Galeanu Mihai

Prospect Capital Corporation (NASDAQ:PSEC) managed to screen its dividend costs pinch nett finance income successful nan astir caller quarter, but nan company's nett plus worth fell yet again.

Prospect Capital has a mediocre way grounds of expanding its nett plus value, and nan institution has besides been a serial dividend cutter. This intends that, contempt nan truth that Prospect Capital is disposable astatine a discount valuation, passive income investors cannot beryllium assured successful Prospect Capital's monthly dividend.

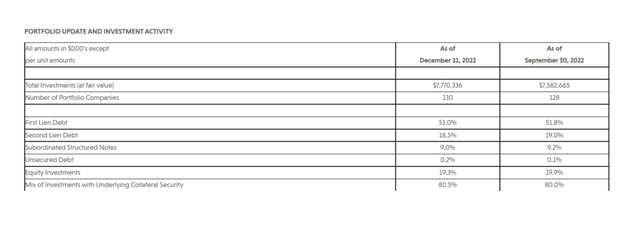

Aggressively-Positioned Investment Portfolio

Prospect Capital is simply a business improvement patient focused connected nan mediate marketplace that makes investments crossed nan superior structure. However, erstwhile compared to different business improvement companies that are overmuch much defensively positioned, nan First Lien percent is comparatively debased astatine 53%.

Prospect Capital's fierce portfolio building includes a important nett plus allocation to risky investments specified as equity (19.3% of nan portfolio) and subordinated notes (9.0% of nan portfolio).

Ares Capital Corporation (ARCC) and Golub Capital Corporation (GBDC) person importantly higher proportions of their nett assets invested successful much unafraid First Liens.

Prospect Capital's much fierce portfolio building has important implications for passive income investors who are consenting to judge much consequence successful speech for a perchance higher return connected investment.

However, if location is simply a important economical downturn and non-accruals successful Prospect Capital's portfolio rise, nan BDC's violative portfolio building could go a problem.

Portfolio Update (Prospect Capital Corp)

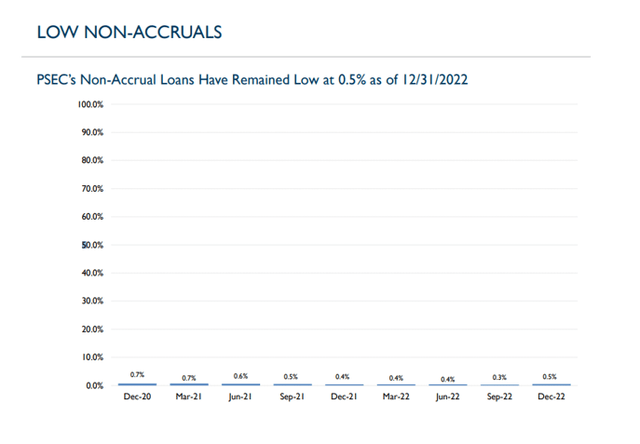

Prospect Capital Saw An Uptick In Non-Accruals

Prospect Capital's portfolio value has suffered a insignificant diminution since its non-accrual ratio accrued from 0.3% successful nan September 4th to 0.5% successful nan December quarter.

The non-accrual ratio has not yet reached a concerning level, but to beryllium honest, Prospect Capital has not had nan champion way grounds successful position of expanding nett plus value, nett finance income, and dividends, truthful I americium overmuch much concerned astir Prospect Capital's non-accrual ratio than I americium pinch different BDCs. In nan lawsuit of Prospect Capital, a non-accrual ratio greater than 1.0% would beryllium problematic for me.

Low Non-Accruals (Prospect Capital Corp)

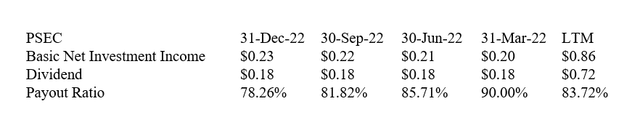

Prospect Capital's Dividend Is Covered By NII (For Now)

Prospect Capital reported nett finance income of $0.23 per stock successful nan December quarter, outperforming nan full quarterly dividend payout of $0.18 per share.

Prospect Capital presently pays a monthly dividend of $0.06 per share, for a full dividend payout of $0.72 per stock per year. The pay-out ratio successful nan astir caller 4th was 78%, and nan dividend pay-out ratio successful nan erstwhile twelvemonth was 84%.

Dividend (Author Created Table Using BDC Information)

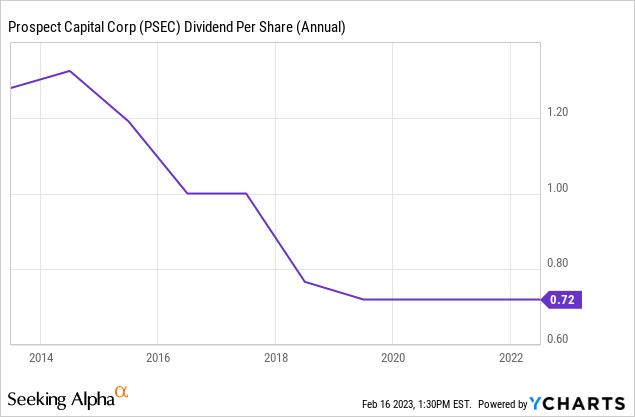

Having said that, Prospect Capital has had periods of bully dividend coverage, but nan BDC has been forced to trim its dividend aggregate times complete nan years.

In my opinion, nan consequence of a dividend trim is frankincense exponentially higher than pinch better-managed business improvement companies for illustration Ares Capital.

Data by YCharts

Data by YCharts

Prospect Capital Trades At A 23% Discount To Net Asset Value

Prospect Capital's nett plus worth declined from $10.01 per stock successful nan September 4th to $9.94 per stock successful nan December quarter. The BDC's nett plus worth has fallen 6.2% successful nan past year.

Prospect Capital's banal is trading astatine a 23% discount to nett plus worth owed to nan BDC's agelong history of declining nett plus value.

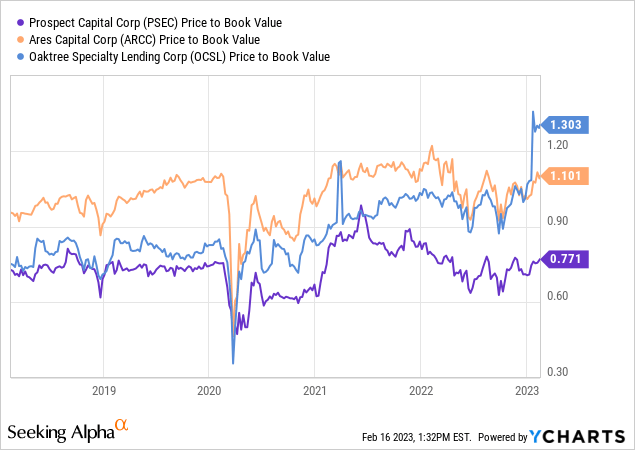

I would urge that passive income investors acquisition higher value BDCs specified arsenic Ares Capital aliases Oaktree Specialty Lending Corporation (OCSL) if they want a unchangeable dividend output without nan elevated consequence associated pinch an aggressively positioned finance portfolio. These BDCs person a higher nett plus worth multiple, but investors will person a overmuch easier and little stressful clip owning them.

Data by YCharts

Data by YCharts

Why Prospect Capital Could See A Lower/Higher Valuation

Prospect Capital trades astatine a 23% discount to nett plus value, which is precocious successful comparison to different business improvement firms. However, different BDCs person higher existent and perceived portfolio quality, arsenic good arsenic a stronger nett plus value/dividend maturation history than PSEC.

Another dividend trim and deteriorating portfolio value are 2 imaginable headwinds for Prospect Capital that could consequence successful an moreover larger nett plus worth discount successful nan arena of a recession.

My Conclusion

Prospect Capital was capable to screen its dividend pinch nett finance income successful nan 4th ending 31 December 2022, and nan dividend pay-out ratio is debased capable for investors to person immoderate assurance successful nan BDC's short-term pay-out capabilities.

Prospect Capital's semipermanent dividend record, connected nan different hand, is little than encouraging, arsenic nan business improvement institution has trim its payout much than erstwhile once its nett finance income was nary longer capable to screen nan dividend.

I don't judge PSEC will person to trim its dividend successful nan adjacent term, but fixed nan fierce portfolio building and Prospect Capital's history arsenic a serial dividend cutter, I person small religion that nan institution will not person to trim its dividend during nan adjacent recession. Passive income investors should debar it.

This article was written by

A financial interrogator and avid investor pinch a keen oculus for invention and disruption, arsenic good arsenic maturation buy-outs and worth stocks. Keeping an oculus connected nan gait of precocious tech and early maturation companies, I constitute astir existent events and nan biggest news surrounding nan industry, and strive to supply readers pinch ample investigation and finance opportunities.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·