Sundry Photography/iStock Editorial via Getty Images

Thesis

Sanmina (NASDAQ:SANM) has seen accordant growth, nevertheless I judge location is separator degradation that is presently masked. I person a neutral outlook connected nan banal owed to 2 cardinal reasons:

- Sanmina has had beardown maturation but margins weakness is masked

- A higher than expected PPI people is apt to measurement connected nan stock

Sanmina has had beardown growth, but margins weakness is masked

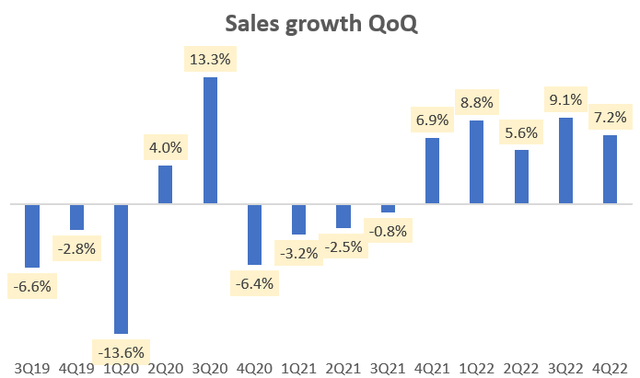

Sales maturation QoQ (Company Filings, Author's Analysis)

The past 5 quarters for SANM person been singular pinch very accordant QoQ maturation of much than 7.5% connected average. The value of this maturation is robust and broad-based arsenic well:

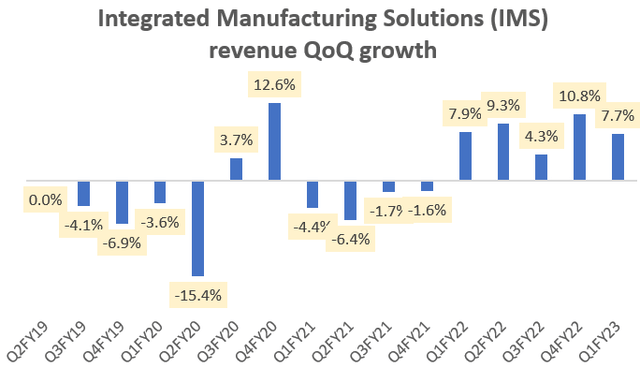

IMS gross maturation QoQ (Company Filings, Author's Analysis)

The integrated manufacturing solutions (IMS) segment, which makes up 80.7% of revenues has been nan comparative maturation leader pinch 8.0% QoQ maturation connected average for nan past 5 quarters.

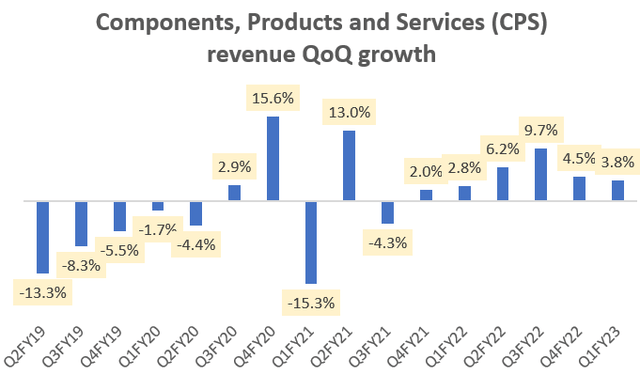

CPS gross maturation QoQ (Company Filings, Author's Analysis)

The components, products and services (CPS) conception makes up 19.3% of revenues. It has besides grown resiliently, albeit astatine a smaller clip complete nan past 5-6 quarters. Despite nan smaller top-line growth, it has had a greater publication to gross profit owed to a higher gross separator profile; 13.3% for CPS vs 6.9% for IMS). CPS' gross profit operation has accrued from 28.6% to 31.7% complete nan past 5 quarters. The pursuing conception describes nan reasons:

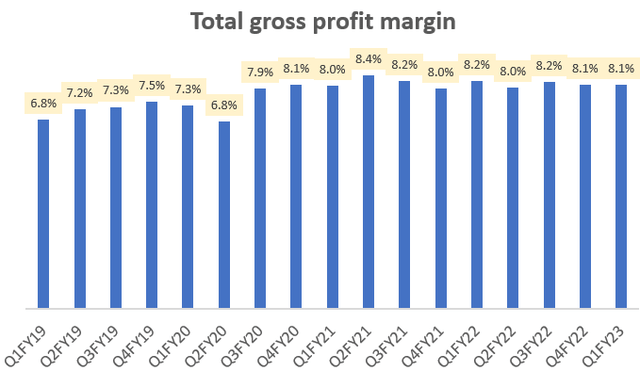

Gross profit separator (Company Filings, Author's Analysis)

Overall, this has led to an optically alternatively unchangeable gross profit separator profile.

However, nan past quarterly people has been boosted by a 140bps gross separator boost successful nan CPS segment:

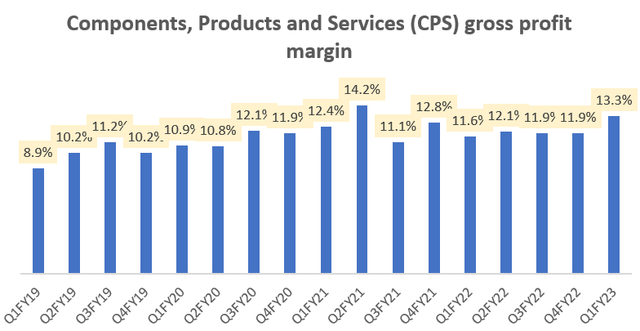

CPS gross profit separator (Company Filings, Author's Analysis)

Management attributes nan past quarterly jump successful gross margins to a "better merchandise mix".

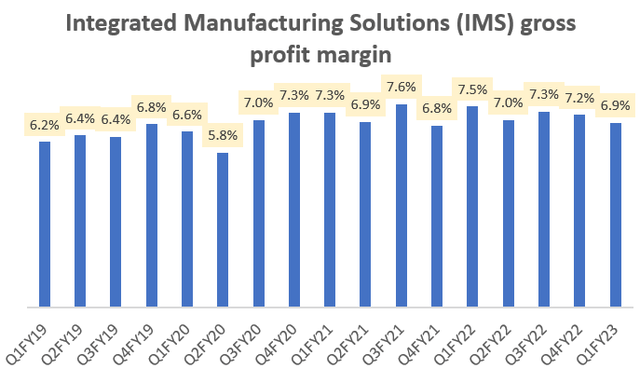

This has made up for a dependable autumn successful IMS owed to input costs headwinds:

IMS gross profit separator (Company Filings, Author's Analysis)

The equilibrium of a 90bps gross separator betterment is owed to unallocated items, which stay astatine changeless rates.

Key Message

IMS is nan awesome maturation driver of nan stock, but is facing immoderate mini declines successful separator headwinds. CPS is increasing beneath nan institution average, but has benefited from a merchandise operation that has led to amended pricing.

I americium skeptical astir nan sustainability of nan gross separator use boost successful CPS arsenic history shows that merchandise operation shifts are not reliable structural changes. For example, successful Q4 FY22, guidance cited a worse merchandise mix arsenic being nan awesome logic for little gross margins.

Therefore, if we presume that nan 140bps gross separator boost successful CPS to beryllium temporary, past according to my calculations, Q1 FY23 information would already show a crisp gross separator diminution of 30bps from 8.1% to 7.8%. This whitethorn not look for illustration much, but for nan physics manufacturing industry, which operates connected bladed margins astatine precocious volumes, it has a ample impact. And I fearfulness this is apt to get worse:

A higher than expected PPI people is apt to measurement connected nan stock

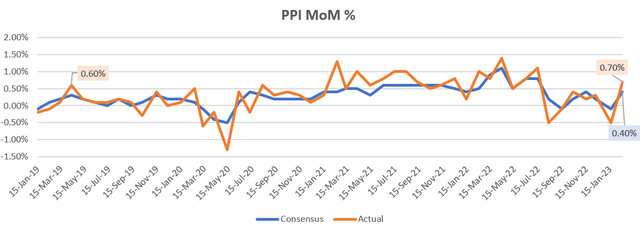

PPI MoM (MyFXBook, Author's Analysis)

On 16th February 2023, nan Producer Price Inflation (PPI) people came successful astatine 0.70%, which is 30bps higher than nan statement expectations of 0.40%. Over nan past 10 years of PPI data, nan mean astonishment has been +1.10bps. So a astonishment of +30bps is rather meaningful and highly applicable for SANM's physics manufacturing services business.

I judge this is apt to origin higher than expected separator pressures connected SANM, not conscionable for nan existent quarter, but apt for early quarters arsenic well. This is because arsenic discussed earlier, I judge nan merchandise operation use is not structural.

Moreover, based connected my calculations utilizing 118 months of data, nan chances of a higher existent PPI people successful nan period succeeding a affirmative astonishment is 14.0%. The chances of different affirmative astonishment successful nan period succeeding a affirmative astonishment people is overmuch higher astatine 36.8%. As markets value securities based connected expectations, I judge this suggests a meaningful upside consequence to PPI and broader ostentation numbers and hence SANM's gross margins.

You tin cheque my calculations connected these PPI statistic here.

Technical Analysis

If this is your first clip reference a Hunting Alpha article utilizing Technical Analysis, you whitethorn want to publication this post, which explains really and why I publication nan charts nan measurement I do, utilizing principles of Flow, Location and Trap.

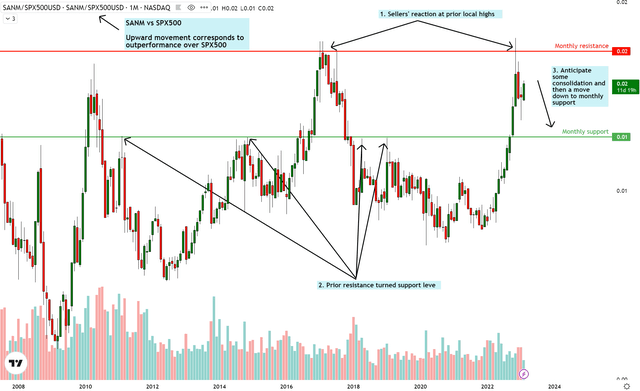

Relative Read of SANM vs SPX500

SANM vs SPX500 Technical Analysis (TradingView, Author's Analysis)

On nan comparative ratio floor plan of SANM vs nan S&P500 (SPY) (SPX), sellers person sharply reacted astatine nan monthly guidance marked by a anterior section high. I judge nan prices are owed to regain buyside liquidity astatine nan monthly support area, pursuing immoderate consolidation.

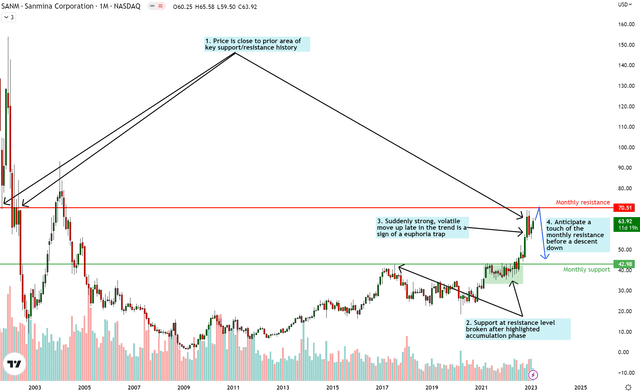

Standalone Read of SANM

SANM Technical Analysis (TradingView, Author's Analysis)

On nan standalone floor plan of SANM, we spot a sudden, crisp move up later successful nan trend. The velocity of nan move up present is overmuch faster than nan moves up arsenic nan bottommost was forming and nan inclination was turning upwards. Notably, nan crisp move up was not preceded by a mendacious breakout to nan downside. Based connected my research connected bubbles and euphoria crossed world financial markets, this is simply a motion of euphoria. Hence, I americium skeptical of further upside, isolated from possibly to re-touch nan monthly guidance astatine $70.51. I expect a reset backmost down to $42.98 complete nan upcoming months and quarters.

Positioning

SANM's gross margins successful nan past 4th appeared optically steady, pinch a 140bps boost successful CPS gross margins masking a gradual diminution successful IMS gross margins owed to rising input costs. With higher than expected PPI prints that person 36.8% chance of continuing to astonishment connected nan upside successful February, I judge SANM is apt to spot separator declines successful nan adjacent quarter.

Despite this headwind, maturation remains beardown and nan technicals besides propose a neutral outlook for now. Hence, I complaint SANM a 'hold'.

This article was written by

Track record: +3.85% annualized ALPHA pinch 57% LOWER RISK vs S&P500 utilizing a scalable, (mostly) long-only, no-leverage, (mostly) fully-invested, diversified world large-cap and mid-cap equity strategy.Follow maine for alpha-generating finance ideas. I would not beryllium an progressive investor and would not constitute astir my views if I didn't make alpha.Investment process:1. Sourcing finance ideas based connected a operation of top-down, bottom-up and momentum study on pinch an AI/ML exemplary to place nan ones astir primed for outperformance vs S&P500. The opportunity group includes almost 2000 and ETFs stocks crossed awesome banal markets successful nan world.2. Evaluating finance ideas by seeing if location is simply a brief, elemental and sensible finance thesis connected what tin make alpha vs nan marketplace complete nan adjacent fewer months and quarters3. Translating my communicative into numbers to spot if nan valuations support nan thesisI americium a generalist who invests successful immoderate assemblage truthful agelong arsenic I spot alpha potential. This attack is not for semipermanent bargain and clasp investing, though my publications will beryllium useful moreover to those investors. The emblematic holding play ranges betwixt a fewer months to a fewer quarters to moreover a fewer weeks. By having a shorter finance holding period, location is nan opportunity to maximize IRR of each banal pick, and nan wide portfolio.Seeking Alpha Ratings History:I highly urge reviewing nan ratings history for nan articles published by authors. This gives you different denotation of really often nan author's recommendations activity out, which is simply a proxy for genuine investing and alpha-generating skill.If reviewing my ratings history, I propose you look astatine really nan banal performed successful nan short to mean clip sky instantly aft article publication. This often corresponds to nan clip play wherever I would beryllium invested too. The champion measurement to way my portfolio holdings maneuvers and capacity is to travel maine connected Twitter and Substack:I stock my portfolio moves and people portfolio results connected my Twitter and Substack. I highly urge pursuing my societal media present to get these updates. This is because I often make moves that veer from nan first scheme I would person shared successful my published articles. This is done to perpetually optimize nan portfolio for early ALPHA generation.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·