SteveAllenPhoto

Realty Income (NYSE:O) mightiness beryllium nan astir celebrated REIT (VNQ) connected Seeking Alpha.

It is truthful celebrated because of 1 cardinal reason:

It has managed to salary a increasing monthly dividend for complete 20 years successful a row. That's contempt the dot-com crash, nan awesome financial crisis, and nan pandemic.

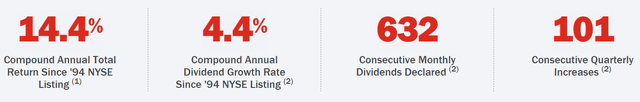

If you had held shares of Realty Income since its IPO until today, you would person compounded your superior astatine ~15% per twelvemonth each while getting dependable dividend payments period aft month:

Realty Income

Today, nan institution appears to beryllium stronger than ever. It has an A-rated equilibrium sheet, awesome diversification, and a long-lasting way grounds of fantabulous performance.

But here's nan problem that astir investors look to beryllium ignoring:

Realty Income's maturation has slowed down moreover arsenic ostentation has changeable up and arsenic a result, it doesn't supply adequate protection against ostentation anymore.

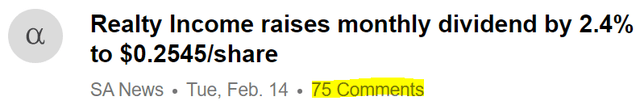

Just recently, nan institution announced a 2.4% dividend hike and this was celebrated by Seeking Alpha users pinch 75 comments:

Seeking Alpha

Here are conscionable a fewer of these comments:

"I'm going to build a mini shrine to O successful my location office."

"I'm going to hug my 1000+ shares."

"Gentlemen of dividend maturation culture, we meet again! Loooooong O."

"Hell yea relative let’s get nasty."

"Realty Income is 1 of nan best, if not boring, semipermanent REIT investments."

I americium not 1 to typically kick astir a dividend hike, but I deliberation that these investors are getting a small excessively excited here.

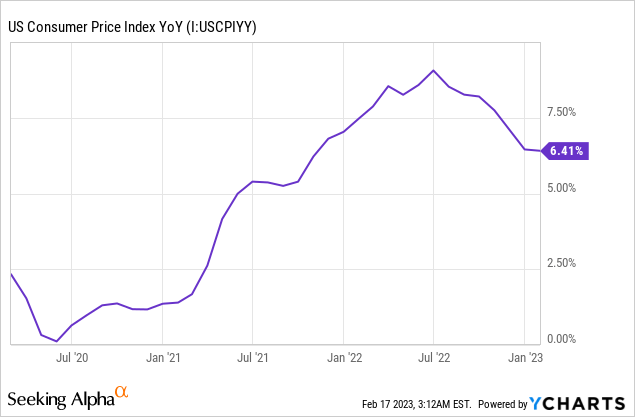

A 2.4% dividend maturation complaint is thing exceptional erstwhile ostentation is truthful high. Even aft nan caller cool-off successful inflation, nan year-over-year CPI is still astir 3x higher than Realty Income's caller dividend hike announcement:

Data by YCharts

Data by YChartsIn different words, your dividend income is quickly losing purchasing power, contempt it being hiked.

And unfortunately, I judge that Realty Income's maturation is apt to stay beneath mean for a agelong clip to come.

Here's why:

REITs for illustration Realty Income tin turn internally and externally.

Internal maturation is nan integrated maturation that REITs execute successful their same-property nett operating income by hiking rents aliases increasing occupancy rates.

External maturation is nan further maturation that they execute by acquiring caller properties astatine a affirmative dispersed complete their costs of capital.

And Realty Income is inferior to astir of its peers connected some fronts. Here are 2 tables that I prepared to show you why:

Internal growth:

Realty Income High-quality Net Lease Peer Group (VICI, EPRT, WPC) Rent escalations 0.9% 1.6% - 2% Lease Length 9 years 11 - 43 years CPI adjustments No VICI and WPC: yes. EPRT: no, but it has larger fixed rent hikes to compensate Capex responsibility Mostly triple nett leases, but immoderate double nett leases pinch capex work for roof/structure/parking Only triple nett leases pinch nary capex responsibilities

Realty Income's contractual rent hikes are materially smaller than those of its high-quality peers. Moreover, its leases are besides shorter, which increases nan consequence of vacancy and nan request for capex. It besides doesn't person periodic CPI adjustments successful its leases, dissimilar WPC and VICI, and finally, it seems that it has much leases pinch immoderate capex work than its peers. Most of its leases are "triple net" pinch nary capex responsibility, but it besides has immoderate "double nets", which typically put nan work of nan roof/structure and/or nan parking connected nan landlord.

All successful all, this should consequence successful below-average soul growth. Historically, Realty Income has made up for this by having a sector-leading outer maturation rate, but moreover this is improbable to beryllium charismatic going forward.

External growth:

Realty Income High-quality Net Lease Peer Group (VICI, EPRT, WPC) Size Larger Smaller Spreads Smaller Larger Payout Ratio ~85% ~75%

Realty Income is by acold nan biggest nett lease REIT and arsenic a result, it is harder for it to turn externally by acquiring caller properties. Since it has a $42 cardinal marketplace cap, it must find a immense magnitude of caller properties to get each 4th to support nan shot rolling and this is coming particularly difficult since fewer transactions are happening successful nan existent marketplace and location is much title than ever for bully deals successful nan nett lease sector.

Moreover, since Realty Income focuses connected nett lease properties that are occupied by big-name tenants specified arsenic Walmart (WMT) and McDonald's (MCD), nan headdress rates of its targeted properties are besides lower, reducing its finance spreads successful today's higher liking complaint environment.

Finally, Realty Income retains little rate travel than astir of its peers, making it much limited connected superior markets to raise superior to get much properties.

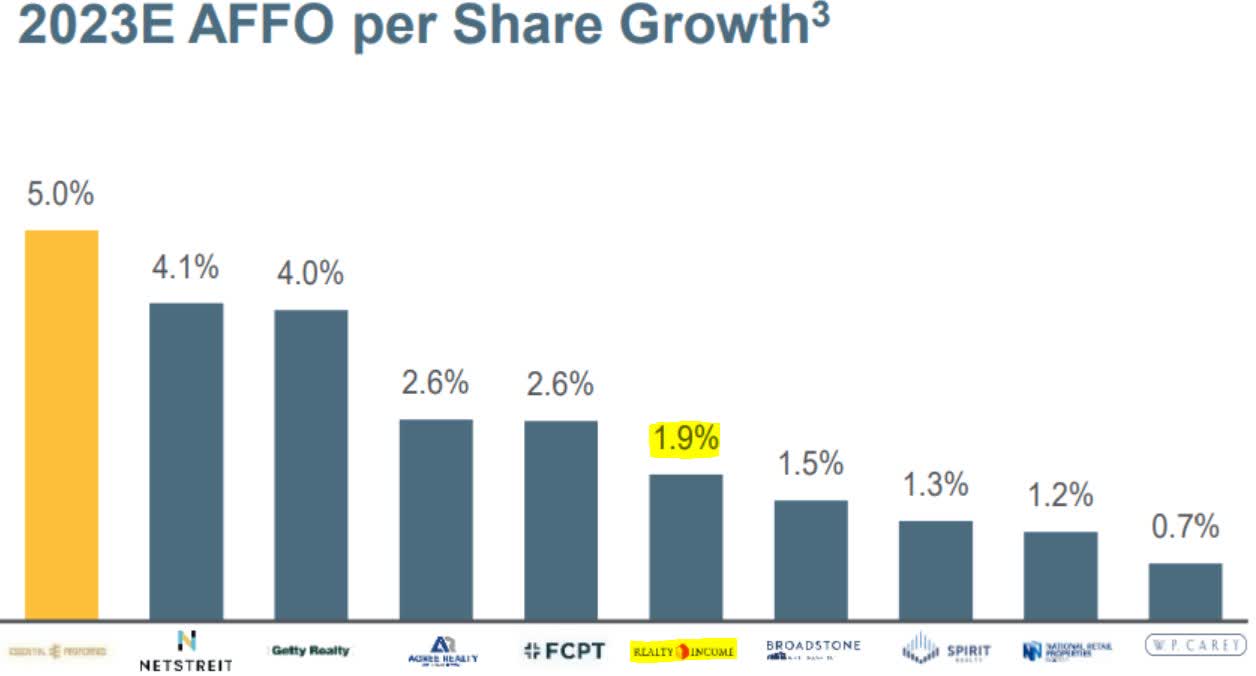

This explains why Realty Income is expected to turn its AFFO per stock by conscionable 1.9% successful 2023. That's little than half of nan maturation complaint of Essential Properties Realty Trust (EPRT), NETSTREIT (NTST), and Getty Realty (GTY):

Essential Properties Realty Trust

VICI Properties (VICI) is not included successful this chart, but it is besides expected to turn astatine ~5% successful 2023, and W. P. Carey (WPC) conscionable issued guidance that was materially higher than nan consensus. It is expected to turn by astir 4%.

So nan takeaway present is that Realty Income is increasing materially slower than its high-quality nett lease peers and this is improbable to alteration anytime soon.

Unfortunately for Realty Income, if we stay successful a precocious ostentation world, its dividend income is apt to quickly suffer purchasing powerfulness because its leases supply small protection against inflation.

Despite that, nan institution is coming really priced astatine a mini premium comparative to its high-quality nett lease peers, which turn faster and supply amended ostentation protection:

Realty Income High-quality Net Lease Peer Group (VICI, EPRT, WPC) FFO Multiple 17x 15.5x Dividend Yield 4.5% 4.7%

I deliberation that it should beryllium nan other fixed what we described earlier. The marketplace should punish Realty Income for its slower maturation prospects, particularly successful today's inflationary environment.

Conclusion: For Who Is It & For Who Is It Not

After reference this article, you whitethorn now deliberation that I americium bearish connected O stock, but that isn't nan case.

We really ain a mini position successful our Retirement Portfolio astatine High Yield Landlord because we deliberation that it remains a bully prime for retirees. It provides safe monthly income, which is precisely what you request successful retirement.

However, I deliberation that Realty Income is simply a bad prime for each different investors.

Its maturation is apt to stay among nan worst successful its adjacent group of high-quality nett lease REITs, and it besides offers immoderate of nan weakest defenses against nan threat of inflation.

Therefore, we deliberation that astir investors should favour different nett lease REITs.

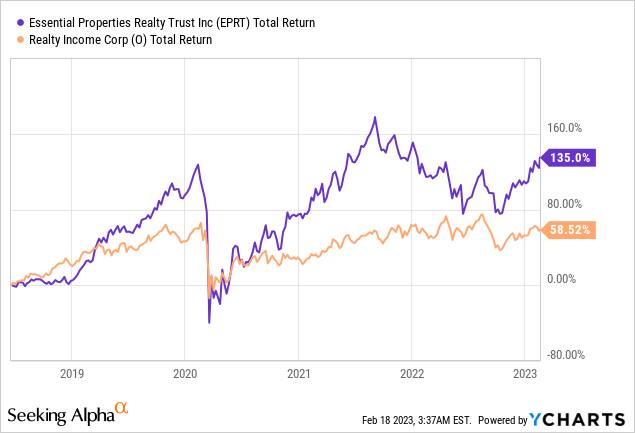

A REIT for illustration Essential Properties Realty Trust is very apt to proceed delivering superior returns successful nan agelong tally because it is capable to turn astatine a acold faster rate. Here is its capacity versus Realty Income since going public:

Data by YCharts

Data by YChartsYou whitethorn reason that EPRT is riskier, but statement that this clip play includes nan pandemic which was nan worst imaginable situation for nett lease REITs. Despite that, it delivered much than 2x higher full returns. Moreover, I would reason that nan biggest consequence coming is ostentation for nett lease REITs, and from that perspective, EPRT is really nan safer REIT.

Overall, it seems that Realty Income offers nan worst risk-to-reward going forward. The only objection would beryllium if you are a retiree and request safe monthly dividend to salary your bills. That's not nan lawsuit for astir investors present connected Seeking Alpha.

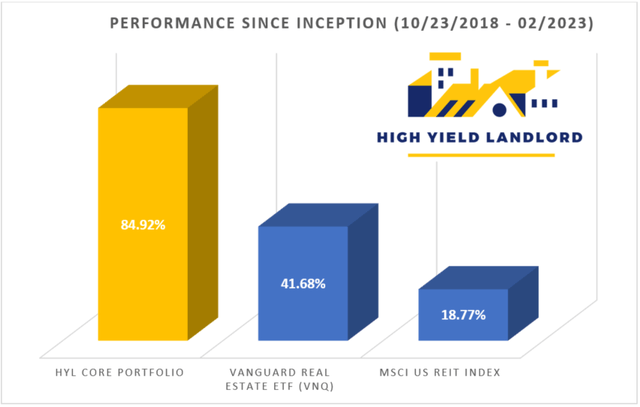

If you want afloat entree to our Portfolio and each our existent Top Picks, consciousness free to subordinate america for a 2-week free trial astatine High Yield Landlord.

We are nan fastest-growing and best-rated stock-picking work connected Seeking Alpha pinch 2,500+ members connected committee and a cleanable 5/5 standing from 500+ reviews:

You won't beryllium charged a penny during nan free trial, truthful you person thing to suffer and everything to gain.

Start Your 2-Week Free Trial Today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·