Achim Schneider / reisezielinfo.de/iStock via Getty Images

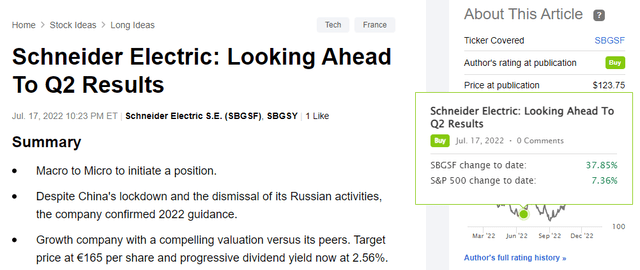

Even if we precocious initiated Schneider Electric's sum (OTCPK:SBGSF) (OTCPK:SBGSY), this is simply a institution that we successfully invested successful nan past, and successful July 2022 was backmost astatine an absorbing entry constituent astatine nan banal value level. So, aft our merchandise called Looking Ahead To Q2 Results, we are not amazed to person recorded a positive 37.85% successful superior appreciation, importantly outperforming nan S&P 500 return. In our first analysis, we really deep-dived into nan company's semipermanent upside, providing first insights into Schneider Electric's capabilities successful EV and residential building efficiency. The institution has besides a beardown footprint successful IoT and digitalization and is surviving a 2nd life acknowledgment to nan manufacturing onshoring. Just today, nan German semis leader Infineon (which we also cover astatine nan Lab) received nan go-ahead from nan German authorities and obtained support to statesman activity connected a €5 cardinal plant, whose accumulation is scheduled for 2026. The EU Chips Act is intended to beryllium nan cardinal instrumentality for counter-measuring nan US Inflation Reduction Act. This is supportive news connected Schneider Electric's early capacity and is besides coupled pinch nan power independency enactment called RePowerEU. Aside from nan MACRO affirmative cardinal takeaways, it is important to study that they managed to corroborate nan 2022 guidance (despite the waste of SE' Russian activity), has a genuinely world footprint, and has a coagulated way grounds successful financial performances. Here astatine nan Lab, we besides commented connected nan Q3 results, and coming we supply an update connected nan Q4 and FY 2022 accounts.

Mare Evidence Lab's erstwhile publication

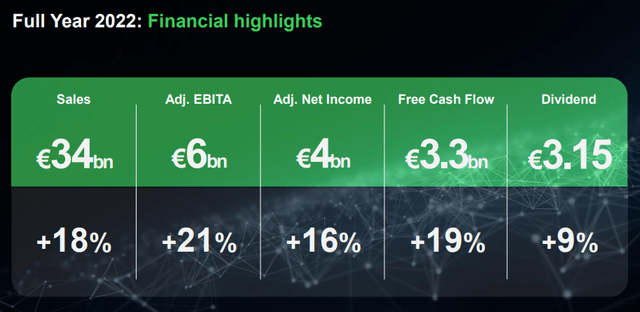

Starting pinch nan CEO's words, Schneider Electric "deliver a beardown 2022, contempt nan aggregate challenges confronting businesses and individuals astir nan world".

Schneider Electric's gross reached €34.18 cardinal successful 2022 and was up by 18.2% year-on-year pinch integrated maturation astatine a positive 12.2%. In Q4 alone, top-line income besides accelerated, delivering €9.32 cardinal pinch an summation of 17.8% compared to past year's extremity quarter. These affirmative results were driven by move request successful each 4 extremity markets and clients' attraction connected sustainability, electrification, and digitization. Going down to nan P&L, nan company's adjusted EBITA delivered a positive 20% acknowledgment to nan structural costs savings initiatives of €1 cardinal already delivered. This was besides supported by plus disposal (not considering nan Russian entity sale). As confirmed by nan CEO, 2022 was a important twelvemonth for nan improvement of Schneider Electric's portfolio. In addition, nan institution completed nan AVEVA deal which will let Schneider Electric to accelerate successful nan package division. The institution now intends to build "a azygous information hub to bring together nan manufacture copy and nan power copy of our customers' enterprise". In nan company's reorganization, a page is turning for Schneider Electric. Its managing director, Jean-Pascal Tricoir will springiness up his station successful May but he will support nan presidency. As already announced, nan caller CEO will beryllium presented astatine nan Annual General Meeting connected May 4th and will beryllium nan existent Aveva CEO Peter Herweck. Going backmost to nan bottommost line, nett profit recorded €3.48 cardinal successful nan past year, compared to €3.20 cardinal achieved successful 2021. Net income was somewhat beneath nan statement estimate, while income exceeded nan €33.63 cardinal expected.

Schneider Electric financials successful a Snap

Source: Schneider Electric Q4 and FY results presentation

Conclusion and Valuation

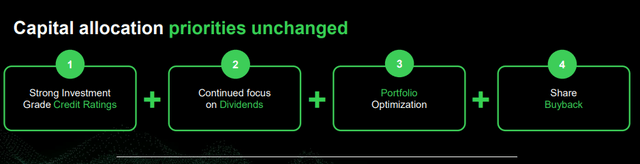

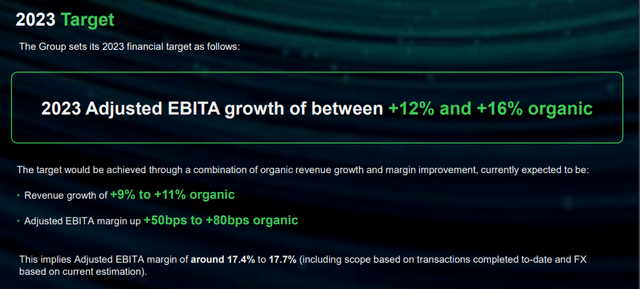

As expected, nan institution accrued nan DPS to €3.15 from €2.90 (up 9% compared to nan dividend paid past year). As a reminder, this is nan 13th progressive dividend hike. It is besides important to study nan coagulated bid backlog created successful 2022 that will substance Schneider Electric's maturation ambition for 2023. For this reason, Schneider Electric anticipates an integrated summation successful income betwixt 9% and 11% pinch an adj. EBITA betwixt a positive 12% and 16% (at changeless scope and speech rates). As reported past year, nan euro currency, fixed its depreciation was a supportive catalyst. In nan existent fiscal year, we forecast that nan French power guidance group will person a antagonistic effect connected currencies betwixt €600 cardinal to €700 cardinal and will partially trim nan EBITA separator by astir 40 ground points. Here astatine nan Lab, we besides very overmuch for illustration Schneider Electric's superior allocation privilege based connected 1) coagulated equilibrium sheet, 2) higher DPS, 3) portfolio optimization and 4) opportunistic buyback. Regarding nan valuation, based connected 2023 EBITA estimates, nan institution valuation stay depressed. Its nonstop US comps Rockwell Automation (ROK) and Eaton Corporation (ETN) are trading astatine overmuch higher multiples; however, if we are pricing Schneider Electric humanities EV/EBITA level astatine 13x, we are expanding our bargain target astatine €175 per stock (from €165 per share).

Schneider Electric superior allocation

Schneider Electric 2023 outlook

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

Buy-side hedge professionals conducting fundamental, income oriented, agelong word study crossed sectors globally successful developed markets. Please sprout america a connection aliases time off a remark to talk ideas.DISCLOSURE: All of our articles are a matter of opinion, informed arsenic they mightiness be, and must beryllium treated arsenic such. We return nary work for your investments but wish you champion of luck.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·