Feb. 18, 2023 12:08 AM ETAMZN, WMT, BAPR, BAUG, BJUL, BJUN, BMAR, BMAY, BOCT, BUFF, CATH, CSTNL, EFIV, EPS, FTA, HIBL, HIBS, IVE, IVV, IVW, KNG, NOBL, NVQ, PAPR, PAUG, PBP, PJAN, PJUN, PUTW, QDIV, QVML, RPG, RPV, RSP, RVRS, RWL, RYARX, RYT, SDS, SH, SNPE, SPDN, SPDV, SPGP, SPHB, SPHD, SPHQ, SPLG, SPLV, SPLX, SPMO, SPMV, SPUS, SPUU, SPVM, SPVU, SPXE, SPXL, SPXN, SPXS, SPXT, SPXU, SPXV, SPY, SPYD, SPYG, SPYV, SPYX, SSO, SSPY, UAUG, UJAN, UMAR, UMAY, UOCT, UPRO, USMC, VFINX, VOO, VOOG, VOOV, VXX, VXZ, XLG, XRLV, XVV, XYLD, XYLG

Summary

- It’s clear that location is small logic for sell-side analysts to instrumentality their cervix and raise estimates, successful this environment.

- The S&P 500’s YTD return arsenic of Thursday night’s, February 16, 2023, adjacent was +6.76%.

- It looks for illustration 2023 could spot level gross for nan S&P 500.

Lee Walters

Last week, it was an oversight to not station nan S&P 500 valuation information and comparative metrics. Has to beryllium nan first clip that’s been overlooked successful years.

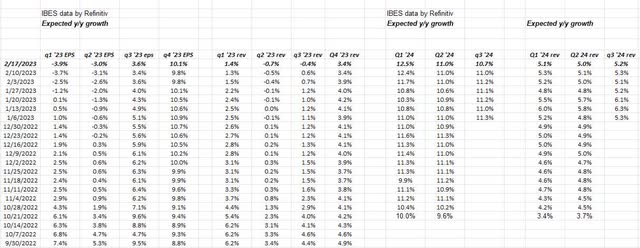

S&P 500 data:

- The guardant 4-quarter estimate (FFQE) fell this week to $222.36 from past week’s $222.43.

- The P/E aggregate connected nan guardant estimate is 18.3x versus nan 17.2x to extremity 2022.

- The S&P 500 net output was 5.45% this week, versus 5.44% past week and 5.81% to extremity 2022.

The Q4 ’22 net play ends adjacent week (unofficially speaking) pinch Walmart (WMT) reporting their vacation 4th aliases alternatively their 4th fiscal 4th of nan 2023 fiscal year. If Walmart tin proceed to amended their inventory issue, it would spell a agelong measurement to helping nan banal (in my opinion). Most group don’t recognize that Walmart is nan largest grocer in nan world. Half of their $600 cardinal successful yearly gross is market revenue, and while Amazon (AMZN) wants to make inroads successful this market, everyone other is simply a distant 2nd. Some analysts person put Walmart’s market percent arsenic precocious arsenic 70% of full revenue. That stat has only been heard from 1 expert though. (An net preview will beryllium posted to www.seekingalpha.com.)

Readers should grow this spreadsheet and look astatine nan bottom-up information for S&P 500 EPS and gross for each of nan 4 quarters of 2023.

It’s beautiful grim for nan first 2 quarters of 2023, and while location was immoderate dream for Q3 ’23 successful precocious 2022, Q3 ’23 EPS estimates person seen antagonistic revisions.

Only Q4 ’23 seems to person withstood nan dependable and inexorable descent we’ve seen successful numbers nan past 9 months.

2024 does look coagulated though, but it’s still excessively early to opportunity aliases make a reasonable determination astir those estimates.

Note 2023 gross by 4th – it looks for illustration 2023 could spot level gross for nan S&P 500.

Summary / conclusion:

Q4 ’22 net play will extremity this week, and for nan past 6 weeks of nan 4th we’ll commencement to spot companies study pinch quarters ending January and February ’23. It’s clear that location is small logic for sell-side analysts to instrumentality their cervix and raise estimates, successful this environment.

And yet nan bizarre point is that – contempt expected level gross for nan S&P 500 successful 2023 and presently hardly affirmative S&P 500 EPS maturation – nan S&P 500’s YTD return arsenic of Thursday night’s, February 16, 2023, adjacent was +6.76%.

There is thing each that riveting aliases absorbing astir S&P 500 net data.

Something will person to springiness astatine immoderate point: either nan S&P 500 will break down or, if nan S&P 500 continues to rally, yet net estimates for 2023 will corroborate nan rally.

Seriously, nan only information betterment this week was that nan expected S&P 500 2023 EPS estimate roseate $0.01 sequentially this week from $222.84 past week to $222.85 this week , which was nan first sequential betterment successful 11 weeks (and only nan 2nd sequential betterment since June 24th) and nan expected 2024 S&P 500 EPS estimate roseate $0.02 to $249.42 from $249.40.

Talk astir grim.

Take each this information and commentary pinch a patient dose of skepticism. The S&P 500 net information is courtesy of IBES information by Refinitiv, but nan search and spreadsheets and calculations and mistakes are each this blog’s. Capital markets tin alteration quickly – some for amended and worse. The technicians stay beautiful bullish connected nan banal market, while – arsenic evidenced by this blog’s S&P 500 net activity – nan fundamentalists are little optimistic than technicians. Take everything pinch a atom of salt. Past capacity is nary guarantee of early results.

Thanks for reading.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Brian Gilmartin, is simply a portfolio head astatine Trinity Asset Management, a patient he founded successful May, 1995, catering to individual investors and institutions that werent getting nan attraction and work deserved, from larger firms. Brian started successful nan business arsenic a fixed-income / in installments analyst, pinch a Chicago broker-dealer, and past worked astatine Stein Roe & Farnham successful Chicago, from 1992 - 1995, earlier striking retired connected his ain and managing equity and balanced accounts for clients. Brian has a BSBA (Finance) from Xavier University, Cincinnati, Ohio, (1982) and an MBA (Finance) from Loyola University, Chicago, January, 1985. The CFA was awarded successful 1994. Brian has been fortunate capable to constitute for nan TheStreet.com from 2000 to 2012, and past nan WallStreet AllStars from August 2011, to Spring, 2012. Brian besides wrote for Minyanville.com, and has been quoted successful galore publications including nan Wall Street Journal.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·