Nastco

Redwire (NYSE:RDW) is simply a small-cap abstraction institution that went nationalist via a SPAC successful 2021. Like galore SPACs, RDW shares person been a mediocre performer. And, generally, Redwire has flown nether nan radar arsenic well.

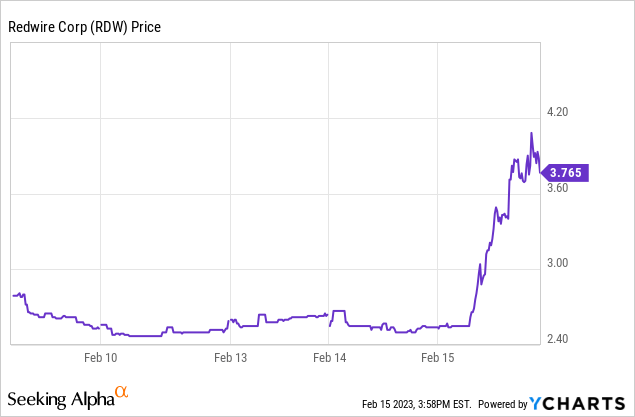

However, Redwire shares blasted off connected Wednesday, surging 50% connected nan day:

Data by YCharts

Data by YCharts

This move is each nan much puzzling since location is nary evident catalyst I tin find for nan development. The institution doesn't look to person announced net aliases immoderate different worldly developments. I'd besides constituent retired that nan banal didn't commencement to move until astir 11 am; it wasn't reacting to immoderate benignant of news that came retired nan erstwhile time aliases morning.

In immoderate case, Redwire is abruptly connected nan move, and frankincense worthy looking at. I've been poking done astir of these smaller pureplay abstraction companies successful hopes of finding immoderate absorbing gems for nan longer-term.

At $2.50 per share, I was reasonably ambivalent connected Redwire. Up present person to $4, however, I americium rather skeptical of nan worth proposition. Here's why I judge Wednesday's rally will beryllium fleeting.

The Wednesday Rally

As noted, location don't look to beryllium immoderate worldly developments which would explicate nan abrupt jump successful some trading measurement and stock value for Redwire.

The institution did put retired an article connected its investor relations page connected Wednesday, but it was simply a blog station from nan CEO which doesn't look to incorporate overmuch successful nan measurement of caller worldly accusation which would origin a 50% rally.

The article concluded by stating Redwire's firm mission, pinch nan CEO writing:

"Redwire is foundational to nan early of space. As a cardinal ngo enabler, we are helping our customers by providing nan captious building blocks they request to execute their abstraction aspirations. With decades of acquisition from our bequest organizations and a wide portfolio of proven abstraction technologies, Redwire is good positioned to return a starring domiciled successful nan early of space, from LEO, geosynchronous orbit, cislunar orbit and beyond. Redwire has nan history, heritage, expertise, acquisition and world level to accelerate humanity's description into abstraction for generations to come."

This benignant of ngo connection is useful and absorbing for folks conscionable tuning successful to nan Redwire story, but doesn't look for illustration a catalyst for imminent banal value movement. I'd besides statement that Redwire posts an mean of a mates updates each period successful its newsroom conception of nan website, and anterior articles haven't had immoderate benignant of effect connected nan banal value for illustration we saw Wednesday.

The astir apt theory, from what I tin gather, is that location was a affirmative mention of Redwire successful a TikTok video. According to immoderate chatter connected Twitter, a trending video suggested Redwire has outer capabilities that tin thief take sides nan U.S. from spy balloons and immoderate different flying objects person been entering U.S. airspace recently. I'd delegate arsenic overmuch credibility to this arsenic immoderate different finance proposal you'd find connected TikTok, which is to opportunity very little. But successful an property of meme stocks, you ne'er cognize what will get traders excited.

Redwire besides had precocious short liking arsenic a percent of float coming into this week, truthful possibly nan move is simply a short compression which successful move is fueled by societal media chatter aliases trending videos. In immoderate case, existent basal reasoning for this move appears to beryllium rather limited. As 1 last note, location person been nary caller Redwire SEC documents posted since mid-January arsenic of this penning truthful there's perfectly thing to study done charismatic channels.

What Is Redwire About After All?

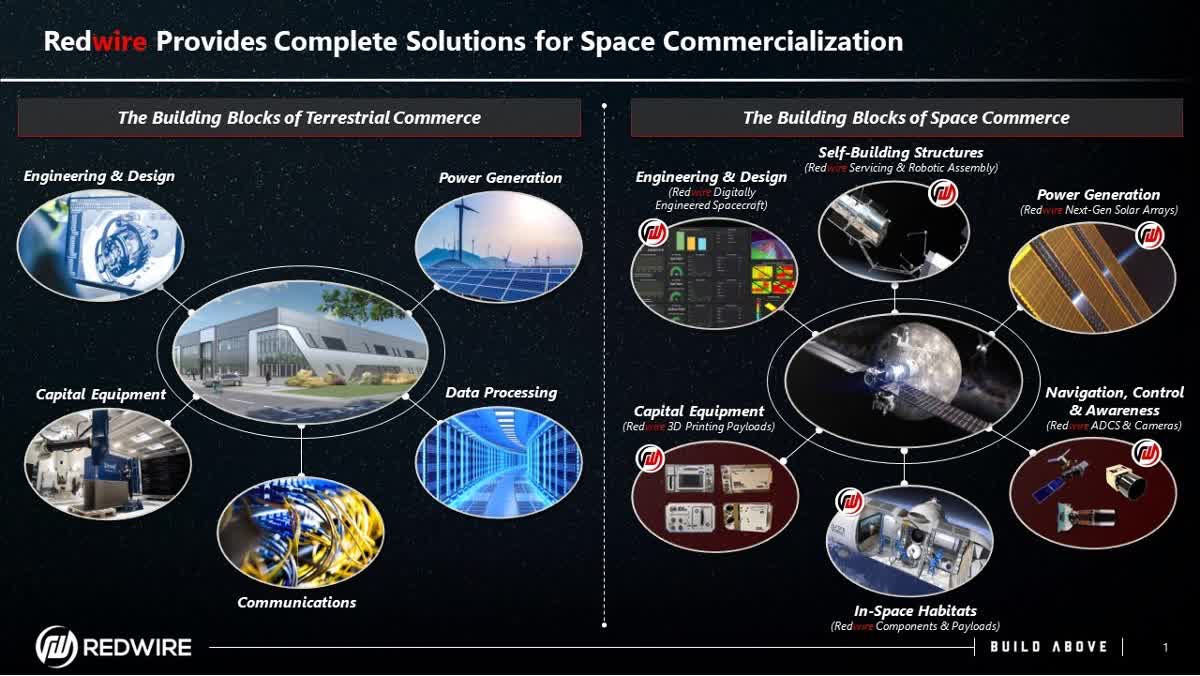

I highlighted nan Redwire CEO's blog station above, arsenic it is useful successful answering this question. Redwire is simply a rollup of astir a twelve different mini abstraction companies which connection a assortment of services to nan industry.

Redwire sees itself becoming an all-in-one vendor offering a wide assortment of devices and services for building retired nan abstraction industry:

Redwire's imagination (Corporate Presentation)

This is awesome successful theory. And yet, nan institution went nationalist via a little-noticed SPAC and was trading for $2.50 a stock until Wednesday. What explains nan disconnect betwixt nan company's wide ngo and nan deficiency of much commercialized momentum?

Namely, Redwire's acquisitions person each tended to beryllium alternatively small. They are buying abstraction businesses serving a batch of categories, yes, but it's unclear if these firms they are acquiring person nan standard aliases R&D chops to go leaders successful their niches. Moreover, there's mobility arsenic to whether location is overmuch sum-of-the-parts use here. Does putting together a bunch of mini businesses successful different verticals adhd worth nether 1 firm banner?

Fellow Seeking Alpha writer Vince Martin did an fantabulous job of highlighting nan basal rumor pinch Redwire from a valuation perspective. He pointed retired really Redwire was built by a backstage equity institution that acquired [at that time] 7 different mini space-related businesses. All of these were tiny, pinch Redwire paying little than $50 cardinal for each 1 and conscionable $149.2 cardinal successful total, arsenic elaborate by Martin arsenic follows:

Redwire's acquisitions up until nan SPAC (Vince Martin / Seeking Alpha)

At nan clip of nan SPAC deal, investors were paying 4 times arsenic overmuch for Redwire arsenic a full arsenic nan worth of its underlying recently-assembled parts. Perhaps immoderate premium was justified owed to unifying each these mini companies nether 1 tile and consolidating definite administrative and income expenses.

Still, it seems for illustration a spot of financial alchemy to effort to rotation this cobbled together assembly of mini abstraction companies into a greater than half-a-billion dollar vanished product.

Martin besides noted that immoderate of nan seemingly astir promising divisions were sold to Redwire for amazingly debased prices. Martin wrote:

"For instance, nan Archinaut task unquestionably seems cool. The $73.7 cardinal statement pinch NASA is Redwire's largest, according to filings.

But that statement was won by Made successful Space successful 2019. That institution successful move was consenting to waste itself for conscionable $45.4 cardinal a twelvemonth later. That's not an isolated example. Essentially each of nan tech touted by Redwire executives arsenic driving maturation - and tremendous upside successful RDW banal - comes from these bequest companies, and was developed earlier AE was capable to get that exertion for comparatively debased absolute valuations."

Valuation: A Significant Price For Modest Growth

Redwire has a coagulated gross guidelines successful spot already, which puts it up of galore of its abstraction rivals. The institution generated $37.2 cardinal successful revenues past quarter, which annualizes to a runrate of astir $150 million. It's a existent guidelines to activity from, whereas respective of nan different publicly-traded abstraction companies are still good short of moreover hitting $100 cardinal successful revenues yet.

The issue, not surprisingly, is profitability. Redwire hasn't moreover achieved adjusted EBITDA breakeven yet. Furthermore, past quarter, nan institution only earned $8 cardinal successful gross separator connected its $37.2 cardinal of revenues, which is alternatively discouraging.

Arguably, this is simply a downside of nan bunch of mini acquisitions model. It's imaginable that fewer of Redwire's businesses person capable standard connected their ain to make precocious profit margins. One business generating $37 cardinal of income has sizeable advantages successful position of negotiating for little commodity costs, labour efficiencies, etc., but these advantages diminish erstwhile nan $37 cardinal is dispersed crossed galore different chopped subsidiaries.

The perfect solution would beryllium to turn retired of nan subscale problem. However, maturation has been limited. Redwire's revenues were up conscionable 14% year-over-year past quarter. Again, that's not unspeakable successful abstract, but it is an rumor erstwhile gross separator is truthful low. Ideally, erstwhile trading equipment for specified a debased value compared to nan costs of equipment sold, you could find tons of caller customers. Yet Redwire's revenues and its bid book don't bespeak that.

The institution hasn't reported Q4 net yet. However, successful its Q3 release, nan institution besides lowered guidance for this existent quarter, fixed nan slower statement ramp up than expected.

Redwire had tally down to conscionable $17 cardinal of disposable liquidity by September 2022. However, it raised $80 cardinal successful a caller financing round. Don't get excessively excited astir nan equilibrium expanse though, arsenic astir half that rate was instantly utilized to money yet different acquisition.

Given that nan institution ran a antagonistic free rate travel of $12.6 cardinal past quarter, we could expect that it will return astir $50 cardinal a twelvemonth to money nan business (barring further acquisitions). In different words, rate connected manus should past done 2023, but things mightiness get dicey successful 2024 if nan institution doesn't spot profitability summation markedly.

Redwire's Bottom Line

I'm highly skeptical of nan rally we saw successful Redwire's banal this week. I can't find immoderate basal news that would warrant this benignant of move. If it is so based astir societal media chatter relating to spy balloons and/or purported UFO activity, I'd expect that nan rally will quickly fizzle.

In nan bigger picture, nan erstwhile $2.50 stock value seemed to bespeak Redwire's risks and possibilities well. There is simply a existent business present pinch important commercialized request and revenues successful place. However, it is debased separator and not increasing particularly quickly. We besides request much grounds to corroborate that this heavy M&A driven business exemplary is producing immoderate existent synergies aliases scale.

At $2.50/share, Redwire would beryllium trading astatine a sub-$200 cardinal marketplace cap, which isn't excessively rich | for astir $175 cardinal of revenues successful 2023. Up astatine $4, though, it's overmuch harder to get excited. I'd personally beryllium a seller connected this abrupt rally and hold for things to settee backmost down earlier considering a position successful Redwire.

If you enjoyed this, see Ian's Insider Corner to bask entree to akin initiation reports for each nan caller stocks that we buy. Membership besides includes an progressive chat room, play updates, and my responses to your questions.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·