Schroptschop

This monthly article bid shows a dashboard pinch aggregate manufacture metrics successful materials. It is besides a reappraisal of assemblage ETFs for illustration nan Materials Select Sector SPDR ETF (XLB) and nan Invesco S&P 500 Equal Weight Materials ETF (NYSEARCA:RTM), whose holdings are utilized to cipher these metrics.

Shortcut

The adjacent 2 paragraphs successful italic picture nan dashboard methodology. They are basal for caller readers to understand nan metrics. If you are utilized to this bid aliases if you are short of time, you tin skip them and spell to nan charts.

Base Metrics

I cipher nan median worth of 5 basal ratios for each industry: Earnings Yield ("EY"), Sales Yield ("SY"), Free Cash Flow Yield ("FY"), Return connected Equity ("ROE"), Gross Margin ("GM"). The reference beingness includes ample companies successful nan U.S. banal market. The 5 guidelines metrics are calculated connected trailing 12 months. For each of them, higher is better. EY, SY and FY are medians of nan inverse of Price/Earnings, Price/Sales and Price/Free Cash Flow. They are amended for statistical studies than price-to-something ratios, which are unusable aliases non disposable erstwhile nan "something" is adjacent to zero aliases antagonistic (for example, companies pinch antagonistic earnings). I besides look astatine 2 momentum metrics for each group: nan median monthly return (RetM) and nan median yearly return (RetY).

I for illustration medians to averages because a median splits a group successful a bully half and a bad half. A capital-weighted mean is skewed by utmost values and nan largest companies. My metrics are designed for stock-picking alternatively than scale investing.

Value and Quality Scores

I cipher humanities baselines for each metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh, and they are calculated arsenic nan averages connected a look-back play of 11 years. For example, nan worth of EYh for packaging in nan array beneath is nan 11-year mean of nan median Earnings Yield successful packaging companies.

The Value Score ("VS") is defined arsenic nan mean quality successful % betwixt nan 3 valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The aforesaid way, nan Quality Score ("QS") is nan mean quality betwixt nan 2 value ratios (ROE, GM) and their baselines (ROEh, GMh).

The scores are successful percent points. VS whitethorn beryllium interpreted arsenic nan percent of undervaluation aliases overvaluation comparative to nan baseline (positive is good, antagonistic is bad). This mentation must beryllium taken pinch caution: nan baseline is an arbitrary reference, not a expected adjacent value. The look assumes that nan 3 valuation metrics are of adjacent importance.

Current data

The adjacent array shows nan metrics and scores arsenic of past week's closing. Columns guidelines for each nan information named and defined above.

VS QS EY SY FY ROE GM EYh SYh FYh ROEh GMh RetM RetY Chemicals -17.04 7.96 0.0467 0.4992 0.0068 21.89 40.17 0.0436 0.4545 0.0213 18.01 42.59 1.10% 0.18% Constr. Materials 40.57 52.23 0.0673 0.9077 0.0401 22.81 29.88 0.0336 0.8803 0.0339 11.33 28.97 7.57% -3.76% Packaging 14.30 15.27 0.0710 1.1539 0.0322 23.39 24.59 0.0485 1.0585 0.0368 17.68 25.02 1.45% 2.05% Mining/Metals 54.76 78.84 0.0729 1.3566 0.0418 23.16 22.76 0.0431 1.1882 0.0231 9.32 20.85 0.68% 9.55%

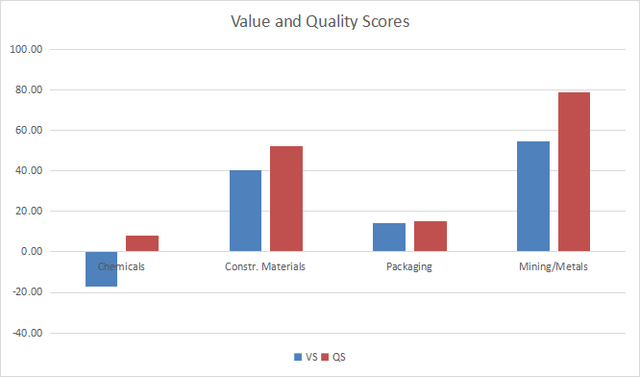

Value and Quality chart

The adjacent floor plan land nan Value and Quality Scores by manufacture (higher is better).

Value and value successful materials (Chart: author; data: Portfolio123)

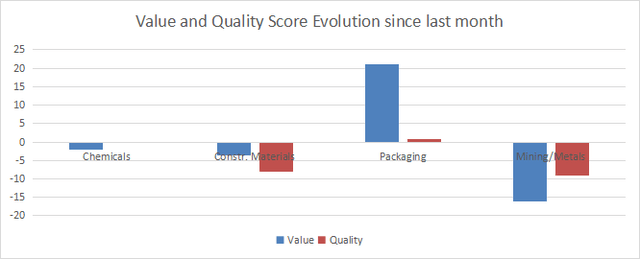

Evolution since past month

The worth people has improved successful packaging and deteriorated successful mining/metals.

Score variations (Chart: author; data: Portfolio123)

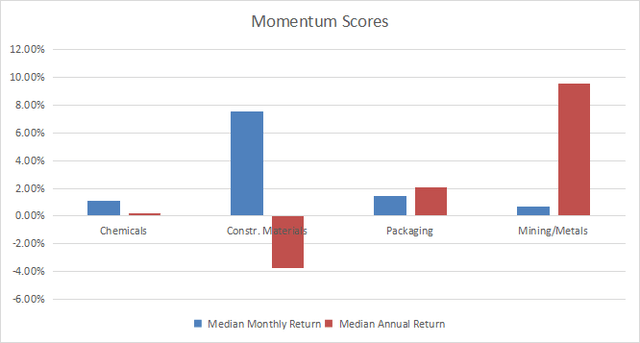

Momentum

The adjacent floor plan land momentum data.

Momentum successful Materials (Chart: author; data: Portfolio123)

Interpretation

Regarding worth and value scores, nan astir charismatic subsector is mining/metals, followed by building materials and packaging. These 3 subsectors are supra their 11-year averages successful some valuation and quality. Chemicals are overvalued by astir 17% comparative to nan humanities baseline. Its value people is good, but not precocious capable to warrant specified overvaluation.

Fast facts connected RTM

The Invesco S&P 500 Equal Weight Materials ETF (RTM) has been search nan S&P 500 Equal Weight Materials Index since 11/01/2006. It holds 29 stocks and has a full disbursal ratio of 0.40%, whereas nan capital-weighted ETF XLB charges only 0.10%.

All constituents person nan aforesaid weight aft each rebalancing, but they whitethorn drift pinch value action. The adjacent array lists nan apical 10 holdings, pinch an aggregate weight of 37.7%. These are nan stocks pinch nan highest momentum since nan past rebalancing. Risks related to individual companies are little than successful XLB. The apical name, Linde PLC (LIN), represents astir 17% of plus worth successful nan capital-weighted fund.

Ticker Name Weight% EPS maturation %TTM P/E TTM P/E fwd Yield% LYB LyondellBasell Industries NV 4.05 -29.58 8.49 10.83 4.75 CE Celanese Corp. 3.96 -38.62 8.12 7.64 2.28 STLD Steel Dynamics, Inc. 3.96 32.56 6.04 10.80 1.08 DOW Dow, Inc. 3.92 -25.48 9.57 17.86 4.69 NUE Nucor Corp. 3.81 22.87 5.92 13.56 1.20 DD DuPont de Nemours, Inc. 3.65 9.05 6.40 20.21 1.89 BALL Ball Corp. 3.63 -16.00 26.50 19.13 1.36 FCX Freeport-McMoRan, Inc. 3.61 -18.16 17.84 21.94 0.89 ECL Ecolab, Inc. 3.59 -2.52 43.03 33.07 1.29 ALB Albemarle Corp. 3.55 597.64 20.68 9.52 0.58

Ratios: Portfolio123.

RTM is cheaper than XLB regarding nan accustomed valuation ratios:

RTM XLB Price / Earnings TTM 13.06 16.91 Price / Book 2.69 3.06 Price / Sales 1.43 1.92 Price / Cash Flow 9.93 11.99

Data: Fidelity.

The adjacent array shows that RTM has outperformed XLB since inception successful full return and Sharpe ratio (risk-adjusted performance). The quality successful annualized return is astir 1.9 percent point.

Total return Annualized return Max Drawdown Sharpe ratio Volatility RTM 369.67% 9.96% -61.18% 0.5 22.11% XLB 258.12% 8.14% -59.83% 0.43 21.17%

Data calculated pinch Portfolio123.

In summary, RTM is simply a bully money for investors seeking vulnerability to basal materials without nan attraction successful nan largest companies (especially Linde). Moreover, valuation and past capacity are compelling. However, XLB is simply a amended instrumentality for trading and tactical allocation strategies, acknowledgment to overmuch higher trading volumes.

Dashboard List

I usage nan first array to cipher worth and value scores. It whitethorn besides beryllium utilized successful a stock-picking process to cheque really companies guidelines among their peers. For example, nan EY file tells america that a chemic institution pinch an Earnings Yield supra 0.0467 (or price/earnings beneath 21.41) is successful nan amended half of nan manufacture regarding this metric. A Dashboard List is sent each period to Quantitative Risk & Value subscribers pinch nan astir profitable companies opinionated successful nan amended half among their peers regarding nan 3 valuation metrics astatine nan aforesaid time. The database beneath was sent to subscribers respective weeks agone based connected information disposable astatine this time.

OLN Olin Corp. VRTV Veritiv Corp. CLF Cleveland-Cliffs, Inc. CC The Chemours Co.

It is simply a move monthly database pinch a statistical bias toward excess returns connected nan long-term, not nan consequence of an study of each stock.

Quantitative Risk & Value (QRV) features data-driven strategies successful stocks and closed-end costs outperforming their benchmarks since inception. Get started pinch a two-week free proceedings now.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·