Stephen Brashear/Getty Images Entertainment

The pursuing conception was excerpted from this money letter.

Redfin (NASDAQ:RDFN)

Redfin’s results person been disappointing successful 2022. Aside from nan COVID lockdown 4th of Q2’20, Redfin ne'er knowledgeable a year-over-year diminution successful transaction volume. In fact, nan company has ne'er grown transaction measurement little than double digits.

The lodging marketplace has been difficult to navigate since COVID. Recent volatility successful existing location income is not what 1 would expect from normal cyclicality but has been owed to nan imbalances successful supply/demand since COVID, mixed pinch higher liking rates. Housing is unsocial successful that astir location buyers are besides location sellers. Since rates moved up importantly successful 2022, homeowners that refinanced astatine little rates are little consenting to bargain a caller home, astatine slightest astatine existent prices, which has led to standstill successful existing location transactions.

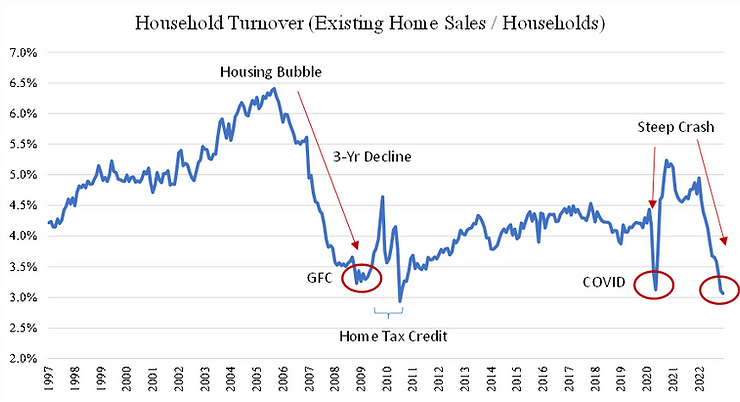

The floor plan beneath shows conscionable really volatile existing location income person been since COVID. Over nan past 25 years, location turnover (U.S. location income / U.S. household) ranged betwixt 3.0%-6.5% astatine nan extremes. At nan extremity of 2022, volumes were astatine nan low-end of nan historical extremes. On average, aliases successful much normal times, ~4%-5% of households typically waste their home. At nan extremity of 2022, location turnover reached historically debased levels of conscionable 3%.

Source: FRED, Saga Partners

Despite what has happened complete nan past 3 years, I do not deliberation location will beryllium a permanently lowered complaint of location turnover aliases that nan utmost volatility successful existing location income will beryllium nan caller normal acold into nan future. People bargain homes for various reasons, specified arsenic caller family statement (starting a family) and different life events (moving for work, upsizing arsenic family grows aliases making much money, downsizing arsenic kids time off aliases retire). Peoples’ lives alteration and truthful do their needs. With location affordability astatine historical lows, prices either request to diminution aliases family incomes request to emergence to accommodate peoples’ lives. Though galore homeowners are locked into little owe rates today, arsenic nan wide costs of caller homeownership normalizes, I’d expect existing location income to attack nan ~4% scope again (implying 5-6 cardinal units successful an mean year).

Are Redfin’s existent results a reflection of a weakness successful its worth proposition aliases competitory position?

My position (which whitethorn look evident since we still ain Redfin) is that thing fundamentally has changed surrounding nan company’s semipermanent competitory advantage. Other starring existent property brokers person knowledgeable akin if not worse declines successful transaction volumes.

Redfin’s comparative costs advantage to accepted existent property brokerages has not changed. It generates request done its website that is funneled to Redfin agents who past thief guideline customers done nan analyzable transaction of buying and trading a home. Redfin has invested successful building an end-to-end existent property offering, starting pinch online hunt and 3D virtual tours, past self-tour scheduling ability, owe underwriting, and transaction advisory done its full-time agents. Increased automation surrounding request aggregation and touring enables agents to walk their clip wherever customers worth it nan most. Since supplier do not person to imaginable for request to a akin grade arsenic a accepted agent, they are much productive which lowers nan frictional costs of exchanging location ownership. It’s not that immoderate 1 of Redfin’s services is an advantage successful and of itself, it is nan integration of each nan services moving together that springiness it a costs advantage to accepted brokerages.

Historically Redfin has reinvested gross profits into building its integrated work offering operating astir breakeven. Despite a difficult 2022, early maturation successful gross profits is expected to turn astatine a faster complaint than operating expenses arsenic nan halfway work offerings person mostly been built, providing affirmative rate travel successful 2023 and nett profits successful 2024. From there, I’d expect Redfin to proceed to turn arsenic it takes stock successful each of its markets. While weaker results and a higher costs of superior (discount rate) would bespeak a little intrinsic worth than a twelvemonth aliases 2 ago, I find nan $460 cardinal marketplace headdress that shares sold for astatine nan extremity of 2022 baking successful an overly pessimistic future.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Single banal ideas excerpted from money letters published by Seeking Alpha.

Additional disclosure: © by Saga Partners. All Rights Reserved.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·