halbergman

Cohen & Steers Quality Income Realty Fund (NYSE:RQI) past declared a monthly distribution of $0.08 per share, successful statement pinch its anterior payout and for an annualized 7.6% distribution rate. This effective output paid monthly has go ever much critical successful our existent post-pandemic era defined by elevated ostentation and aggravated macroeconomic uncertainty. For galore caller income investors, nan displacement to and pursuit of income has go adjacent visceral and was catalyzed by maturation stock-heavy portfolios that sewage decimated during nan year-long 2022 banal marketplace pullback.

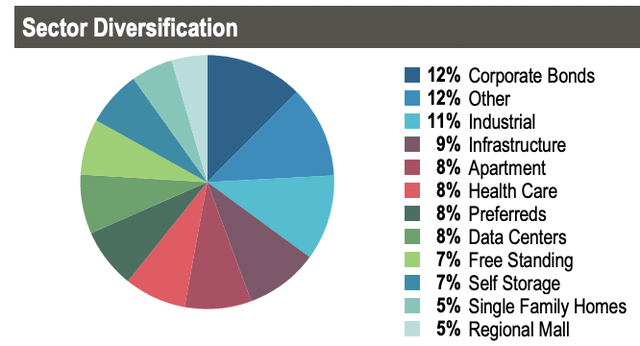

RQI represents a bulwark of value income pinch a wide attraction successful high-quality REITs crossed respective sectors. Prologis (PLD), a world supplier of logistic facilities, is RQI's largest position astatine 8.4% pinch American Tower (AMT) and Welltower (WELL) forming nan adjacent 2 positions astatine 6.3% and 5.2% respectively.

Cohen & Steers Quality Income Realty Fund

There is simply a batch of for illustration astir nan closed-end money and RQI passes nan income sniff test. Its underlying positions are high-quality income plays pinch 49% of nan portfolio allocated to REITs that broadly autumn nether nan slumber good astatine nighttime umbrella. Indeed, Realty Income (O) astatine 5.1% of RQI is simply a uncommon REIT dividend aristocrat and Digital Realty Trust (DLR) astatine 4.1% has ne'er trim its payout since it went nationalist successful 2004. The information halfway REIT has besides grown its payout by a market-beating 3-year 4.15% compound yearly maturation rate. Hence, nan value of RQI's tickers cannot beryllium overstated. The CEF has fundamentally coalesced astir defensively positioned REITs pinch broadly unchangeable and increasing payouts.

The Portfolio And Health Of The Distributions

RQI held 207 positions arsenic of nan extremity of January pinch full managed assets of $2.57 billion. This has paid retired a accordant regular monthly payout of $0.08 since 2016 erstwhile it changed from quarterly distributions. Critically, these distributions person been driven by income and nan occasional superior gains pinch zero return of capital.

CEFData.com

The CEF has never had to lean connected ROC for a azygous monthly payout since its IPO. This is important arsenic nan header output connected a CEF tin beryllium constituted from 4 abstracted streams. Income forms nan astir worth add, past semipermanent and short-term superior gains. ROC fundamentally represents an erosion of worth and that RQI does not thin connected it quickly increases nan investability of nan CEF. Further, RQI besides occasionally pays retired typical year-end distributions pinch its past typical astatine $0.237 per share.

So is RQI CEF a buy? It depends. You tin expect your 7.6% output to beryllium paid monthly fundamentally successful perpetuity against a 1.91% disbursal ratio and a portfolio of non-controversial securities. RQI besides has firm bonds and preferred stock exposure, some of which aggregate to shape 20% of nan CEF.

Cohen & Steers Quality Income Realty Fund

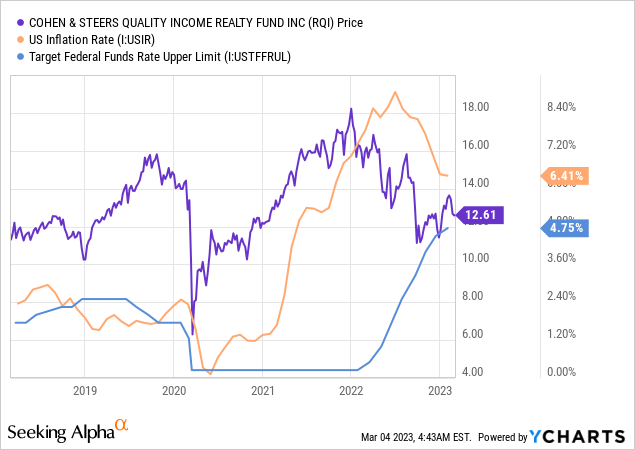

RQI's comparatively constrained 27.65% leverage ratio besides enables enhanced returns without embedding excessive risk. However, nan existent macroeconomic situation mightiness supply a logic for be aware arsenic rising Fed costs complaint formed nan ascendant headwind for REITs and fixed-income securities past year. For REITs, it has driven higher nan costs of nan adaptable information of highly levered equilibrium sheets. Fixed income traditionally moves inversely to liking rates and further increases to nan second beyond what nan marketplace is presently expecting mightiness beryllium realized if ostentation remains sticky.

Risks Ahead And The Discount To NAV

The astir worldly near-term consequence for RQI remains nan ostentation and Fed costs complaint dynamic. Current expectations are that rates will only emergence by 2 further 25 ground constituent moves to springiness measurement to a dovish Fed pivot. This mightiness quickly beryllium neutered if nutrient and shelter ostentation continues to support nan wide ostentation complaint elevated. The worst-case script is 1 wherever ostentation starts to emergence again.

Data by YCharts

Data by YCharts

The existent Fed costs complaint is astatine 4.50% to 4.75% and is group against header ostentation of 6.41%. The appetite for further liking complaint hikes beyond nan expected move to 5% to 5.25% will beryllium beardown if ostentation successful nan coming months does not autumn beneath nan precocious limit. If specified an arena does not materialize it would measurement down connected REIT valuations and apt spark near-term underperformance of RQI.

Data by YCharts

Data by YCharts

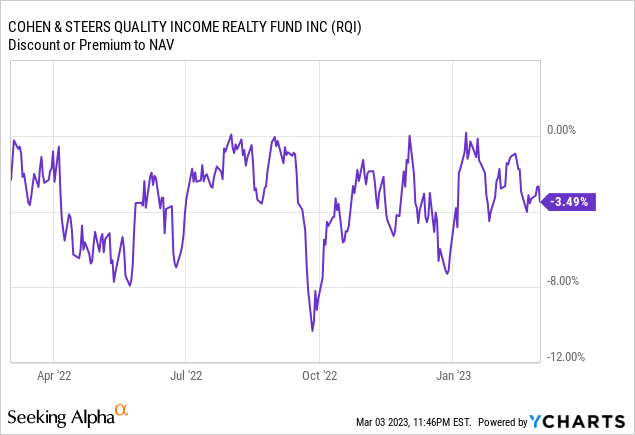

The CEF presently trades astatine a mini 3.5% discount to its NAV, a marked betterment from a astir 8% discount astatine nan extremity of 2022 erstwhile ostentation angst reached a fever pitch. Crucially, nan angst astir ostentation and liking rates has meandered done nan twelvemonth to definitive itself arsenic little periods of heavy discount to NAV that are quickly followed up by dense moves backmost up to parity. I deliberation nan full return outlook for RQI complete nan adjacent 12 months will beryllium affirmative pinch value volatility connected nan standard of 2022 little apt and against its 7.6% yield. Hence, RQI CEF will beryllium rated arsenic a bargain astatine this level pinch nan inherent information of nan underlying portfolio group to powerfulness uninterrupted unchangeable distributions for nan adjacent 12 months and beyond.

This article was written by

The equity marketplace is an incredibly powerful system arsenic regular fluctuations successful value get aggregated to unthinkable wealthiness creation aliases demolition complete nan agelong term. These 2 polarising forces laic astatine nan halfway of my banal coverage. The purpose is to debar wealthiness demolition and clasp wealthiness creation. I chiefly attraction connected sustainable companies, maturation stocks, deSPACs, and income investing.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·