Joe Raedle

The pursuing conception was excerpted from this money letter.

Carvana (NYSE:CVNA)

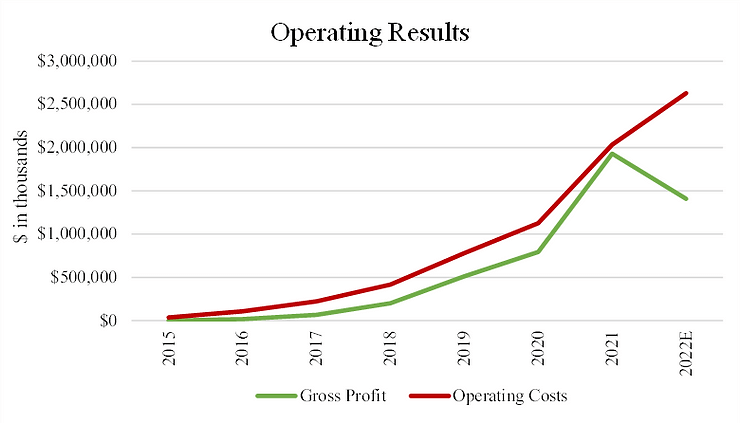

I person discussed Carvana respective times since we first purchased it successful 2019 but want to supply an update fixed nan stock’s diminution and antagonistic headlines. Historically, Carvana has grown gross profits astatine a faster complaint than operating costs. In 2021, Carvana grew unit portion volumes 74% to complete 400,000 cars to go nan 2nd largest utilized car trader aft CarMax. Carvana reached $1.9 cardinal successful gross profits, EBITDA breakeven, and expectations entering 2022 were for continued portion measurement maturation and standard operating costs.

Source: Company filings, Saga Partners

What happened successful 2022?

Similar to Redfin, Carvana has been impacted by beautiful utmost manufacture disruptions/volatility. Supply concatenation bottlenecks restricted caller car accumulation and caused prices to rise. When mixed pinch higher liking rates, car affordability declined and utilized car volumes crashed.

Carvana plans and hires for expected capacity 6-12 months into nan future. Entering 2022 nan Company expected to turn portion volumes successful nan ~30% scope year-over-year and truthful faced a costs building acold excessively precocious for nan unit portion volumes experienced. Since request has travel successful beneath expectations, guidance is now pursuing costs cuts to get backmost to EBITDA breakeven.

While adjusting to a much adverse macro situation would not typically beryllium overly problematic, Carvana’s acquisition of Adesa successful April added $3.25 cardinal of 10.25% indebtedness to its equilibrium sheet. While nan acquisition made strategical consciousness and enables Carvana to much than triple its reconditioning capacity and waste cars done nan wholesale transmission easier, it added much than $300 cardinal successful yearly liking disbursal correct earlier 1 of nan steepest declines successful utilized car manufacture measurement knowledgeable successful history.

The cardinal statement is whether Carvana has nan liquidity runway to get to free rate travel breakeven. Carvana has 3 awesome buckets that dress up nan mostly of operating expenses: compensation & benefits, advertizing expense, and different overhead (roughly half of which is transaction & customer use costs). While these costs are reasonably fixed successful nan short-term, they are much adaptable successful nan intermediate-term. Carvana has nan expertise to drastically trim costs if needed, to amended lucifer nan request environment.

Based connected actions taken by management, it is expected that operating costs should autumn to ~$400 cardinal per 4th ($1.6 cardinal tally rate) by Q3’23. This was astir wherever operating costs were successful Q1 and Q2 2021, erstwhile Carvana sold ~100,000 unit units. At that time, they were increasing portion volumes ~75% year-over-year which suggests they were not operating astatine imaginable efficiency. As Carvana shifts attraction from maturation to efficiency, it is reasonable to expect costs to beryllium capable to travel down commensurate pinch those portion volumes.

One tin estimate what unit portion volumes whitethorn do passim nan adjacent year, but astatine that costs basis, it would return ~100,000 unit units per 4th and a gross profit per unit portion of $4,000 to scope EBITDA breakeven. Without immoderate further operating efficiencies, ~125,000 unit units per 4th would get them to free rate travel breakeven to screen their liking disbursal and privilege superior expenditures. If units stay depressed for longer than expected, guidance could trim operating costs further, nevertheless nan ~$600 cardinal successful yearly liking disbursal is beautiful fixed absent a indebtedness restructuring.

Depending connected Q4’22 results, Carvana will apt person ~$1.4 cardinal successful committed liquidity, netting retired restricted rate if its level scheme were afloat drawn. As disbursal cuts spell through, they should scope EBITDA breakeven by Q3’23. At that constituent they will apt person ~$1 cardinal successful committed liquidity to screen ~$150-200 cardinal successful quarterly liking and capex, giving them until nan extremity of 2024 for utilized car volumes to retrieve to much normalized levels. This does not moreover see nan ~$2 cardinal successful unpledged existent property that provides them pinch further liquidity options if needed.

The truth we person to moreover see a script of whether Carvana will get done an extended downturn could beryllium considered a reddish flag. I would thin to work together successful astir situations, but Carvana has knowledgeable a highly different environment. Part of nan separator of information to their operating results is that they person nan portion economics to trim costs if request were to decrease. They besides person ample liquidity to supply a runway to do so. They are now having to propulsion that lever fixed nan adverse environment.

Perhaps Carvana was overly fierce by expanding capacity excessively fast. However, 1 tin besides reason that successful nan semipermanent that buying and trading cars online is specified an evidently amended customer acquisition than nan accepted utilized car buying experience. Therefore, it should return a decent stock of wide utilized car income and location is simply a winner-take-most move to nan institution that tin champion merge nan online utilized car buying/selling experience. Once nan infrastructure is built, it would beryllium highly difficult for anyone other to compete pinch and displace nan institution pinch nan top marketplace share. While Carvana is nan clear online utilized car trader leader today, it is very imaginable for a CarMax (KMX), Vroom (VRM), CarGurus (CARG), Lithia Motors (LAD), General Motor’s (GM) CarBravo, aliases moreover Amazon (AMZN) to either standard their operations aliases participate nan space. The prize for winning is important pinch perchance small near complete for 2nd place. Therefore, being fierce successful scaling its infrastructure is nan correct determination to make, pinch nan knowing that it takes a batch of first superior and 1 needs to beryllium capable to past immoderate imaginable downturn.

While Carvana has been negatively portrayed successful nan headlines, it has a beardown customer worth proposition, charismatic portion economics compared to accepted ceramic & mortar dealerships, and a ample marketplace opportunity. It has nan costs building to get to EBITDA breakeven successful nan foreseeable future, and free rate travel breakeven arsenic unit volumes statesman to normalize sometime complete nan adjacent 2 years. Some whitethorn inquire why we person not added to our Carvana position if I proceed to person condemnation successful Carvana’s semipermanent outlook and shares person continued to diminution into nan extremity of nan year. The reply is that we person limits to really overmuch superior we are consenting to put into immoderate azygous finance and person reached that limit past June. That whitethorn mean we are limiting immoderate upside by not adding to what could perchance beryllium 1 of nan champion opportunities disposable astatine nan existent price, but it besides limits nan consequence that immoderate azygous position mightiness permanently impair nan Portfolio.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Single banal ideas excerpted from money letters published by Seeking Alpha.

Additional disclosure: © by Saga Partners. All Rights Reserved.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·