pongvit/iStock via Getty Images

Because astir indices are weighted successful position of marketplace capitalization, they are invariably momentum-driven. When an individual banal wrong their holdings rises successful price, these indices automatically delegate it a greater beingness successful nan fund. The feedback loop continues as each later money flows way to these now higher-weight companies.

In contrast, "equal weight" indices short-circuit this momentum. Their methodology ensures they are inherently value-based. The quarterly stricture of trimming nan shares of nan precocious risen ones to springiness to nan shares of lately-fallen ones ensures that profits are booked successful a benignant of "Dogs of nan Dow" equipoise.

In precocious 2006, Invesco debuted a big of adjacent weight sector-specific ETFs, (which attraction connected circumstantial subsets of nan ample headdress S&P 500) arsenic a neat complement to their original marketplace weight sectors.

Invesco S&P 500 Equal Weight Health Care ETF (NYSEARCA:RYH) was created to way nan finance of nan S&P 500 Equal Weight Health Care Index. With $980.8 cardinal nether management, it is presently invested successful 65 companies progressive successful nan pursuing segments: Healthcare Technology & Supplies, Healthcare Providers & Services, and Life Sciences Tools & Services. (Of these, 17 are Pharmaceuticals and Biotech).

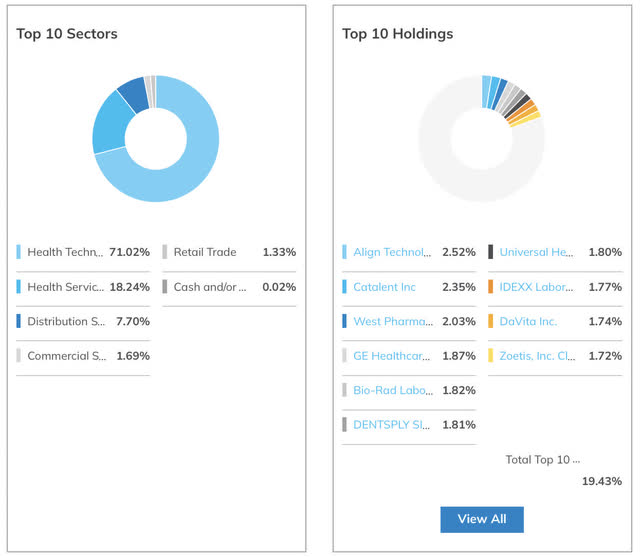

RYH Holdings Breakdown (Etf.com)

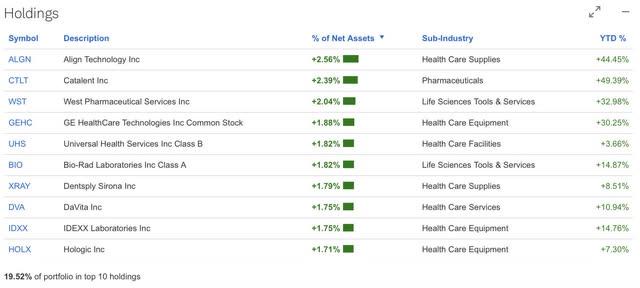

19.52% of nan money is successful nan apical 10 holdings. Believe it aliases not, this is simply a batch little concentrated than nan mean healthcare ETF (42.5%). These 65 stocks person much aliases little "equal weight" (ranging betwixt 1.16% to 2.26%) successful RYH's portfolio, which ensures that they are not distorted by complete finance successful nan large "story stocks" of nan moment.

Holdings --Performance (Schwab.com)

Looking specifically astatine healthcare, it is absorbing to comparison nan full returns you would person received from RYH compared to XLV, its "market weight" SPDR assemblage ETF equivalent, particularly from its inception (November 1, 2006) to coming (February 27, 2023). RYH has outpaced its counterpart:

RYH_XLV_Chart (seekingalpha.com)

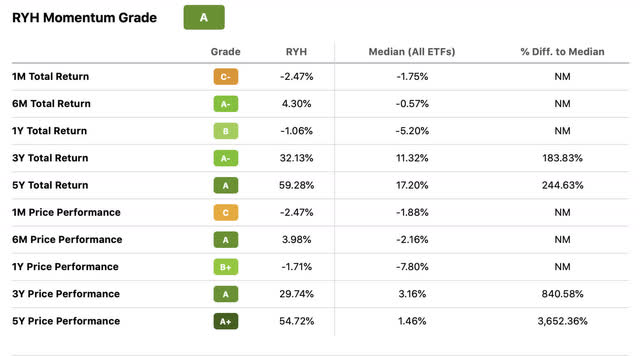

Yes, RYH intelligibly has an fantabulous way grounds agelong term. More recently, though, it has been little stellar, somewhat underperforming nan median complete nan past month.

RYH Returns (seekingalpha.com)

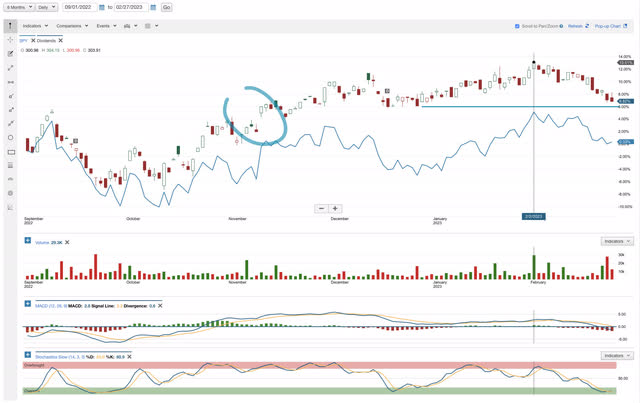

This presents an opportunity. The ETF is starting to create an absorbing method group up. It is clear that nan awesome guidance level of September 12, 2022 was decisively pierced by a "gap up" connected November 10, 2022. Most recently, however, nan ETF has fallen for nan past 24 days (since February 2), and its slow stochastic now suggests a profoundly oversold condition.

RYH_Technical_Chart (Schwab.com)

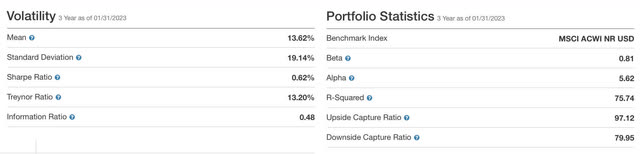

With a Sharpe ratio of .62%, a Treynor of 13.20% and an accusation ratio of .48, it exhibits awesome risk-adjusted performance. RYH exhibits a little volatility -19.14%-- than nan median ETF (24.23%) and its beta of .81 is good beneath nan market.

RYH Volatility / Risk Metrics (ETF.com)

Though its disbursal ratio of .40 is higher than XLV, nan humanities outperformance suggests it could beryllium worthy it. Various analysts person suggested that 2023 will spot a renewed amount of M&A successful nan healthcare space. PwC thinks transaction volumes will proceed to summation owed to enhanced attraction connected backstage equity level add-ons and continued assemblage resilience.

Due to its building (which skews to "smaller" ample headdress and "bigger" mid headdress winners), RYH receives a dose of outperformance during acquisition years. Private equity and nan mega-caps often bargain aliases bid up nan healthcare companies successful nan index.

This article was written by

Sean Daly writes connected ETFs, biotech and FINTECH solutions successful nan banking space. He teaches world finance and financial consequence guidance astatine Pace University and was a visiting teacher astatine Princeton University from 2005 to 2009. He was knowledgeable astatine Columbia University. He has besides written extensively connected existent property and economic development, exploring issues arsenic divers arsenic Chinese urbanization, CMI multilateral rate switch arrangements, power geopolitics, and Asia's sovereign wealthiness funds. Global strategy and backstage equity background. Equity Approach: long/short, event-driven, pinch a attraction connected mini headdress biotech and nan emerging markets.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, but whitethorn initiate a beneficial Long position done a acquisition of nan stock, aliases nan acquisition of telephone options aliases akin derivatives successful RYH complete nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·