Mar. 01, 2023 8:25 AM ETFV, QQQ, IVW, IWF, VUG, PWB, FPX, PDP, RPG, FTC, MGK, IWY, FVC, SFY, QQH, FDG, QQC, QQD, IQM, ILCG, SPYG, ONEQ, IUSG, QQEW, QQXT, SCHG, VOOG, VONG, SPGP, QQQE, GURU, MMTM, CACG, MTUM, FBGX, STLG, PTNQ, SPMO, LEAD, MILN, FDMO, TTAC, GVIP, NULG, LRGE, AIEQ, JMOM, TMFC, QGRO, PLAT, SFYF, AMOM, QRFT, XOUT, DWAW, NJAN, DWEQ, DWUS, ECOZ, FBCG, TCHP, TGRW, QQQM, RORO, ENTR, IVSG, PLDR, PFUT, PGRO, WGRO, ATFV, KNGS, GK, QPX, LCG, SXQG, SENT, FGRO, FMAG, MMLG, GGRW, XDQQ, DFNV

Summary

- US maturation stocks were deed difficult successful past year’s downturn, pinch nan mega-caps accounting for astir half of nan market’s decline.

- Some mega-caps will clasp ascendant business positions and whitethorn proceed to connection charismatic investing opportunities.

- By positioning beyond nan mega-caps, portfolio managers tin besides amended their consequence budgeting. A broader benchmark reduces nan search correction of portfolios pinch ample underweights of mega-caps.

tadamichi

By Vinay Thapar, CFA and John H. Fogarty, CFA

Broadening US Market Opens Wider Growth Opportunities

Past capacity does not guarantee early results.

*FAANGM includes Meta Platforms (Facebook), Amazon, Apple, Netflix, Alphabet Inc. (Google) and Microsoft.

†Where securities person been excluded from nan index, nan excluded weights were reallocated amongst nan remaining holdings connected a market-cap weighted basis.

Left show done December 31, 2022; correct show arsenic of February 17, 2023

Source: FactSet, FTSE Russell and AllianceBernstein (AB)

US maturation stocks were deed difficult successful past year’s downturn, pinch nan mega-caps accounting for astir half of nan market’s decline. Now, nan changing contours of nan marketplace mean investors tin seizure a broader array of betterment candidates while incurring little benchmark risk.

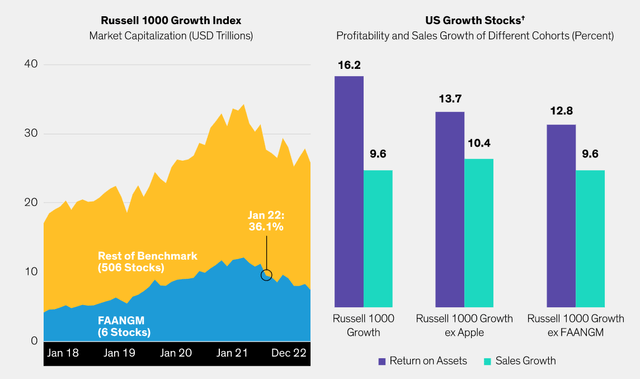

Last year’s shingle retired of mega-cap US stocks is reshaping nan market. The alleged FAANGM stocks—Meta Platforms (Facebook) (META), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), Alphabet Inc. (Google) (GOOG)(GOOGL) and Microsoft (MSFT)—dominated marketplace capacity for respective years. At its highest successful January 2022, nan FAANGM cohort comprised 36% of nan Russell 1000 Growth benchmark. By nan extremity of past year, that group comprised 29% of nan scale (Display).

Bigger Pond for Growth Investors

To beryllium sure, nan aggregate weight of nan largest companies is still supra pre-pandemic levels. Yet erstwhile nan marketplace capitalization of stocks worthy a mixed $7 trillion falls by a fewer points, it opens nan doorway for a wider array of stocks to lend to marketplace and portfolio returns. This intends discerning investors person a bigger pond to food successful for companies pinch resilient businesses, coagulated profitability and charismatic maturation prospects that tin execute good done challenging economical times.

Market information show that features for illustration these tin beryllium recovered distant from nan mega-caps. For example, successful mid-February, nan Russell 1000 Growth’s return connected assets—a cardinal measurement of profitability—was 16.2% and its income maturation was 9.6%. When you portion Apple retired of nan index, profitability declines, but maturation really increases. And erstwhile nan full FAANGM cohort is removed, profitability is still rather charismatic and maturation mostly unchanged, successful our view. In different words, we judge it’s imaginable to create a diversified portfolio of charismatic US maturation stocks coming without making sacrifices aliases concentrating excessively heavy successful nan largest names.

Improved Conditions for Risk Budgeting

Of course, immoderate mega-caps will clasp ascendant business positions and whitethorn proceed to connection charismatic investing opportunities. However, passive portfolios will beryllium forced to ain nan full cohort. We judge each institution should beryllium evaluated individually and held astatine positions due to a portfolio’s finance accuracy and discipline. In an situation of structurally higher ostentation and liking rates, accrued selectivity is basal to place those pinch robust semipermanent maturation prospects.

By positioning beyond nan mega-caps, portfolio managers tin besides amended their consequence budgeting. A broader benchmark reduces nan search correction of portfolios pinch ample underweights of mega-caps.

The civilized of nan story? Portfolios seeking to seizure early marketplace activity don’t person to trust connected yesterday’s champions to thrust tomorrow’s returns.

The views expressed herein do not represent research, finance proposal aliases waste and acquisition recommendations and do not needfully correspond nan views of each AB portfolio-management teams and are taxable to revision complete time.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

AB is simply a research-driven finance patient that combines finance penetration and innovative reasoning to present results for our clients. At AB we judge that investigation excellence is nan cardinal to amended outcomes and arsenic a consequence we person built a world patient pinch exceptional investigation capabilities. We connection a wide array of finance services that span geographies and plus classes to meet nan needs of backstage clients, communal money investors and organization clients astir nan world.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·