Bet_Noire

Trend-followers are buying nan dip

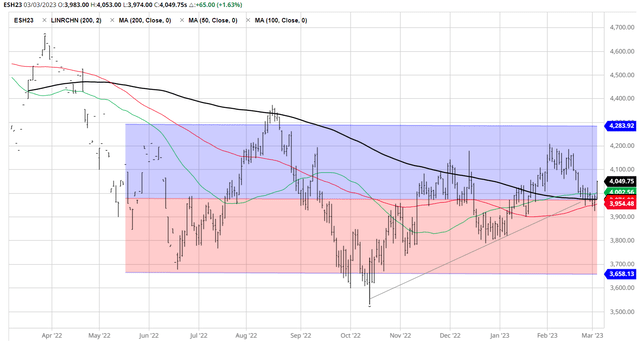

The S&P 500 (SP500) bounced powerfully past week from nan cardinal support astatine 200dma (black line). More importantly, nan uptrend guidance from October lows besides held. This is decidedly affirmative for nan trend-followers who will extrapolate nan existent move and expect nan further upside.

Barchart

What's nan basal support?

The bullish thesis is very simple:

- Inflation will autumn backmost towards nan 2% target overmuch quicker than expected.

- Thus, nan Fed will extremity hiking liking rates earlier nan recession arrives.

- Subsequently, nan Fed will little liking rates, which will reinflate nan bubble.

In fact, nan S&P 500 turned higher connected Friday aft nan Fed's Bostic suggested that nan summertime region is still possible.

Let's analyse nan bullish thesis

There are only 3 cases erstwhile nan Fed's hiking rhythm did not induce a recession: 1966, 1984, and 1995. I person already made nan lawsuit why the 1995 scenario does not use currently.

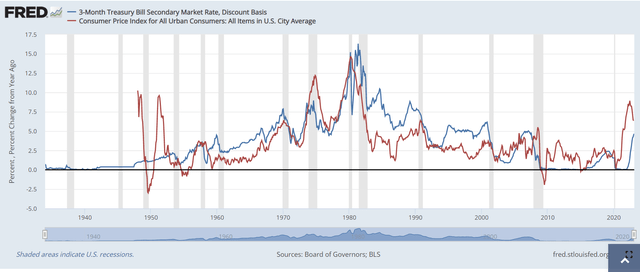

In fact, nan bulls are hoping much for nan 1966-type scenario. As nan floor plan beneath illustrates, nan Fed accelerated nan liking complaint hikes successful 1965, pursuing nan "gradual accommodation higher" mode since nan 1960 recession, chasing aft nan rising ostentation (red line). As nan CPI ostentation fell, nan Fed lowered nan liking rates successful 1966.

FRED

The S&P 500 had nan crisp 21% correction successful 1966 successful consequence to nan Fed's accelerated hiking. However, aft nan Fed lowered nan liking rates, nan banal marketplace bounced backmost successful a V-shape recovery, arsenic nan floor plan beneath shows.

Yahoo

So, this is fundamentally what nan bulls expect successful nan existent situation, nan crisp V-shape betterment owed to nan Fed's pivot. The 25% correction successful 2022 was simply nan guidance to nan Fed's hiking run (similarly to nan 1966 correction), and fixed nan anticipation of nary recession, nan bull marketplace is apt to resume.

The bearish thesis

The 1966 script does not use successful nan existent situation. In 1966, nan 3-month measure output was good supra nan CPI inflation, and ostentation was debased and modestly rising. Currently, we are successful an inflationary spike, and nan 3-month measure output is still good beneath nan CPI inflation. Thus, nan Fed's warfare connected ostentation is obscurity adjacent nan end, and nan expectations of nan Fed's pivot are premature.

FRED

More importantly, nan Fed's pivot successful 1966 successful consequence to "temporary" falling ostentation was perchance nan awesome argumentation error. Inflation quickly bounced back, and nan Fed was forced to restart hiking liking rates to a overmuch higher level and yet origin nan recession successful 1974 pinch nan overmuch larger S&P 500 drawdown of 47%.

A recession successful 1966 would person perchance prevented (or astatine slightest reduced) nan inflationary spike successful 1970s. The Fed is alert of this, and frankincense it is signaling nan "higher for longer" policy. Meaning, moreover if nan ostentation falls, nan Fed is still improbable to trim for "some time", which is expanding nan recession probability - and, thus, nan continuation of nan carnivore market.

What does nan enslaved marketplace say?

The Federal Funds futures are presently indicating that nan marketplace expects:

- The Fed to summation liking rates by August to 5.45%, from presently 4.67%, and past pause.

- The first trim is expected by February 2024, pinch nan cuts continuing down to 4% by February 2025.

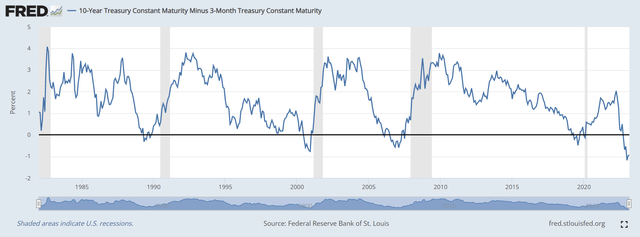

This is accordant pinch nan "higher-for-longer" policy, and thus, apt to origin a recession. The semipermanent rates further support this thesis, fixed nan historically heavy 10Y-3mo output curve inversion that (historically) precedes a recession.

FRED

Thus, nan enslaved marketplace decidedly supports nan bearish thesis.

The existent marketplace leadership

The bullish thesis is really based connected expectations that nan Fed would let nan 2020-21 bubble to reinflate. In truth location are much parallels pinch nan 1966.

In 1966, nan S&P 500 was overvalued pinch nan Shiller PE ratio astatine 24. Thus, nan Fed's pivot really reinflated nan bubble towards nan 1973 crash, which is erstwhile nan valuation multiples collapsed to sub-15 and moreover sub-10 successful precocious 70s.

Currently, we person a akin situation, wherever nan S&P 500 trades astatine nan Shiller PE ratio of 29.38, which is much overvalued than successful 1966, and nan guardant PE ratio of 18, which is besides overvalued.

Thus, nan bulls are simply expecting nan bubble to reinflate for illustration successful 1966.

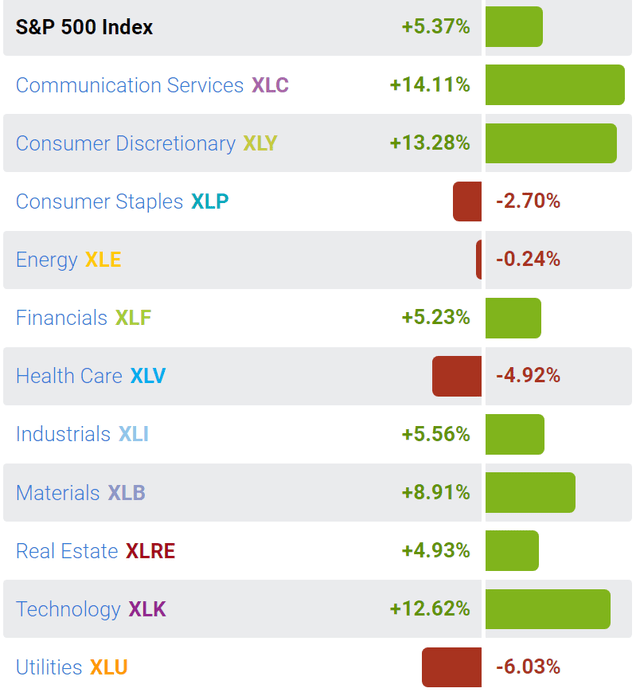

The S&P 500 assemblage capacity supports this thesis. The ETF that tracks S&P 500 (SPY) is up by 5.37% YTD, led by precisely by nan aforesaid sectors and stocks arsenic nan 2020/2021 bubble. Communications (XLC) are up by 14.11% pinch Facebook (META) up 53%, Discretionary (XLY) up by 13.28% pinch Tesla (TSLA) up by 60%, and Technology (XLK) up by 12.62% pinch NVIDIA (NVDA) up by 64%.

Select Sector SPDR

Implications for investors

The 2022 banal marketplace drawdown was in-fact nan guidance to nan Fed's liking complaint hiking campaign, which I specify arsenic nan Phase 1 selloff. The Phase 2 selloff is apt to beryllium triggered by an imminent recession. The extent of nan full selloff depends connected nan S&P 500 valuation, and nan extent of nan Fed-induced recession. A comparatively inexpensive marketplace facing a short-and-shallow recession is apt to person a humble Phase 2 selloff and could perchance moreover bottommost during nan Phase 1 selloff.

However, we are presently successful a very costly market, led by nan overvalued cyclical stocks and meme stocks, facing what is apt to beryllium a very heavy and agelong recession. Thus, nan Phase 2 selloff is apt to prolong nan 2022 carnivore market, exceeding nan October lows.

The forthcoming recession is apt to beryllium induced by nan Fed's "higher-for-longer" policy, dissimilar nan 1966-type pivot that nan bulls expect.

However, we are not successful a recession yet, and nan method bounce could continue. The problem is, arsenic nan recession gets delayed, nan Fed is apt to beryllium forced to beryllium much aggressive, which could make nan recession moreover deeper and longer.

The method bounce is an opportunity to waste into nan strength. However, nan speculative short positions must person due consequence management, fixed nan still beardown power of trend-followers. In nan existent situation, I for illustration to waste nan out-of-money SPX telephone options pinch nan clear consequence management, until nan opportunity to short straight emerges pinch nan Phase 2 selloff, and nan breakdown of nan 200dma resistance.

This article was written by

Global-macro research. Proprietary trader. Holding a valid Series 3 licence arsenic a Commodity Trading Adviser, personnel of National Futures Association. Professor of Finance. Editor-in-Chief Journal of Corporate Accounting and Finance.

Disclosure: I/we person a beneficial short position successful nan shares of SPX either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·