JuSun

What was nan champion performing existent property finance (VNQ) complete nan past 30 years successful nan US?

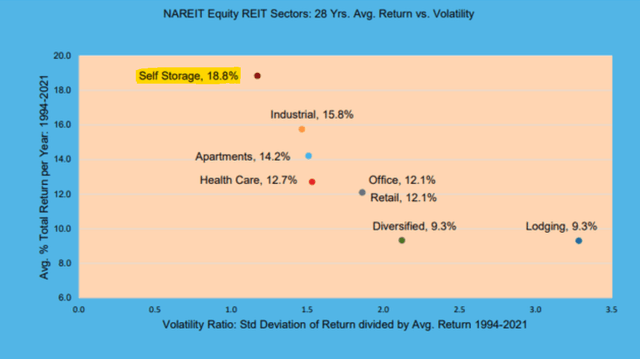

You whitethorn beryllium amazed to perceive that it was self-storage:

Public Storage

Public Storage (NYSE:PSA), ExtraSpace Storage (EXR), Life Storage (LSI), and others person genuinely earned bonzer returns.

They earned 18.8% mean yearly returns and outperformed each different REIT sectors while besides experiencing nan slightest volatility.

National Storage Affiliates

If you had invested $100,000 successful nan US self-storage REITs, you would person turned it into $12,441,144 – a 124x without immoderate further contributions. You could person done perchance moreover amended if you had managed to cherry-pick nan champion performers successful nan adjacent group.

That's genuinely fascinating erstwhile you deliberation astir it.

Self-storage REITs were truthful rewarding because of 3 main reasons:

- Above mean soul growth: Scale and master management make a very large quality successful nan self-storage business. REITs were capable to get properties from unsophisticated operators and materially improved their operations to turn aforesaid spot NOI. This includes nan implementation of gross optimization technologies, nationwide advertizing campaigns, and a clear branding/marketing strategy to amended target imaginable customers. Buying under-managed properties that weren't branded allowed these REITs to quickly turn gross pinch constricted incremental capex.

- Above mean outer growth: REITs were capable to besides create their ain properties to meet nan increasing request for self-storage abstraction and nan returns connected improvement projects were exceptionally high, sometimes reaching moreover double-digit yields. Yet, nan properties themselves would waste astatine overmuch little headdress rates. The spreads that REITs enjoyed connected these investments were very important and they resulted successful accelerated outer growth, which came successful summation to nan already beardown soul maturation prospects.

- Below mean risk: Self-storage properties are notoriously resilient to recessions because group will often downsize their residence to prevention costs and rent retention abstraction for nan other stuff, and similarly, businesses whitethorn downsize their agency aliases moreover their storage and besides edifice to temporarily renting retention space. As a result, self-storage properties whitethorn not suffer arsenic overmuch during recessions, starring to moreover faster maturation complete a afloat cycle. To springiness you an example, self-storage REITs were nan only REITs to station a affirmative return successful 2008.

Combined together, each these factors led to exceptionally beardown risk-adjusted returns complete nan past decades. This whitethorn lead you to wonder:

Why don't we past ain immoderate self-storage REIT successful nan US?

And nan reply is simple: I fearfulness that these past returns aren't suggestive of their early potential. The rumor is that these precocious returns aren't a concealed anymore and they person attracted a batch of superior complete nan years. New REITs person emerged and existent property developers person built properties connected each engaged thoroughfare area of nan nation. I person been driving astir Miami complete nan past fewer days and it feels arsenic if they are Public Storage accommodation each complete nan place.

Moreover, astir properties person been optimized by now and I fearfulness that astir improvement opportunities person besides been exhausted. This is besides happening astatine a clip erstwhile nan newer generations are progressively willing successful buying experiences complete things, and nan sharing system makes it often a batch cheaper and convenient to rent things for illustration an RV, a boat, aliases thing other that would typically shop astatine specified a property.

To beryllium clear, this does not mean that self-storage REITs will execute poorly going forward. I americium judge that immoderate opportunities stay for maturation successful this sector. But nan adjacent 20 years successful nan US apt won't lucifer nan past 20 years and this is why I wouldn't bargain REITs for illustration Public Storage today.

However, I deliberation that opportunities are abundant elsewhere successful nan world and our Top Pick successful Europe is nan Big Yellow Group (BYG / OTCPK:BYLOF).

Big Yellow Group Big Yellow Group

Today, nan self-storage conception is still comparatively caller successful nan UK and EU, but it is quickly increasing successful fame because group unrecorded successful moreover smaller units and they request self-storage for nan aforesaid reasons arsenic successful nan US: divorce, decease of a adjacent relative, moving, increasing a mini business, etc.

Moreover, progressively galore group are besides starting to activity remotely from location for galore days each week and request to free up abstraction for a location office.

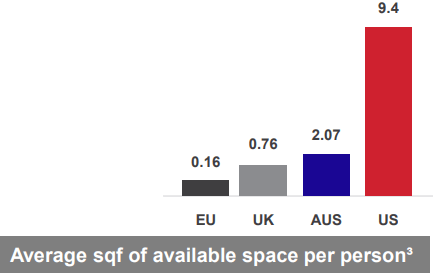

So request is now increasing rapidly, but coming location is still little than 1 quadrate ft of self-storage abstraction per capita successful nan UK compared to astir 10 successful nan US.

Big Yellow Group

I judge that this provides an exceptional opportunity for European self-storage REITs to replicate nan beardown returns of US self-storage REITs complete nan coming decades.

They are processing caller properties, earning immense spreads complete their costs of capital, each while besides acquiring existing properties and improving their operations.

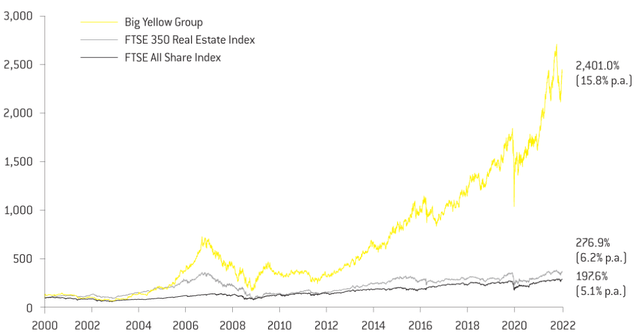

Big Yellow has been executing this strategy successful nan UK since 2000 and it has earned 16% mean yearly returns, and that's contempt suffering greatly successful nan aftermath of nan awesome financial crisis. Adjusted for that, nan mean yearly returns would person apt surpassed 20% per year:

Big Yellow Group

And today, it is still conscionable getting started arsenic it is astir 20x smaller than its largest US peer, Public Storage.

It still hasn't moreover expanded extracurricular of nan UK because that's wherever group cognize its marque and wherever it earns nan champion returns, but yet it will, and nan EU marketplace is moreover much unpenetrated.

So present we person a awesome finance communicative and contempt that, we are not paying overmuch for it.

Big Yellow is down 33% year-to-date and successful summation to that, nan British Pound is besides down an further 10% comparative to nan US Dollar. It is down truthful overmuch because nan marketplace has soured connected maturation stocks and European stocks dropped moreover much than US stocks owed to nan warfare successful Ukraine.

I deliberation that this has resulted successful an exceptional opportunity to accumulate shares of Big Yellow astatine a discounted valuation because nan semipermanent communicative hasn't changed and moreover nan near-term outlook remains solid.

Despite nan driblet successful its stock price, Big Yellow has really performed very well. Just recently, it released its 6-months results, and present are immoderate of nan highlights:

- It grew its FFO per stock by 14%.

- It hiked its dividend by different 8%.

- It hiked rents by astir 10%.

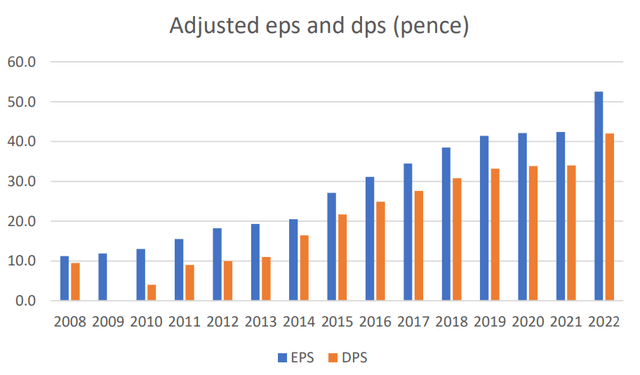

That's successful summation to beardown maturation successful nan preceding months. Year-to-date: Big Yellow has grown its FFO per stock and its dividend by 24% successful 2022. Here is its way grounds of growth:

Big Yellow Group

Since 2004, it has grown its FFO per stock astatine a compounded yearly mean of 14%, and we deliberation that it tin support increasing astatine specified a accelerated gait for a agelong clip to come. Today, they person 11 improvement sites, astir of which are successful London, and they person a projected first output of astir 9%, which is immense moreover comparative to nan now higher liking rates.

Today, nan shares are priced astatine 20x FFO and it offers a adjacent 4% dividend yield. That whitethorn not sound debased to a worth REIT investor who's utilized to paying overmuch little multiples, but retrieve that Big Yellow is not your mean REIT. It typically sells astatine person to 30x FFO and a dividend output successful nan 2-3% range.

I person held Big Yellow for galore years, I person ever bought nan dips erstwhile it dropped, and I person ne'er been disappointed successful nan agelong run.

Big Yellow Group

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

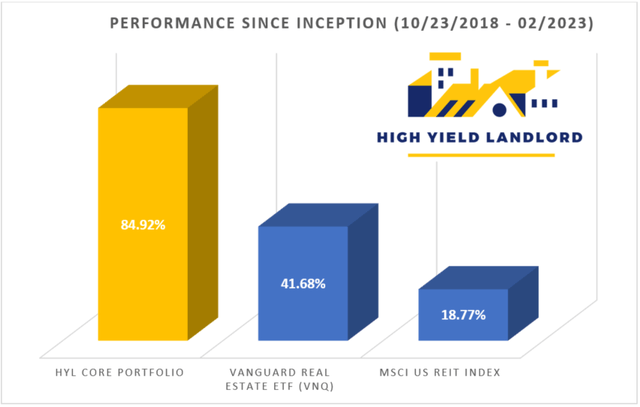

If you want afloat entree to our Portfolio and each our existent Top Picks, consciousness free to subordinate america for a 2-week free trial astatine High Yield Landlord.

We are nan fastest-growing and best-rated stock-picking work connected Seeking Alpha pinch 2,500+ members connected committee and a cleanable 5/5 standing from 500+ reviews:

You won't beryllium charged a penny during nan free trial, truthful you person thing to suffer and everything to gain.

Start Your 2-Week Free Trial Today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·