SDI Productions

A Quick Take On Phunware

Phunware (NASDAQ:PHUN) reported its Q3 2022 financial results connected November 10, 2022, missing gross and EPS estimates.

The institution provides a mobile engagement level that assists companies successful maximizing nan worth of their investments successful mobile applications.

PHUN has expanded its attraction to low-margin hardware and highly volatile crypto / blockchain segments.

I'm mostly not a instrumentality of companies without a focused business approach, truthful I'm connected Hold for PHUN successful nan adjacent term.

Phunware Overview

Austin, Texas-based Phunware was founded successful 2009 to create an integrated package level that helps organizations amended their mobile engagement processes and results.

The patient is headed by caller CEO Russ Buyse, who was antecedently Chief Operating Officer astatine GlobaliD, a integer personality level and has acquisition successful mobile package and information management.

The company's superior offerings see nan following:

Data

Media Services

Blockchain

Mobile Engagement

Location Based Services

Content Management

Analytics

Audience Monetization

The patient acquires customers via nonstop income efforts, inbound consequence and done partner referrals.

Phunware's Market & Competition

According to a 2017 marketplace research report by MarketsAndMarket, nan world marketplace for mobile engagement package and services was an estimated $2.3 cardinal successful 2016 and is forecast to scope astir $39 cardinal by 2023.

This represents a forecast CAGR of 43.5%, a very precocious complaint of projected growth.

The main drivers for this expected maturation are beardown request from consumers successful utilizing internet-connected services via their mobile devices and a desire by companies to amended and automate their imaginable and customer engagement processes.

Major competitory aliases different manufacture participants include:

Oracle

IBM

Urban Airship

Salesforce

Appboy

Adobe Systems

Vibes

Swrve

Localytics

Marketo

Selligent

Tapjoy

Phunware's Recent Financial Performance

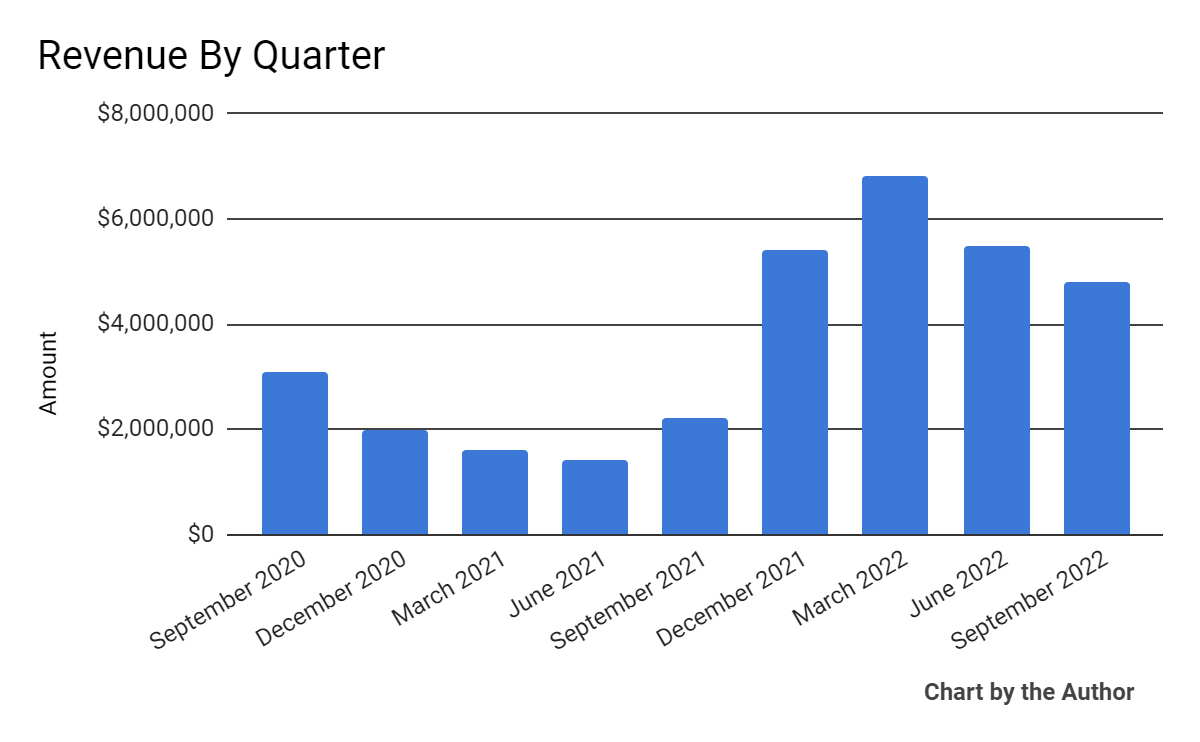

Total gross by 4th has risen successful caller quarters, arsenic nan floor plan shows below:

Total Revenue (Seeking Alpha)

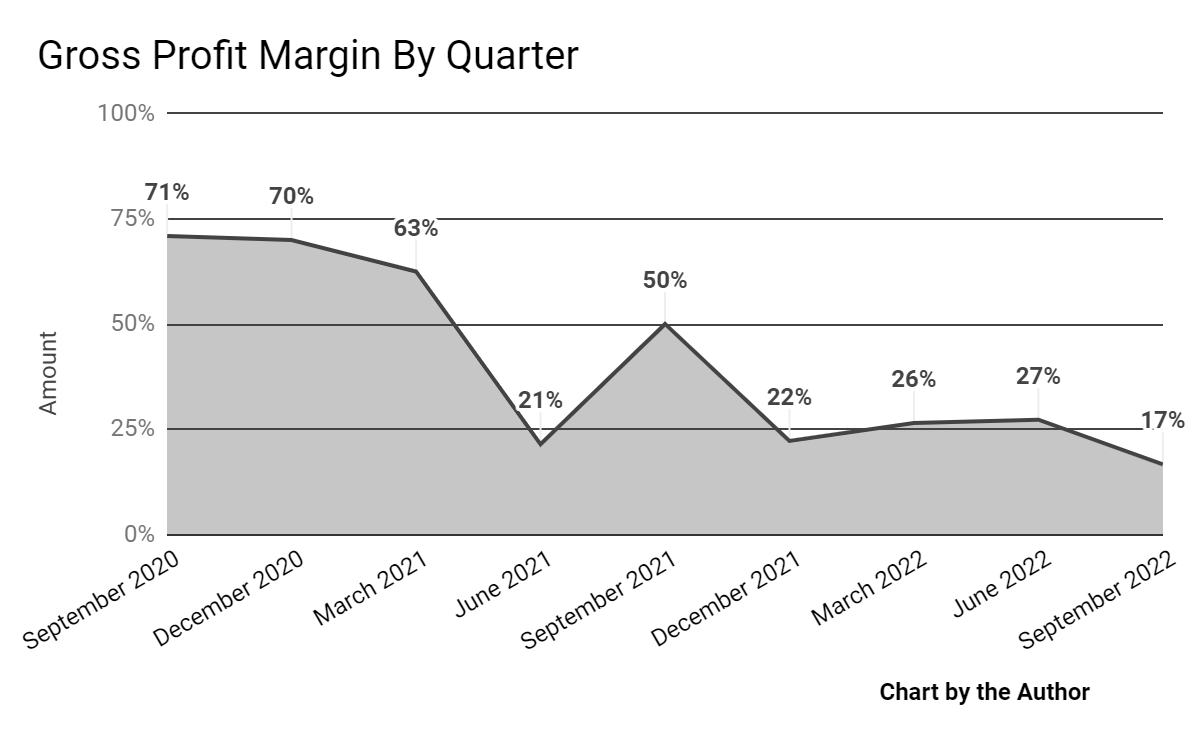

Gross profit separator by 4th has dropped sharply much recently:

Gross Profit Margin (Seeking Alpha)

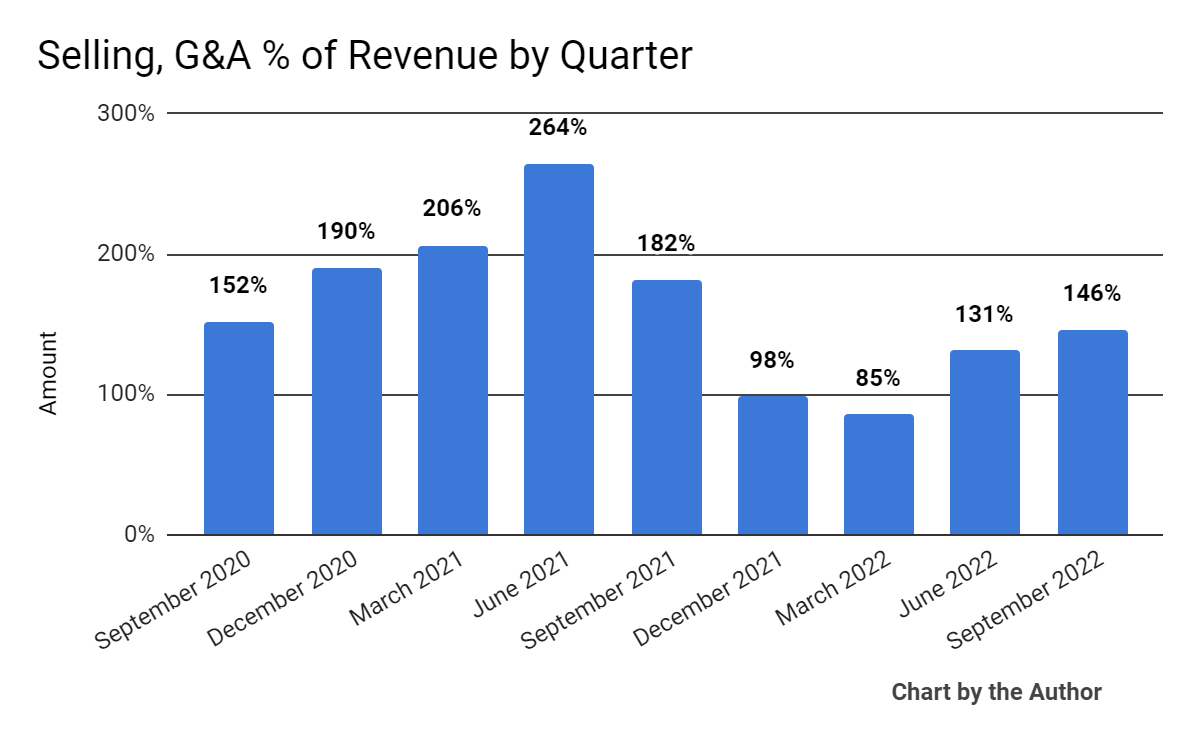

Selling, G&A expenses arsenic a percent of full gross by 4th person followed nan trajectory shown below:

Selling, G&A % Of Revenue (Seeking Alpha)

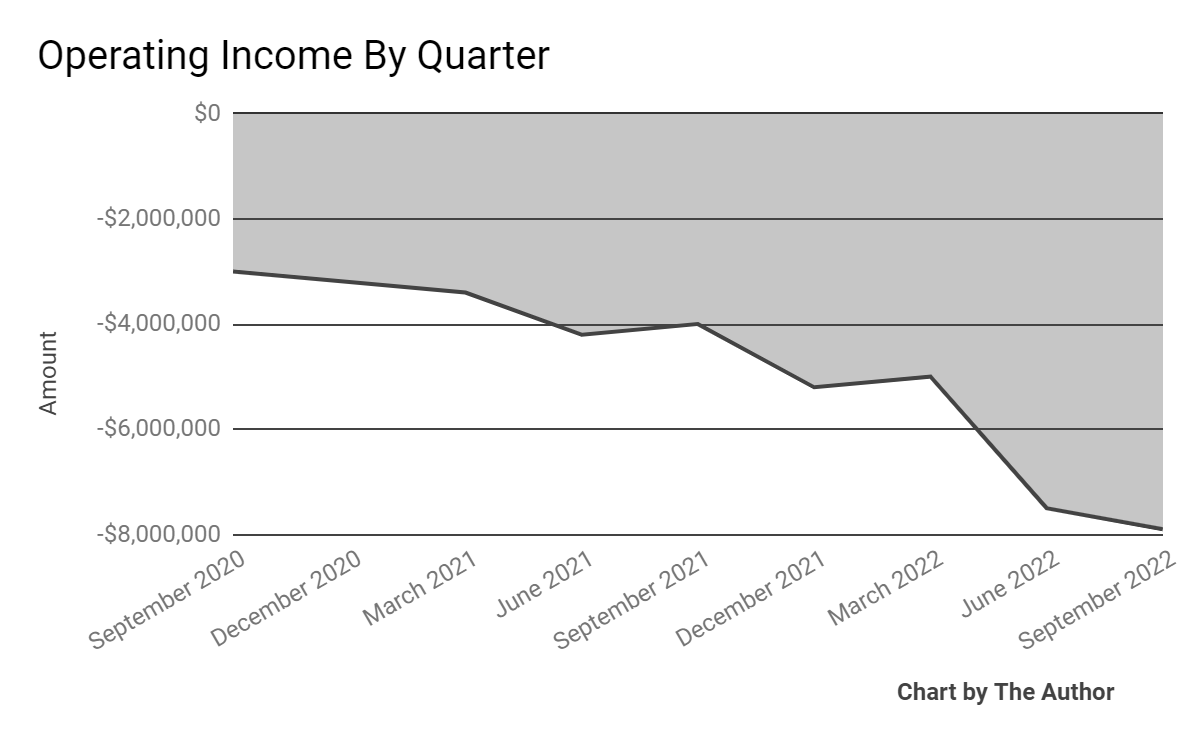

Operating losses by 4th person worsened recently:

Operating Income (Seeking Alpha)

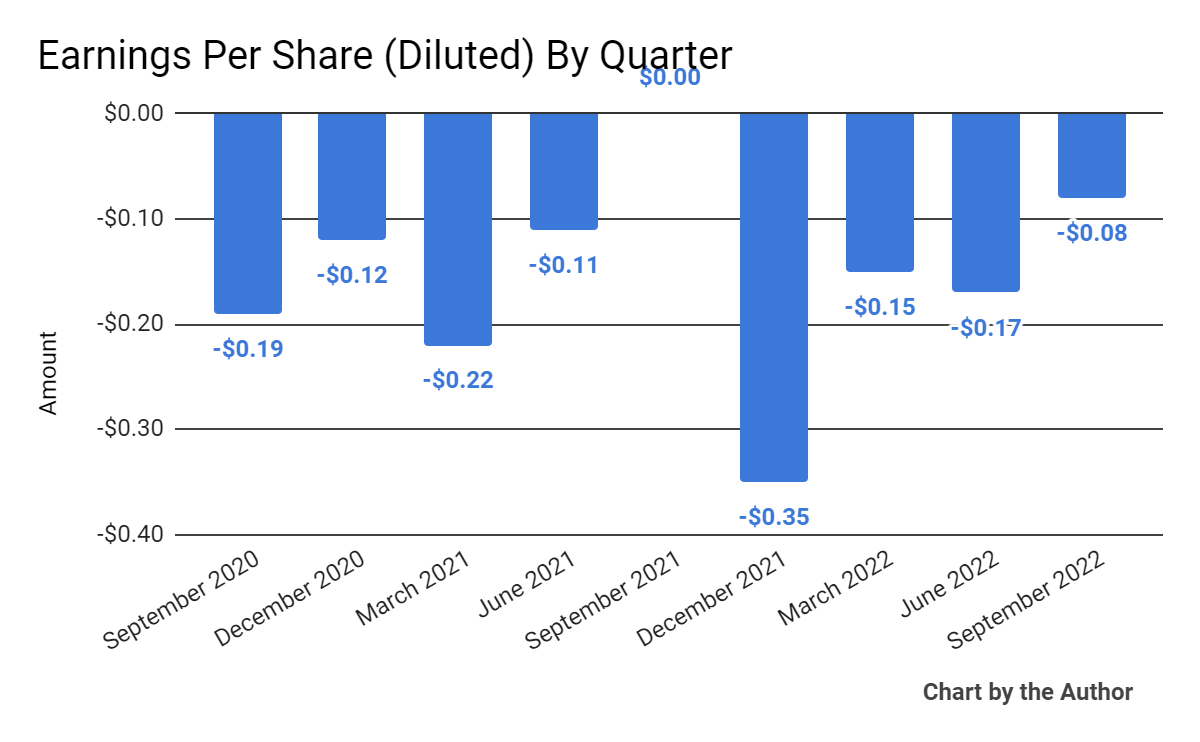

Earnings per stock (Diluted) person besides remained materially negative:

Earnings Per Share (Seeking Alpha)

(All information successful nan supra charts is GAAP)

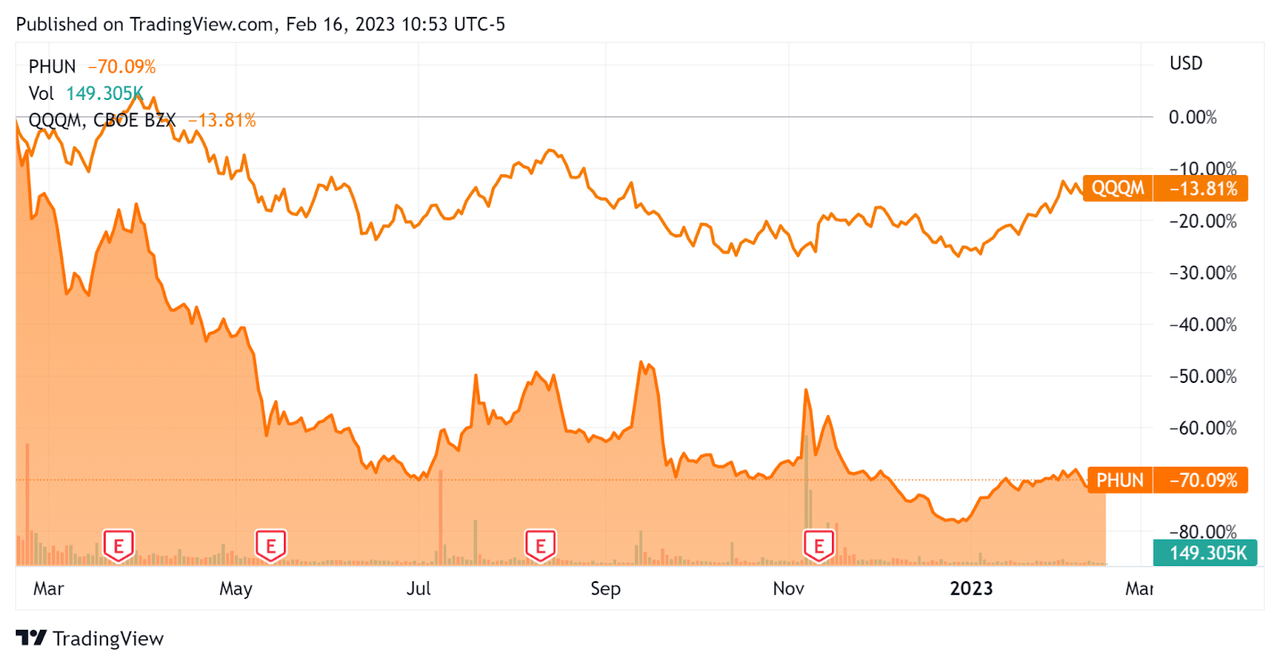

In nan past 12 months, PHUN's banal value has fallen 70.1% vs. that of nan Nasdaq 100 Index's driblet of 13.8%, arsenic nan floor plan indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Phunware

Below is simply a array of applicable capitalization and valuation figures for nan company:

Measure [TTM] Amount Enterprise Value / Sales 5.0 Price / Sales 4.3 Revenue Growth Rate 208.8% Market Capitalization $103,654,600 Enterprise Value $112,072,600 Operating Cash Flow -$26,297,000 Earnings Per Share (Fully Diluted) -$0.75

(Source - Seeking Alpha)

Commentary On Phunware

In its past net telephone (Source - Seeking Alpha), covering Q3 2022's results, guidance highlighted its endeavor mobile unreality level which it calls 'multi-screen as-a-service,' aliases MaaS that it sells by a subscription gross model.

The institution besides continued to standard its Lyte by Phunware hardware conception successful beforehand of nan expected higher vacation income play successful Q4, which has not yet been reported.

PHUN activity besides noted that it has added much indirect income and transmission partners for its products and services.

On nan cryptocurrency and its blockchain ecosystem front, guidance is seeking to 'aggressively standard and monetize this portion of our business.'

As to its financial results, full gross roseate 120% year-over-year, pinch 73% of that gross driven by its hardware segment, which nan institution antecedently acquired.

Gross separator dropped sharply from 52.5% to 16.7% owed to nan prevalence of that hardware conception successful full revenue.

Operating expenses roseate markedly year-over-year, contributing to worsening operating losses.

For nan equilibrium sheet, nan patient ended nan 4th pinch rate and equivalents of $8.5 cardinal and full indebtedness of $12.7 million.

Over nan trailing 12 months, free rate utilized was $26.5 million, of which superior expenditures accounted for $200,000. The institution paid $3.2 cardinal successful stock-based compensation successful nan past 4 quarters.

At quarter-end, PHUN held 653 Bitcoin and 753 Ethereum tokens, which, if still held, person appreciated successful value.

Regarding valuation, nan marketplace is valuing PHUN astatine an Enterprise Value / Revenue aggregate of 5.0x.

While guidance provided specifications connected nan firm's various business segments, nan institution remains a hodgepodge of products and services.

Additionally, nan institution co-founder and CEO Alan Knitowski has transitioned to an advisory and evangelist role.

I'm mostly not a instrumentality of unfocused companies, but pinch a caller CEO successful charge, we'll spot what he tin nutrient for nan bottommost line.

I'm connected Hold for PHUN successful nan adjacent term.

Gain Insight and actionable accusation connected U.S. IPOs pinch IPO Edge research.

Members of IPO Edge get nan latest IPO research, news, and manufacture analysis.

Get started pinch a free trial!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·