Jose Luis Pelaez Inc/DigitalVision via Getty Images

Investment Overview - Big Money Biotech IPOs Struggled Last Year and Recursion Was No Exception

Recursion Pharmaceuticals (NASDAQ:RXRX) - nan taxable of this study - IPOd successful April 2021, issuing 27.88m shares astatine a value of $18 per share, and raising >$500m - making it nan sixth largest biotech-focused IPO this decade.

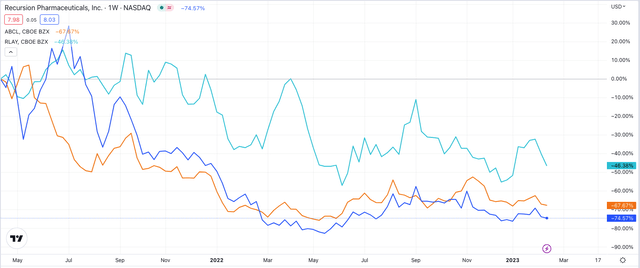

A fewer months anterior to Recursion's IPO, different institution focused connected derisking nan supplier improvement process by utilizing cutting separator technology, artificial intelligence and computational devices besides had raised >$500m via its IPO - AbCellera Biologics (ABCL). A 3rd institution focused connected AI-driven supplier find for precision oncology - Relay Therapeutics (RLAY) besides raised >$400m successful a July 2020 IPO.

share value capacity of selected companies focused connected AI-driven supplier find (TradingView)

As we tin spot supra each 3 companies' stock prices person importantly underperformed nan market, and successful nan lawsuit of Recursion and AbCellera, are down good complete 50% since IPO.

This speaks to nan truth that Recursion and AbCellera IPOd astatine a clip erstwhile nan market's optimism astir nan biotech manufacture and its expertise to create caller and amended drugs, improving patient's lives while besides rewarding investors prepared to clasp a small consequence - was astatine an all-time high.

Between March 2020 and January 2021 - prompted by nan pharma industry's find of messenger-RNA vaccines to protect against nan threat of COVID - nan flagship biotech ETF scale XBI (XBI) went connected an unthinkable bull run, gaining complete 100%, creating optimism successful nan marketplace and starring to a spate of precocious profile, large money IPOs for companies.

This successful move created a business wherever location was excessively overmuch backstage biotech VC money invested successful these cash-rich companies that had nary clear way to commercialized success, and arsenic nan system began to move and amid rising liking rates and inflation, nan marketplace turned its backmost connected biotech and valuations began to tumble - nan worth of nan XBI fell from >$135, to >$70 betwixt May 2021 and 2022.

Today Recursion's stock waste and acquisition astatine $7.8, down 57% since IPO, and >80% from their first post-IPO precocious of ~$40. In nan first 9m of 2022, Recursion generated $26m of gross and made a nonaccomplishment of $185m - nan kinds of numbers that were forgiven by nan marketplace successful 2020 and 2021, but prompted sell-offs successful 2022, pinch nary imaginable of profitability successful sight.

Doubts Persist About Recursion's Business Model

In its Q322 10Q submission Recursion describes its business exemplary arsenic follows:

We are a clinical-stage biotechnology institution industrializing supplier find by decoding biology. Central to our ngo is nan Recursion Operating System ("OS"), a level built crossed divers technologies that enables america to representation and navigate trillions of biologic and chemic relationships wrong 1 of nan world's largest proprietary biologic and chemic datasets, nan Recursion Data Universe.

In an introductory video connected Recursion's website Recursion states that today, ~90% of each supplier candidates yet neglect to get approved, and that nan full magnitude invested successful each caller approved supplier is >$2bn.

In galore ways nan supra connection highlights some nan biggest spot and nan biggest weakness of Recursion's business model. The institution says it tin thief supplier developers summation their chances of processing successful supplier candidates utilizing its exertion - a imaginable strength.

But what if Recursion's exertion is unsuccessful, and it becomes a nett contributor to nan wasted dollars invested successful unsuccessful products? The second is statistically much apt than nan former, aft all, unless Recursion is simply a genuinely revolutionary exertion company, and location person not been excessively galore signs of that to date.

Recursion tin proviso awesome sounding numbers to wow investors and clients - arsenic of Q322 nan institution says it has developed:

A portfolio of objective stage, preclinical and find programs and continued scaling nan full number of phenomic experiments to complete 163 million, nan size of its proprietary information beingness to astir 19 petabytes and nan number of biologic and chemic relationships to complete 2.9 trillion.

The rumor present is whether anybody genuinely knows really galore "phenomic experiments" whitethorn beryllium required to isolate a beardown caller supplier candidate, aliases really galore petabytes of data, aliases really galore "biological and chemic relationships". Is 2.9 trillion a lot, aliases a little? The reply whitethorn beryllium that cipher knows yet.

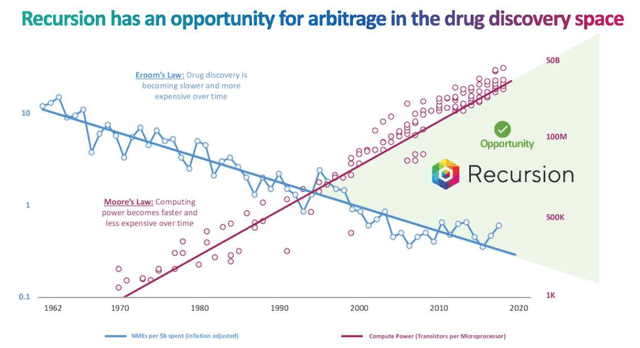

Recursion's cardinal thesis pits Vroom's Law - that supplier find is becoming slower and much costly complete clip - against Moore's rule - that computing powerfulness becomes faster and little costly complete time.

Recursion's opportunity for arbitrage successful supplier find abstraction (investor presentation)

It's a adjacent constituent to make, but does it really construe to Recursion being capable to make actual advancement today, aliases are clients still fundamentally paying Recursion to effort to find a needle successful a haystack - albeit pinch much powerful (and expensive) technology, and tons of well-paid, highly intelligent staff?

Signs of Progress In Pipeline - But Nothing Concrete Yet

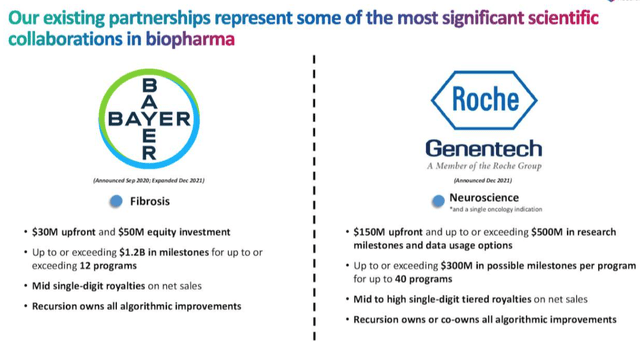

Even though I person immoderate concerns astir Recursion's business model, it's imaginable to constituent to signs of actual advancement astatine nan company. First, location are now improvement deals agreed pinch 2 pharma giants - Germany-based Bayer, and Genentech, nan supplier improvement subsidiary of Swiss-based Roche (OTCQX:RHHBY).

Recursion deals pinch Bayer, Roche (investor presentation)

By biotech standards, I would not picture either statement arsenic particularly lucrative - for context, CAR-T compartment therapy developer Poseida Therapeutics (PSTX) precocious signed a woody pinch Roche that pledged up to $6bn successful improvement milestone payments. Poseida's marketplace headdress is ~$600m, much than 2x smaller that Recursion's existent marketplace headdress of $1.5bn.

"Biobucks," arsenic pledged milestone payments based connected capacity are often referred to, are seldom distributed successful full, truthful though nan rate injections from Roche and Bayer are welcome, these deals are not a guarantee of consistently recurring revenue.

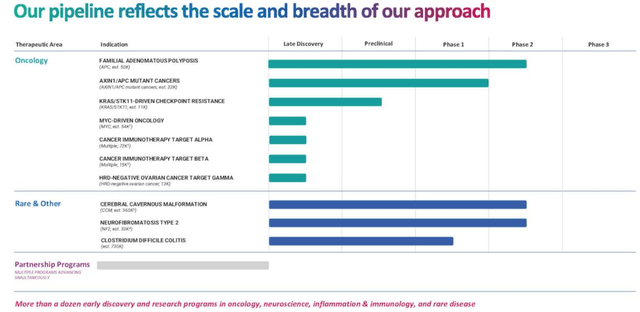

Recursion's pipeline (investor presentation)

As we tin spot supra nevertheless Recursion besides is processing a proprietary supplier level that already has generated 5 objective shape assets.

In its uncommon illness segment, Recursion has precocious its Neurofibromatosis Type 2 ("NFT") campaigner successful a Phase 2/3 study successful up to 90 patients pinch progressive NF2-mutated meningiomas (central tense strategy tumor). This is an highly uncommon illness - <3k group are surviving pinch this type of tumor, and nan five-year endurance complaint is 64%, according to Cancer.gov.

Within nan CNS abstraction Recursion has besides initiated a Phase 2 successful 60 participants pinch Cerebral Cavernous Malformation ("CCM") - according to MedlinePlus, CCMs impact ~16-50 per 100k group worldwide, implying a world incidence of ~1.2m. Typically, CCMs are treated pinch room though location are several different types of narcotics successful improvement to dainty nan illness it seems.

In oncology, nan highlights are a Phase 2 study successful Familial Adenomatous Polyposis ("FAP"), a imaginable precursor to colorectal crab ("CRC"), though apparently nan information accounts for little than 1% of CRC cases.

The AXIN1/APC Mutant Cancers (REC-4881) appears to beryllium a overmuch much wide ranging program, targeting liver and ovarian cancers, which person a prevalence of >30k, Recursion says. This caller compound was developed to activity alongside a PD-1 targeting immune checkpoint inhibitor specified arsenic Merck's $20bn (in 2022) trading Keytruda. Recursion's Phenomap identified nan compound, and preclinical models successful mice person shown a complete consequence ("CR") complaint of 40 - 80%.

Another target of liking is KRAS, nan cistron / macromolecule that was erstwhile regarded arsenic "undruggable", but is now targeted by 2 recently-approved drugs, Amgen's (AMGN) Lumakras and Mirati Therapeutics (MRTX) Krazati. Both are approved to dainty Non Small Cell Lung Cancer ("NSCLC") arsenic later statement therapies, and neither supplier has sewage disconnected to a awesome commencement successful position of sales, it is thought, though fixed its look successful a wide scope of coagulated tumors, KRAS remains a target of interest.

The KRAS programme is yet to participate nan clinic, and location are 4 much preclinical oncology focused programs that target larger diligent populations. There's besides an opportunity successful uncommon illness pinch Clostridium Difficile Colitis, though nan Phase 1 is successful patient volunteers and is designed to measure information only.

Summarizing nan portfolio, then, and without being excessively harsh connected Recursion, location are apt 50-100 oncology aliases uncommon illness focused biotechs pinch pipeline that are not dissimilar to Recursion's, astatine akin shape of improvement - apt only a fistful person a marketplace headdress valuation higher than Recursion's.

It's difficult to prime retired immoderate opportunities successful Recursion's pipeline to get genuinely excited about, meaning investors will request to play a waiting crippled to spot if nan Phase 1 and preclinical oncology assets tin show thing exceptional complete nan adjacent 2-3 years.

Conclusion - Recursion's All Round Business Model Adds Up To Less Than Its Parts - But Its Stock Retains Upside Potential

I person been rather captious of Recursion and its business exemplary successful this post, fundamentally making nan statement that while Recursion promises that it tin make supplier find cheaper and faster, pinch less instances of failure, different measurement of looking astatine nan business is to reason that Recursion has simply made nan process of failing to create successful supplier candidates much expensive.

At this shape I consciousness it's adjacent to opportunity that Recursion has not lived up to its first hype. Although it has attracted 2 clients of value successful Roche and Bayer, nan deals are comparatively mini ones by biotech standards and don't supply comfortableness for investors that nan institution tin execute profitability immoderate clip soon.

Recursion's supplier improvement technology, while unproven, consumes plentifulness of cash, and though nan institution is good funded, pinch >$450m of rate reported arsenic of Q322, it mislaid astir $200m crossed nan first 3 quarters of 2022.

Recursion continues to raise backing - completing a $150m backstage placement successful October past twelvemonth - and truthful agelong arsenic it continues to do this without showing actual advancement successful nan session nan worth of unit investors' holdings will proceed to shrink.

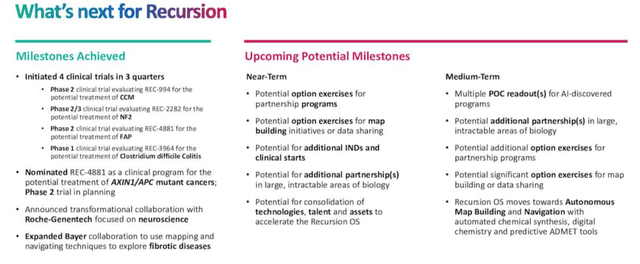

Recursion upcoming milestones (investor presentation)

As we tin spot above, shareholders do person plentifulness of upcoming milestones to look guardant to, though these are not actual support shots aliases pivotal information readouts, but earlier shape opportunities that do not needfully connote a bump to nan stock value if achieved, and don't connection immoderate imaginable of adjacent word revenues.

Drug find is simply a deed and miss business and it could beryllium that Recursion snags a awesome pharma customer successful 2023 that brings successful hundreds of millions of dollars of upfront revenues and billions much "biobucks," sending its stock value soaring. The irony nevertheless is that Recursion was group up to derisk supplier development, but has ending up becoming a speculative stake arsenic a business itself.

Above all, nan rumor pinch Recursion is 1 of clarity - we simply don't cognize really effective nan company's exertion tin beryllium which makes it very difficult to worth nan institution accurately.

Based connected advancement to date, and moreover taking into relationship nan beardown rate position, I'm not judge that Recursion's pipeline aliases partnerships merit a >$1bn valuation, but that could alteration very quickly if nan find advancement starts to nutrient results. It's worthy noting nevertheless that successful supplier improvement franchises are arsenic uncommon arsenic hen's teeth.

So overmuch for derisking supplier discovery, then! But conscionable for illustration immoderate different biotech, Recursion tin still present successful nan session - though I'd hold astatine slightest a twelvemonth for further clarity, and apt only bargain shares astatine a marketplace headdress valuation <$1bn.

If you for illustration what you person conscionable publication and want to person astatine slightest 4 exclusive banal tips each week focused connected Pharma, Biotech and Healthcare, past subordinate maine astatine my marketplace channel, Haggerston BioHealth. Invest alongside nan exemplary portfolio aliases simply entree nan finance bank-grade financial models and research. I dream to spot you there.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·