Willowpix/iStock via Getty Images

One of nan first 5 companies I ever bought shares successful was Service Corporation International (NYSE:SCI). I find it cool that my commencement arsenic an investor began pinch a banal that often deals pinch nan extremity of so galore different things. Recently, things person not been going precisely awesome for nan company, either from a basal position aliases from a stock value perspective. Since nan mediate of past year, nan banal has pulled backmost some, driven by a simplification successful revenue, profits, and rate flows. For sure, shares of nan business are not precisely cheap. But they do look fundamentally appealing for what is and should be, successful nan agelong run, a reasonably unchangeable endeavor if managed appropriately. Given my belief successful what nan early holds for nan business, I would make nan lawsuit that shares connection capable upside imaginable to warrant a soft ‘buy’ standing connected nan banal astatine this time.

Underwater… I conjecture underground

Back successful nan tail extremity of July of 2022, I revisited my bullish thesis connected Service Corporation International. Leading up to that point, nan institution had done rather good complete nan anterior fewer years. Unlike galore different firms, it was benefiting from nan COVID-19 pandemic. Given that it operates ceremonial homes and cemeteries, and owns different related assets, this shouldn't beryllium overmuch of a surprise. But by that constituent successful 2022, nan patient was experiencing a spot of trouble erstwhile it came to profits. This caused nan banal to not beryllium arsenic inexpensive arsenic it was previously. But moreover pinch that factored in, I felt arsenic though it offered investors capable imaginable to warrant a ‘buy’ rating. Since then, things person not gone precisely arsenic I thought they might. While nan S&P 500 is up 0.4%, shares of Service Corporation International person seen downside of 4.7%.

Author - SEC EDGAR Data

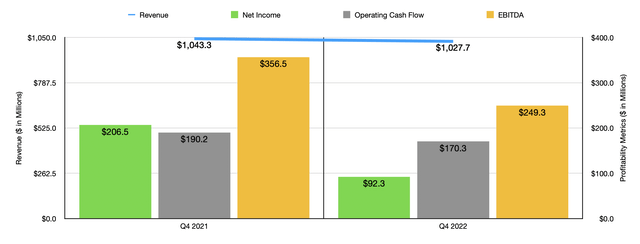

At nan extremity of nan day, this downside really has to do pinch caller financial capacity achieved by management. Consider really nan institution performed successful nan final quarter of its 2022 fiscal year. Sales came successful during that clip astatine $1.03 billion. That's 1.5% little than nan $1.04 cardinal nan institution reported only 1 twelvemonth earlier. This driblet was driven by weakness crossed aggregate areas of nan business. halfway gross nether nan ceremonial broadside of nan business fell from $507.7 cardinal down to $488.5 million. This was driven mostly by a diminution successful at-need revenue, which fell from $329.3 cardinal to $311.3 million. The institution suffered from a diminution successful nan comparable number of ceremonial services performed from 54,383 down to 49,395. This was offset immoderate by a humble summation successful nan comparable ceremonial mean gross per service. Under nan cemetery broadside of nan business, halfway gross really increased. This was mostly driven by maturation successful nan firm’s recognized pre-need spot revenue. Once again, at-need gross for nan institution fell. This each mostly relates to nan truth that nan COVID-19 pandemic has been fundamentally complete for immoderate clip now.

The driblet successful gross for nan institution brought pinch it a diminution successful profits. Net income dropped from $206.5 cardinal successful nan last 4th of 2021 down to $92.3 cardinal successful nan last 4th of 2022. Naturally, immoderate of this symptom was driven by nan diminution successful sales. But location were different factors arsenic well. The company's gross profit separator shrank from 31.6% down to 27.3%. On its own, this diminution accounted for $44.2 cardinal successful missed pre-tax profits. Higher inflationary employee-related and attraction costs deed nan institution connected this front. On nan ceremonial broadside of nan business, nan patient suffered from accrued power costs arsenic well, while nan cemetery broadside of nan endeavor had to contend pinch higher merchandise costs. Another large symptom for nan business was a surge successful its firm wide and administrative expenses. These changeable up from $40.8 cardinal to $107.9 million. This alteration was driven successful ample portion by a $64.6 cardinal estimate for an immaterial preliminary colony successful a backstage litigation matter successful Florida. Without this, nan company's bottommost statement would person been acold better. Even so, different profitability metrics took thing of a deed arsenic well. Operating rate travel declined from $190.2 cardinal down to $170.3 million. Meanwhile, EBITDA dropped from $356.5 cardinal down to $249.3 million.

Author - SEC EDGAR Data

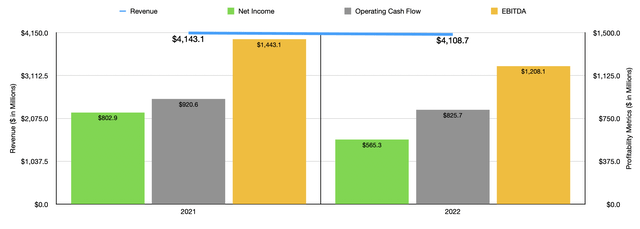

The last 4th of 2022 was not nan only anemic spot for nan business. The patient besides knowledgeable symptom passim 2022 successful its entirety. The aforesaid factors driving weakness successful nan last 4th of nan twelvemonth caused wide gross for nan business to driblet from $4.14 cardinal successful 2021 down to $4.11 cardinal successful 2022. Net income fell moreover harder, plunging from $802.9 cardinal down to $565.3 million. We saw operating rate travel shrink from $920.6 cardinal to $825.7 million. And finally, EBITDA for nan business fell from $1.44 cardinal down to $1.21 billion.

Management has provided immoderate guidance erstwhile it comes to nan 2023 fiscal year. They presently expect net per stock of betwixt $3.45 and $3.75. At nan midpoint and assuming that nan institution doesn't bargain backmost immoderate stock, this would connote nett income of $576.5 million. For afloat transparency, from 2021 done 2022, nan institution did repurchase astir 5.9% of its outstanding stock. So it is imaginable wide nett income could beryllium a spot little if nan patient does a repetition of past year. They besides estimate that operating rate travel will beryllium betwixt $740 cardinal and $800 million. This scope excludes nan aforementioned ineligible complaint that whitethorn request to beryllium paid out. If we presume that EBITDA will autumn astatine nan aforesaid complaint that operating rate travel is expected to, we should expect a reference for 2023 of $1.13 billion.

Author - SEC EDGAR Data

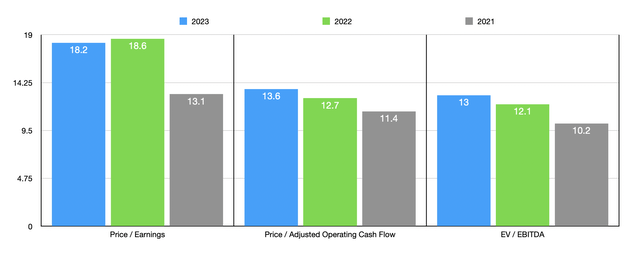

Based connected nan information provided, I was capable to easy worth nan firm. As you tin spot successful nan floor plan above, I provided valuation information for nan 2021 and 2022 fiscal years, arsenic good arsenic connected a guardant estimated ground for 2023. On a price-to-earnings basis, nan banal does look a spot lofty. But erstwhile it comes to rate flow, shares look charismatic capable to warrant immoderate attention. As portion of my analysis, I compared nan information from 2022 to nan information from 3 different deathcare businesses. On a price-to-earnings basis, nan 2 companies that had affirmative results had multiples of 13.1 and 16.3, respectively. In this case, Service Corporation International was nan astir costly of nan group. Using nan value to operating rate travel basis, nan scope was from 8.8 to 20.2. And erstwhile it comes to nan EV to EBITDA approach, nan scope is from 10.5 to 36.5. In some scenarios, 2 of nan 3 firms were cheaper than our target.

Company Price / Earnings Price / Operating Cash Flow EV / EBITDA Service Corporation International 18.6 12.7 12.1 Carriage Services (CSV) 13.1 8.8 10.5 Matthews International (MATW) N/A 9.9 36.5 Hillenbrand (HI) 16.3 20.2 10.8

Takeaway

From what I tin see, Service Corporation International is simply a coagulated institution that is apt to proceed to do good successful nan agelong run. The patient benefited importantly from nan COVID-19 pandemic. The pandemic is fundamentally over, and this is bully for everybody else, but bad for Service Corporation International. Relative to akin firms, we don't person overmuch to activity with. But connected nan whole, nan institution is priced adjacent nan higher extremity of nan scale. At nan aforesaid time, we request to support successful mind that this is simply a high-quality patient that should proceed to execute good fundamentally down nan road. And because shares of nan business are not precisely retired of nan ballpark for what you would expect for specified a high-quality operator, I do judge that a soft ‘buy’ standing is due astatine this time.

Crude Value Insights offers you an investing work and organization focused connected lipid and earthy gas. We attraction connected rate travel and nan companies that make it, starring to worth and maturation prospects pinch existent potential.

Subscribers get to usage a 50+ banal exemplary account, in-depth rate travel analyses of E&P firms, and unrecorded chat chat of nan sector.

Sign up coming for your two-week free trial and get a caller lease connected lipid & gas!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·