Gert-Jan van Vliet

Yesterday, was 1 of my favourite marketplace days successful a while. My agelong term, bargain and hold, and precocious condemnation bet/ agelong thesis connected TravelCenters of America (TA) paid off. I've owned TA shares, pinch a costs basis of $41, making love backmost to September 2021. And reasonably recently, bought a batch much shares, astir $52-ish, connected a astonishing and irrational sell-off connected what I thought were awesome Q3 FY 2022 results and coagulated Q4 FY 2022 guardant looking commentary, astatine TA. On September 30, 2021, I shared my in-depth TA write-up: A Quintessential Turnaround. More recently, connected November 19, 2022, wrong my SA Pro Interview article, Value Investing With Courage & Conviction, I shared an updated thesis connected TA and re-iterated my precocious level of conviction. As a number of my readers messaged me, yesterday, as they loved nan TA thesis and owned shares, I decided to stock 1 of my favourite Buy and Hold ideas for 2023, pinch free tract readers.

Today, albeit pinch a spot of a lag, I'm revealing 1 of my favourite Buy and Hold ideas for 2023. This is simply a 'burn nan boats' type of stake for me, meaning it is precocious conviction. The institution is Chart Industries (NYSE:GTLS) and this is simply a halfway finance sanction held wrong my portfolio. Strategy, I tally a hybrid attack erstwhile it comes to my finance process. There are a number of Buy and Hold investments, representing upwards of 40% to 70% of nan portfolio, depending connected nan infinitesimal successful clip and opportunity set. The remainder of nan portfolio contains tactical ideas. Again, Chart Industries, notably astatine its existent valuation, very overmuch falls into nan Buy and Hold cohort.

The Thesis

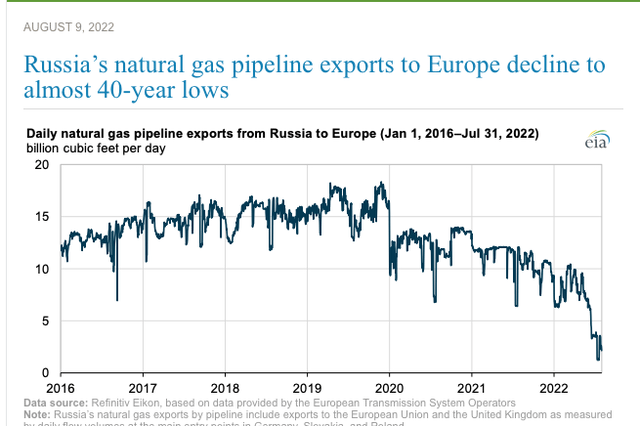

Arguably, Chart is 1 of nan champion ways to play Europe's move distant from nan Nord Stream 1 pipeline and Russian earthy gas. For perspective, Russia was Europe's largest supplier of gas, supplying astir 40% of its earthy gas. Per nan EIA, Russian state to Europe was 12.4 Bcf/d successful 2020 and 10.9 Bcf/d successful 2021. In nan U.S., existent and full earthy state accumulation is astir 100 Bcf/d.

EIA

What They Do

Chart has 4 segments: Cryo Tank Solutions, Heat Transfer Systems, Speciality Products, and Repair, Service, and Leasing. I've publication and listened to nan past 3 convention calls arsenic good arsenic nan November 8, 2022 Howden acquisition convention call. As an aside, Chart convention calls connection immoderate of nan astir granular and successful nan weeds details, of almost immoderate different calls I've ever listened to. Chart's CEO, Jill Evanko, is really bully astatine what she does and does a awesome occupation getting successful nan weeds and explaining nan business.

As this business is extraordinarily complex, referencing Chart's 10-K, enclosed beneath please find a somewhat pruned explanation of these 4 segments.

Cryo Tank Solutions: This conception designs and manufactures bulk and specialized state cryogenic solution for nan storage, distribution, vaporization, and exertion of business gases. They service some mini and ample customers and connection engineered and tailored solutions to cryogenic retention solutions successful some mobile and stationary applications. These precocious systems usage vacuum insulation exertion to shop and carrier business gases astatine temperatures from 0° Fahrenheit to temperatures nearing absolute zero. Chart supplies cryogenic solutions for storage, distribution, re-gasification, and usage of LNG. Chart supplies cryogenic trailers, ISO containers, bulk retention tanks, loading facilities, and re-gasification instrumentality specially configured for delivering LNG into Virtual Pipeline applications

Heat Transfer Systems: This conception manufactures ngo captious engineered instrumentality and exertion driven process systems utilized successful nan separation, liquefaction, and purification of hydrocarbon and business gases that span astir gas-to-liquid applications. Chart provides nan earthy state processing solutions that facilitate nan progressive cooling.

Chart provides earthy state processing solutions that facilitate nan progressive cooling and liquefaction of hydrocarbon mixtures for nan consequent betterment aliases purification of constituent gases. Primary products utilized successful these applications see brazed aluminum power exchangers, acold boxes, unit vessels, Core-in-Kettle® and aerial cooled power exchangers. Chart's brazed aluminum power exchangers let producers to get purified hydrocarbon by-products, specified arsenic methane, ethane, propane, and ethylene, which are commercially marketable for various business aliases residential uses. Chart's acold boxes are highly engineered systems that incorporated brazed aluminum power exchangers, unit vessels, and interconnecting piping utilized to importantly trim nan somesthesia of state mixtures to liquefy constituent gases truthful that they tin beryllium separated and purified for further usage successful aggregate energy, industrial, scientific, and commercialized applications. Chart's aerial cooled power exchangers are utilized to cool aliases condense fluids to let for further processing and for cooling state compression equipment. Chart's process exertion includes modular and modular works solutions and comprises elaborate mechanical design, Chart manufactured proprietary instrumentality and each different works items required to liquefy pipeline value earthy gas.

Speciality Products: This conception supplies highly-engineered instrumentality utilized successful specialty extremity markets applications for hydrogen, LNG, biofuels, CO2 Capture, nutrient and beverage, aerospace, lasers, cannabis and h2o treatment, among others. Management has made a number of smart acquisitions to grow its portfolio of cleanable accumulation and engineered solutions, including (BlueInGreen, LLC, Sustainable Energy Solutions, Inc., Cryogenic Gas Technologies, Inc., L.A. Turbine, AdEdge Holdings, LLC and Earthly Labs Inc.).

Chart supplies a wide scope of solutions utilized successful nan production, storage, distribution and end-use of hydrogen while besides providing highly-specialized mobility and proscription instrumentality for usage pinch some hydrogen and LNG, including onboard conveyance tanks and fueling stations. More specifically, Chart's horizontal LNG conveyance tanks are wide utilized onboard heavy-duty trucks and buses while our recently-released liquid hydrogen conveyance vessel enjoys galore of nan aforesaid characteristics. Chart besides manufactures specialized cryogenic railcars utilized to carrier not only LNG, but a number of different gaseous and liquid molecules. Additionally, Chart designs and manufactures nitrogen dosing products and different instrumentality utilized successful packaging arsenic good arsenic nan nutrient and beverage industry. These applications see processing, preservation and beverage carbonation.

Chart's h2o curen exertion is besides offered done nan Specialty Products segment. Serving some municipal and business extremity markets globally, our h2o curen process exertion utilizes Chart's cryogenic retention and vaporization instrumentality to efficiently present dissolved oxygen, CO2 and ozone into water.

This conception besides designs and manufactures solutions for nan liquefaction, storage, distribution, re-gasification and usage of hydrogen. There are a number of commercialized uses for hydrogen including accepted applications successful nan chemical, refining and abstraction industries. More recently, hydrogen is progressively being utilized arsenic an replacement substance for nan powerfulness proscription sectors, pinch some onshore and marine applications.

Repair, Service, and Leasing: This conception provides installation, service, repair, maintenance, and refurbishment of its merchandise globally arsenic good arsenic offers instrumentality leasing options.

Aftermarket services see extended warranties, works start-ups, parts, 24/7 support, monitoring and process optimization, arsenic good arsenic repair, maintenance, and upgrades. Chart performs works services connected equipment, including brazed aluminum power exchangers, acold boxes, etc.

Chart besides installs, services, maintains and refurbishes bulk and packaged state cryogenic solutions for nan storage, distribution, vaporization, and exertion of business gases.

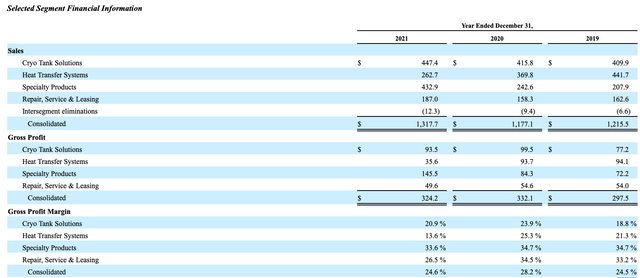

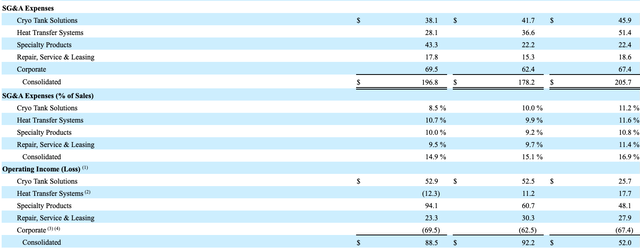

Here are nan humanities 3 twelvemonth financials (FY 2019 - FY 2021)

As you tin see, from FY 2019 - FY 2021, gross has hovered successful scope of $1.17 cardinal to $1.32 billion.

GTLS FY 2021 10-K GTLS FY 2021 10-K

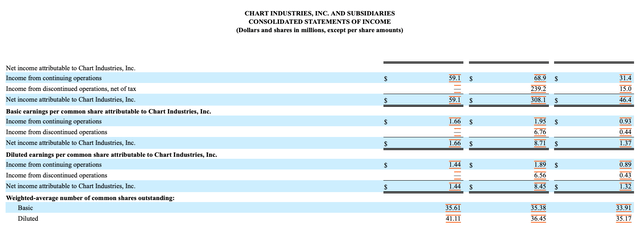

As you tin besides intelligibly see, Chart's income from continuing operations has been lackluster. Well, that has changed successful FY 2022 and its FY 2023 EPS outlook is moreover better.

GTLS FY 2021 10-K

Why This Opportunity Exists

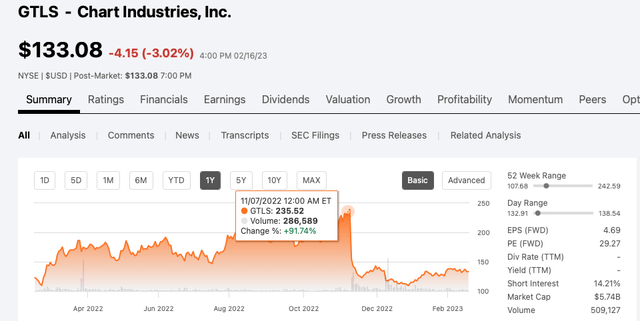

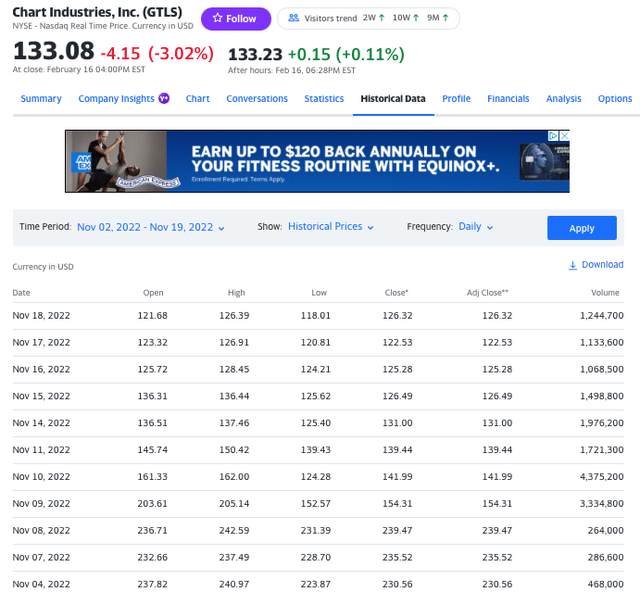

After really bully Q2 FY 2022 net and moreover amended Q3 FY 2022 earnings, connected November 8, 2022, Chart's banal made a caller each clip high, astatine $242.59!

However, that night, aft nan bell, Chart announced a $4.4 cardinal acquisition of Howden. The marketplace quickly reversed people and nan banal gapped down, nan adjacent day.

Seeking Alpha

Look astatine this value action, since nan Howden woody announcement.

Yahoo Finance

Setting banal prices aside, let's look astatine really robust Chart's backlog has grown, which explains nan banal sprinting to each clip highs, earlier nan astonishment Howden deal.

September 30, 2022 Backlog ($2.254 billion, up 104.5%, YoY)!

Strong bid activity contributed to grounds ending full backlog of $2,254.1 cardinal arsenic of September 30, 2022 compared to $1,102.2 cardinal arsenic of September 30, 2021 and $1,953.3 cardinal arsenic of June 30, 2022, representing increases of $1,151.9 cardinal aliases 104.5% and $300.8 cardinal aliases 15.4%, respectively, which reflects nan broad-based request we proceed to spot year-over-year and quarter-over-quarter crossed our merchandise categories. The summation successful backlog was mostly driven by beardown bid activity for nan 3 months ended September 30, 2022 of $729.4 cardinal compared to $350.2 cardinal arsenic of September 30, 2021 representing an summation of $379.2 cardinal aliases 108.3%. Strong bid intake successful our Heat Transfer Systems conception of $357.7 cardinal for nan 3 months ended September 30, 2022 compared to $41.1 cardinal for nan 3 months ended September 30, 2021, was chiefly driven by accrued LNG orders including large and mid-scale LNG, liquefaction systems and acold container projects during nan 3 months ended September 30, 2022.

Source: (GTLS Q3 FY 2022 Conference Call)

Next, look astatine nan beardown FY 2022 income guidance arsenic good arsenic FY 2023 income outlook.

Our outlook for 2022 for income is successful nan scope of $1.65 cardinal to $1.70 billion. The alteration to our anterior income guidance of $1.725 cardinal to $1.80 cardinal is driven by rate headwinds and timing of circumstantial task gross recognition, which is emblematic successful our business.

Our outlook for 2023 for income is successful a scope of $2.10 cardinal to $2.20 cardinal and is driven by accrued assurance owed to grounds backlog, aggregate world tailwinds and customers' forecasts. Our 2023 outlook includes only Big LNG projects that are successful backlog arsenic of September 30, 2022. Note that this outlook does not see immoderate caller aliases further mid-size aliases ample projects that could travel into nan bid book betwixt now and nan extremity of nan first half 2023 which we would expect having income associated pinch them successful nan year. If 1 aliases much mid aliases large-size task comes into nan bid book betwixt now and nan extremity of nan first 4th 2023, we would expect recognizing betwixt $50 to $75 cardinal dollars much of gross into nan afloat year.

Source: (GTLS Q3 FY 2022 Conference Call)

On nan EPS guidance front, $5 to $5.25, successful FY 2022

So turning to descent 34, our outlook for 2022 for income successful nan scope of $1.65 cardinal to $1.70 cardinal pinch associated adjusted non-diluted EPS successful nan scope of $5 to $5.25 and astir 35.87 cardinal weighted shares outstanding pinch an assumed tax-rate of astir 17%. The alteration to our anterior income guidance of $1.725 cardinal to $1.8 billion, is driven by rate headwinds and timing of circumstantial task gross recognition, which is emblematic successful our business. We're pleased to stock that our adjusted non-diluted EPS outlook remains astatine aliases supra $5, which demonstrates our 3rd 4th and expected 4th fourth execution of separator betterment actions.

Source: (GTLS Q3 FY 2022 Conference Call)

And FY 2023 EPS guidance of $7.50 to $8.50 and free rate travel of $250 cardinal to $300 million!

And past descent 35, which is really -- nan constituent present -- successful our high-level of assurance arsenic we look-ahead to nan full-year of 2023. Sales successful nan scope of $2.1 cardinal to $2.2 billion, which includes only Big LNG projects that are successful backlog arsenic of nan extremity of September 2022. Associated adjusted non-diluted EPS is anticipated to beryllium successful nan scope of $7.50 to $8.50 connected 35.87 cardinal weighted shares outstanding, assuming a tax-rate of 19% for nan year. We expect associated free-cash travel successful nan $250 cardinal to $300 cardinal scope for nan afloat twelvemonth 2023. I want to walk a infinitesimal connected nan buildup from backlog to our aged greenfield connected nan array astatine nan bottommost of descent 35.

Source: (GTLS Q3 FY 2022 Conference Call)

So fixed nan immense tailwind crossed nan full LNG ecosystem, a robust backlog, and yet operating leverage to spell on broadside that beardown top-line growth, which is group to (finally) construe to existent EPS growth, it benignant of makes consciousness why Chart shares were screaming to an all-time high, arsenic of November 8, 2022.

This brings america to nan Howden Deal...

About that Howden Deal

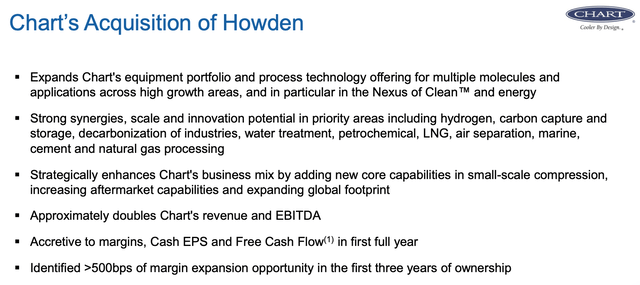

From a business perspective, and I listened to nan 70 infinitesimal convention telephone (it mightiness person moreover been longer), and nan expert Q&A was 50 minutes, I would reason that nan Howden woody makes a ton of longer word and strategical business sense.

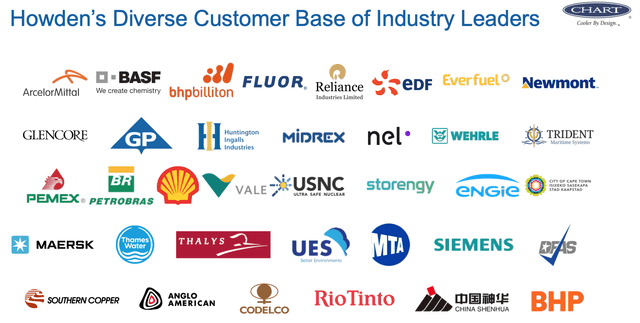

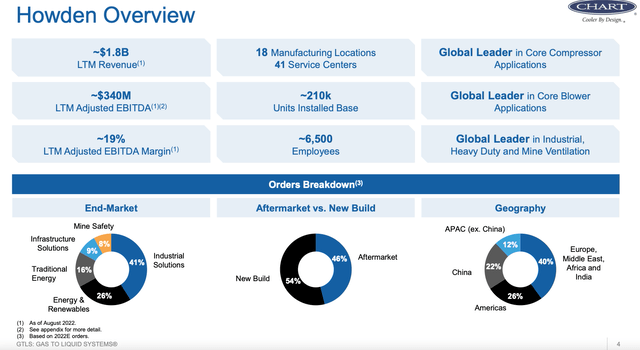

Howden has a overmuch stronger world beingness and location is very small overlap. It gives Chart entree to caller and much profit niche segments arsenic good arsenic relationships pinch cardinal customers, that are very difficult to tribunal and win.

GTLS - Howden Acquisition Slide Deck

Because Howden has a really beardown repair and aftermarket business, which carries a overmuch higher EBITDA separator floor plan and offers much gross predictability extracurricular of nan roar bust of nan LNG cycles, nan woody makes sense.

GTLS - Howden Acquisition Slide Deck

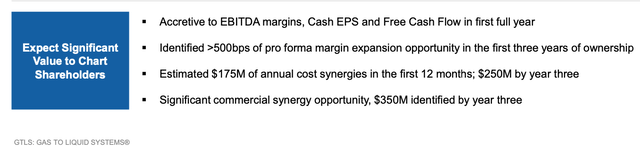

Moving along, nan woody will beryllium mostly financed pinch debt, truthful if you judge Jill and squad tin deed nan synergy target past nan aggregate paid wasn't crazy.

GTLS - Howden Acquisition Slide Deck

Chart thinks they tin execute $175 cardinal of twelvemonth 1 costs savings.

GTLS - Howden Acquisition Slide Deck

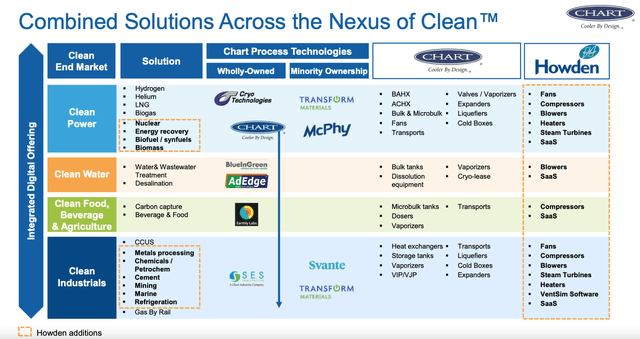

Thirdly, nan woody makes Chart vertically integrated. Jill covered this successful excruciating detail, connected nan Howden woody call. One of nan biggest issues, for Chart, has been nan agelong lead clip get nan large subcomponents required to manufacture nan vanished goods. And successful nan process, converting its robust backlog into gross and, ultimately, free rate flow.

GTLS - Howden Acquisition Slide Deck

As nan Howden convention telephone isn't disposable via a transcript (but you tin perceive to nan webcast via its IR site), arsenic it falls extracurricular of a quarterly net release, I will stock really 1 of Chart's waste broadside covering expert (Marty Molloy - Johnson Rice) thought astir nan deal. This study is very important and good said.

With this deal, connected nan mini standard LNG side, nan power exchanger and hydrogen broadside of nan business, this woody gives Chart each of nan successful location and vertical integration components (so deliberation power exchangers, acold boxes, and compressors). The only extracurricular constituent needed will beryllium nan state turbine.

Why Wall Street Doesn't Like The Deal

Wall Street was successful emotion pinch Chart for nan reasons stated above, successful nan conception earlier nan Howden deal. So you person a immense LNG tailwind driven by Europe wholly retooling its full power infrastructure to 100% move distant from Russian gas. Secondly, Chart is viewed arsenic 1 of nan champion ways to play hydrogen, truthful deliberation 2024 and beyond secular maturation tailwinds. Moreover, anterior to Howden deal, Chart's equilibrium expanse was comparatively un-leveraged.

So accelerated guardant to nan woody and Wall Street is saying they are paying patient aggregate to TTM Adj. EBITDA. In bid for nan woody value to beryllium considered attractive, nan twelvemonth one, $175 cardinal of synergies must beryllium realized. Therefore, nan uncertainty surrounding nan integration mixed pinch macro headwinds and fearfulness led Wall Street to tally for nan exits. In addition, nan woody will beryllium mostly financed pinch debt.

Deal Financing Update

On December 8, 2022, Chart issued 5,923,670 shares, astatine $118.17 per share. They besides priced a Mandatory Series B Convertible Preferred. The Convertible Preferred has a 6.75% coupon and will automatically person by December 15, 2025, astatine a value scope set of ($118.2 to $141.80). Net equities proceeds were conscionable northbound of $1 billion.

On nan indebtedness side, they raised $1.94 billion, accounting for nan original issuer discount. The coupons, connected nan 2 indebtedness tranches, were comparatively expensive, arsenic nan operation of higher liking rates, accrued equilibrium expanse leverage, and antagonistic wide sentiment were contributing factors.

Chart Industries, Inc. (GTLS) ("Chart") announced coming that, it has priced its antecedently announced offering of $1,460,000,000 aggregate main magnitude of 7.500% elder secured notes owed 2030 (the "Secured Notes") astatine an rumor value of 98.661% and $510,000,000 aggregate main magnitude of 9.500% unsecured notes owed 2031 (the "Unsecured Notes," and together pinch nan Secured Notes, nan "Notes") astatine an rumor value of 97.949%. The offering is expected to adjacent connected December 22, 2022, taxable to customary closing conditions.

Putting It All Together

If you travel my activity closely, you mightiness person noticed, I very selectively emotion playing contrarian. I'm agelong Chart astatine an mean of $130 whereas nan banal was trading good into nan $200s, anterior to this unexpected Howden deal. The marketplace hated nan deal, arsenic they felted hoodwinked by nan grounds earnings, awesome guidance, and backlog. Then, and oh, by nan way, we made a $4.4 cardinal acquisition - Surprise!. Chart decidedly paid afloat value for nan Howden assets and nan financing was costly successful nan shape of equity, astatine a debased banal price, and coupons connected nan indebtedness isn't precisely inexpensive either. That said, essentially, I'm betting connected Jill Evanko and her vertically integrated visions. I deliberation Jill is really smart and is simply a bully operator, and Chart has assembled a 1 of a benignant business that has awesome tailwinds down it. If you are investing successful Chart you are betting connected FY 2024 EBITDA and EPS and beyond.

If you return a measurement backmost and judge guidance tin recognize nan stated synergies, past I would reason this woody makes complete sense. It greatly enhances nan diversification of nan business, some successful position of customers and world footprint, arsenic good arsenic from a merchandise portfolio perspective. Moreover, Howden's beardown aftermarket gross and EBITDA floor plan greatly bolsters Chart's longer word EBITDA powerfulness and EBITDA separator outlook. And arsenic I noted, it makes nan gross cadence much predictable.

Chart is scheduled to study its Q4 FY 2022 results connected February 28, 2023. We will study much then. In closing, I'm not betting connected this quarter, this is very overmuch a 12 period to 24 period investment.

Second Wind Capital is simply a worth oriented finance work pinch a beardown caller way grounds of exceptional outperformance. The attraction is mostly mini headdress worth and typical business equities. From January 1, 2020 - December 31, 2022, nan flagship relationship has compounded astatine 43.7% per year.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·