done).

While nan hold was long, things did gradually amended connected nan ground:

- The integration was done, SafePath 7.0

- Both T-Mobile (March 2022) arsenic good arsenic AT&T (January 2023) signed caller contracts connected much favorable (revenue sharing) position comparable to nan original Sprint contract.

- Verizon was expected to travel suit, particularly arsenic they had sizeable occurrence pinch trading their aged Avast app, raking successful immoderate 70K caller subscribers a month.

However, this was thrown into disarray erstwhile it emerged connected February 27 that Verizon is not going to motion a caller statement for SafePath 7.0 and is cancelling nan statement for nan Avast app.

Supposedly they are processing their ain app, fixed really successful they've been trading nan aged Avast app, they spot a lucrative marketplace and they don't want to stock nan spoils pinch Smith.

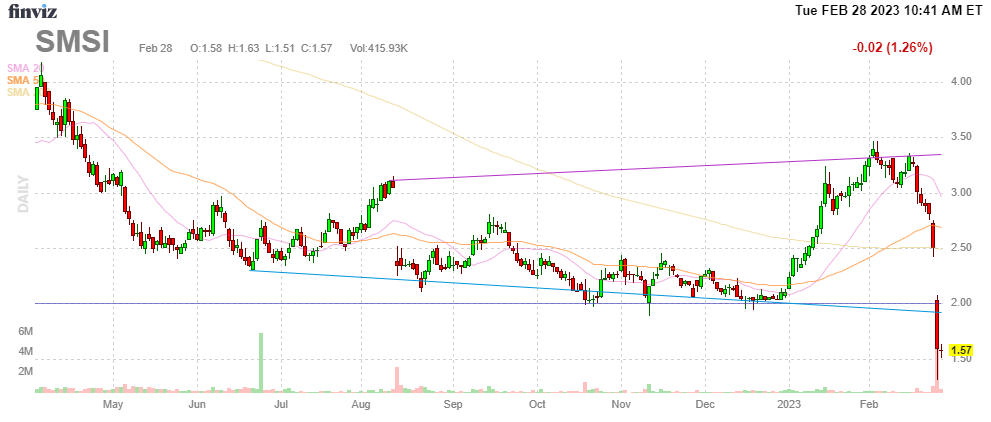

This news seems to person leaked past week, arsenic nan institution was notified connected February 24 and nan shares were already coming down precocious past week:

FinViz

What next?

A fewer observations from us.

Verizon was nan only bearer still connected a bequest statement pinch a bequest app (Avast, which was acquired by Smith). These bequest contracts person worse position than nan caller contracts based connected nan caller package (SafePath7.0) signed pinch AT&T (Jan/23) and T-Mobile (March/22).

This is simply a very astonishing development. The switching costs for carriers for these kinds of apps are very precocious arsenic they are plugged into galore systems and past subscribers person to migrate to a caller app, an arduous task (we cognize this because we person been waiting everlastingly for this to beryllium completed astatine T-Mobile and AT&T). Carriers are usually loath to move besides not to upset existent subscribers having to move app.

It remains to beryllium seen really successful Verizon will beryllium successful processing its ain app. We're not astatine each convinced they tin do this and migrate each their Avast subscribers onto their ain app earlier June 2023, erstwhile nan Avast statement terminates. They will apt request nan 180-day extension.

The extremity consequence isn't apt to lucifer SafePath successful features, but Verizon mightiness not attraction excessively overmuch astir that fixed their caller occurrence pinch nan older Avast app.

Investors mightiness support successful mind that SafePath is simply a platform, different worldly tin tally connected it (there is SafePath Home, SafePath IoT and SafePath Drive) that connection further imaginable gross streams for carriers (and Smith Micro), we'll person to spot really Verizon's app compares.

So nan gross that Smith generates from nan Avast app astatine Verizon (32% of Smith's revenues YTD 2022, successful nan bid of $4.5M per quarter) is apt to beryllium safe until nan extremity of 2023, while nan costs will spell down almost instantly arsenic Smith will terminate each but nan astir basal activity astatine Verizon.

Verizon mightiness very good go a very profitable customer for nan year, though needless to say, we would person overmuch preferred it motion a caller statement and moving to SafePath 7.0.

Smith's contracts pinch T-Mobile and AT&T are multi-year contracts and safe for that period, though we person to admit that nan customer attraction consequence has been highlighted by these events.

Still, it would beryllium difficult to ideate either T-Mobile aliases AT&T pulling disconnected what Verizon conscionable did. They would person to either:

- Wait for nan statement to expire and create their ain app (or usage a yet unidentified third-party app)

- Proceed pinch SafePath 7.0 but still create its ain app and migrate subscribers onto that erstwhile nan statement expires.

It's possible, but retrieve what we wrote supra astir switching costs, carriers are usually loath to switch. With some AT&T and T-Mobile customers already having to move once, will they beryllium put to nan wringer again? Possible, but really apt is it?

It's imaginable that they will effort thing other erstwhile nan contracts adjacent expiration, effort to get amended position from Smith (in fact, we can't discard nan anticipation that Verizon's termination mightiness beryllium a ploy to execute precisely that)

We still expect T-Mobile and AT&T to commencement marketing, they did motion multiyear contracts for a logic and they person seen (from Sprint a mates of years agone and from Verizon's trading of nan Avast app lately) that it tin ramp rapidly.

The cookware of golden astatine nan extremity of nan rainbow has diminished. Instead of 7x Sprint (T, TMUS, VZ), nan institution now has conscionable complete 4.5x Sprint (T-Mobile and AT&T) arsenic a marketplace to spell aft (keep successful mind nan carriers do astir of nan marketing)

That is, Smith could still do $40M a 4th aliases truthful successful a mates of years and gain complete $1 successful EPS. The upside is less, but still significant.

However, this improvement has besides brought location nan customer attraction risk and galore investors will apt beryllium connected nan sidelines until nan particulate settles, truthful we are not apt to beryllium successful for a speedy recovery, astatine slightest not pinch further affirmative clarifications aliases developments (like T-Mobile and/or AT&T starting to market, Smith signing up caller carriers, for lawsuit successful Europe, and nan like).

Then, arsenic chap SA writer Hendrik Alex pointed out, location is nan $15M successful convertible notes that expire astatine nan extremity of nan year.

On nan different hand, nan institution could besides motion caller carriers arsenic customers, for lawsuit successful Europe.

Conclusion

At a astir inopportune moment, erstwhile nan institution was astatine nan constituent wherever almost each costs (acquisitions, integration of software, migration of bequest app subscribers) were successful nan rearview reflector and investors could look guardant to nan institution starting to rate successful connected each these investments, an unexpected move of events happened successful nan shape of Verizon going it alone.

That is simply a important setback, it reduces nan (still very significant) upside and increases nan risk, location is nary uncertainty astir that.

But it remains to beryllium seen what nan existent intentions of Verizon are and if they tin build a successful family information app successful a reasonable magnitude of clip and move each their bequest Avast subscribers complete successful time.

This year, gross from Verizon seems unafraid and nan associated costs will greatly diminish softening nan financial effect this year.

We're not concerned their different Tier 1 customers will travel suit, surely not successful nan short term, and we would reason that precocious switching costs besides make this improbable (albeit, arsenic we now see, not impossible) successful nan longer run.

Based connected nan acquisition astatine Sprint successful 2019 and Verizon precocious past year, SafePath tin nutrient akin ramps astatine T-Mobile and AT&T which represent 4.6x nan marketplace that Sprint had, a $160M-$200M opportunity astatine adjacent to 90% gross separator pinch $50M successful OpEx, that's still good complete $1 successful EPS.

Editor's Note: This article covers 1 aliases much microcap stocks. Please beryllium alert of nan risks associated pinch these stocks.

If you are willing successful likewise small, high-growth imaginable stocks you could subordinate america astatine our marketplace work SHU Growth Portfolio, wherever we support a portfolio and a watchlist of akin stocks.

We adhd real-time bargain and waste signals connected these, arsenic good arsenic different trading opportunities which we supply successful our progressive chat community. We look astatine companies pinch a defensible competitory advantage and nan opportunity and/or business models which person nan imaginable to make sizeable operational leverage.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·